Blockpit.io Review – Tax Software for Cryptocurrency

What you'll learn 👉

What is Blockpit.io?

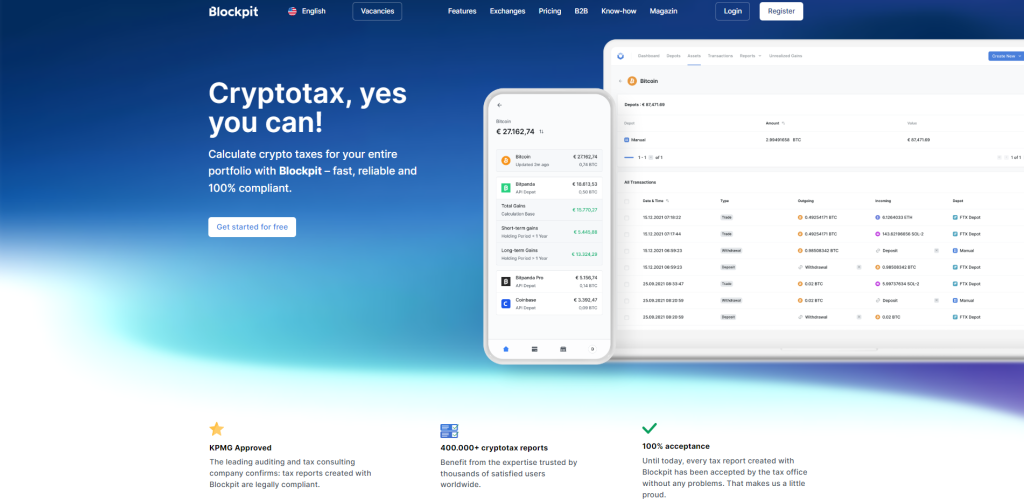

Blockpit is a crypto tax reporting and portfolio monitoring solution that is automated, web- and mobile-based. It connects its services to the APIs of multiple exchanges, including Binance, Coinbase, Bitpanda, Kraken, and many others.

Blockpit aims to provide a solution for its users to be able to seamlessly connect all of their trades, wallets, mining rewards, and other income sources such as airdrops into one dashboard.

The dashboard summarizes the gains that should be reported to the tax authorities concisely. In addition, Blockpit’s users can generate tax reports that can be reviewed and approved by one of Blockpit’s legal partners.

Which functions does Blockpit offer?

Blockpit offers a great variety of tools to help you track your portfolio development, set up individual alerts, and automatically import data into your tax reports.

You can also download your tax report directly from Blockpit or export it into other popular tax calculators for further processing. Some of Blockpit’s functions are reviewed in the text below:

Automatic imports

The ability to sync your data across multiple channels is one of the most sought-after features for online businesses. This feature allows you to automatically import your transaction data into your accounting software, CRM system, eCommerce store, etc., without having to manually enter it every month. In addition to saving you precious time, automatic imports are a great way to ensure accurate financial reporting.

Importing transactions via API- and CSV files is easy. Simply download the file(s) from your exchanges, wallets, or other services, upload them to your Blockpit and schedule regular imports to keep up with your monthly activity.

You can even set up recurring imports based on dates, times, or events.

Portfolio management

A portfolio analysis tool allows you to monitor the performance of individual assets over time, including historical data, current trends, and future projections. You can track key metrics such as ROI – return on investment, cash flow, and net worth.

The software can help you analyze how each asset fits into your overall strategy, identify potential risks, and make smarter decisions about which ones to sell and which ones to keep.

Tax report

Blockpit offers a number of different reporting options depending on what you want to report. You can use API to generate a report based on a specific set of criteria, such as tax forms, filing status, or even the type of account you are looking to track.

For example, you could request a capital gain/loss report for a single asset or a complete US tax return for a corporation or an individual. It supports over 40 different types of reports. Here is a list of the most common ones Blockpit offers:

- IRS form 8949

- Capital gains & losses

- Additional income and adjustments to income

- Form 1040 U.S Individual Income Tax Return

Blockpit Pricing

Blockpit offers four pricing options: Free, Basic, Advanced, and Professional.

Each option provides a different number of transactions and a different yearly price.

- For example, the free option costs 0€, and it provides 25 transactions.

- The Basic option costs 79€, and it provides up to 1000 transactions.

- The Advanced option costs 199€, and it provides up to 25 000 transactions.

- Finally, the best option, i.e., the Professional option, costs 599€, and it provides an unlimited number of transactions.

Supported exchanges

Blockpit provides support for several crypto exchanges It is always working hard to add more exchanges and encourages users to let it know about any exchanges they think should be added. The supported exchanges on Blockpit, for now, are:

AscendEX, Binance, BitFinex, BitFlyer, BitMart, BitMEX, Bitpanda, Bitpanda Pro, Bitstamp, Bittrex, Bitvavo, Blockchain.com, ByBit, Celsius, Coinbase, Coinbase Pro, CoinEx, Coinfinity, Crypto.com, Deribit, FTX, Gate.io, Gemini, HitBTC, Huobi, Indodax, Kraken, Kucoin, Latoken, MEXC Global, OKX, Paymium, Phemex, Poloniex, WhiteBIT.

Supported wallets

Blockpit offers support for several popular and safe crypto wallets. As with crypto exchanges, it is always working hard to add support for more wallets. Those who are supported right now are:

Bitbox, Electrum, Exodus, Ledger, Metamask, MyEtherWallet, and Trezor.

Learn more about how to report taxes on other crypto activities:

- How to do DeFi taxes

- How to report NFTs on your tax return

- How to report your crypto staking rewards in your tax returns

Blockpit Alternatives

Blockpit is good, but when it comes to crypto tax tools, there are a couple of them that are more established. The list includes:

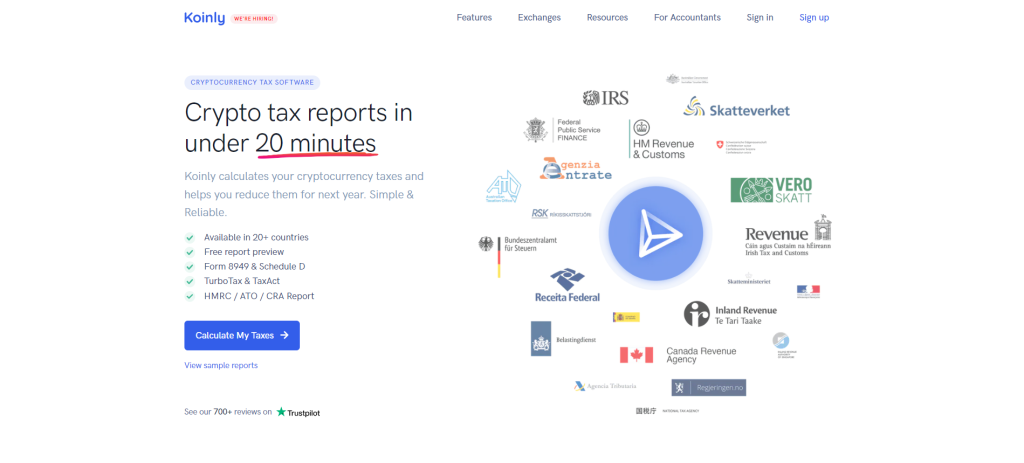

Koinly

With the help of the online crypto tax platform Koinly, you can keep track of all your transactions and create tax documents that adhere to all applicable regulations. Koinly makes it easier to keep track of all the ins and outs of recording transactions by allowing you to combine your wallets and keep track of activities like trading, mining, staking, lending, and airdrops.

You may use Koinly to automatically import transactions, track market prices, manage wallet transfers, determine your crypto gains and losses, and produce tax reports.

The platform offers a full crypto tax reporting service and can be accessed in over 20 different countries. It also interfaces with over 6,000 blockchains, 350 exchanges, and 75 wallets. The platform’s base plan is free, however, annual subscriptions cost between $49 and $279.

Accointing

Accointing is an online platform that allows you to easily manage your bitcoin taxes and portfolio; it’s not your typical crypto tax preparation tool. This powerful solution serves as a one-stop shop for all demands related to crypto administration for both crypto experts and enthusiasts.

Accointing’s desktop and mobile dashboards are both intelligent and offer a spectacular user experience, allowing you to monitor your progress and transactions in real-time. Accointing supports over 100 exchanges and has an easy-to-use CSV/API connection for syncing with your wallets.

Consider Accointing to be a complete tax report and crypto tracker. Both inexperienced and experienced crypto holders can use its user-friendly interface. The majority of the platform’s capabilities are accessible for free to everyone, however, creating tax reports requires one of the paid subscription packages.

There are 4 types of annual subscriptions. Those are Free, which provides 25 taxable transactions for $0, then Hobbyist, which provides 500 taxable transactions for $79. The Trader subscription type costs $199, and it provides 5000 taxable transactions. Finally, there is the Pro type which provides 50 000 taxable transactions for $299.

Coinpanda

With Coinpanda, a crypto tax program, you may get help with your tax returns and gain insight into your holdings.

You can complete your crypto tax returns in under 20 minutes using it. It automatically supports tax reports for trades on exchanges, wallets, DeFi, NFTs, staking, mining etc.

Coinpanda provides 4 pricing plans. Those are Free, which provides 25 taxable transactions for $0. Hodler, which provides 100 taxable transactions for $49. The Trader subscription type costs $99, and it provides 1000 taxable transactions. Finally, there is the Pro type which provides 3000+ taxable transactions for $189.