What you'll learn 👉

What Is Cointelli?

Cointelli is a crypto taxation reporting tool that was built by a team of experienced professionals who want to provide you with accurate information about how to file your taxes.

Cointelli can also be used as a portfolio tracker but tax reporting is it’s core feature and most used case.

Cointelli automates your process by combining your entire crypto portfolio into one single report. This way, you don’t have to worry about anything else. You just focus on doing what you do best – making money.

The key difference between Cointelli and similar tools is that it is particularly focused on accurate reports following US laws. The platform helps you prepare your taxes and protect yourself against potential penalties.

Cointelli Features

You can connect Cointelli to any major crypto exchange, no matter where it’s based. DeFi, margin trading, NFTs, and other types of transactions are just a few of the many that can be imported. The Cointelli platform also makes automatic deductions for transaction fees and internal transfers.

The software was developed by CPAs who are aware of the difficulties involved in calculating crypto taxes, which is another crucial point to remember as these are the folks that best understand the pain points of the whole process.

The user interface for Cointelli is simple to use and walks you through each stage of the procedure. For the most part, importing data from exchanges is simple.

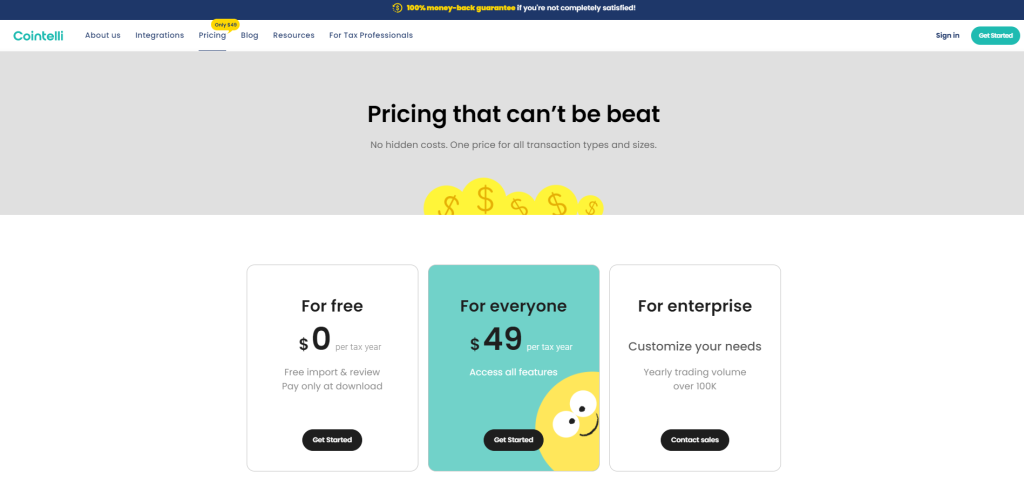

Cointelli Pricing

Cointelli offers a unique pricing model that allows traders to pay a fixed monthly cost for each trading account. With no hidden fees, there are no surprises.

The annual subscription fee is $49.00. It supports up to 100,000 transactions and can handle more upon request. So, no cap on transactions.

This pricing structure makes Cointelli very attractive for businesses looking to scale quickly and individuals that do a high number of transactions (using bots or some other automated systems).

Is Cointelli Safe?

Cointelli is safe to use because the platforms doesn’t get to manage your funds, it just integrates with exchanges or wallets (or other services) to read the data, not to manipulate it. Or, you don’t even have to do that as you can import data into it via a CSV file.

As for the user data, Cointelli excels in that.

Cointelli employs a team of experts who have been trained to safeguard customer data, ensure privacy, and respond promptly when incidents occur. The primary reason for these measures is the Cointelli Incident Response Team, which ensures that security initiatives are implemented throughout the organization.

Data security is paramount, which is why Cointelli encrypts information both while in motion and when stored. Cointelli’s services are hosted on AWS (Amazon Web Services) servers in the United States; however, these servers are isolated from the internet by virtue of being located within Cointelli’s VPCs.

For further safety and dependability, it also backs up data on a regular basis. Their payment gateway, Stripe, is a highly trusted and well-known company in the online payments business.

Amazon Cognito will not allow logins from unfamiliar devices or places and will provide a notification to the user.

It’s clear that Cointelli takes the security of its users’ data seriously.

Cointelli Integrations

The Cointelli tax app integrates with multiple blockchains, services, wallet providers, and crypto exchanges via API integrations. If you are looking for a simple way to automate your taxes, look no further. With one API integration, they can connect your accounts to Cointelli and allow them to process all your crypto trading activities for free (you pay if you want to download the data – and you will want to do that ;)).

Once the integration is completed, they will automatically review and update your trades throughthe API. This includes updating your portfolio holdings, adding gains/losses, calculating capital gains/losses, and generating reports based on your portfolio holdings. You don’t need to open up the app; everything happens behind the scenes.

You’ll never lose another cent again because everything will be recorded automatically.

Cointelli & Turbo Tax

Compatibility with standard tax and accounting packages is crucial when deciding on a crypto tax software platform. Unfortunately, the most popular tax and accounting programs are incompatible with many crypto tax software systems. Checking the crypto accounting software’s compatibility with tax preparation programs like TurboTax and those used by CPAs is crucial.

Both of these and more are perfectly fine with Cointelli. Your tax return is prepared in a format that can be uploaded straight to TurboTax, and you may also choose to have your report emailed to your accountant by selecting the “Send to Accountant” option.

You may rest assured that Cointelli was built with compatibility with your accounting software in mind from the ground up. Thus, your accountant will have no trouble generating tax reports that work with his bookkeeping software.

Cointelli alternatives and competitors

There are quite a few crypto tax reporting tools out there but the most popular are definitely Koinly, Coinledger (check the review here) and Zenledger (check how safe and legit is it).

Cointelli doesn’t work in Australia, Canada, UK and other major countries. But these tools do work:

Koinly vs. Cointelli

Both Koinly and Cointelli streamline the process of reviewing hundreds or thousands of crypto and DeFi transactions in order to determine taxable capital gains. The following text is a comparison we made between the two programs.

#1 Integrations

The number of integrations that Cointelli and Koinly support are indicated here:

| Koinly | Cointelli | |

| Crypto Services | 10+ | 5+ |

| Blockchains | 6000+ | 18+ |

| Exchanges | 350+ | 42+ |

| Wallets | 50+ | 49+ |

These statistics show that Koinly is more thoroughly integrated than Cointelli, thus, it’s likely that Cointelli won’t be able to benefit you if you are outside of the US, since Cointelli is heavy US-focused.

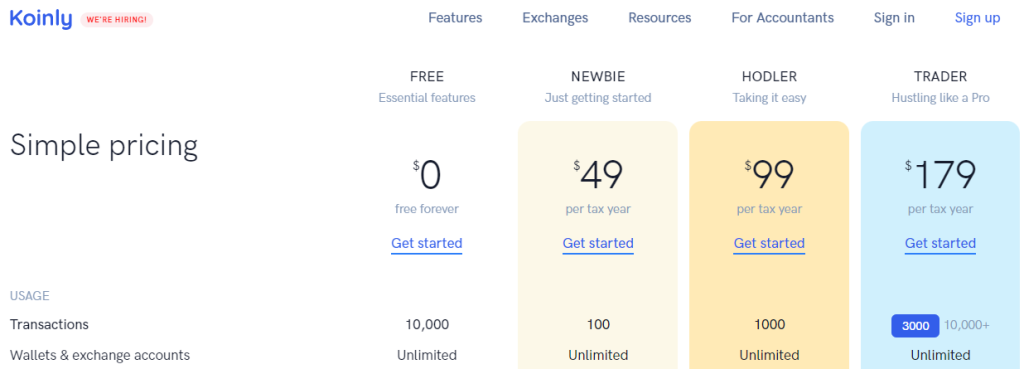

#2 Pricing

Cointelli is better in this category because it is simpler.

Koinly has these plans:

- FREE – 10 000 transactions (no reports)

- NEWBIE – 100 transactions for $49

- HODLER – 1000 transactions for $99

- TRADER – 3000 transactions for $179

- PRO – 10 000 transactions for $279

On the other side, Cointelli has these plans:

- FREE – where you can free import & review documents and pay only when you want to file.

- EVERYONE – $49, which supports up to 100,000 transactions

- ENTERPRISE – if you need more than 100,000 transactions, you must contact them to create a price for you

#3 Asset Tracking

The ability to monitor the performance of an entire crypto portfolio over time is a crucial function for traders. When compared to Koinly, Cointelli lacks this feature, making it difficult to utilize for portfolio-wide monitoring.

It doesn’t really matter which crypto wallet you use, but if you have many cryptos in different wallets, you’ll be much better served by Koinly, as it shows you your total invested capital, earnings, and losses to date, and unrealized capital gains.

#4 Limited To The USA?

Cointelli only works for US customers, so if you’re outside the United States, you can’t use it. However, Koinly, on the other hand, works worldwide and has integrations across hundreds of exchanges and other financial services around the globe.

In Summary – Is Cointelli Worth It?

If having automated, efficient, and compliant tax reporting sounds appealing to you, then you’re likely to enjoy using the Cointelli tax software. It offers the best value for money among its competitors, so it’s well worth checking out.

With its powerful API integrations with multiple crypto wallets, blockchain platforms, exchanges, and crypto services, Cointelli is a great platform. And because it saves you tons of time tracking your crypto taxes, it’s a great tool for saving you hours of billable time from your accountant in tax preparation.

If you have a simple or sophisticated crypto portfolio, Cointelli can help. The only exception is if your complex portfolio doesn’t integrate with Cointelli. If so, use Koinly. Otherwise, Cointelli is an excellent platform for automated crypto tax reporting.