Delta Exchange Review – Fees, KYC, Payment Methods

Delta Exchange is one of the pioneering crypto futures and options exchanges. Since its launch in 2020, Delta has quickly gained popularity among both retail and institutional traders. However, with the largely unregulated nature of the cryptocurrency industry, traders may have concerns around the safety and security of trading on Delta.

This article seeks to provide traders with an independent review of Delta Exchange to help answer the question – is Delta Exchange safe? We will examine Delta’s security measures, history of hacks or theft incidents, insurance policies, regulatory compliance and more. The goal is to give traders an objective assessment of Delta’s track record and the measures it has in place to protect users and funds. By the end, readers should have a better understanding of whether Delta can be considered a trusted and secure platform for trading cryptocurrency derivatives.

| Feature | Description |

|---|---|

| 📈 Delta Exchange Overview | A cryptocurrency derivatives exchange offering futures, options, and interest rate swaps with up to 100x leverage, known for lower fees, tight spreads, and advanced risk management tools. |

| 🔐 KYC Requirements | Mandatory verification process for platform access and fund withdrawal, with a daily limit of $50K and a lifetime limit of $500K for verified plus users. |

| 🌍 User Restrictions | Supports various countries but restricts residents of the USA, Canada (Ontario & Quebec), among others. |

| 💰 Trading Options | Offers trading in Bitcoin and 50 other DeFi and altcoins, but does not support fiat deposits or trading against fiat currencies. |

| 📋 KYC Guidelines | Provides detailed guidelines for individual and institutional KYC requirements. |

| 💳 Deposit Methods | Allows fund deposits through various methods, including Remitano for INR deposits. |

| 👥 User Interface and Support | Known for its user-friendly interface, high liquidity, and customer-centric approach. |

What you'll learn 👉

What is Delta Exchange?

Delta Exchange is one of many Singaporean platforms offering trading on crypto-based derivatives. It offers a broad range of derivative types but in the new context of cryptocurrencies. There are different challenges with crypto such as volatility, 24/7 trading, and a lack of regulatory oversight.

So, what are the risks? What are the rewards? Should we get involved? First, let’s look at a little background, then see how Delta Exchange measures up.

Understanding Derivatives

When you bet on a sports team, you don’t buy a piece of the team. You make a contract with the bookie about future events – who will win and by how much. This is the crucial difference between buying and selling assets vs derivatives.

Back in the times of yore… As a hedge against future market conditions, farmers may agree to sell their rice crop a year in advance for a small discount. Should the price of rice plummet, at least they’ll survive to plant another crop. For an acceptable premium, the farmer mitigates external risks to his operation.

That’s the old-fashioned approach to derivatives; to smooth out the bumps in life’s rocky road. Things have changed and they are no longer used to reduce risk. Quite the opposite, they are used to increase risk through leverage.

So why do people crave leverage? Because they want to make more profit. Instead of trading $1000 of Bitcoin, you could use that $1000 as a 5% deposit on the purchase of $20,000. Now you can make some real money – 20 times what you would have made with traditional trading.

This sounds like a free lunch, so where’s the catch? Just as your profits increase at 20 times the spot price, so your losses can pile up just as quickly. There’s the catch – should the price of bitcoin drop 5% (-$50 for $1000), your losses will be 20 x -$50 = – $1000. You have no money left. You have been liquidated. REKD. The more cautious holder of an unleveraged $1000 of Bitcoin would only have lost $50.

If it’s so risky, why use leverage at all? US Stocks are not likely to change by much more than a percent over a trading day. Cryptocurrencies, on the other hand, regularly move by 20% or more in a few hours. Leverage has proven to be a sensible strategy for maximizing returns on trading relatively stable stocks. Of course, it’s a massive risk for trading much more volatile crypto. Be careful out there – here endeth the sermon.

Read also:

- How to Sell Crypto for Fiat on MetaMask?

- Best Crypto Wallets for Day Trading: Enhancing Security, Accessibility, and Profitability

About Delta Exchange

Delta Exchange offers a comprehensive range of both innovative and traditional cryptocurrency derivatives. Their goal is to provide sophisticated derivatives markets to both retail and institutional investors. They have achieved this with some really interesting trade types, logically presented, and accessible to the retail trader.

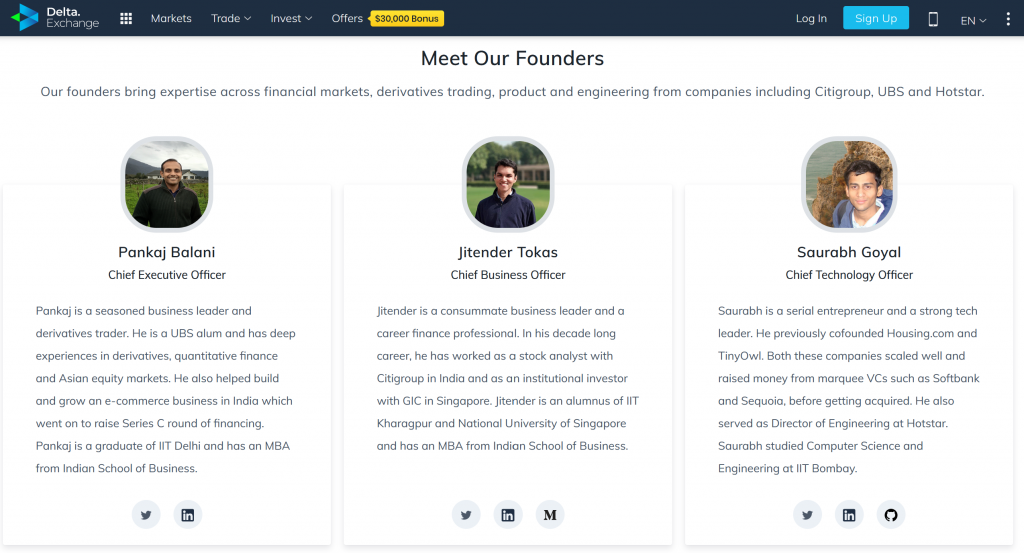

History

Launched in 2018, the privately owned exchange employs around 25 people. It’s backed by venture capitalists including Coinfund, Kyber Network, and Blockchain Valley Ventures. In 3 short years, they have begun generating revenue with a trading volume of around 60 million US$ per day. Delta Exchange CEO, Pankaj Balani is proud of his platform and is an often quoted expert on cryptocurrency derivatives. Delta exchange is a company registered in Saint Vincent and Grenadines.

It’s an exchange spawned by bankers and financial experts in suits, rather than cypherpunks and coders in hoodies. It’s all very grown-up, which fits with the sophisticated nature of their trade types and markets. In fact, reading Delta Exchange literature is the first time in years I heard anyone refer to the Black-Scholes options pricing formula. Impressive stuff, so far.

Delta Exchange Features

Here’s a taste of the trade types Delta Exchange offers. It never ceases to amaze me the number of ways financial developers build novel derivatives. Remember, the crash of 2008 was largely due to institutions not understanding derivatives and their risks. Before I gambled any money on a MOVE contract, I would need to do a lot more reading. Proceed with the utmost caution!

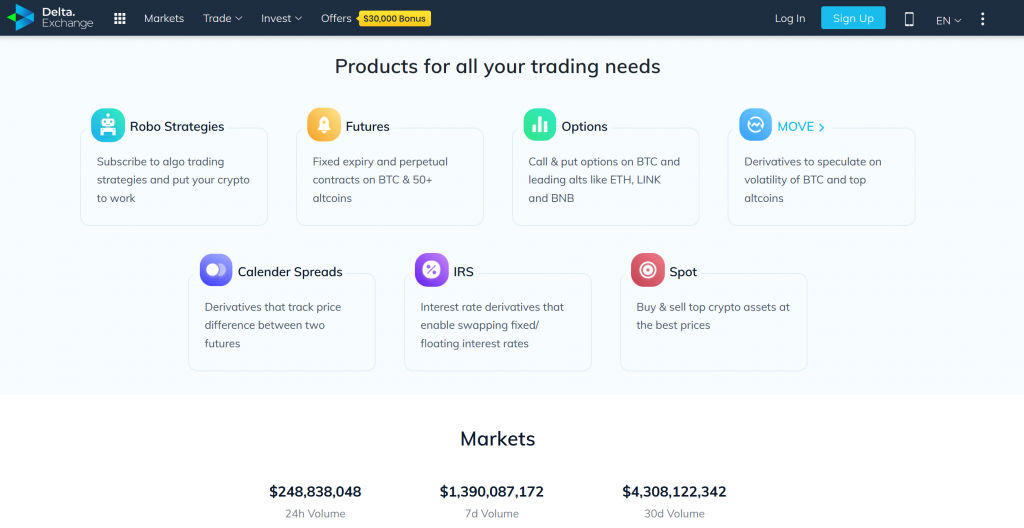

- Futures – These are contracts to buy and sell a specific quantity of a predefined asset, at a predetermined price, on an agreed date in the future. Most of these contracts settle in BTC or USDT and are available across around 30 digital currencies. Some highlights include ADA, MATIC, EOS, DOT, 1INCH, and a bunch of other de rigueur tokens. You bet on whether the asset has gone up or down by the time of the settlement.

- Perpetual swaps – This is a type of perpetual contracts with no end date, allowing the trader to jump in and out of the trade. You hold onto your trade either as long as you dare, or until you lose everything. This is a derivative designed specifically to introduce leverage. Instead of trading BTC against USDT, you can supercharge your action by 100 times.

- Move contract – Options contracts to speculate on price volatility are becoming increasingly popular. You choose a time period and predict the size of the associated movements – daily, weekly, and monthly. So is it just a bet? For the beginner, maybe, but it allows the expert trader to take advantage of the subtleties of volatility while being leveraged up to the hilt.

- Spreads – Trade the price differences between 2 futures. Take both a Long and Short position with up to 200x leverage.

- Options – Choose from Interest rate swaps, Calendar Spread Trading, Robo Trading. There’s too much to mention here, but it’s all backed up with some interesting supporting literature.

KYC

No KYC is required for customers withdrawing less than 2 Bitcoin per day. Back in 2018 that was around US$5,000, these days it’s around US$60,000. I wonder if the 2 BTC limit will be reviewed should BTC continue to grow.

This is in no way a decentralized platform, and Delta Exchange are upfront about this. They claim to be proactive about monitoring suspicious transactions on-chain, to discourage illicit activity. Access is restricted from the USA, some African nations, and a few Middle Eastern countries.

Being unregulated, there is no oversight around what they do with your KYC data, beyond local criminal law. This does not feel right, handing over personal data and sensitive private information.

Fees

Fees are complex and depend on the strategy you use. They range from 0.05% for options, futures, and calendar spreads – up to 0.15% for commodity futures, There are Maker and Taker fees for certain markets. That is, when you buy or sell at the market price you will be charged a fixed percentage in trading fees. You can reduce these fees by placing your sell/bid higher or lower than the market rate, helping to increase liquidity, and expanding the order book.

There are withdrawal fees of 0.0005 BTC on a minimum withdrawal of 0.001 BTC. I assume the standard network fees would also apply, but this is not clear. Withdrawals are paid once every 24 hours which makes me suspicious. This is cryptocurrency and should require no authorization from a third party to move it around. Your funds are your funds, right? Why would I need someone to approve even a small withdrawal?

The structure of the 12% deposit bonus is worrying too. Reading the small print, you have to match the amount of your deposit plus bonus in trading fees before you can cash out the offer. Given that trading fees are around 0.05%, you would have to trade a huge volume before your fees matched your deposit.

It’s 2240 times your initial deposit! For a deposit of $1000 to earn you the advertised $120 bonus, you would have to trade nearly 2.5 million dollars! I say this is a deliberate trap and it’s designed to mislead people.

Even with suicidal 100x leverage, you would still need to trade nearly $25,000 of your balance to make the $120 bonus. Most inexperienced traders would be wiped out long before they qualified. Professionals and institutional traders would not be the least interested in the bonus. It just doesn’t make sense.

This is similar to the unattainable bonuses gambling sites use to lure in new customers. If you ever want to withdraw ANY PART of your deposit before you have qualified, you will lose the entire bonus. Check it out here, if it all sounds too bizarre.

Security and Licensing

Delta Exchange describes itself as “self-regulated,” which means it’s unregulated. There’s no protection for its customers other than the good word of its operators. They claim to have processes in place to counteract market manipulation, but there’s no regulatory organization to ensure this happens.

That’s just not enough for me. Singapore is a flag of convenience for many financial companies, and the MAS (Monetary Authority of Singapore) sanctions the operations of many of them. Even though Delta Exchange has a good reputation and respected backers, things change quickly in the crypto business.

To illustrate this point, I am writing in the wake of the Iron / Titanium liquidity pool staking debacle in which many people lost everything. They too invested in a project that had an impeccable reputation and prominent backers. Again, buyer beware. There are no guarantees here.

Conclusion

Delta Exchange strives to “reduce complexity,” which is never a bad thing – or is it? It’s one of those exiting crypto trading platforms. Derivatives are by their nature risky, and managing that risk is complicated. Understanding this complexity was a natural barrier to entry, without which inexperienced retail traders are at grave risk. Perpetual contracts is something that not all exchanges offer, but Delta does.

The lack of regulation and the centralized nature of the business put me off. If I’m to engage with an unregulated exchange, I would choose a DeFi platform. If I use a centralized exchange, it may as well be regulated.

With the dubious bonus offer, the delay transferring crypto, the withdrawal fees, and the centralized nature of the platform – I’ll be giving this one a miss.

In case you are looking for more derivatives exchanges, below is our list of reviews:

- Binance Review

- BitMex Review

- Deribit Review

- eToro Review

- Bybit Review

- PrimeXBT Review

- Bitfinex Review

- Kraken Review