WiXi Exchange is an emerging crypto trading platform that aims to provide users with a simple, reliable and open ecosystem for trading digital assets. What makes Wixi Exchange different from other products is that they have developed a product that can protect all traders from losing their deposits.

At the same time, traders can trade not only on the Wixi Exchange, but also on any other platform. With its headquarters in Estonia and plans to obtain licenses in the EU, Singapore and UAE, WiXi seeks to operate under proper regulations while maintaining an accessible platform for all traders.

In this overview, we will explore the key features and benefits of the WiXi platform, including its trading tools, new insurance offering, tokenomics, referral program and more.

What you'll learn 👉

Trading Tools and Features

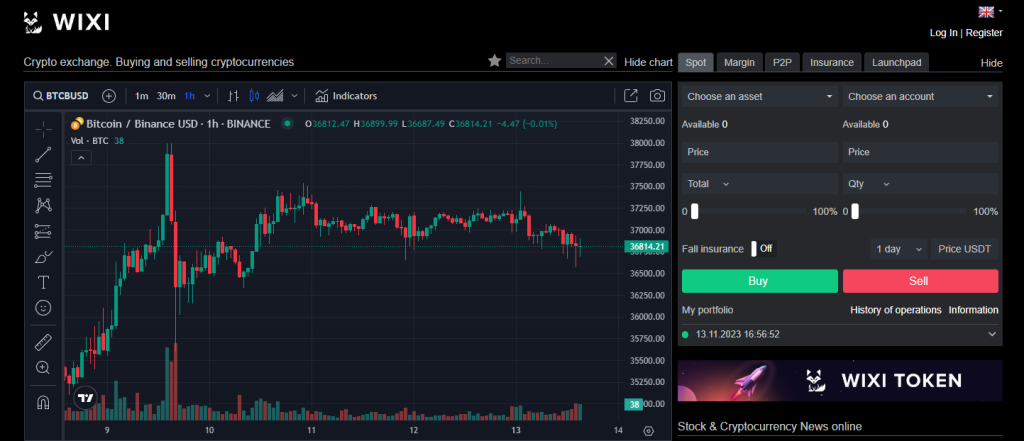

The WiXi exchange currently supports trading for over 100 cryptocurrencies, including fiat-to-crypto trades. Users can access two main trading terminals:

Spot Trading: This allows buying and selling of major cryptoassets like Bitcoin, Ethereum, Solana, Cardano and more. Trades occur directly between buyers and sellers.

Margin Trading: Also known as leveraged trading, this terminal allows traders to open larger positions with borrowed funds. Leverage on WiXi can go up to 100x, providing the potential for bigger gains (and losses).

In addition to these core trading tools, WiXi offers:

- P2P fiat gateways: Users can purchase crypto with fiat currencies through peer-to-peer transactions.

- Fiat deposits: Crypto can also be purchased directly through fiat deposits (e.g. via credit card, bank transfer).

- Insurance products: WiXi’s flagship offering, explained more below.

- Launchpad: Allows projects to launch and distribute tokens through WiXi.

This suite of features provides users with a full-scale crypto trading experience. The exchange aims to differentiate itself by focusing on two key pillars: simplicity and transparency. The platform has an intuitive interface that is easy for beginners to navigate. And as a regulated entity, WiXi maintains transparency around its operations and user funds.

WiXi Insurance: Protecting Users from Crypto Volatility

The unique selling proposition of WiXi exchange is its insurance offering. Crypto market volatility poses a major risk for traders – positions can quickly swing into major losses.

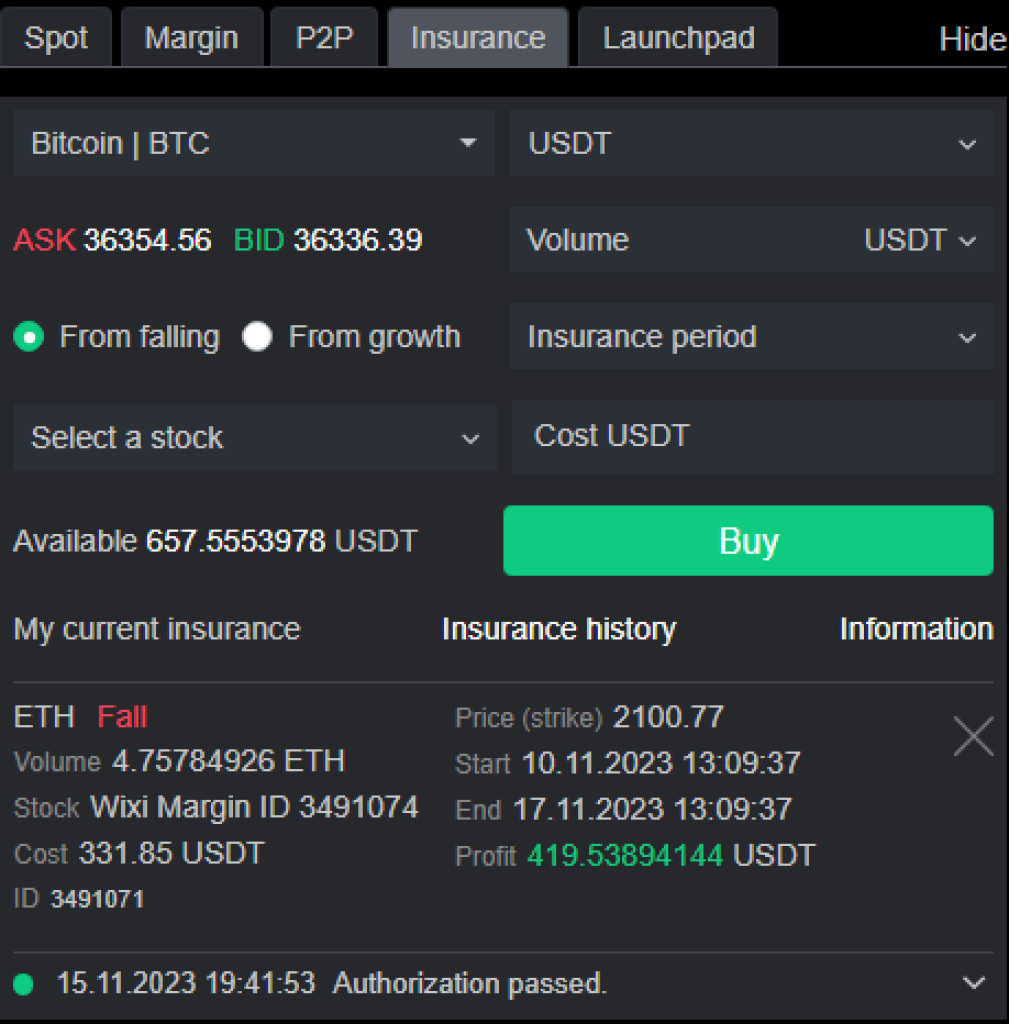

Insurance for Spot Trading Positions

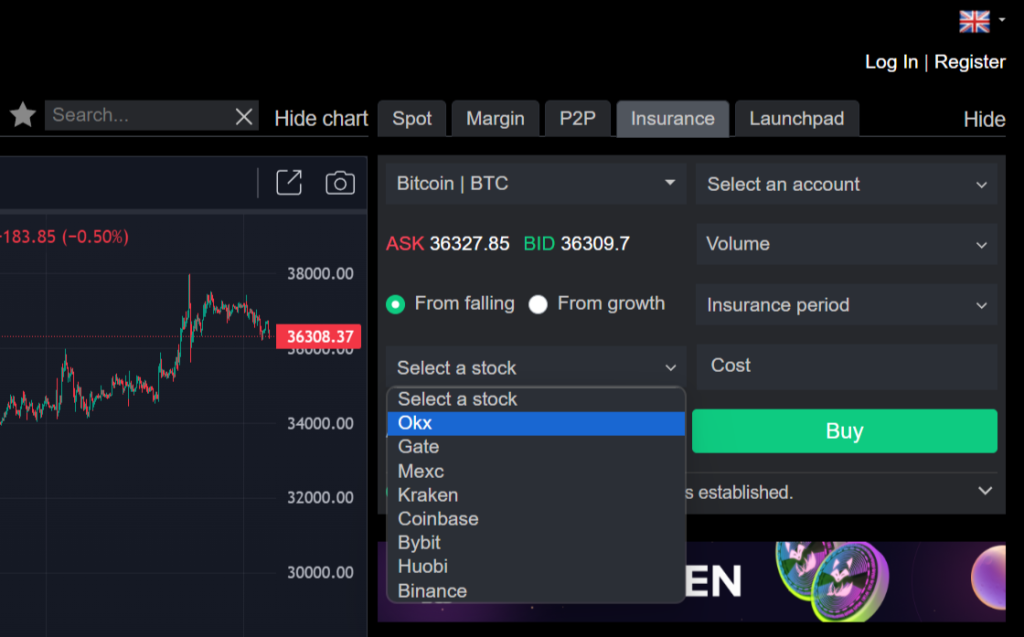

When a client buys an insurance product for a spot trading position on WiXi, they can protect their investment against significant price drops. This insurance is applicable not only for positions held on WiXi but also on other crypto exchanges, offering flexibility and peace of mind to traders.

How It Works:

Selection of Insurance Period and Threshold: Traders select the period during which they want their asset to be insured and set a threshold price. If the asset’s price falls below this threshold during the insured period, the insurance kicks in.

Coverage Against Loss: The insurance covers the difference between the threshold price and the lower market price, up to the insured volume of the position. This means if the market price falls below the threshold, the trader is compensated for the loss incurred up to the insured amount.

Example of Spot Trading with Insurance

Let’s consider a real-world scenario using Ethereum’s recent market movements. Since September 2023, Ethereum surged of $1,500 to around $2,100. Traders anticipating a potential pullback could have used WiXi’s spot trading and insurance in the following way:

- Opening a Spot Position: A trader buys 1 ETH at $2,100, anticipating further growth but wary of a potential drop.

- Purchasing Insurance: The trader then purchases an insurance product from WiXi, setting the threshold price at $2,100 for a one-month period. This insurance would cover the trader if Ethereum’s price falls below $2,100 during this period.

- Market Movement and Insurance Activation: If Ethereum’s price drops to $1,700 within the insured period, the insurance would cover the loss from $2,100 to $1,700, thus protecting the trader from a significant portion of the downturn.

- Short Ethereum: Traders who predicted a downturn after the surge could have shorted Ethereum. This involves borrowing Ethereum when its price is high, selling it immediately, and then buying it back when the price drops. For instance, shorting at $2,100 and repurchasing at $1,800 would yield a profit, minus any fees and interest for borrowing.

Step 1. Opening a deal

Step 2. The market is moving in one direction – insurance is static

Step 3. The market is not moving in our direction. Loss on the position. The insurance will take effect and you will receive the insurance profit, which will cover your loss on the position.

Step 4. Close the insurance. You can do this yourself at any time, or it will be closed on the expiration date. The profit will be credited to your USDT account

WiXi’s insurance products for both spot and margin trading provide traders with a unique tool to manage risks in the volatile crypto market. This feature, combined with the platform’s user-friendly interface and regulatory compliance, makes WiXi an attractive option for both novice and experienced crypto traders.

Margin Position Insurance

Margin trading on WiXi allows traders to open positions larger than their account balance by borrowing funds. The insurance product for margin trading positions covers both upward and downward price movements, providing a safety net against liquidation.

This product insures margin trades on WiXi against liquidations. For instance, a user opens a 5x long position on ETH at $1,500 with $10,000. If ETH drops to $1,350, they would normally get liquidated. With insurance, this liquidation is prevented and the user retains their position.

In both cases, the insurance provides a safety net against crypto volatility. Users pay a premium for the protection, which generates revenue for WiXi. The insurance payouts are funded through the premiums collected.

WiXi Insurance Benefits

Benefits include:

- Downside protection: Insurance limits the maximum loss on a position

- Reduce risk: Traders can take on more leverage/exposure with a hedge in place

- Automatic payout: Claiming the insurance is simple and hands-free

- Coverage for any exchange: Spot insurance works on external exchanges too

Overall, WiXi Insurance provides an innovative way for crypto traders to minimize risk. This enables more active trading and makes WiXi an attractive platform for investing in digital assets.

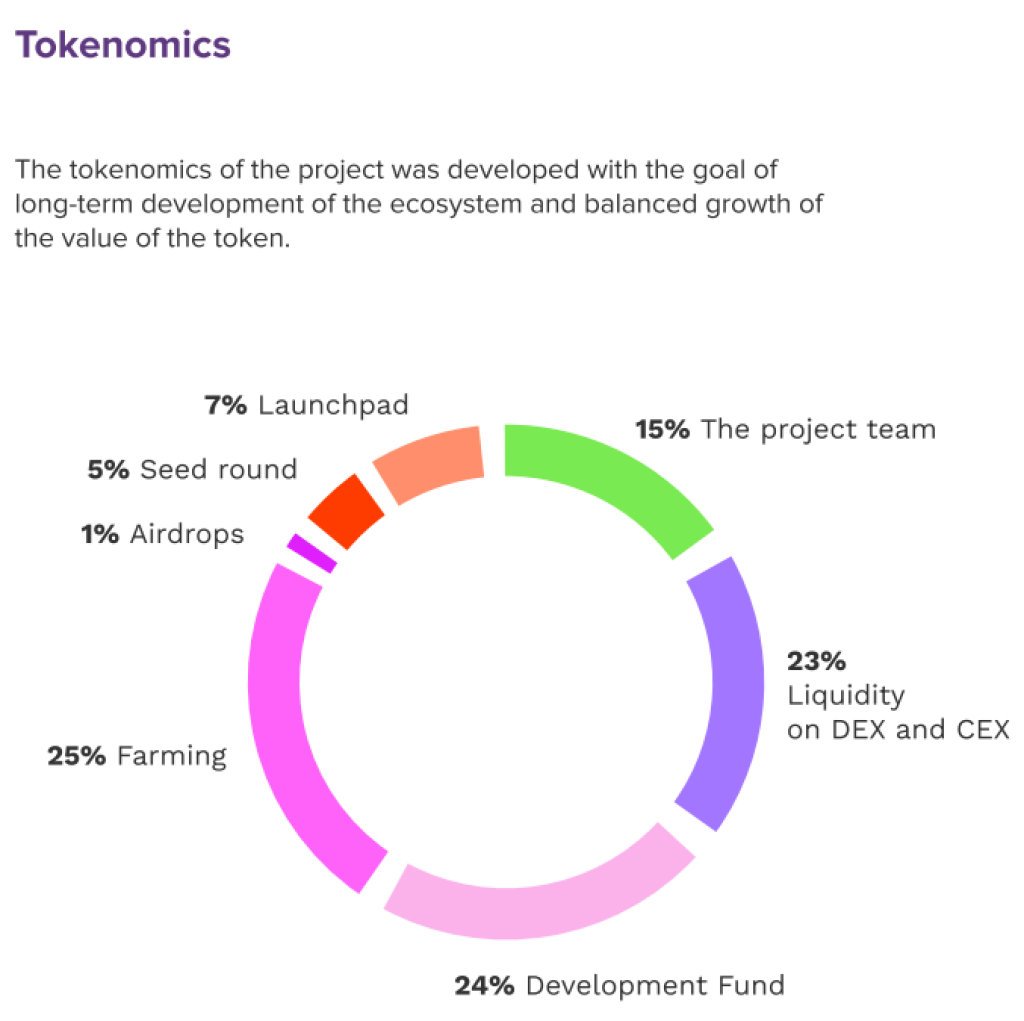

Utility of the WiXi Token

The WiXi Token (WIXI) serves as the backbone of the WiXi Exchange ecosystem, offering a wide range of utilities and incentives for its holders. The token is designed to integrate seamlessly with various services on the platform, enhancing user experience and fostering a sense of community among its users.

Comprehensive Utility Across Services

WXI token holders can use their tokens to pay for an array of services on the WiXi platform, which includes but is not limited to:

- Exchange Fees: Users can pay trading fees on the exchange with WXI tokens.

- Withdrawal Fees: WXI tokens can be used to cover the costs associated with withdrawing funds from the platform.

- Listing Fees: Projects looking to list their tokens on WiXi can pay the listing fees using WXI tokens.

- Insurance Commissions: Users can pay for the unique insurance products offered by WiXi with WXI tokens.

- Transaction Fees in Structured Products: For those engaging in structured financial products, transaction fees can also be paid in WXI tokens.

Profit Sharing and Token Buyback

A significant portion of WiXi’s profits is allocated to support the WXI token ecosystem:

30% of Quarterly Profits: WiXi commits to using 30% of its quarterly profits to support the token. Of this, 15% is used to buy back WXI tokens from the market, reducing the circulating supply and potentially increasing the token’s value. The remaining 15% is invested in liquidity pools, enhancing the overall liquidity of the WXI token.

Discounts and Incentives for Token Holders

Holding WXI tokens comes with tangible benefits:

- Discounts on Insurance Products: Holding over 5,000 WXI tokens in a wallet entitles the user to a 5% discount on WiXi’s insurance products. This discount increases to 7% if the transaction is opened on the WiXi platform.

- Privileged Access in Launchpad Rounds: Token holders with more than 5,000 WXI tokens in their wallet for at least 30 days gain a competitive advantage in private launchpad rounds. They are given priority in the queue to receive opportunities to participate and receive allocations in new token projects launched on WiXi. When voting, applications from users holding the largest number of tokens are considered first, providing an added advantage to substantial WXI holders.

Read also:

- UTEX Review: Features, Trading Strategies, Fees, Security, Affiliate Program, Pros, Cons

- Level Finance Review: Fees, Supported Chains, LVL and LGO Tokens, Pros, Cons

- Apollox Finance Review: History, Features, Chain Settlement, Fees, Interface, Pros, Cons

Wixi Exchange Fees

Wixi Exchange maintains a competitive fee structure for its users. The transaction fees are remarkably low, set at just 0.05%. Additionally, when converting from fiat currencies to USDT, the exchange applies a variable rate.

This rate fluctuates from the peer-to-peer (P2P) bid price, up to an additional 2% of the P2P bid. This dynamic pricing ensures that users can benefit from fair and market-responsive rates.

Referral Program to Incentivize Users

To drive user acquisition, WiXi employs a referral program that rewards existing users for sharing the platform. Any registered user can refer friends and contacts to sign up for WiXi Exchange.

Benefits of the referral program include:

- Lucrative commissions: Referrals receive 30-50% of the exchange commissions taken from the referrals’ trades in spot and margin trading. The affiliate also receives 10% of the platform’s profit from the sale of insurance products. After $1.5 thousand is credited, the reward is reduced to 3%. In addition, you can get credit for those who signed up through a referral link.

- Additional exposure for WiXi: The referral program saves on user acquisition costs and provides organic reach.

- Rewards for evangelizing: Active referrers can potentially generate substantial passive income.

The key motivation factor is the above-industry commissions offered to referrers. Most exchanges offer just 10-20% referral commissions. By providing up to 50%, WiXi incentivizes users to proactively share access to the platform.

This allows WiXi Exchange to grow its user base rapidly in a cost-efficient manner. User trust built through referrals also helps onboard newcomers smoothly.

Example of Benefits from Wixi Exchange’s Referral Program

Imagine you’re a registered user of Wixi Exchange and you decide to participate in their referral program. You refer a friend, Alex, who signs up and starts trading on the platform. Here’s how you can benefit from this scenario:

Earning Commissions from Trading Fees:

If Alex trades and generates trading fees, you receive a significant portion of those fees. Wixi offers 30-50% of these trading fees to you as the referrer. So, if Alex pays $100 in trading fees, you could earn anywhere from $30 to $50 just from this single referral.

Earning from Insurance Premiums:

Additionally, if Alex opts for any insurance products offered by Wixi and pays premiums, you again stand to benefit. You would receive 5-10% of the insurance premiums paid by Alex. For instance, if Alex pays a $200 insurance premium, you could earn $10 to $20.

Passive Income Potential:

The more friends you refer, the more you can earn. If several of your referrals are active traders, your earnings could accumulate, leading to a substantial passive income stream.

Contributing to Wixi’s Growth:

Your referrals help Wixi save on user acquisition costs and expand its reach organically. This not only supports the platform’s growth but also enhances its reputation through word-of-mouth.

Above Industry Standard Commissions:

While most exchanges offer referral commissions in the range of 10-20%, Wixi’s higher commission rate of up to 50% makes its referral program particularly attractive and motivating for users like you.

Future Roadmap and Developments

WiXi has built a solid foundation catering to both basic and advanced crypto traders. Going forward, the platform has several major initiatives planned to expand functionality:

- Structured Products: These financial instruments will allow customized portfolios based on specific risk-return profiles.

- Mobile App Development: iOS, Android and MacOS apps are slated for release by 2024 to improve accessibility.

- Web 3.0 and Rebranding: WiXi aims to launch an upgraded interface with DeFi capabilities by migrating to Web 3.0 architecture.

- Listing of Stock Assets: Along with crypto, WiXi plans to onboard traditional stock market assets, significantly expanding its addressable market.

- Global Expansion: By securing licenses in multiple regions, WiXi will be able to operate across several major markets in a compliant manner.

With these upcoming developments, WiXi Exchange is gearing up to be a dominant player in the crypto fintech space.

Regulatory Compliance for User Protection

As a platform facilitating movement of user funds, regulatory compliance is a top priority for WiXi Exchange. The company is registered and fully operational in Estonia, a crypto-friendly jurisdiction.

It is in the process of securing additional licenses in the EU, Singapore, UAE and other regulated markets.

For Wixi Exchange, users can engage in cryptocurrency transactions without the need for KYC (Know Your Customer) verification, offering unrestricted access and flexibility. In contrast, transactions involving fiat currencies on Wixi Exchange do require verification, but once this is completed, there are no limits to the transactions.

Operating as a licensed entity showcases WiXi’s commitment to transparency and compliance. This builds further trust among the user community, especially institutional investors. In the long run, having necessary regulatory approvals will help position WiXi Exchange as a premier regulated crypto trading venue.

Investor Backing for the Platform

In its seed funding round, WiXi Exchange raised $500,000 from European institutional investors. The investors opted to remain anonymous at this stage.

This investor validation demonstrates that the project and business model have merit. The funds will be deployed to support expansion of the WiXi platform across engineering, marketing, licensing and other functions.

Having reputable institutional investors on board helps accelerate growth in the early stages of the company’s lifecycle. Their expertise and networks support scaling at a rapid pace.

Conclusion

WiXi Exchange brings an innovative formula that makes crypto trading simple, insulated from downside risk, and community-driven through its token model. By combining easy usability with DeFi advantages, WiXi unlocks the potential of decentralized finance for mainstream audiences.

With a successful seed round completed, and a roadmap targeting exponential growth, WiXi has the resources to disrupt incumbent players and establish itself as a top crypto trading venue. Its robust technical architecture, pragmatic business model and commitment to compliance make it poised for long-term dominance.

For both casual traders and institutions, WiXi Exchange presents the next evolution in accessible and transparent crypto finance. As digital assets continue maturing as an asset class, platforms like WiXi will have a pivotal role in driving mainstream adoption.