What you'll learn 👉

Table Of Contents

The Kyber Network

KyberNetwork is running on Ethereum network. It is an on-chain protocol which allows instant exchange and conversion of digital assets (for instance crypto tokens) and cryptocurrencies (such as Ether, Bitcoin, ZCash) with high liquidity. Kyber Network will be the first system that implements several ideal operating properties of an exchange including trustless, decentralized execution, instant trade and high liquidity. Besides serving as an exchange, Kyber Network also provides payment APIs that will allow Ethereum accounts to easily receive payments from any crypto tokens. As an example, any merchant can now use KyberNetwork APIs to allow users to pay in any crypto tokens, but the merchant will receive payments in Ether (ETH) or other preferred tokens.

Ethereum accounts will be able to safely receive payment from Bitcoin, ZCash and other cryptocurrencies via our payment APIs, through this trustless payment service. Derivatives will be introduced to mitigate the exposure to the risk of volatilities for the users of Kyber Network Crystals (KNC) and selected cryptocurrencies. This will allow users to participate in the price movements synthetically.

Recently, centralized exchanges are under constant criticism for their security risks, such as internal fraud and external hacking, and long processing time. In some cases, withdrawing your funds from exchange can take several days. On the other side, popular decentralized exchanges have problems providing active trading due to the low liquidity. Additionally, costs to change a trade can be excessive when the order book is on-chain.

As it was stated, Kyber Network has on-chain exchange but the order book is eliminated. It enables the platform to securely exchange your digital currency promptly at low cost.

Kyber Network Guide will cover:

– Kyber Network’s Workflow

– Kyber Network Crystal (KNC) token

– Team behind Kyber Network

– Trading

– Buying KNC

– Storing KNC

– Final Thoughts

– More info about Kyber Network

Kyber Network’s Workflow

Kyber Network users can also send their existing token A, by converting to a different type of token B and sending it to another user, who only accepts payment in B, all in one transaction. More interestingly, Kyber Network introduces a new standard contract wallet to allow existing contracts, which only accepts few tokens, to receive payments from any future tokens any modification to the contract code. This allows contracts or merchants to access to a wider class of users, receives payments and contributions in any tokens that Kyber Network supports.

Example

Let’s assume that John must pay a rent a car fee. Rent a car agency accepts only ETH and John only owns REP. In this case they will use the Kyber protocol to conclude the transfer.

John will check on the Kyber Network platform that the exchange rate for the transaction is 1 ETH = 16 REP. He will enter an order to Kyber platform to convert 0,01 ETH worth of REP and transfer it to the rent a car agency.

Kyber Network maintains a reserve warehouse which holds an appropriate amount of crypto tokens for purposes of maintaining exchange liquidity. The reserve is directly controlled by the Kyber contract, and the contract has a conversion rate for each exchange pair of tokens by fetching from all the reserves. The rates are frequently updated by the reserve managers, and Kyber contract will select the best rate for the users. When a request to convert from token A to token B arrives, the Kyber contract checks if the correct amount of token A has been credited to the contract, then sends the corresponding amount of token B to the sender’s specified address. The amount of token A, after the fees, is credited to the reserve that provides the token B.

After the Kyber contract checks that John has entered required REP in the contract for conversion, the contract then sends the 0,01 ETH worth of REP and transfers it to the rent a car’s address. Received funds from John, will appear in agency’s balance as if the funds came directly from John’s address. John’s REP with a small fee is credited to the reserve that provides the ETH.

Actors in the KyberNetwork

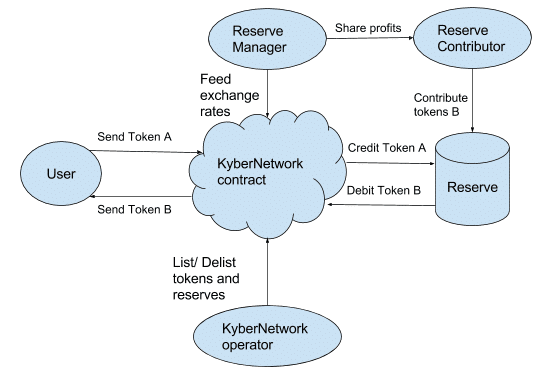

There are 5 roles for the actors in the network:

- Users who send and receive token to and from the network. Users in KyberNetwork include individual users, smart contract accounts and merchants.

- A reserve entity (ies) provides liquidity to the platform. This can be Kyber’s reserve or other third party reserves that are registered by other market makers. Reserves can also be classified into public and private reserves which do and do not take contributions from the public.

- Reserve contributors who provide capital to the reserve entity and share the platform profit. This actor only exists in public reserves which accept contributions from public to build up the reserve.

- Reserve manager who maintains the reserve, determines exchange rates and feeds the rates to the Kyber Network.

- Kyber Network operator who is responsible to add and remove reserve entities, list/ delist pairs of tokens in the network. Initially the Kyber team will act as the Kyber Network operators to bootstrap the platform in the early phases. Later on, proper decentralized governance will be set up to take over the task.

Each of the actors interacts with the smart contract independently in a different way. The users send and receive tokens within a single transaction, without waiting for any response from the reserve or the Kyber Network operator. The Kyber Network operator is responsible for adding and removing reserves, while the reserve manager determines and feeds the exchange rates to the contract for a fixed period (several seconds basis). The main contract relies on the reserve entity to guarantee high liquidity.

Dynamic Reserve Pool

Kyber Network guarantees high liquidity via the dynamic reserve pool by leveraging the existing reserves in the network. All of the Reserve Entities in the system are included in the pool. Kyber Network allows multiple reserves to co-exist to enable better prices (by eliminating monopoly of reserve), guarantees better liquidity (by utilizing other sources).

When a trade/ conversion request arrives, Kyber Network will fetch the conversion rates from all reserves that can process the request. Kyber Network then selects the best rates and executes the request. Kyber Network guarantees that both the reserves and the users are safe, namely Kyber does not keep any party’s funds and all transactions are atomic.

Kyber Network prevents centralization and enables the low volume token listing by allowing external Reserve Entities. There is a greater possibility that external reserves may accept to store less popular tokens that are not listed on Kyber reserves.

The security of reserves becomes a major concern in Kyber Network, especially for public reserves that take contributions from other members in the network. One of the primary concerns is that a bad/ unethical reserve manager may quote and trade bad prices to him/ her to drain all coins from the reserve. Public reserves are subject to greater risk exposure due to its open nature. To mitigate the security risks of public reserves, Kyber will employ a transparent fund management model, for example MelonFund (developed by MelonPort), so that contributors of the reserve can track all trading activities done by reserve managers. Kyber also plans to introduce restrictions to protect open reserves. For example, the funds of the reserves can only be transferred to predefined addresses in the contracts, such as the reserve contract itself, and other exchanges that the reserves interact with. Hence, the risk of unwarranted extraction of funds out of the system is removed. Also, to prevent reserve managers from deliberately setting up false and unreasonable exchange rates, e.g. one million Golem Network Token (GNT) per Ether when the spot rate is only five hundred GNT to one Ether, just so that the manager can buy GNTs at a cheap price, Kyber employs both on-chain mechanisms (e.g., prevent unreasonable changes in price without special authorization) and by off-chain mechanisms. For example, a background monitor that will halt transactions when the system detects dubious activities that undermine the integrity of the network can watch and flag out suspicious behaviors from any reserve manager in the network.

Kyber Network Crystal (KNC) token

Kyber Network reserves need to pre-purchase and store KNC tokens. In every trade, a small fraction (exact numbers are TBD) of the trade volume will be paid by the reserve to Kyber Network platform in KNC. This small fee represents the reserve’s payment in return for the right to be able to operate and earn profits from trading activities in Kyber Network. The collected KNC tokens from the fees, after paying for the operation expenses and to the supporting partners, will be burned , i.e. taken out of circulation. The burning of tokens could potentially increase the appreciation of the remaining KNC tokens as the total supply in circulation reduces.

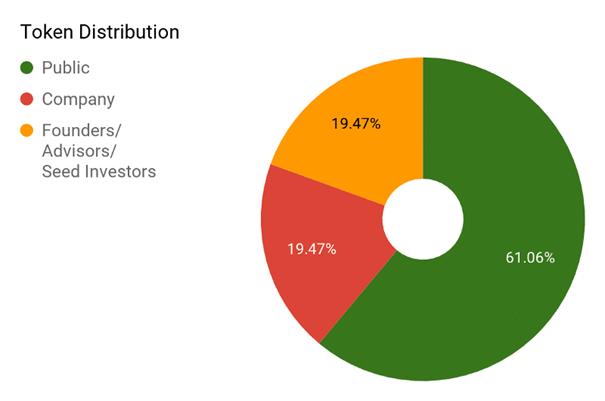

A maximum amount of 226,000,000 Kyber Network Crystal tokens (KNC) will be minted. The token distribution will be shown as below:

– 19.47% for the company

– 19.47% for founders, advisors and seed investors

– No more than 61.06% for the public from our private sale and public sale. The unsold tokens will be burned.

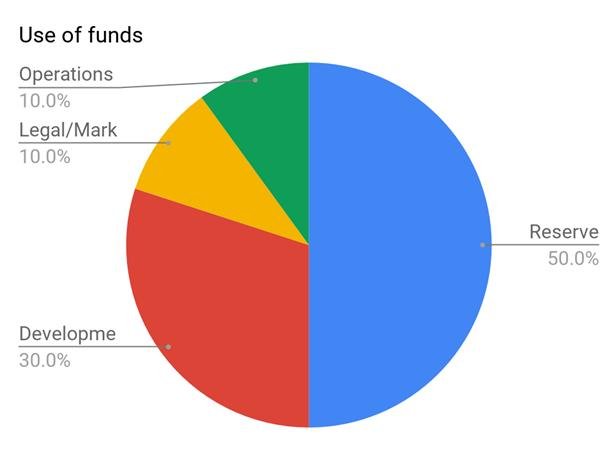

Kyber Network intends to use the proceeds of the Token Sale as follows:

- 50% to a reserve to be managed by Kyber Network as a reserve operator.

- 30% for the development and maintenance of the platform service.

- 10% for the operation of and other costs related to maintaining Kyber Network.

- 10% for marketing and legal costs.

It is critical for Kyber to have and maintain own reserve as it guarantees the liquidity of the platform prior to the participation of third party reserves. Kyber plans to firstly support the popular tokens like OMG, GNT, GNO and REP and a few others. At a later stage when cross chain protocols become more established, Kyber will tokenize other cryptocurrencies (for example Bitcoin, Zcash etc.) on Ethereum to enable trades between ERC20 tokens and different coins. To be able to execute this component, a large initial capital is required in order to provide reasonable liquidity and trading volume. Hence the need for a reserve of 100,000 ETH.

Team Behind Kyber Network

Kyber Network was created by Loi Luu (CEO and Co-Founder), Yaron Velner (CTO and Co-Founder), and Victor Tran (Lead Engineer and Co-Founder). Loi Luu is a researcher working on cryptocurrencies, smart contract security and distributed consensus algorithms. His research publications are available online, and he is a regular invited speaker at Bitcoin and Ethereum workshops such as DevCon2, EdCon, Scaling Bitcoin.

Yaron Velner is a researcher and a co-founder of the SmartPool project. His research is focused on aspects of game theory incentives in blockchain protocols and formal verification of smart contracts. He holds a Phd in computer science from Tel Aviv University. In his Phd thesis he investigated applications of game theory techniques to formal verification of computer programs and systems.

Victor Tran is a senior backend engineer and Linux system administrator. He has experience in developing and building infrastructure for multiple social marketing platforms and advertising networks. He is interested in building high performance multi-platform applications. Victor co-founded and was CTO of several startups in social marketing. He built and maintained platforms which handled millions of monthly active users. Victor is currently the lead engineer in the SmartPool project.

Regarding the advisory board most impressive member is Vitalik Buterin. Vitalik is the Founder and Chief Scientist of Ethereum. He is also both the Founder and a writer for Bitcoin Magazine, a venture that marked the beginning of his career in crypto in 2011. He is interested in creating secure, efficient, and trustworthy systems and advises a number of projects in the crypto space.

Road Map

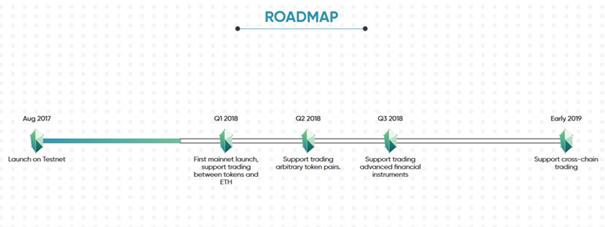

The road map of KyberNetwork includes several phases.

- Phase 0: Testnet deployment. Develop an MVP version of Kyber platform, including the Kyber Network wallet, the main Kyber Network contract and reserve dashboard. The purpose of this phase is to create a basic and functional version of Kyber Network with all the main functionalities and applications. The MVP will be released publicly, and the related contracts will be deployed and tested on the Ethereum testnet.

- Phase 1: Basic mainnet deployment. The team will deploy the first version of Kyber Network on the mainnet. They will start off with supporting trades and proxy payments between any tokens to and from Ether. The tokens that Kyber supports will be the popular tokens that have high demand and high trading volumes in the market. Kyber will also partner with wallet providers like MyEtherWallet, Status, Jaxx and others to implement the core features of Kyber Network.

- Phase 2: Supporting arbitrary pairs of tokens. Team expects to have more reserves (i.e. market makers) to join Kyber Network. The number of supporting tokens will increase as Kyber can get more reserves in its platform. Kyber Network will also work with other strategic partners to build APIs to allow users in their platforms to efficiently withdraw tokens/ shared fees in preferred tokens. For example, many platforms, projects are employing the fees sharing model in which token holders share all the platform fees collected from platform users. Token holders in these platforms may get their shared fees in, for example, ETH seamlessly via Kyber Network if these platforms use Kyber’s related APIs.

- Phase 3: Trading advanced financial instruments. In this phase, Kyber expects to support trading of advanced financial instruments. The plan is to work with decentralized hedge fund platforms (e.g. provided by Melonport) that allow people to invest in trustless hedge fund and get the profit share from efficient fund managements.

- Phase 4: Support cross-chain trades. The deployment in this phase allows users to trade between Ether/ tokens to Bitcoin, ZCash, ETC and so on. There are two ways to enable this goal: using chain relays (e.g. BTCRelay and ZecRelay) or using interchain communication protocols (e.g. Cosmos, Polkadot).

Trading

The Initial Coin Offering was in September 2017 and since then Kyber price was around $1 (decreasing in BTC value) until December. Like many other altcoins, the Kyber token followed the same trend by rising in price in December and losing its value at the beginning of January 2018.

After the launch of mainnet this year, KNC may increase in price. The reason for price rise could also come from number of partners using Kyber Network.

Additionally, increase of the price can come from token burning, mentioned earlier, as the token has limited supply.

Buying KNC

You can buy KNC on Binance and OKEx as a trading pair with Bitcoin. It is also possible to use Ethereum to buy KNC but it has lower liquidity.

You are not able to purchase KNC with “Fiat” currency so you will need to first purchase another currency – the easiest to buy are Bitcoin or Ethereum which you can do at Coinbase using a bank transfer or debit / credit card purchase and then swap that for KNC at an exchange such as Binance.

Storing KNC

KNC is an ERC20 token, which means you can store it in any wallet supporting ERC20. Most popular online option for storing ERC20 tokens is MyEtherWallet. You can also use MetaMask.

If you want an additional protection, you should use hardware wallet such as Trezor or Ledger Nano S. Both hardware wallets provide support for KNC token.

Ropsen Testnet wallet beta version was introduced by Kyber Network.

Final Thoughts

Kyber Network is a decentralized protocol that allows you to convert and exchange tokens securely and instantly. Allowing other reserves it ensures high liquidity and fair rates for users. It also allows for proxy payments, derivatives, and cross-chain payments.

More Info About Kyber Network

– Github

– Slack

– Telegram