MaxSwap bills itself as an extensive crypto ecosystem designed to serve a wide range of crypto users’ needs in one platform. As I began testing MaxSwap out, I was immediately struck by the breadth of its cross-device compatible products spanning a Telegram bot, crypto wallet, exchange, arbitrage services, mobile apps and affiliate programs (coming soon), and more.

Notably, MaxSwap offers flexibility through an optional KYC system. Users can bypass identity verification measures for some basic transactions and access basic cryptocurrency management features when conducting crypto-crypto transactions. However, passing KYC allows for higher transaction volumes and access to MaxSwap’s full suite of offerings, including fiat and cryptocurrency trading.

In this MaxSwap review, I’ll break down my first-hand experience getting started and making use of some key products as a crypto enthusiast. So far, the initial simplicity and flexibility show MaxSwap is targeting ease-of-use for both new and experienced cryptocurrency users.

What you'll learn 👉

Getting Started is a Breeze

Creating a MaxSwap account took me just a couple of minutes. You simply need to enter your email address, set a password, and confirm your email to gain access.

I appreciated how straightforward and fast the signup process was. Without mandatory KYC procedures, I could skip verification and still access core platform features. This optional verification aligns with MaxSwap’s flexibility in catering to different crypto users’ needs.

To start, I just entered my email, created a secure password, and clicked the confirmation link sent to my inbox. Within minutes, I had access to my MaxSwap account dashboard and could begin exploring all that this crypto ecosystem has to offer.

The simplicity of the signup process leaves a strong first impression that the MaxSwap team understands crypto users want an easy onboarding experience. So far, my encounter with MaxSwap made me eager to continue testing out their products aimed at consolidating crypto management and trading into one platform.

Key Features of MaxSwap’s Ecosystem

Reviewing MaxSwap’s extensive suite of offerings, a few standout features catch my eye:

Lucrative 50% Affiliate Program

I’m intrigued by the very generous 50% revenue share affiliate program. Having an opportunity to earn up to half of the fees from your referrals’ activity for life provides a compelling passive income stream. This is currently available for MaxProfit Arbitrage tools and will soon be available for MaxSwap.

This seems like one of the most competitive affiliate rates out there. I can see this being a major incentive to build out a steady referral network on MaxSwap over time.

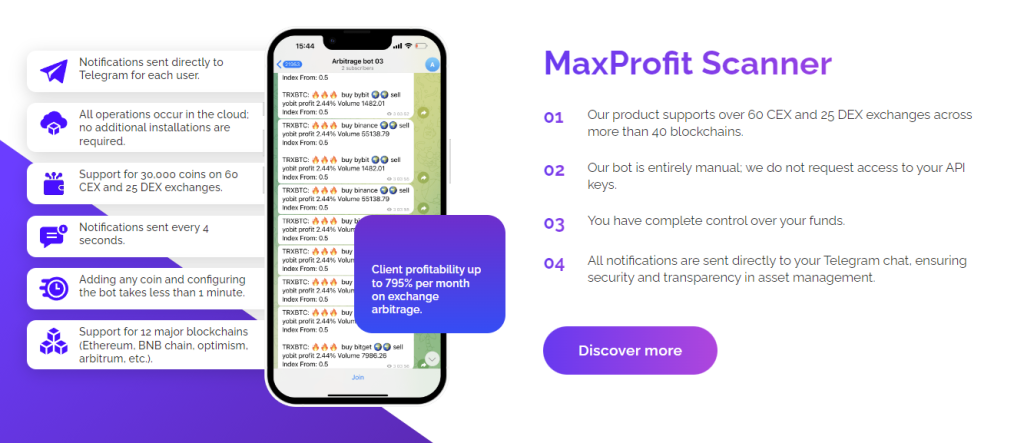

Arbitrage Tools

The integrated arbitrage service enabling automated, one-click trades across platforms is extremely valuable. By flagging price differentials and allowing seamless execution, it unlocks arbitrage opportunities without the typical manual screening.

Having tools that eliminate friction to profitable arbitrage trades at your fingertips makes MaxProfit an arbitrageur’s ecosystem.

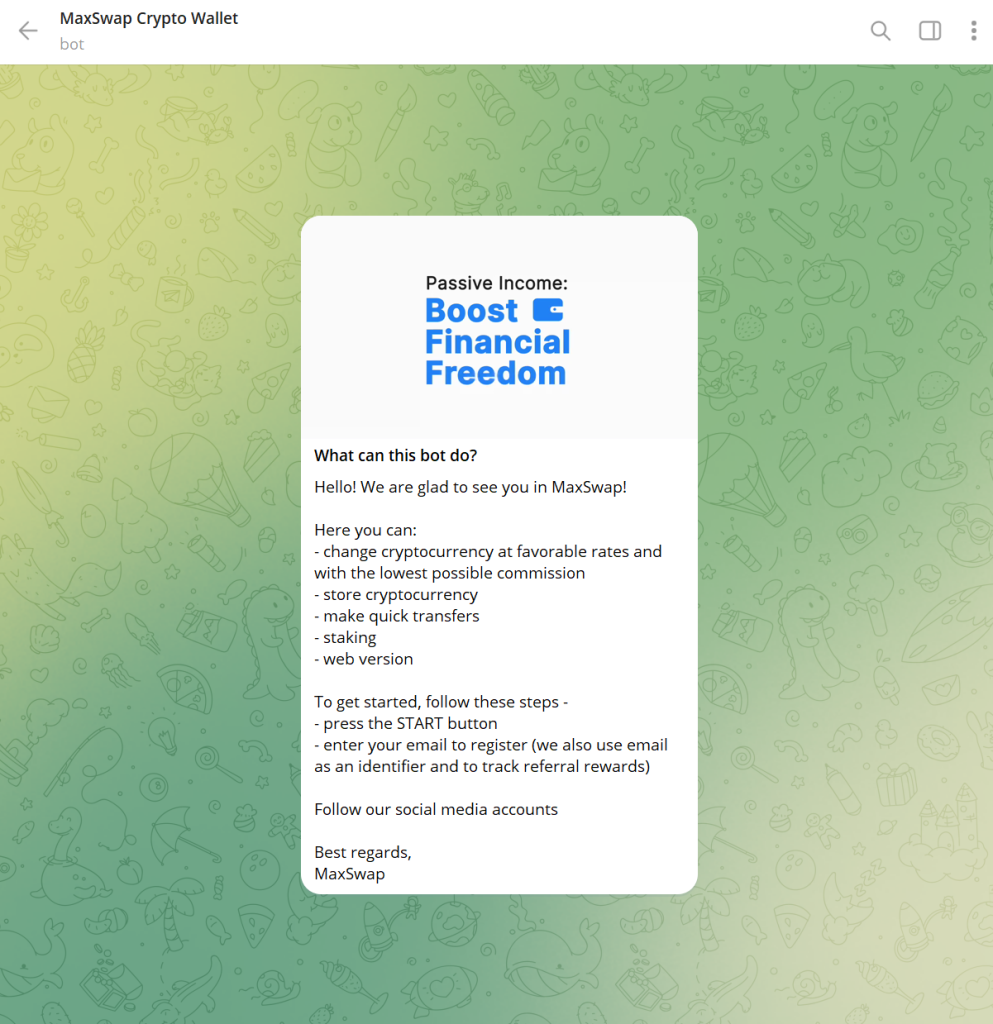

Telegram Bot for Convenience

The Telegram bot grants users platform access and management directly within the messaging app for true cross-device flexibility.

This omni-channel experience where you can exchange, monitor your wallet and positions, stake, and more via Telegram chat mirrors key desktop functionality. Removing device restraints and centralizing crypto tool access through messaging capabilities seems like a major convenience factor.

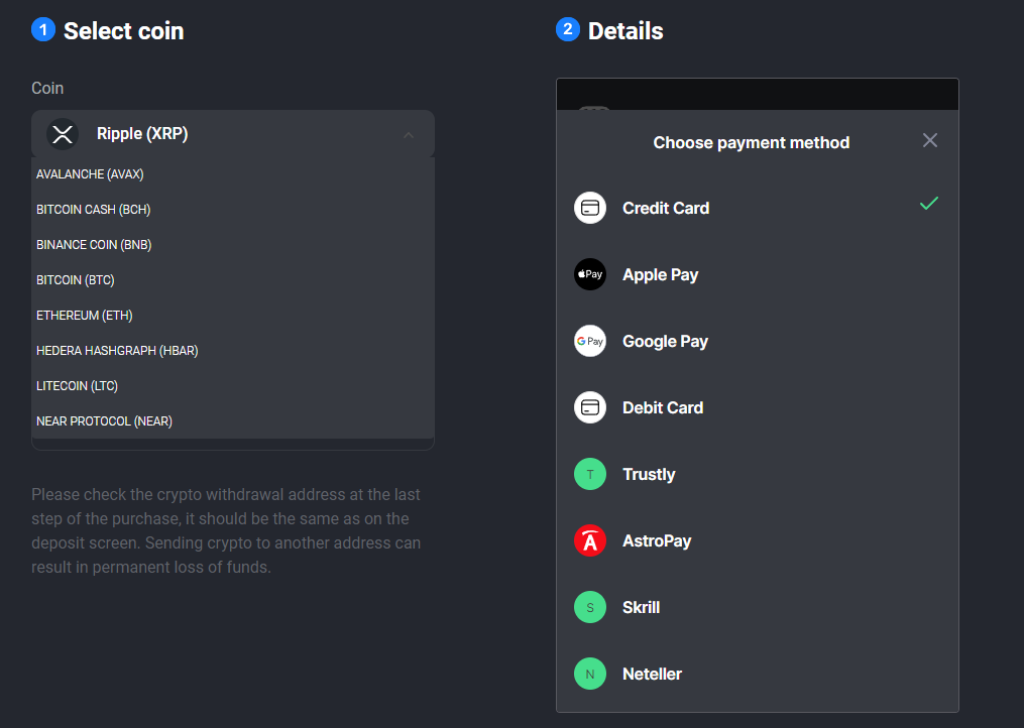

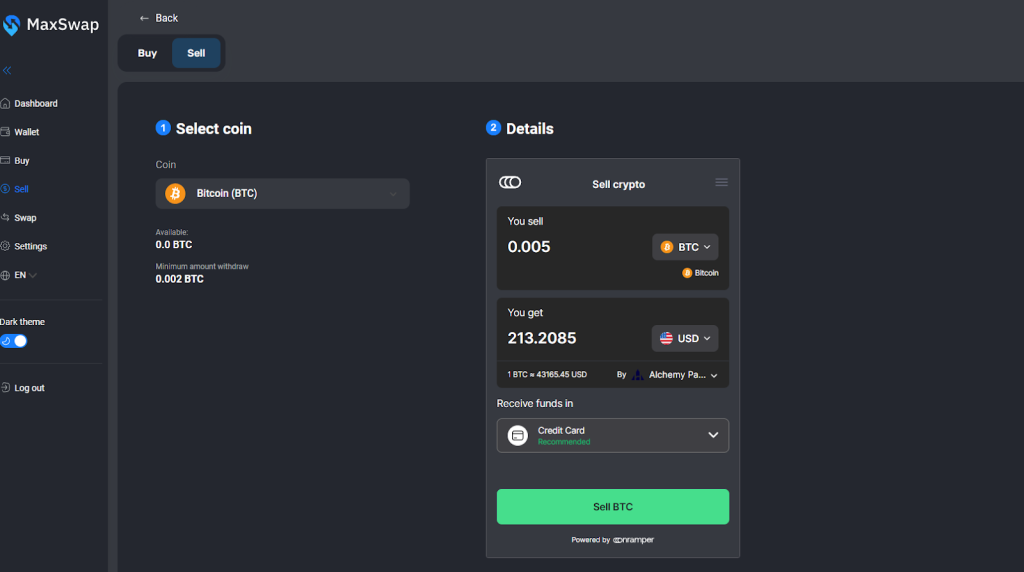

Buying/Selling Crypto with Fiat

As a newcomer looking to turn fiat currency into crypto for the first time, or an experienced investor aiming to expand holdings, having fiat onramps matters. So I was glad MaxSwap incorporates several payment methods to purchase popular digital tokens using traditional money.

MaxSwap allows crypto buying/selling using credit/debit cards, Apple Pay, Google Pay, Trustly, AstroPay, Skrill, and Neteller. This covers many preferred finance apps and should satisfy most people’s payment needs. As an aside, PayPal and Payoneer would be welcomed additions to round out options.

Reviewing the selection of coins available for fiat purchase, MaxSwap covers major offerings like Bitcoin, Ethereum, Ripple XRP, Litecoin, Bitcoin Cash, Binance Coin, and stablecoins USDC and USDT. Users can also directly buy emerging tokens like Avalanche, Hedera, Near Protocol, Stellar Lumens, and more.

While MaxSwap lists over a dozen options, their available crypto assets fall a bit shorter than other exchanges. As a proponent of Decentralized Finance (DeFi) apps, I would have liked to see LINK, KAS, SOL or ADA for purchase using traditional payments. But the choices address most investors’ needs targeting top market cap coins.

The interface also makes completing crypto orders straightforward and buying/selling crypto is literally done within a few clicks. So those new to digital tokens can easily enter the ecosystem. Overall, MaxSwap provides nice fiat gateway flexibility, albeit with fewer altcoin options than crypto-first traders like myself may desire.

Other Key Features and MaxSwap Advantages

Beyond the arbitrage tools, affiliate programs, and fiat purchasing capabilities – MaxSwap contains additional capabilities that catch my eye as a prospective user.

Security and Support

I appreciate the security emphasis with offerings like escrow services for Web2 and Web3 transactions, 2FA authentication, and SSL encryption. For those moving significant value, having escrow mediated counterparty interactions enables trusted engagement.

Additionally, the 24/7 customer support via Telegram and overall positive user feedback provide confidence in MaxSwap’s operations. Maintaining high-quality assistance and service levels at scale is challenging, so this is a good indicator.

Swapping and Exchange

The ability to swap between crypto-crypto pairs directly at market rates without excessive fees unlocks trading opportunities and portfolio adjustment convenience.

I also like the flexibility around exchange volumes and withdrawals – with higher thresholds and quicker settlement times than competitors. This caters well to active investors transacting in size.

Read also:

- UTEX Review: Features, Trading Strategies, Fees, Security, Affiliate Program, Pros, Cons

- Wixi Exchange Review: Manage Risk and Protect Yourself From Deposit Loss With Wixi Insurance

- Level Finance Review: Fees, Supported Chains, LVL and LGO Tokens, Pros, Cons

MaxSwap Outshines Coinbase in Key Areas

For the over 108 million verified Coinbase users, it undoubtedly upholds strong market leader appeal as a smooth mainstream fiat gateway into crypto. However, while I give Coinbase due credit for advancing crypto adoption, its functionality exhibits limitations compared to MaxSwap.

In terms of versatility, MaxSwap contains a wider swath of product offerings to its name – including an integrated DEX protocol, arbitrage tools, savings accounts and staking. This is great for MaxSwap since Coinbase focuses as purely a retail exchange and wallet.

Additionally, MaxSwap’s arbitrage trading architecture inherently enables lower commission trading and instant withdrawal settlement times due to its hybrid centralized and decentralized mechanisms. For those transacting in size or needing quick liquidity access, MaxSwap’s exchange boasts tangible advantages.

When considering ownership, Coinbase maintains custodianship over users’ private keys. This contrasts with MaxSwap’s non-custodial wallet options where individuals retain asset control. Those seeking self-managed solutions may view this as inferior security on Coinbase’s part.

So ultimately while Coinbase nails an accessible cryptocurrency portal for the average consumer, MaxSwap seems optimized for advanced functionality and control – especially attractive to traders, developers, and institutions dealing with scale. By targeting power users’ needs through decentralized solutions, MaxSwap gains edges in capabilities versus a centralized leader like Coinbase.

What’s On the Horizon for MaxSwap

As MaxSwap continues expanding its ecosystem, the platform has exciting launches in store for the upcoming months according to its public roadmap.

First, MaxSwap is set to unveil its dedicated mobile application by next quarter. The iOS and Android app aims to mirror the convenient functionality found in their Telegram bot for cross-device access. Users will enjoy easy account signup via email alongside the ability to exchange, manage assets and portfolio tracking – no matter where they are.

Additionally, MaxSwap will be rolling out virtual debit cards for purchase flexibility, bringing the seamless payments experience directly to users.

These new offerings demonstrate MaxSwap’s commitment to enhancing a centralized and mobile-friendly hub for all crypto activity – from trading tools for seasoned investors to simplified mobile access attracting newcomers.

As they bridge desktop-equivalent capabilities into mobile equivalents all reachable through virtual debit cards, it’s clear 2024 is the year MaxSwap steps up mainstream adoption ambitions while retaining their power user perks. Exciting upgrades lie ahead.

Conclusion: One-stop-shop crypto platform!

As both a longtime crypto enthusiast and trader, I found MaxSwap appealing in its sheer range of offerings providing an advanced decentralized experience with unique advantages. From robust arbitrage tools to yield generating accounts, customizable wallet solutions, discounted trading rates, and passive income affiliate opportunities – MaxSwap consolidates it all into a centralized crypto management hub.

While MaxSwap doesn’t yet provide the UI polish or broad crypto asset selection you may find on prominent retail exchanges and niche functionality outweighs shortcomings for the right power user. If you want robust DeFi engagement, automated trading capabilities, and savings yields without sacrificing security – MaxSwap checks those boxes. For the crypto-first community, MaxSwap delivers an extensive, consolidated way to manage digital asset strategies.