So far, Dogecoin has had a tough year. Since the beginning of the year, DOGE experienced a significant drop that saw its price fall nearly 60% in USD and 66% against BTC.

Dogecoin, currently ranked #28 by market cap, is up 0.81% over the past 24 hours. DOGE has a market cap of $286M with a 24 hour volume of $42.1M. Majority of trading volume comes from CoinEx and its two pairs: DOGEUSDT and DOGEBCH.

What you'll learn 👉

Total market cap analysis

Let’s take a look at what the overall market is doing. It is a well known fact that all coin prices are highly correlated with bitcoin’s price action and by extension with the whole market. Every time we see a surge or plunge of the total market cap, it spills over to the individual coins and their prices.

Market has made a mild recovery two days ago and it hovers around the newly acquired levels today, as it defended the support at $206 billions and is now at $214 billion while attempting to test a sturdy resistance at $219 billions (data by Tradingview, CMC data is off by approx +$8 billions).

Should the market break through the $219 billion zone, we could see a swift move up to the $240 billion zone, area from which we saw this horrific drop in the last week of September.

Read our updated review of Coinmama exchange here.

DOGEUSD Price Analysis

- Major Support Level: $0.00225

- Major Resistance Level: $0.00296

- 23.6% FIB Retracement Level: $0.00265

- 38.2% FIB Retracement Level: $0.00311

- 62% FIB Retracement Level: $0.00384

Dogecoin moved by 0.95% today which makes it 0.1% down on the week.

There is no much interest in Dogecoin as proven by the small ups and downs in the price action – stagnation with slow value leakage is on the menu for a long time.

When we zoom in to the 30 min chart, we can see DOGE glued to its EMA20, fluctuating right above and below it.

Low trading volume, especially the “real trading volume” as calculated by Messari, which is only $756k and is almost 10x lower than the reported volume of $5 million, speaks about the total lack of interest in Dogecoin.

If Dogecoin manages to close above the resistance at $0.00298, there are no major roadblocks for it to reach the Fib618 at $0.0038.

On the downside, Dogecoin has couple of support zones to land on in case of a stumble, first one being at support level of $0.00225.

DOGEBTC

Weekly chart shows Dogecoin recovery against bitcoin, having closed green candles in the last 4 weeks in a row.

Daily chart illustrates Dogecoin approaching the resistance at 30 satoshis, level DOGE reached on October 1st for a short period of time before slumping back to 27 sats.

- Support level: EMA at 27 sats

- Resistance: horizontal line at 30 sats

- Potential upside scenario: blasting through the resistance at 30 to reach the next resistance at 36 sats.

- Potential downside scenario: dropping back to the local low at 22 sats, reached back on September 6th.

- Most likely scenario: stagnation and hovering in the 25-30 sats zone.

Social metrics

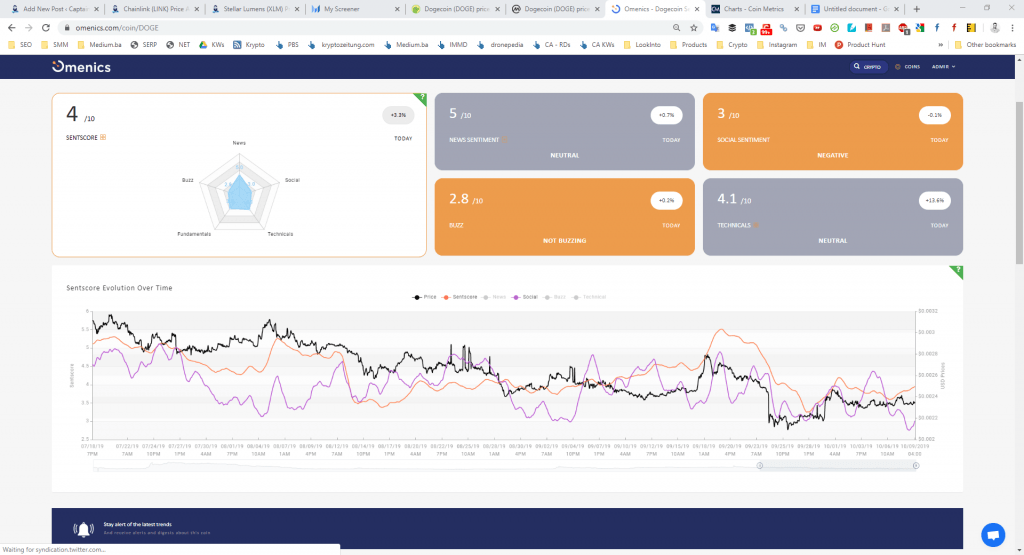

Dogecoin’s sentiment score, measured by the market analytics firm Omenics, paints a neutral picture.

Read our updated guide on crypto trading bots.

Omenics wraps its analysis up into a single simple indicator known as the SentScore, which is formed from the combination of five different verticals:

- News

- Social Media

- Buzz

- Technical Analysis

- Fundamentals

Interpreting the SentScore’s scale:

- 0 to 2.5: very negative

- 2.5 to 4.0: somewhat negative zone

- 4.0 to 6.0: neutral zone

- 6.0 to 7.5: somewhat positive zone

- 7.5 to 10: very positive

Dogecoin currently has a Sentscore of 4.0, with a slight recovery to yesterday of 3.3%. Especially low are the metrics for buzz and social engagement, another proof for the declining love the community has for Dogecoin.