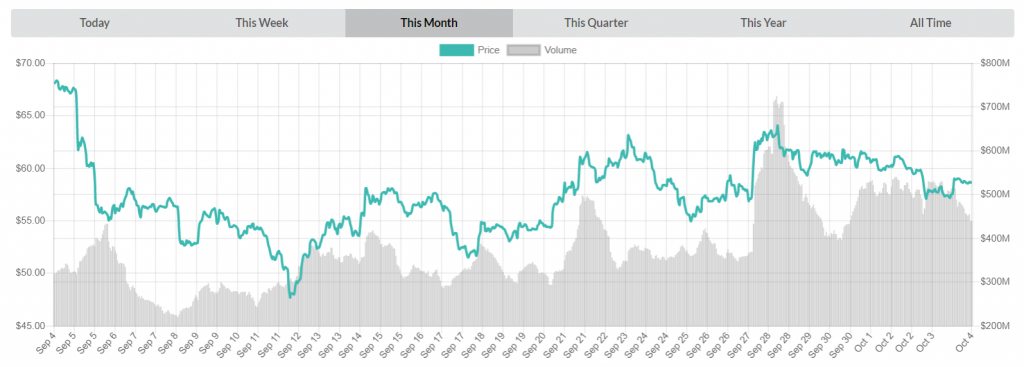

Litecoin reached its peak values on September 4th, when one LTC could have been purchased for $68.34. It fell from there rather sharply towards the monthly lows of $47.67 before experiencing a slight recovery trend which saw the currency peak at $62.77 on the 23rd. It’s been a somewhat steady ride for the coin ever since as it never went more than 5 USD past the value of $60. Interestingly enough, the currency’s trading volumes have been picking up lately, peaking at $714,985,892 on September 28th before correcting to low $500 million levels.

You can currently purchase a single Litecoin for $58.99 USD (2.33% rise in the last 24 hours)/0.00894457 BTC (0.29% rise in the last 24 hours). This value is 84.45% lower than the currency’s all time high of $379.60. Litecoin is pretty well traded at the moment with a daily trade volume of 63,220 BTC, most of which comes from ZB.COM (19%) DOBI trade (18%) and Bibox (12%). With a market cap of $3,455,031,711, Litecoin is the 7th most valuable cryptocurrency on the market.

We looked at what easyMarkets had to say about Litecoin’s current technicals:

“LTCUSD is approaching our first support at 56.70 (horizontal swing low support, ascending channel support, 78.6% Fibonacci retracement , 100% Fibonacci extension) and a strong bounce might occur above this level pushing price up to our major resistance at 67.37 (100% Fibonacci extension).

Stochastic (89,5,3) is also approaching support and we might see a corresponding bounce in price should it react off this level.”

The full technical analysis can be found here.

Litecoin recently released a 0.16.3 update to the Litecoin Core software and as it turns out, it’s a rather important one. The update fixes a bug that the v0.16.2 attempted addressing before and node operators have been advised to shift to the latest version ASAP. The bug, if exploited, could allow a miner to inflate the supply of Bitcoin as he would be able to perform double-spend attacks on the network. Currently shut down nodes don’t have to be immediately upgraded, but only prior to a future launch. The project made it a point to convince the node operators that stored funds were never at risk but there seems to be a miniscule risk of a chain split happening. More details are available in the official announcement Reddit thread.

Meanwhile, Litecoin futures seem to be coming to the trading exchanges near you. TD Ameritrade, the first brokerage firm to launch online trading for traditional assets, recently publicized their intention to enter the world of cryptocurrency trading by investing into ErisX, a new regulated cryptocurrency exchange for spot and futures trading opened by Eris Exchange, a Chicago-based derivatives market. ErisX will apparently be a marketplace where investors will be able to trade Bitcoin, Ethereum, Bitcoin Cash and Litecoin, and futures contracts should be a major part of that trading volume.

Do you know what is Litecoin Cash all about?

Recently Charlie Lee, the creator of the cryptocurrency and a man who famously sold off his entire Litecoin stack just before the market entered its yearly downtrend, addressed what he felt was FUD that was written in an article published by Multicoin Capital. While the community themselves felt the article’s main purpose was to drive the price of a coin that MC has shorted at the time, Charlie Lee went deeper and addressed the points presented in the article.

1/ Recently, there has been a concerted effort to suppress Litecoin price by people/funds that are shorting LTC and by groups that see Litecoin as a threat. I will clear up this FUD and show why Litecoin has tremendous value.

— Charlie Lee [LTC⚡] (@SatoshiLite) September 20, 2018

In a prolonged Twitter thread which we posted above, Lee dispelled rumors of Litecoin losing its edge and market differentiation, lack of mining incentives, lack of merchant acceptance, lack of volume etc. Just a couple of days before we wrote this article, Lee reported that he successfully purchased an Amazon gift card using Litecoin through the Bitrefill platform. The announcement was greeted with adoration by the community as it showcases the real world usability of Litecoin.

I just bought an Amazon gift card using LN on Litecoin. The payment went through instantly and I got the gift card right away. Good job on the great user experience @bitrefill! ? #PayWithLitecoin #PayWithLightninghttps://t.co/dJYLksVVCD

— Charlie Lee [LTC⚡] (@SatoshiLite) October 3, 2018

Finally, an interesting discussion developed in another Reddit thread where user T0pher 90 revealed two bullish rumors/conspiracy theories around Litecoin. The first rumor implies that this last bear market is a complete fabrication designed to intentionally restructure the market, shake out the competition and suck fiat out of crap coins and move it into “quality” ones. Apparently Litecoin was chosen as one of the projects that will survive.

The second rumor goes even deeper, claiming that Litecoin will be the de facto means of exchange for the entire planet, enabling instant transactions with Bitcoin serving as the settlement layer. Only time will tell if there is any truth to these rumors and if Litecoin has what it takes to become the cryptocurrency of the future.

However, the outlook for Litecoin doesn’t look too bright. Right now, its main role seems to be a testnet for bitcoin and an expensive one for that matter. Anything LTC does, BTC does it as well and there appears to be very little distinct added value from LTC to the overall crypto market.