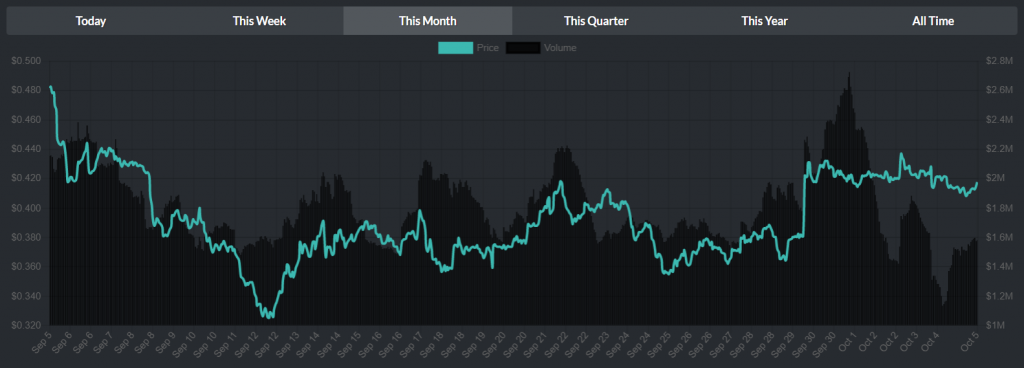

Kyber Network had somewhat of a roller coaster month behind it. Peaking at $0.4812 on September 5th, the currency visited a monthly low of $0.3248 on 12th before going on a slow, short-term recovery run. This run reached $0.4153 and was followed up with a small correction towards $0.35 levels. As September drew close, Kyber Network spiked from those levels towards a high of $0.4304 before shifting into a sideways/downwards pattern throughout October. The currency spiked to its daily trade volume highs of $2,626,444 around this time as well.

At the moment of writing, KNC can be purchased for $0.386670 USD (1.26% rise in the last 24 hours)/0.00005881 BTC (0.93% rise in the last 24 hours). This valuation is a far cry from the currency’s all-time highs of $5.14 (a drop of -92.13%). Daily trade volume is sitting at $1,554,322 USD/236.65 BTC, most of it coming from CPDAX (24%), ABCC (20%) and Binance (11%). With a market cap of $51,911,284, Kyber Network is currently ranked as the 107th most valuable cryptocurrency in the world.

ForecastCity thinks Kyber Network could be looking for a breakout soon enough:

“Technical analysis:

- KyberNetwork/Ethereum is in a range bound and the beginning of uptrend is expected.

- The price is below the 21-Day WEMA which acts as a dynamic resistance.

- The RSIis at 45.

Trading suggestion:

Price is in the support zone (0.0016800 to 0.0015200), traders can set orders based on Daily-Trading-Opportunities and expect to reach short-term targets.”

Check out the complete analysis here for the graph and the trader’s entry zone suggestion.

Kyber Network was quite busy in the last couple of weeks. The exchange lately added 0x (ZRX), Augur (REP) and Binance Coin (BNB) to its KyberSwap, making them accessible through any platform that is tapping into the project’s on-chain liquidity protocol. Kyber is known for powering decentralized atomic swaps and transactions between applications and ecosystems and these latest additions will create a more connected tokenized world where these three tokens will enjoy increased liquidity.

?Interested in pool mining? Check out the leading Genesis mining platform and our review of it.

Kyber also kept going strong with its decentralized payments (a simple integration which allows vendors to accept payments in ERC 20 tokens while still getting paid in ETH or a stable coin like DAI). Platforms like Peepeth, ETHIS and Etheremon have decided to implement this technology and enhance their respective ecosystems with it.

The project also had a couple of new wallet integrations announced in the month of September. Besides wallets such as imToken, Qbao, MyEtherWallet, Trust Wallet and Coinbase Wallet, we recently saw Secrypto, KCash and Midas Protocol Crypto Wallet integrate Kyber’s liquidity protocol to provide simple in-app tokens swaps for their users. A couple of decentralized exchanges decided to utilize Kyber’s liquidity protocol to offer decentralized atomic swaps on their respective platforms. Weswap, Easwap and Totle are the exchange projects in question. Finally, a decentralized margin trading protocol bZx became one of many financial dApps which integrated the mentioned Kyber protocol.

Kyber Network had some neat community activities as well. The team and people who have been working on the project for more than a year now have received the first batch of their previously frozen tokens. The project also visited Singapore Blockchain Week where they participated in various chats and panels discussing crypto exchanges, smart contracts and blockchain in general.

At #ConsensusSingapore talking Asia OTC trading with @Justinchow08 of Cumberland, @loi_luu cofounder of @KyberNetwork and Wayne Trench of @OSLBrokerage

"Deals of 1k to 10k BTC is not uncommon". Exchanges just don't have the liquidity to meet demand(!). New funds prefer OTC ease! pic.twitter.com/dnZ2EXzGYS

— Ben Alexander (@CryptoCoinBen) September 19, 2018

Team members visited another panel at Consensus Singapore where they talked about the growth of Asia’s crypto-asset market and the rise of decentralized exchanges. Kyber’s Head of Business TN Lee visited the Blockchain Pioneers Summit in Chijmes where he spoke in deail about Kyber’s on-chain liquidity protocol and how it benefits decentralized payments.

Besides these, the project visited Vietnam Crypto Dialogue, co-organized with Regulus, Midas Protocol, Tomochain, Kambria and Huobi Global, which focused on decentralized technologies and potential regulation in the country. Vitalik Buterin and other prominent ecosystem players such as Aelf, Zilliqa, Sparrow Exchange, Traceto.io, Signum Capital, Hashed and imToken were present as well to offer their thoughts on discussed topics.

The project held several meet-ups throughout the month, including the ones in Hanoi, Berlin (during ETHBerlin), Korea (during ETHKorea) and Japan (organized within HashHub, a popular blockchain co-working space). Kyber will be present at San Francisco Blockchain Week / ETHSanFrancisco from October 5th — 12th where they’ll be presenting their project to a wider audience.

With a large attendance of talent and innovators, the co-founder of @kybernetwork Loi Luu will be joining #SFBW2018 along with many other participants! https://t.co/wngnDuYwSg pic.twitter.com/oFbvlumd98

— San Francisco Blockchain Week (@SFBWofficial) August 28, 2018

The project will be taking part in the event’s hackathon, with up to $11,000 worth of Kyber Network Crystal (KNC) tokens available to those who fulfill the bounties presented here.

Overall the Kyber Network seems to be focused on ecosystem growth and platform development. If they keep up the pace they’ve been setting so far, they might just become a major player in the world of decentralized payments and finance.