What you'll learn 👉

Table Of Contents

BitShares (symbol BTS), formerly known as ProtoShares (PTS), is one the of the true blockchain veterans. Created in 2014 by blockchain wunderkind and visionary Dan Larimer (“Bytemaster”), BitShares (symbol BTS) is peer to peer distributed ledger and network based on a Delegated Proof of Stake (DPoS) algorithm. Dan Larimer is co-founder of Steemit, EOS and Cryptonomex and he created BitShares in order to facilitate financial transactions and interactions in a decentralized way. BitShares is technologically quite advanced. It even has the record for most transactions in one day (920,000 transactions on September 13, 2017).

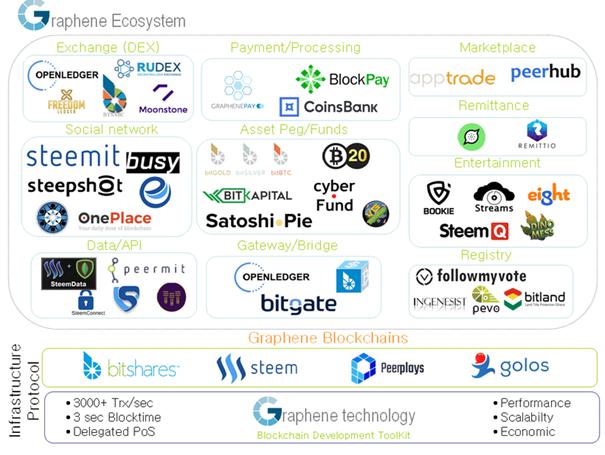

BitShares is based on Graphene technology, which allows for incredibly fast and cheap transactions. Graphene technology has been announced recently, but it managed to gain its popularity after Scaling Bitcoin 2017 conference. Graphene is an open source C++ blockchain implementation that acts as a consensus mechanism and is used by several other projects like PeerPlays.com and Steemit.com, which indicates real-world usage.

According to researchers, the Graphene technology is far more efficient than any of the existing analogs and through the use of this technology, BitShares is theoretically able to execute a maximum of 100,000 transactions per second and has a block time of 1.5 seconds.

The cryptocurrency tokens behind BitShares are called BTS and they are used as a collateral for a variety of decentralized financial services like decentralized exchanges, smart contracts, banking, derivative creation (of market pegged “bitAssets”) and currency rails. That’s the reason why BitShares is advertised more as an equity rather than a purist “currency”.

BitShares Technical Details – BTS Coin Review

- Block reward:1 BTS (from Reserve Pool)

- Block time:1.5-second average, 3 sec max, ~1.5 sec latency for 99.9% irreversibility certainty

- Irreversible blocks:(2 * BLOCK_INTERVAL * WITNESSES / 3) ~ 34s

The BitShares blockchain uses a Delegated Proof-of-Stake (DPOS) consensus mechanism. This means that voting on consensus issues can be done democratically by stakeholders. The current price of one BTS is $0.209327 and BitShares market cap comes to $546,20 M. The total number of BTS tokens is 3,600,570,502 BTS and with 2,608,090,000 BTS of them in circulation (992,480,502 coins are in reserve fund).

Noteworthy is the lightning fast blockchain with 1.5 second average block times and is theoretically able to execute a maximum of 100,000 transactions per second (proven 3,400+ tx/s). This is faster by far than, for example, Bitcoin and Ethereum, which can handle about 4 and 15 transactions respectively, and is more faster than all the credit card transactions worldwide combined (VISA, for example, can process 45,000 transactions per second).

BitShares management is controlled by a Decentralized Autonomous Company (DAC), a framework which changed how the industry looked at the possibilities of blockchain technology. DAC allows BitShares holders to contribute and ultimately decide on the future direction of BTS. BitShares itself is actually a DAC and they demonstrate the beauty of blockchain technology and decentralization in its purest form. The BitShares platform is programmed in such a way that there is a budget for the workers upgrading and developing the platform.

Your username acts as your wallet address

What’s nice about BitShares is that your wallet address is a username that you pick for yourself, which is way better than long cumbersome strings of letters and numbers.

The BitShares Team

BitShares was created in 2014 by the American programmer and entrepreneur, Daniel Larimer, who was also responsible for the creation of the Steem blockchain and is currently working on the highly anticipated EOS blockchain. Although Dan Larimer isn’t as well-known as, say, Ethereum’s Vitalik Buterin or Litecoin’s Charlie Lee, he is still a strong brand in the world of cryptocurrencies, seen as a rare visionary who cares about the project and not just the quick gathering of funds.

Very little is known about the rest of the team, but every user actively participating on the platform through voting, staking, developing, and creating contributes to the development of Bitshares.

An example of how this plays out in real life is the BitShares foundation, which is not as influential as other cryptocurrency organizations, but it still works to keep the project on track and help bring improvements.

BitShares Financial Service Offerings

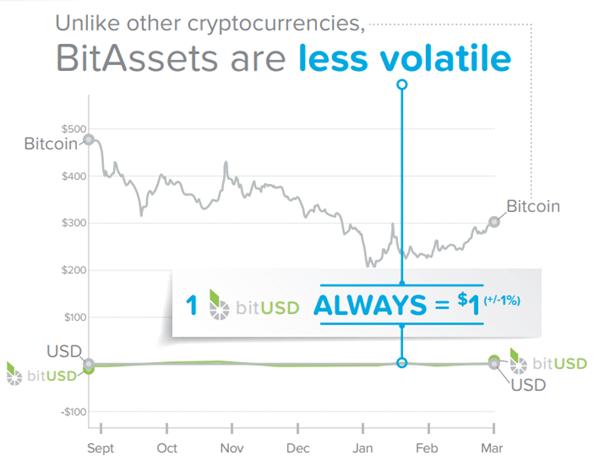

BitShares competes with banks by issuing collateralizing market-pegged and stable bitAssets, which are assets like bitUSD, bitGOLD, and bitCNY that track the value of their counterparts. This means that 1 bitUSD today will be worth 1 USD a week, a month or a year from now. BitAssets minimize the risk of volatility in the cryptocurrency market by pegging the BitAssets (bitUSD, bitEuro) to common currencies like USD, Euro, etc.

This Smart Coin token always has at least 200% (or more) of its value backed by the BitShares core currency (BTS), to which they can be converted at any time at an exchange rate set by a trustworthy price feed, as collateral in a smart-contract based loan managed by the blockchain. Smart Coins are guaranteed to be worth at least their face value (in all but the most extreme market conditions).

What makes BitShares unique is that it’s free from counterparty risk yet still has a loan backed by collateral, which is achieved by allowing the network to secure collateral and perform settlements.

Smart Coins are fungible, divisible, and free from any restrictions and are considered to be a powerful tool for everyone from speculators and savers, to traders and entrepreneurs.

There are four goals of price stable Smart Coins (bitAssets) – a relatively reliable solution to predict the future value of a token, a predictable stable price with reduced volatility, hedging against volatile cryptocurrency markets and price action, and a unit of account distinct from assets with capital gains or losses (which has increased tax liability).

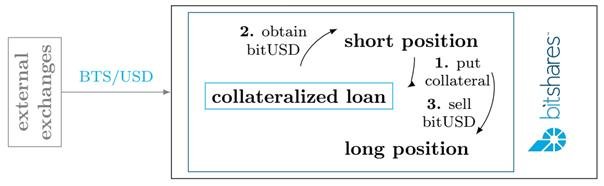

A Market Pegged Asset (MPA) is a cryptocurrency whose value is pegged to that of another asset, such as the USD, and a BitShares MPA can be viewed as a contract between an asset buyer seeking price stability and a short seller seeking greater exposure to BTS price movement.

Figure 2: The image above shows price discovery and a short seller who makes a bet to profit from BTS price movements. This ensures liquidity as with a 24-hour forced call (selling of position) from call time.

BitShares (BTS) as a Lender

As things stand currently, BitShares is a working, dynamic “smart” economy which adjusts to the needs of the market and offers their users the capability to loan their BTS holdings with customizable reserve levels (a minimum of 200%, reaching as high as 1000% or even 2000%+ reserves). Large collateralized loans (10-20x) can be created allowing loans to last almost indefinitely, which will help preserve price stability.

BitShares integrates with any stock, commodity or currency pair provided there are price feeds available, and in addition, bitAssets including bitGold, bitSilver, bitOil and other crypto focused commodity pairings can also exist in this construct.

Decentralized Exchanges (DEX)

Currently cryptocurrencies like Bitcoin, Ethereum, Litecoin, etc. are traded at large exchanges, which follow the traditional logic of centralization, with a single point of failure for corruption, information-theft, fraud, coercion, robbery, and so on. Typically with crypto exchanges, there’s a clearinghouse required to facilitate buyers and sellers that wish to transact in cryptocurrency and fiat currency. Centralized management is a constant security risk and there is room for improvement when providing a needed service for the market.

Many exchanges have withdrawal limits, delays, complicated verification processes, etc.

The traditional crypto exchanges operate very similarly to traditional equity exchanges – receive crypto and fiat currency like USD issuing IOUs in its place, redeem and allow exchange of IOUs and process the order book.

However, the same people are responsible for both the security of funds and the “books” of the whole market, which means that the same entity doing the above 3 steps is in a conflict of interest situation (not to mention a security risk).

The solution is no further away than using the technology behind Bitcoin, the blockchain, to create decentralized exchanges (BitShares was partly designed with this in mind). The BitShares financial services whitepaper explains that there is no reason why the same people need to be responsible for issuing IOUs and for processing the order book. They also explain that, from a security standpoint, this is actually a disadvantage.

Decentralized Exchanges remove the single point of failure and counterparty risk and replace them with an open source blockchain which can perform all the functions of an exchange. These two roles have been combined, and that’s the thing that causes centralization particularly in the crypto space with exchanges, which has proved to be problematic especially when exchanges mismanage wallets, keys or any other vulnerable aspect of the infrastructure.

They also provide the user with a greater level of privacy, and other problems like server downtime and the aforementioned hacks are avoided because there is no central server to hack, but rather a network of nodes that host the exchange. This may cause breaches, hacks and other losses of assets. Unfortunately, this has happened many times in the past (Mt Gox, Mintpal, or Bitfinex).

Crypto-Bridge is a new DEX built on the Bitshares blockchain, and the most important innovation that Crypto-Bridge brings to the platform is the decentralized gateways. Gateways operate as trustless portals to trade various assets that are recorded on the BTS blockchain and they represent a major step forward in increasing user security for the whole ecosystem. A gateway can be imagined like the gate through which external cryptocurrencies can flow into the BitShares Exchange, and if you deposit some cryptocurrency funds through a gateway, the gateways will accept the amount of coin and add the amount as a plain number of the corresponding Smart Coin to your BitShares wallet. A gateway purchases the coin and then sends it to your wallet, under your control, and they do not hold it for you like other exchanges, which is more secure than having others hold your coins because you are in control of your private keys and always have your coins in your possession.

Open Ledger is a decentralized exchange (DEX) and Gateway

Developed by the Danish virtual currency exchange, CCDEK, Open Ledger is essentially a chain of monetary transactions, which is where the “chain” in blockchain comes from. It allows users to buy various assets (called open assets) which are IOUs like any Gateway coin. ICOs can easily be created and issued in a secure and decentralized way through this platform. Open Ledger hosts several projects, such as GetGame (based on game-related ideas with a focus on VR, AR and blockchain-based creations), eDEV.one (a freelancing platform based on blockchain technology), and Apptrade.

The DEX levels the playing field for trading and the New York Stock Exchange and Wall Street will soon face disruptive competition from projects like BitShares. In this system, those insiders who are wise and clever position their trading infrastructure close to the crypto exchanges for faster order filling coupled with trading algorithms which shut out most non-insiders.

With BitShares it is possible to trade many different types of assets in addition to the native cryptocoin – gold, silver, gas, oil, and other crypto-based derivatives including bonds, stocks indexes, inflation and other market baskets. These pairs can be traded against each other so you could trade bitUSD to BTC or silver to gold (just imagine if Bitcoin is failing down and you just switch to silver or gold).

Smart Coins are marked assets (MPA) backed by real-world value and these are built-in features and are pegged to assets such as bitUSD follows the value of USD. This way, you can convert your BTS into BitUSD, the same way you would convert BTS to USD, without leaving the blockchain itself, which keeps your anonymity, is instantaneous and costs less in transaction fees. 1 bitUSD will always be redeemed for at least $1 of BitShares with a variance of maybe 1% and that closes up as the market depth deepens. Price parity is retained through a price feed maintained by Witnesses (who paid to process transactions and secure the network), which allows collateralized shorts and options opening the door for BitShares to take a bite out of the estimated $1 quadrillion derivatives market.

Most exchanges currently available on the market require some sort of identity verification in the form of a passport, driver’s license, proof of residence, and other data compelled through Anti-Money Laundering (AML), Know Your Customer (KYC) and many other regulations before joining. On the other hand, trading on DEX offers no trade limits, small fixed commissions on pre-order basis, and there are no hoops to jump through or gauntlet to conduct your own transactions.

BitShares DEX graphical user interface (GUI)

Delegated Proof of Stake (DPoS) and Governance

The Proof-of-Work (PoW) mechanism requires a large amount of energy consumption to secure the network, and many people consider this unsustainable long term (roughly a billion watts (1GW/sec) are used globally every second to create a valid PoW, and the amount of energy for this process accounts for about $50,000 per hour). Many people consider this “wasted energy”. Some people also claim that it has a negative impact on the environment. In addition, with the emergence of ASICs (application-specific integrated circuit chips), many users who cannot afford or scale up quickly enough with the difficulty are shut out, and those miners ultimately have the power to support the network or not to, as their machines are the backbone of the blockchains security and validity.

Delegated Proof of Stake (DPoS)

It’s important to note that Delegated Proof-of-Stake (DPoS) and traditional Proof-of-Stake (PoS) are very different.

Traditional Proof-of-Stake (PoS) works by giving the ability of adding new blocks to the blockchain to the token holders, and rewarding them for doing so, if their block ends up in the majority blockchain.

Delegated Proof of Stake (DPOS) is the fastest, most efficient, most decentralized, and most flexible consensus model available and it eliminates PoW and adds onto the traditional PoS architecture with a Governance layer. DPoS mitigates the potential negative impacts of centralization through the use of Witnesses (formaly called delegates), and Users “delegate their stake” and allow electing of Witnesses who collect transactions, bundle them into a block, and broadcast to the network. Witnesses are elected by stakeholders at a rate of one vote per share per witness and they are paid in shares for this service from the reserves pool.

Any decision made in BitShares is taken by the community through a weighted vote (1 BTS = 1 vote), but for most users, this process is burdensome. That’s the reason why proxy voting was proposed. It allows shareholders to direct their voting power to another account which then has more total voting power, which helps reduce voter apathy and allows shareholders to react quickly to immediate business and security concerns. Traditional bureaucracies are hated because of the amount of time, paperwork and review needed to get anything done, but with delegated Witnesses, you get temporary contracted centralized management with the right to retract that power thus preserving decentralization.

The witnesses are paid to process transactions, maintain the blockchain, publish price feeds, and improve the BitShares ecosystem.

Who Are Committees?

The team behind BitShares allowed the fee schedule to be updated by the so called committee. They are responsible for adjusting the fee schedule of transactions to ensure they remain at a low level as the price of BTS rises. The people in that committee are voted by the shareholders and the median of top rated users will become Committee Members. The new fee schedule will be installed and automatically activated after approval of a new fee schedule by at least 50%+1 of the committee members.

Who Are Workers?

You can set up a “worker”, a specific BTS account, to propose any project for the BitShares network, and if you are voted in you can get paid to work on their project. You need to include a scope of work, your pay rate, and start/end dates. You send all this to the network of BTS token holders, and they receive and vote on the proposal which can be accepted or rejected by the network.

It’s also important to note that BitShares offers membership subscriptions which will range from annual to lifetime memberships. These subscriptions allow reduced fees for using the BitShares rails (shorter term subscriptions have a designated time frame for getting the reduced rate).

BitShares also has an advanced referral program built directly into its software, which allows them to receive reduced fees and a percentage of the fees that are paid by those they refer, which means that this Program lets you earn from people you bring into the BitShares network.

BitShares (BTS) Problems and Risks

This all sounds great, doesn’t it? However, what about the problems and risks?

Black Swan Event – Extreme Market Conditions

As I already said, BitShares Smart Coins are created by borrowers who lock 200% of its value in collateral (in BTS), and then, they sell those assets on the market creating the current supply. Automatically, when the collateral goes under 175% of the value, the blockchain creates a margin call, buy back the asset in the market and cover the loan, but when the value of the BTS collateral backing the smart coin drop below 100%, a black swan occurs.

As you probably already know, the total market capitalization of Cryptocurrency has overwhelmingly increased exponentially to date. However, that has not been without a long bumpy ride. For most growing businesses, a Black Swan event would greatly erode confidence in the system and disrupt the ability to conduct a safe transaction, especially on a large scale, and that would lead to a major setback for the business and even complete business failure.

This is still all very experimental technology. However, it must work flawlessly because people and businesses (banks even more so) are sensitive about their money.

BitShares Getting Delisted from Bittrex

BitShares was delisted of the popular exchange Bittrex for unknown reasons. There’s also rumor that BitShares wasn’t delisted due to the SEC at all, but rather Bittrex made the decision themselves because the BitShares DEX competes as a decentralized exchange. Others calling it FUD (Fear, Uncertainty and Doubt) to drive the price down, then it was that their nodes were “too big” to run.

The above reasons are unverified conjecture. All we know is that Bittrex said they were delisting BitShares but has not issued an explanation (yet). Speculators are fickle and whether or not it is BitShares’ fault. I have also done some research in Bittrex website to find the exact reason to delist BitShares, but I found none of those points are applicable to BitShares.

Bittrex is really a big exchange and such an announcement is really making a big impact on BTS. However, there has still been a fair bit of buying activity and “support”.

No one can prevent the possibility of unforeseen software bugs, breaches or exploits

This argument could be made about any project to date including Bitcoin. For example, the $55m DAO hack in Ethereum was due to a bug in their smart contract. In the end, they had to hard fork the network which caused a split into two different coins: Ethereum (ETH) and Ethereum Classic (ETC).

Or the recent Ethereum wallet Parity debacle, when a bug in a popular Ethereum wallet Parity froze $150 million worth of ether, including the creator of Parity Dr. Gavin Wood’s Polkadot ICO funds.

User error is the documented cause of most issues with IT and cybersecurity, and this is also a perpetual threat not only with cryptos but technology in general. As with all cryptos, this is experimental tech and there is not enough information available online to make informed decisions regarding the platform. That’s why a healthy amount of skepticism and caution must always be exercised.

Conclusion

BitShares is an open, scalable decentralized exchange and fintech platform with Smart Coins, which are a powerful tool for everyone from speculators and savers, to traders and entrepreneurs. Their services are just awesome, and despite all of these risks and challenges mentioned, the team perseveres, grows and continuously irons out kinks.

The BitShares blockchain has been around for over 4 years and it provides a toolset with which innovators can experiment to find optimal currency solutions using free market discovery. BitShares has been under constant development, offers a lot of functionalities and can be used for a wide array of purposes.

A proper roadmap has yet to be designed by the development team behind it, so it is a bit unclear what will happen in the near future. However, there’s plenty of reason to keep an eye on the BitShares project in 2018.