Everything’s going DeFi this year. Decentralization might be the latest buzzword in the cryptocurrency space, but it’s not new. The original and largest cryptocurrency, Bitcoin, has always been decentralized. That was the whole point of blockchain technology, that it could sustain itself without the intervention of a central authority.

What has changed is the emergence of Layer2 scaling, which works like this. Transactions are handled off-chain to improve the speed, cost, and quantity of the transactions. Here’s a familiar example.

Back in the day, cash was directly related to a stash of gold the government held in a vault. The inconvenience of carrying actual gold, and shaving off a few grams whenever one made a purchase was obvious, so we used cash instead to represent the gold.

Gold was layer1. Cash was layer2.

The Bitcoin and Ethereum networks are Layer1. The Lightning Network and DeFi platforms are layer2.

What you'll learn 👉

What Are The Best DeFi Wallets?

Before we go into details of each option, let’s have a quick look at 3 best options.

Blockwallet

Available on web, iOS, and Android versions Support for a lot of blockchains

Trezor

Screen offers verification and extra protection

Popular

Best DeFi Wallet

Privacy, security, and utility were always traded off against each other until DeFi emerged. Now your wallet can have all the useful features you want, with almost no compromise on security or privacy. There are dozens of projects offering similar services, but how do we choose between them?

An Overview of DeFi Wallets

Certain features are non-negotiable, for example:

- Open Source Software – available for inspection by anyone

- Fully custodial – You retain exclusive ownership of your private keys

- Anonymous – You don’t supply any personal information

- Compatible with DeFi networks and assets

Non-critical features include:

- Investing your crypto in a lending pool

- Attached DEX (Digital Exchange).

- Borrowing against your assets

DeFi Wallet Characteristics

Below are a few of the most popular wallets and a brief rundown of their features. They all do largely the same stuff, so I have focussed on their more innovative features. Some are much better presented than others and inspire real confidence. It’s still early days in the DeFi wallet space, as we can see from some of the less inviting offerings.

MetaMask

First released in 2016 as a browser extension, Metamask by ConsenSys is considered one of the most secure DeFi wallets around. Now available as a mobile app, it can manage your transactions, your private keys, and all your basic wallet requirements. It also interacts with WEB3.0 applications (The Decentralized Web), such as Rarible, Maker, Opensea, and Uniswap.

You can make in-app swaps of ERC20 tokens with their onboard exchange, but perhaps the most interesting feature is associating Metamask with your hardware wallet. You can have the security of cold storage with all the advantages of an online DeFi wallet, as we shall see later.

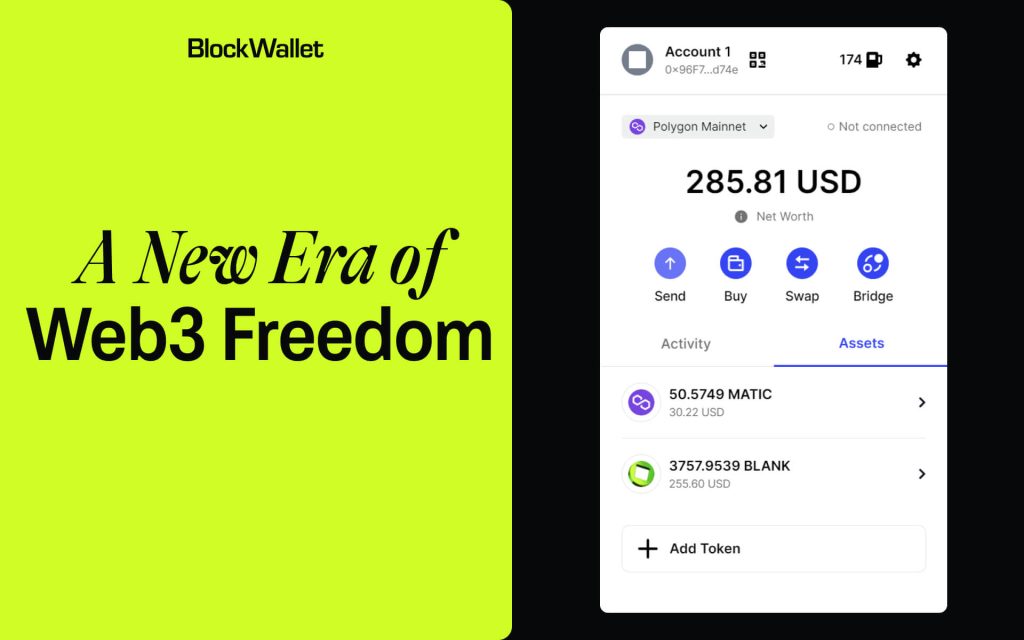

Blockwallet

BlockWallet.io is a privacy-focused, self-custodial crypto wallet that protects Web3 users’ privacy and security. The wallet has privacy proxies, gas tracker, phishing prevention, flashbot protection, and more. It supports Ethereum, Binance Smart Chain, Polygon, Avalanche, and Fantom.

It offers Web3 VPNs and privacy proxies that reduce personal data. Phishing and flashbot protection help consumers avoid scams and front-running bots. When users connect to a node provider, they can leak their IP address and other data, which may compromise their privacy and security. However, BlockWallet’s Privacy Proxies prevent this by trimming personal data and acting as a VPN for Web3.

Low fees: BlockWallet.io charges less than MetaMask, according to Product Hunt.

BlockWallet.io is a newer wallet on the market and it may have fewer users and reviews than more established wallets. That is the only con we could came up when it comes to Blockwallet.

Coinbase Wallet

Anything associated with Coinbase is turning to gold at the moment, with their imminent direct listing on the Nasdaq stock exchange. Coinbase is the biggest and most respected centralized crypto exchange in the U.S, but they have a separate DeFiwallet application called Coinbase Wallet.

The original Coinbase exchange platform requires you to store your cryptocurrency in their web application, so you don’t hold the private keys. Remember the saying, “Not your keys? Not your cheese!” Their DeFi Coinbase wallet gives you exclusive custody of your private keys, with no requirement ever to distribute them to third parties.

You can access DApps (Decentralized Applications), send and receive ERC20 tokens, and interact with all the popular Layer2 Ethereum platforms. It’s by Coinbase, so it’s a well-trusted application, backed by one of the fastest-growing networks in the cryptocurrency space.

Trezor & Ledger Wallets

Cold storage hardware wallets are the least vulnerable to online attacks, but to engage with DeFi products you need to connect to the network. The nature of this connection is important. Applications like DeFisaver and Metamask interface with your cold storage wallet without ever being able to see your private keys.

Trezor is regarded as more Bitcoin-focused, and recently the Ledger has become the default hardware wallet. Both now interact with Ethereum network platforms, where most of the DeFi world exists.

Personally, I would have a separate hardware device for large amounts of cryptocurrency, and one for interfacing with DeFi platforms. At $69 – $200 per device, it depends on the amount of crypto you hold, whether the risk justifies the expense.

Get Ledger by clicking here and Trezor by clicking here.

Argent

Along with all the usual wallet services – saving, borrowing, and token swaps – the Argent wallet has an innovative recovery feature – Guardians. As they point out, everyone has known for years not to scribble their passwords on post-it notes. So why would we write down our seed phrase on a vulnerable piece of paper?

The DeFi solution is quite neat. When you install a wallet on your phone, a smart contract is embedded identifying your ‘Guardians.’ These are people, devices, or third-party providers that are needed to confirm a wallet recovery. Only you hold your private keys so you retain exclusive access to your Guardians list. You can select as many of each type as you want, and edit the list whenever you like.

The safest option is to nominate your hardware wallet as a Guardian. The fewer humans involved, the better, but if you select friends and relatives who use the Argent app, try to make sure they are not aware of one another’s Guardian status.

The Guardians feature is the current subject of an EIP (Etheruem Improvement Proposal), as Argent is keen to see wider adoption of the technology. Good luck to them!

Another cool little extra is being assigned an ENS (Ethereum Name Services) domain name with each application installation. These are in the form, “XXXX.argent.eth,” and have lots of other uses. They act as a front end for accepting crypto payments, allow access to the decentralized web, and ending in “.eth” they may become valuable in their own right, one day.

Read also:

- Aave vs Compound

- Aave price prediction

- UNI price prediction

- FTM price prediction

- Top 10 Binance Smart Chain Projects – Best DeFi Coin on BSC

- Read also about the top 10 DeFi projects overall.

- Best Yield Aggregator on Binance Smart Chain

- Best Yield Aggregators on Ethereum Blockchain

- PancakeSwap review

- How to provide liquidity on Uniswap V2 & V3?

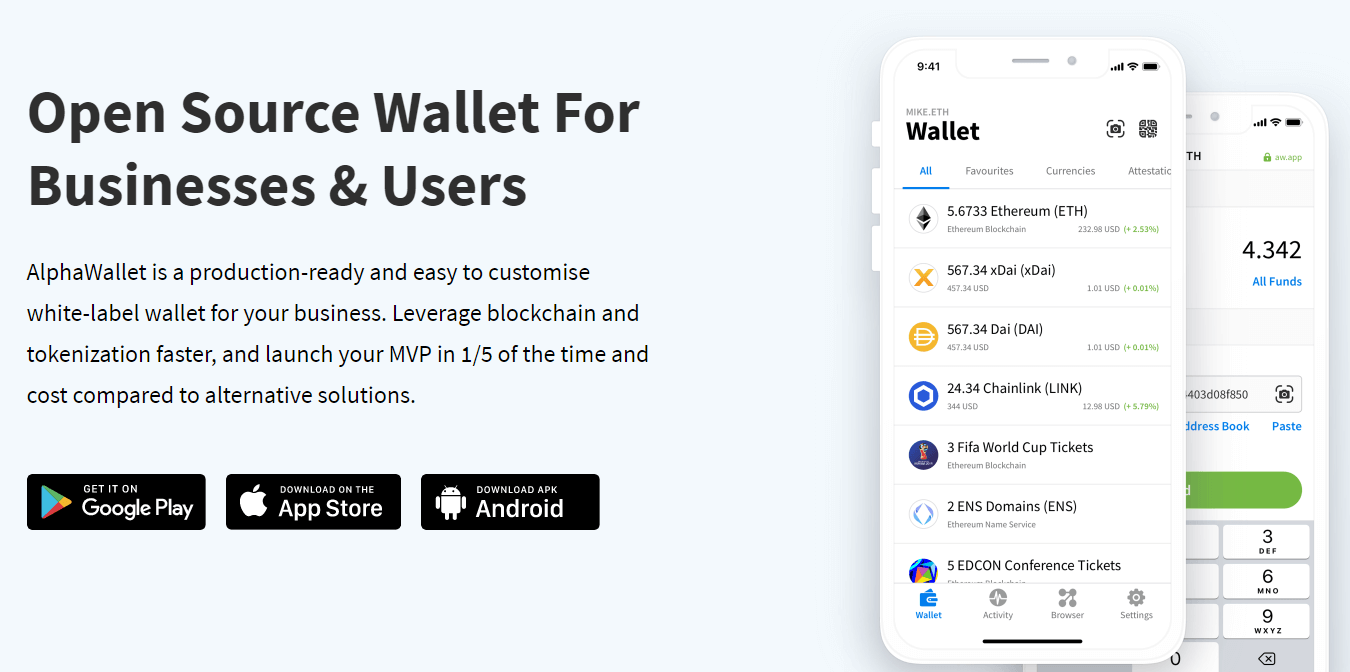

AlphaWallet

This open-source platform is aimed at businesses that need a DeFi network on which to operate. AlphaWallet runs an open framework called TokenScript, which they view as the “HTML of tokens.” This allows developers to design “smart-tokens” to perform whatever functions a project requires. AlphaWallet is focused on tokens being integrated across multiple systems, eventually allowing seamless integration with the entire decentralized web.

The actual DeFi wallet is the application from where all these smart-tokens can be accessed and coordinated. The design is easily customizable for a unique look and feel for your DeFi project.

The important selling point of AlphaWallet’s platform is its generality. It’s a blank canvass onto which startups can paint their DeFi business vision.

Betoken

They advertise as a “Crowd-powered asset management protocol,” yet they have less than US$ 5,000 under only 9 managers. They offer a service similar to eToro’s dubious mirror-trading feature. The difference is that you can’t choose which traders to emulate.

The website is shoddy and they claim to have a monthly ROI of 0%, which still seems optimistic to me! Page 2 of their websites even begs for donations. The whole thing feels like it’s best avoided.

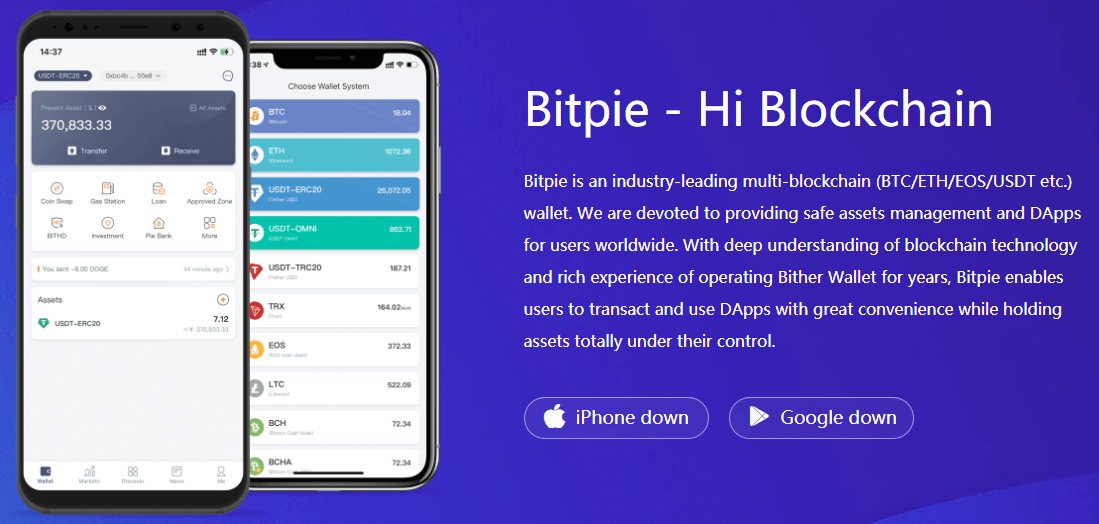

Bitpie

I didn’t get past the ‘about’ page with this company. If they can’t provide information about their product in anything like competent English, then I worry about the efficacy of the rest of the platform. When it comes to my money, I need to be confident about the service providers I use.

On the upside, they have a track record in the crypto wallet space, with Bither. They also support plenty of networks – Bitcoin, Ethereum, EOS, LTC, Dash, Zcash, Tron, etc. Independent reviews and comments are generally negative, so alarm bells are ringing here. Sorry, but no thanks.

Cobo Wallet

By now you know the drill – it’s a DeFi wallet that supports ERC20 tokens on the Ethereum network, connecting you to WEB3.0, etc. The stand-out feature of China’s Cobo Wallet is the support for more than 20 sidechains and 700 tokens. The platform offers custodial services for enterprise-level clients.

As an average retail crypto investor, “stable returns and worry-free investing from an all-in-one app to manage your digital assets,” look good to me. A nice touch is no-fee transfers to other Cobo Wallet users from within the app.

Key Points to Consider

Given our non-negotiable features, there are still plenty of choices. I would never keep life-changing quantities of cryptocurrency in a hot wallet, exposed to the internet. However, all these DeFi wallets should be safe, as long as the devices on which you run them have not been compromised. Remember, it‘s far more likely that a security breach is the result of user error, rather than a design fault.

DeFi Wallet Comparison

Usually, there’s a tradeoff between functionality and security, but with DeFi tech, that is less of a problem. DeFi wallets are focused on privacy, but good internet housekeeping is still required. As long as the software is open source and you never have to give up your private keys, they are all effective.

It’s the extra services that set some wallets apart, whether it’s a simpler recovery process, compatibility with hardware wallets, or investing and borrowing.

Conclusion

If I wanted a belt-and-braces approach, I would have a dedicated Ledger wallet connecting to DeFi networks via Metamask. I would also tend to keep to the larger, more established platforms in these early days.

For smaller amounts, I would choose the Argent or Coinbase DeFi wallets. It depends on which tokens I wanted to hold.

Great article, thanks