No matter how long you have invested in cryptocurrencies, you have probably heard or read about crypto bots. Somebody either praised them or complained about some of them not working. And depending on whose experience you ran into, they sound very interesting and you would want to know more or they sound terrible and you would rather avoid them.

Well, the thing with the bots is: that they are as good as the developers that create and maintain them. The bad experiences stem probably from outdated or badly structured bots. And the good ones are probably from people who use up-to-date and well-implemented software. Today I want to review and talk about one such bot – Hodlbot.io.

What you'll learn 👉

What is Hodlbot.io?

Hodlbot.io is a solid piece of software that does what it tells you it does and, which is rare in the cryptocurrency space, is intuitive and has a great user experience. Hodlbot can be customized to fit your needs but in general, it does one thing: it automatically rebalances your portfolio in a way you set it to do it.

What Does HodlBot Do?

HodlBot is a strategy-agnostic crypto trading bot that helps you manage your portfolio in a more powerful, and sophisticated way.

Create your own portfolio

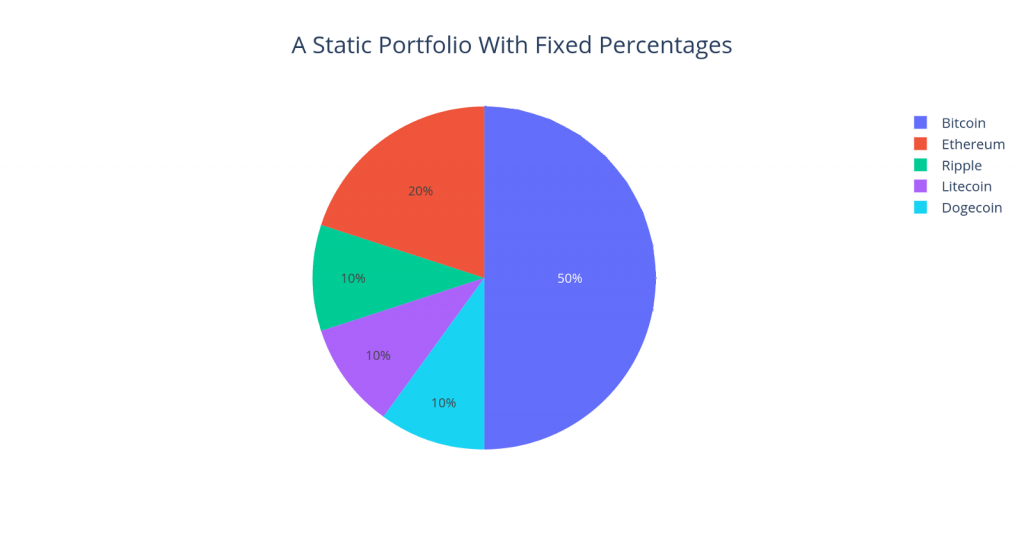

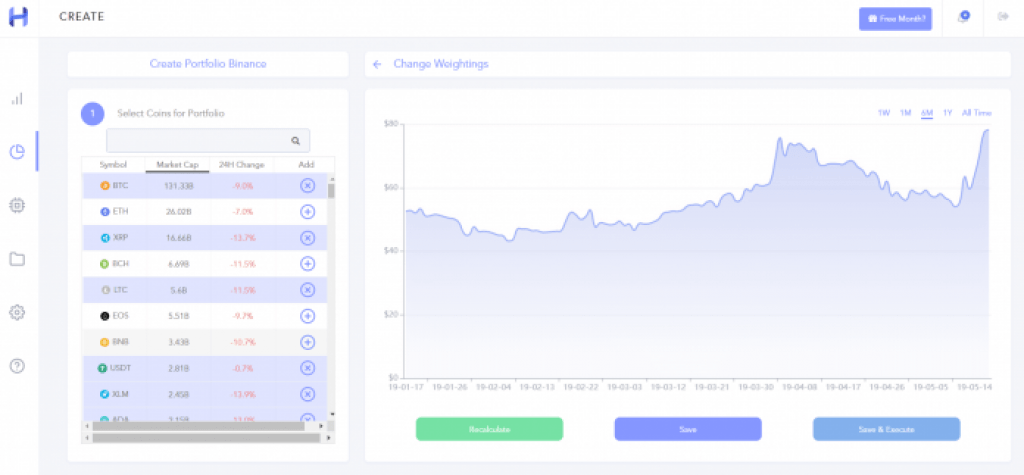

Rather than manually executing trades, you can use HodlBot to simply create a portfolio with custom weighting and allocations.

Index the market

Crypto traders can also use HodlBot to create DIY index funds. An index fund is a portfolio designed to track the performance & risk of the entire cryptocurrency market.

95% of investors are lousy traders and beating the market is terribly hard thing to do. And I am not making this up – read here evidence-based analysis that tells you the same thing – 95% of active funds fail to beat index funds.

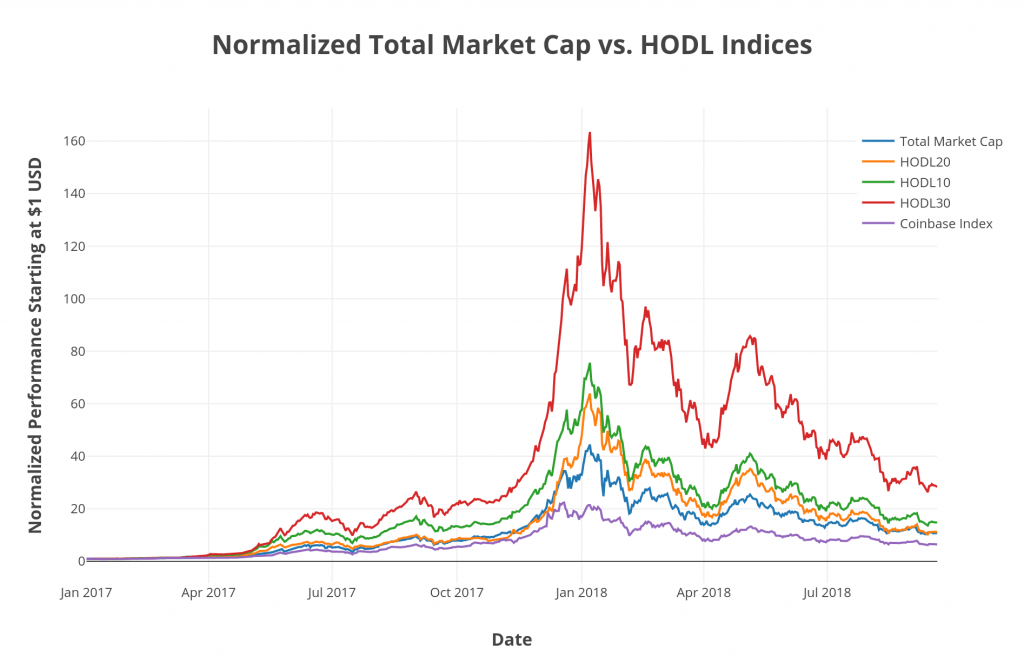

With Hodlbot you can create your own index fund or use the HODL10 or HODL30 to mitigate trading risks and increase the chances of gains.

Portfolio Rebalancing

When the market moves up or down, HodlBot will automatically make a series of trades to rebalance your portfolio back to its original, ideal allocation. Portfolio rebalancing has been shown to reduce risk and generally improve returns.

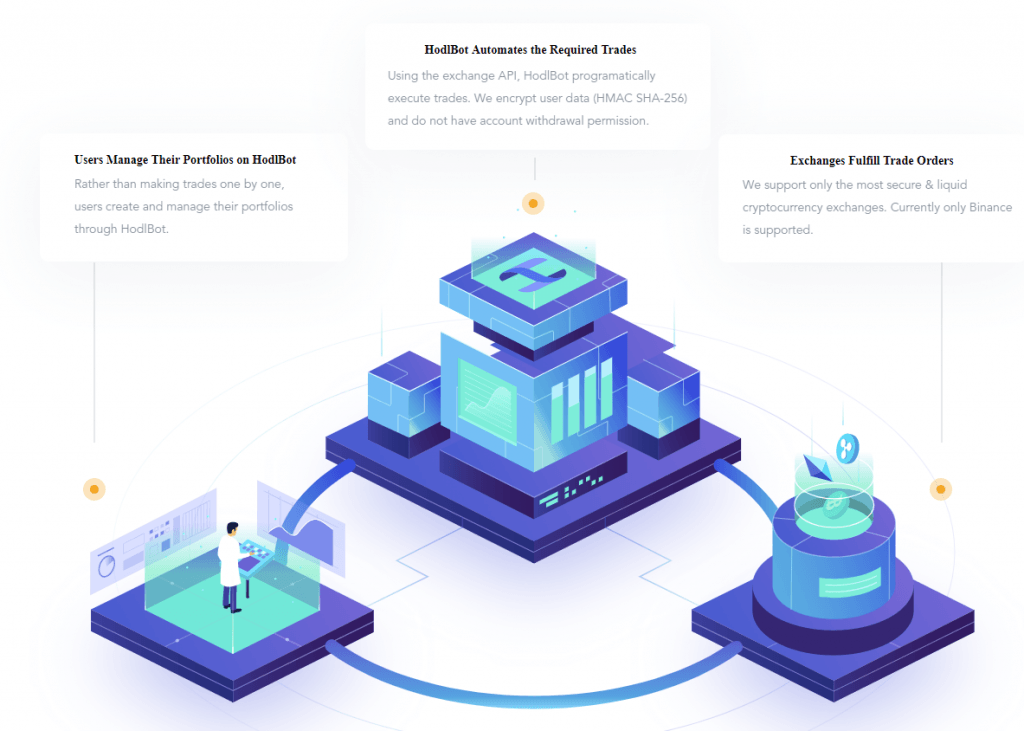

How does Hodlbot.io work

Just like other bots, hodlbot.io will need to connect to your exchange account to do its job. Once you connect to the exchange, you will then set up your own portfolio – divided into coins you want to trade with allocations set for each individual coin. For example, you want a portfolio where you hold 50% of BTC, 20% ETH, 20% XRP, and 10% of ADA. The bot will then do the work for you – whenever one of the coins in your portfolio goes up, Hodlbot will sell it (you set your own profit margin) and take the profits to rebalance the portfolio back to the original percentages and allocations.

You can also create your own index fund of top 10 or top 20 coins (or whichever number of coins you want).

Types of Indexes

The HODL10 Index – Top 10 coins weighted by square root market cap.

The HODL30 Index – Top 30 coins weighted by square root market cap.

Is Hodlbot.io safe?

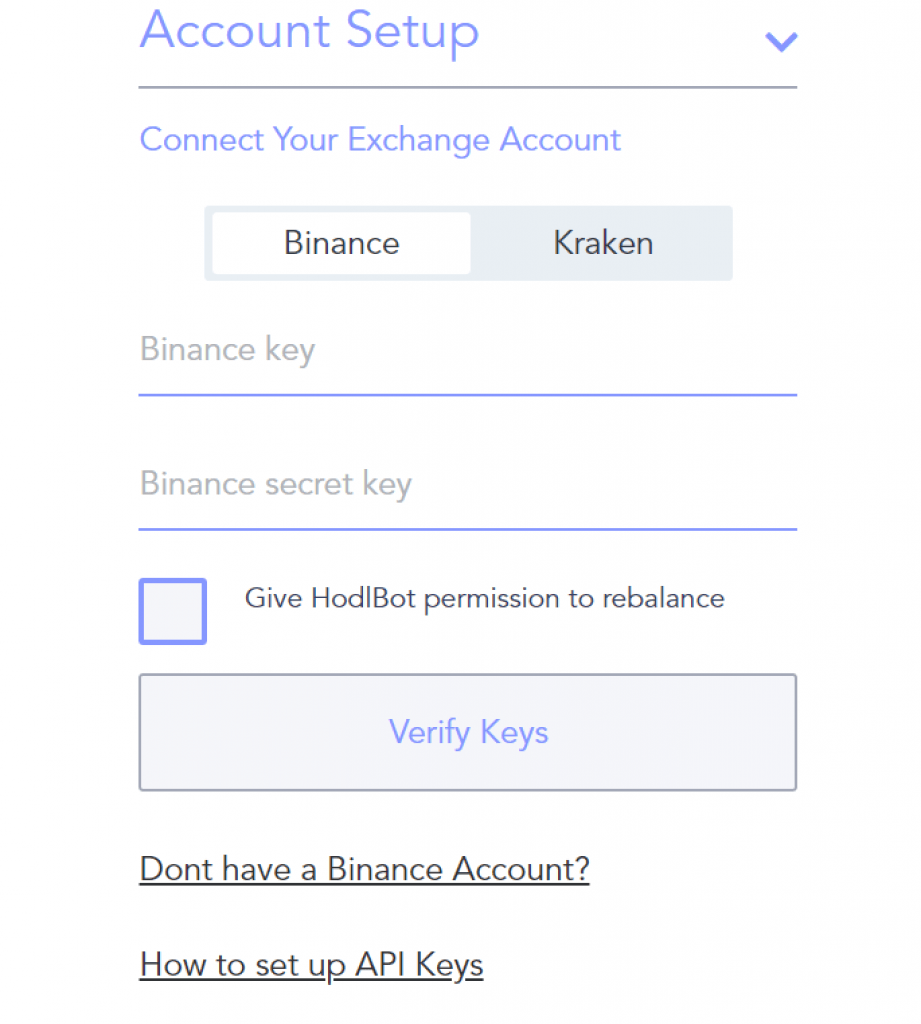

Yes, since it connects to your exchange account via API that only allows it to trade your funds and not withdraw them. The connection is also encrypted so none of the user data transferred is visible.

The bot is well established with more than 10k users and over $ 50 million worth of executed transactions.

How to setup Hodlbot.io

- Connect to an exchange – there is a detailed guide on the site on how to find the API key and connect the bot with your exchange.

- Set up your trading strategy or choose one of the pre-made indexes.

- Click run

You can opt for a bear market, a bull market, or a neutral market strategy.

What exchanges are supported?

Currently, only Binance & Krakenare supported.

However, HodlBot is adding new exchange integrations all the time. In the next month, Kucoinand Coinbaseare expected to be supported.

How often does Hodlbot.io rebalance my portfolio?

That is another option you determine – you can set the frequency of rebalancing to any timeframe you want. You can also blacklist coins you don’t want to invest in.

Why would I use Hodlbot.io instead of trading manually?

Because 95% of investors are lousy traders and beating the market is terribly hard thing to do. And I am not making this up – read here evidence-based analysis that tells you the same thing – 95% of active funds fail to beat index funds. With Hodlbot you can create your own fund or use the HODL10 or HODL30 to mitigate trading risks and increase the chances of gains.

Would Hodlbot outperform bitcoin?

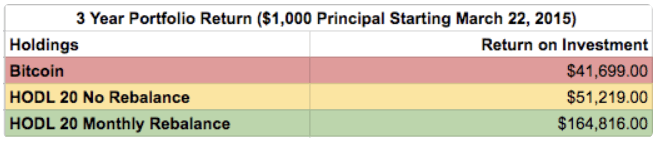

In the last 3 years, Bitcoinhas gone up by a staggering 42x. However, HODL 20 with no rebalancing was up even more – a whopping 51x and the HODL 20 with monthly rebalancing was up by a factor of 164x.

Based on this 3-year term the HODL 20 outpaced BTC by almost 4 times. You can check this out on Hodlbot by using the backtest function in the software to test other comparisons of indices or strategies that are there to help you make a decision on how you want to design your own strategy!

Fees

HodlBot is noob-friendly as it is free for accounts under a $500 portfolio. This is great for inexperienced traders – you can test a lot and get a good grip of the bot before moving up with your cryptocurrency portfolios and account type on Hodlbot.io – the one for custom portfolios of over $500 costs $10 per month.

You do have a 14-day trial period so you can take the bot for a ride without paying a cent for it.

Make sure to check out our guides on crypto bots:

- Best Crypto Grid Trading Bots

- Best Crypto Scalping Bots

- Best Cryptocurrency Arbitrage Bots

- Best Free Crypto Bots

- Quadency review

- Coinrule Review

- 3Commas review

- Bitsgap Review – Is this the best crypto trading bot for Cryptocurrency?

- Cryptohopper Review – How do I start Cryptohopper?

- TradeSanta Review – Is TradeSanta free?

- Mudrex Review

- Wunderbit Review

- Coinmatics Review