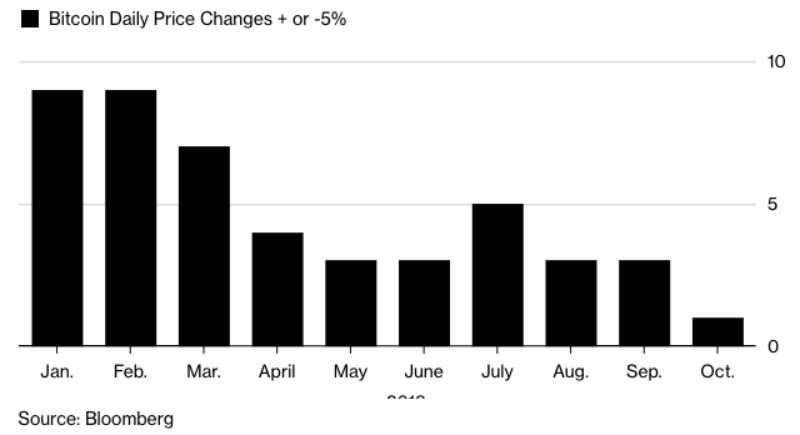

This month, Bitcoin’s price only fluctuated one day by more than 5 percent – in January and February 2018, there were nine days each on which Bitcoin made headlines due to strong price fluctuations. The low volatility signals that the largest crypto currency in terms of market capitalization has bottomed out, explains Bloomberg analyst Mike McGlone.

The low volatility is “a sign that speculation is leaving the market and ultimately a bottom-building process,” McGlone said. In the chart’s technical sense, a bottom formation means a stabilization of prices after a downward trend. When the bottom formation is complete, then the low prices form the so-called bottom – the prices will rise subsequently.

Bloomberg data shows that Bitcoin only fluctuated more than 5 percent one day in October compared to nine days in January and February.

Bitcoin price fluctuations

Days with Bitcoin price fluctuations of 5 percent or more, source: Bloomberg

Charlie Morris, multi-asset chief at Atlantic House Fund Management in London, agreed with McGlone’s statement. Morris sees the relatively low level of volatility as a sign of a balanced market and is optimistic about “the next big step”:

“It simply means that the market is calm and balanced. This means that speculative interest is low,” Morris said. “Given the fact that this bear market is now 10 months old and getting tired, I would be inclined to be optimistic for the next big step”.

Bitcoin’s price has fallen more than 65 percent this year. After a rally towards the end of last year with a high of just under $20,000, Bitcoin fell to an annual low of $5,755 in June. Currently, one Bitcoin is traded at a price of around 6,450 dollars.

Michael Novogratz, former hedge fund manager at Goldman Sachs and founder of crypto asset manager Galaxy Digital, said in an interview this month that institutional investors could fire up the Bitcoin price again next year.

According to Novogratz, there is currently a lack of the right tools for institutional investors to trade Bitcoin and other crypto currencies. Until “Q1 or Q2” 2019, this problem will be solved by products from companies like Bakkt, the billionaire said.