Whether you are someone who just created their first crypto exchange account or a veteran trader who weathered many a bear/bull market, you have likely heard about buy and sell walls.

My first encounter with the phenomena came as a budding crypto enthusiast, when one experienced trader in a Telegram group I was in posted a picture of the Binance order book, with the graph on the red side noticeably more pronounced than the one on the green side. “Check out this massive sell wall”, the trader typed out with excitement in his fingers, adding: “Might just go nuts and slam into it”.

At the time I had very little idea what he was talking about and wondered why he would consider willfully slamming into a wall. As any good/nosy crypto citizen would do, I decided to take matters into my own hands and do some research on the topic. Today’s article will be a culmination of this research, and will give us all the answer to the question: what exactly are buy/sell walls in crypto trading?

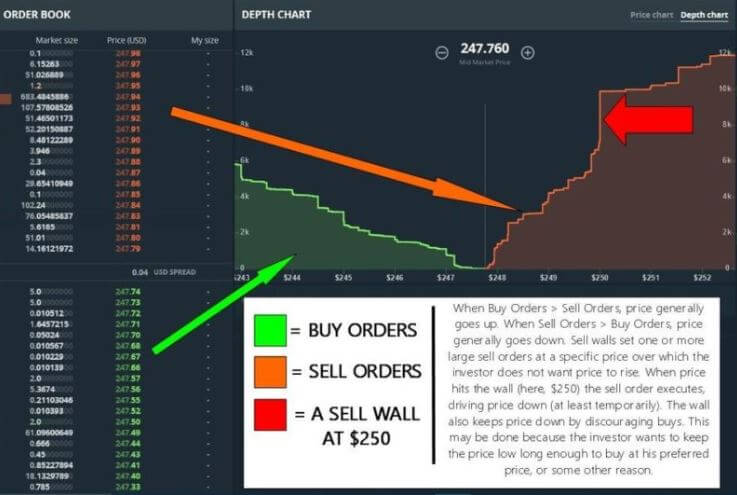

To understand the concept, we should familiarize ourselves with the order book itself. The order book is a collection of all active buy/sell orders for a certain asset on a trading platform. The book has two pages/sides: the buy/bid side and the ask/sell side. The color of both will depend on the exchange but you’ll usually find the buy side shown in green and the red side shown in red.

The highest buy order value will be at the top of bid side of the book while the top spot of the ask side will be reserved for the lowest sale offer. All the orders on the buy and sell sides are eventually grouped together into a visual, graph-like representation. Most exchanges (at least those serious ones) display the order book as it allows their traders to gain insight into the market depth and overall trader sentiment.

Buy or sell walls appear when a large amount of orders accumulates on either of the sides of the book. Keep in mind that the orders we are talking about are limit orders, where you don’t buy or sell at a market price but instead set the price manually. Let’s take a look at both types of walls individually.

Read also:

- How to trade Binance options?

- Best crypto screeners?

- Best apps for trading crypto

- How to short bitcoin?

- How to short ethereum

What you'll learn 👉

What is a sell wall in crypto? Are sell walls bullish?

Sell walls happen when a large amount of sell orders is made at a specific price. One sell wall will most of the times be created by a single investor; with time, the wall will likely be lined by smaller orders of other traders who decide to “jump on the bandwagon”.

Such a wall will act as “bear” support and creates downward pressure on the price of a cryptocurrency, preventing it from going up. The existence of sell walls is a good indication of negative market sentiments and ongoing/future price decline. Sell walls mostly appear in two variants:

- Real walls – real walls are generally created in an organic fashion, over a longer period of time. One real wall will have a more laid, curved shape, with price levels staggered on top of each other, reflecting naturally formed prices and a healthy market (especially if a coin has a high trading volume). These walls usually reflect pessimistic trader sentiments based on fundamentals; negative news about the project like hacks, rumors, failed deadlines, scams or just negative news about the general market can lead to the development of said pessimism and placement of large numbers of sell orders. While these walls usually take a longer period of time to form, they can be put up relatively quickly if the market sentiment turns sour quickly and suddenly enough.

- Fake walls – these are something that threads the line of market manipulation. Whales (rich individuals and early investors who are able to take significant positions on a certain cryptocurrency market) or pump and dump groups (a groups of whales with malicious intentions) can pop these walls up in a very short period of time. A whale or a group of whales is usually interested in popping a fake sell wall in situations where they want to purchase even more of the cryptocurrency. Once the whale pops the sell wall, his intention isn’t to sell the cryptocurrency but to create a false negative market sentiment. Retail traders will see this massive sell wall, think that a massive whale knows something they don’t, get scared that the price of their holdings will go down, and start making sell orders of their own at prices that undercut the one set by the wall. Fake walls will usually pop up suddenly in the order book and will look unnatural and steep, almost cliff-like. By setting a fake wall, the whale is intentionally putting pressure onto the coin’s price, likely in an effort to keep it low until he lines up his bags as much as he wants. Once his shopping spree is done, the whale will just remove his original sell orders, causing the wall to crash down and allowing the price to rise again. These steep walls are usually a sign that it’s not a good time to take a position in the cryptocurrency, as a significant period of insecurity could be ahead of it.

There is a lot of nuance to sell walls. They won’t form organically in bull markets, as the market is mostly oriented towards buying. If a whale were to try to pop one up forcefully, the wall would just end up being bought out by the market. Bear/sideways markets are the time where you’ll see more sell walls form, both real and fake ones.

What is a buy wall in crypto? Is a buy wall good?

As for buy walls, they are similar to the sale ones, except the orders traders are making are intended for purchasing cryptocurrency. A buy wall will appear when there is a significant amount of buy orders open on an exchange platform’s order book. These walls are usually a good sign, indicating that the market is overall bullish on a cryptocurrency and wants to purchase it more than they want to sell it. Buy walls put positive pressure on cryptocurrency price, making it go upwards over time. With buy walls we also have the two abovementioned types:

- Real walls – result of a positive market sentiment which was caused by good news regarding the cryptocurrency in question or industry in general. Will also take a longer time to form and will have a curved, sloped shape with orders with different prices stacked on top of eachother.

- Fake walls – buy walls can also be faked. Whales can also attempt to spoof the other members of the market by putting up large buy walls into the order book. This buy wall will be very steep and sharply cut off, “cliff-like” as we described before. It will also have a strong psychological effect on retail traders, giving them confidence that there is a strong buy interest in the currency. This will also lead them to rush into becoming a part of the demand for said currency. The whale will take advantage of that, sell the newcomers his bags, and finally pull the buy wall down once he’s done selling. This will cause a sharp decline in demand and can potentially trigger a sell-off/drop in price. It should go without saying that these fake walls also signal a period of uncertainty for a cryptocurrency; any potential orders should be avoided during the time fake buy walls are up.

Some General Thoughts

When you want to sell, you put a buy wall and sell to those who want to buy thinking it’s a bull market. Spoofing with fake walls is usually most effective on low-to-mid-sized altcoins who don’t have much trading volume but still represent a “juicy” target for manipulation.

Putting up massive walls on order books for these coins is much simpler than doing so on an average Bitcoin market. More experienced traders will be able to hide the fake walls they put up better than newbie manipulators, with some utilizing the help of trading bots to do their spoof bidding for them. Big sell/buy walls can be interpreted as resistances/supports for the price of the underlying asset. One interesting thing is that big and fake buy walls usually serve as a sign of upcoming price downfall, while similar sale walls can indicate a spike in your cryptocurrency’s price.

Buy/Sell walls and order book tracking can be a good way of gaining insight into the current state of a market and help you with predicting price movements (especially short term ones). Of course, they shouldn’t be your only indicator, and should be paired up with strong fundamental analysis as well as deeper technical analysis of the market charts.

Keep in mind that the practices of putting up fake walls are frowned upon on the cryptocurrency markets and are even illegal on stock markets; the practice is called spoofing and is expected to become outlawed in crypto trading as well in the future, when regulation comes to the space. Check out these two Medium articles to gain a bit deeper understanding of the phenomena. Hopefully the resources provided above will teach you how to spot fake walls/how to avoid getting rekt by them, and help you understand why you shouldn’t be putting these walls up yourself.