By now you’ve probably heard about SUI, which has gained much traction over the past couple of weeks on Crypto Twitter.

What you'll learn 👉

Who is behind the SUI project?

SUI was founded by the team over at Mysten_Labs.

Its five co-founders, as well as several Mysten employees, worked on developing the now abandoned Diem blockchain and Move programming language.

Note that the @mysten_labs team are not affiliated with AptosLabs, another Move-based blockchain.

Who are the main Backers:

SUI is backed by some big names, with a16z leading their Series A funding round that raised $36M

Architecture:

At a high-level, the $SUI blockchain achieves great speed and scalability through optimization for simple transactions.

This is done by making each transaction idempotent, meaning that transactions retain its end state no matter how many times it is repeated.

WTF is idempotency?

Idempotency is important in blockchain and payment systems to prevent duplicated transactions resulting in the recipient receiving a payment twice, for example.

SUI assumes that each transaction is a user-to-user transaction or asset manipulation and optimizes accordingly. There are 2 types of assets: 1. Owned objects; can only be modified by its specific owner. 2. Shared objects; can be modified by more than one user

This results in a dual-protocol system where the former is based on the Byzantine Consistent Broadcast while the latter is based on the Narwhal and Tusk mempool + BFT Consensus.

What this all means is that simple transactions can be conducted with near real-time finality. Essentially REMOVING the concept of “block times”!

MOVE programming language

Move: Move is based on the well known and supported Rust programming language Originally developed by @Meta for the Diem blockchain.

Unlike Solidity, which has security and verifiability issues, Move was specifically designed to represent digital assets and conduct safe operations over them.

The Move data model allows for the execution and commitment of transactions in parallel, resulting in near-instant finality. This is not possible with the EVM data model because assets are stored in dynamically indexable maps.

Put simply, the Move programming language allows SUI to achieve its purpose: to be horizontally scalable and to offer industry-beating speeds at low cost.

Move enables support for powerful performance improvements–these would not be possible with the incumbent EVM/Solidity model.

High throughput (100,000+ transactions per second) — Sub-second transaction finality — Parallel execution of transactions — Very fast testing Parallel execution of transactions works when the TXs are causally unrelated (i.e., they modify different state objects).

Writing secure and reliable code in Move is much easier than it would be in Solidity. It also makes conceptualizing digital assets simpler, more expressive, and more composable via the resource model.

- Move is highly type-safe/strongly typed.

- Instead of modifying a database, you create and pass around resources. Resources have customizable capabilities like creation, storage, deletion, and copying.

- For example, instead of modifying a table of balances to mint, transfer, and burn ERC20 tokens, you create, split, merge, and drop Coin objects.

- No calling arbitrary addresses—only known functions of known modules.

- So no reentrancy exploits (because there’s no way to loop back into a module).

- And no ghost reverts! 🙂

- Pass storable capability objects instead of whitelisting addresses for access control.

Tokenomics:

SUI will have a total supply of 10B tokens. As of the time of writing, there is no detailed distribution plan for the tokens.

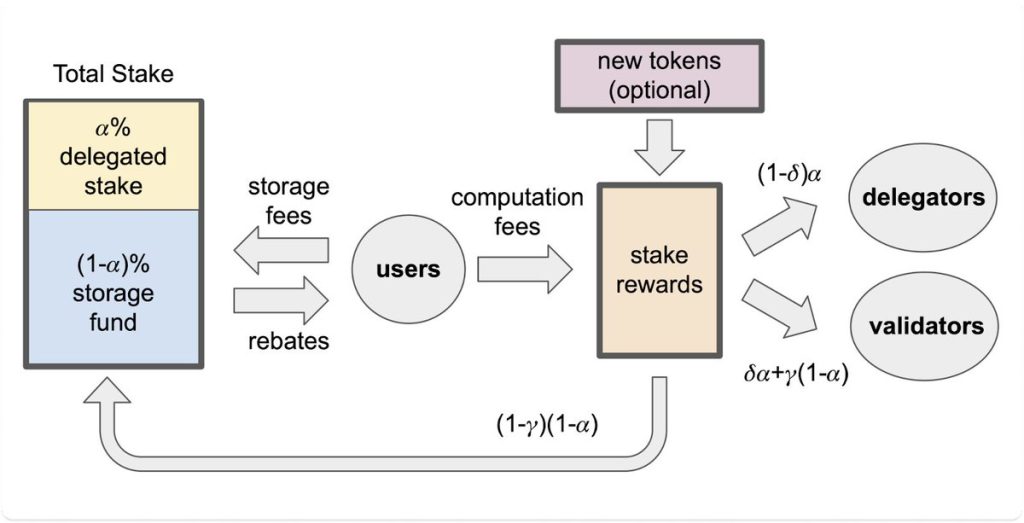

Illustrated below, SUI introduces a Storage Fund that redistributes storage fees from past transactions to future validators. This is to incentivize future validators to continue securing the network.

Incentivized Testnet:

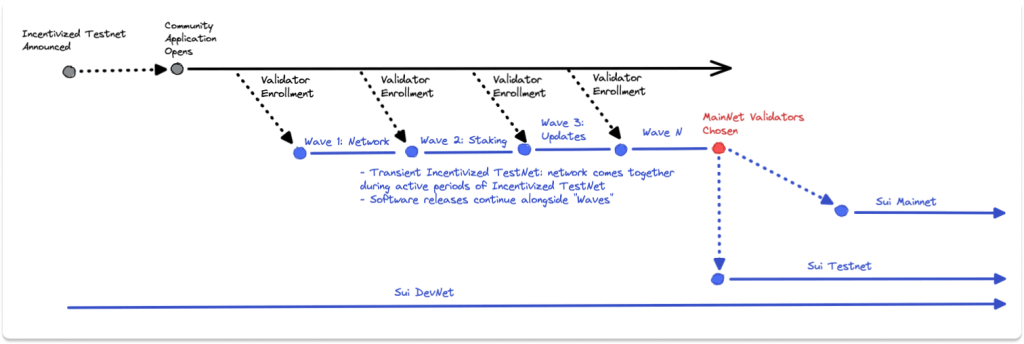

Launching in August 2022, the incentivized testnet will gradually introduce key features in order to stress-test the network before moving to Mainnet.

The testnet will be organized into various waves, each of them consisting of two challenges: a “sink” (operational challenge) and a “swim” (developer challenge).

When Token & Mainnet Launch?

Besides the announced incentivized testnet, there are no solid timelines for both the token and mainnet launches.