Mining is a crucial part of any Proof-of-Work protocol and is integral in maintaining the decentralized, secure nature of a blockchain. Bitcoin employs a typical PoW algorithm which has miners maintaining and verifying the network, making sure that the network is secure, democratic, immutable, trustless, and in theory more scalable than the average centralized database.

Each miner in a network like Bitcoin is an independent computer node, connected to the blockchain and other similar nodes through the internet.

A miner uses his computing, processing power to verify Bitcoin transactions, packs them up in blocks and attaches these blocks onto the Bitcoin blockchain. Attaching a block to the blockchain requires the miner to solve a complicate cryptographic task whose difficulty varies with the amount of mining power present on the network.

Solving the abovementioned task requires a significant expenditure of resources (namely computing power and electricity); the miner is motivated to keep solving/mining on the network by new coins being “minted” every time a new block is added to the blockchain. The entire process is called mining mostly because of this mechanic, as the node is “putting in work” to “mine out” new units of digital gold we know as Bitcoin.

In the beginning of the Bitcoin network, mining was mostly CPU-based. Throughout time, as more CPU devices began mining, the difficulty of the mining started increasing (this mechanic exists to maintain the average block time of 10 minutes that Bitcoin’s blockchain currently employs).

With time, the network saw a switch to GPU mining (due to higher processing output/hashing power that can be achieved with the graphical processing units).

It’s interesting that Satoshi Nakamoto, the man who originally created Bitcoin in 2009, was against the idea of GPU mining. Still, the network inevitably evolved with computer technology evolving as well, and we soon saw mining “rigs”, multi-thousand dollar behemoths with multiple GPUs attached to a single frame, appear and start mining on the network. These devices represented the peak mining technology for a short period of time.

Mining technology evolution didn’t stop here as someone FPGA (Field Programmable Gate Arrays) devices inherited the position of the best hardware devices one can use to mine Bitcoin. Finally, several hardware manufacturers came up with ASIC (Application Specific Integrated Circuits) technology for mining Bitcoin, which is currently considered as the peak mining solution out there.

But let’s take a couple of steps back. As the mining technology kept evolving, the mining difficulty kept rising.

This automatically meant that previous generation devices weren’t able to contribute to the mining process as much as they were able to during their hayday. This ultimately meant that people with such devices had to join mining pools if they wanted to keep getting regular Bitcoin payouts. Wikipedia explains the idea of a mining pool nicely:

“A mining pool is the pooling of resources by miners, who share their processing power over a network, to split the reward equally, according to the amount of work they contributed to the probability of finding a block.

A “share” is awarded to members of the mining pool who present a valid partial proof-of-work. Mining in pools began when the difficulty for mining increased to the point where it could take centuries for slower miners to generate a block. The solution to this problem was for miners to pool their resources so they could generate blocks more quickly and therefore receive a portion of the block reward on a consistent basis, rather than randomly once every few years.”

With time and with spread of stronger and stronger ASIC devices, individual Bitcoin mining kept being thrown in the background. As things stand, it is really not worth it to attempt to individually mine out Bitcoin blocks.

The hash rate (the speed at which a computer is completing an operation in the Bitcoin code; higher hash rate means it’s more likely that you’ll find the next Bitcoin block) of an individual mining node pales in comparison to what even an average mining pool can achieve at the moment.

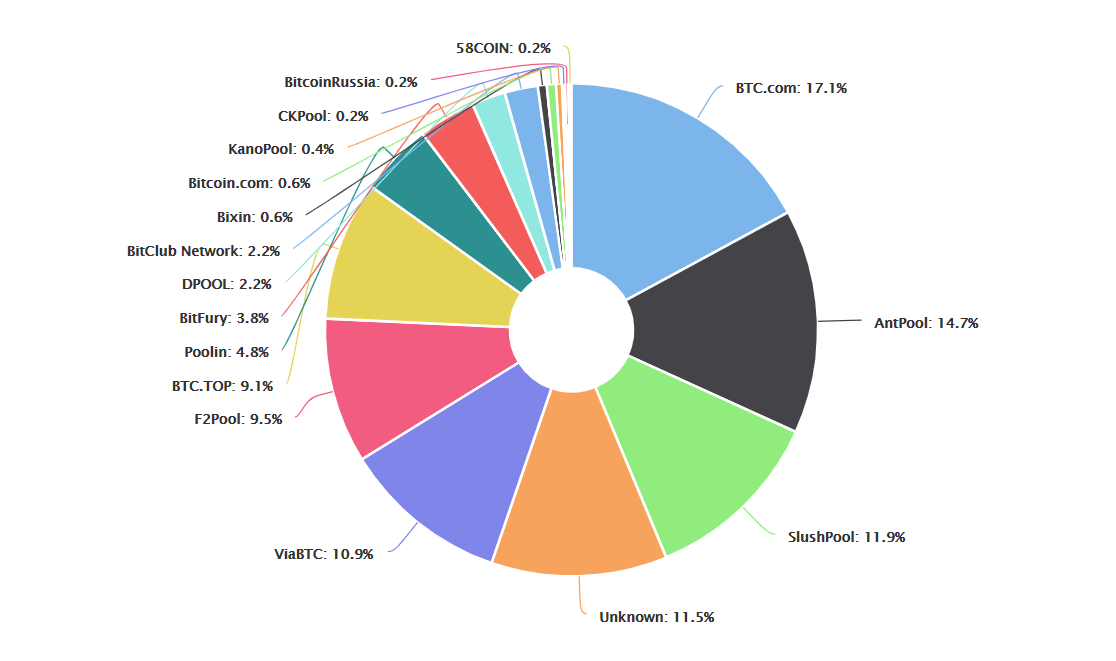

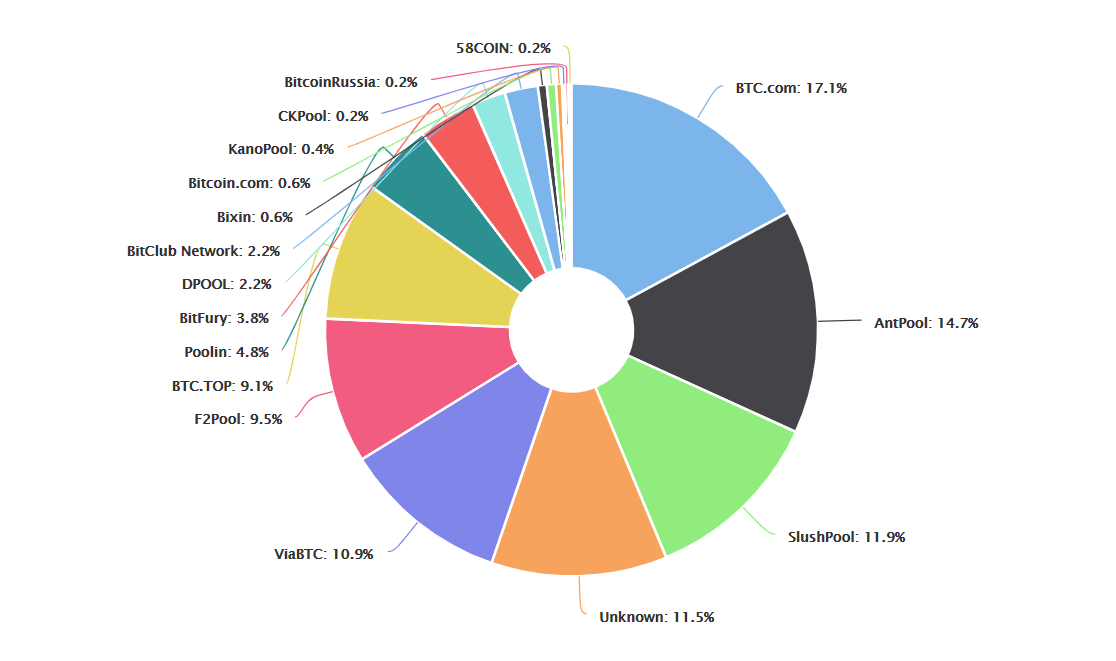

So currently the only possible solution to effectively contribute to Bitcoin mining (and earn some Bitcoin from the ordeal) is to join a mining pool. Looking at the data from blockchain.com, you can notice several mining pools are currently in charge of the Bitcoin blockchain’s mining network. And while no pool is currently controlling more than 20% of the network’s hash rate, almost 70% of the hash rate is located in Chinese pools; this has some experts worried.

If Chinese government were to go rogue in the future and confiscate this technology, major issues with decentralization, privacy and safety of your Bitcoin could arise. For now this seems like a distant doom scenario, but one that should be mentioned and worked towards avoiding.

This brings us to the topic of our article, the mining pools themselves. Further down we’ll give you a short overview of available mining pools on the market. The current pool distribution looks like this:

As we gave you a relatively in-depth introduction into Bitcoin mining, we might as well just jump into (no pun intended) the mining pools themselves.

- BTC.com

Owned and operated by Bitmain, world’s largest mining hardware producer, the pool was launched in 2015. The pool is said to be the one utilized by past Bitcoin community member and current most famous Bitcoin Cash promoter, Roger Ver. The pool is one of the most prominent ones out there and offers a native Bitcoin wallet as well as a related forum with an active community.

The pool operates on a Pay per Share model where the operator gives an instant, guaranteed payout to a miner for his contribution to the probability that the pool finds a block. regardless of how many valid blocks the pool finds. This model allows for the least possible variance in payment for miners while also transferring much of the risk to the pool’s operator. The pool lets its users mine currencies like Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic and Decred.

BTC.com has fees which range from 1.5% to 4%. The pool offers three types of cloud mining contracts and there is usually a requirement to join a waiting list to get one. It is one of available pools that offer a chance to profit from Bitcoin mining. The payments miners get based on their contracts are delivered daily. Overall, the pool is considered legitimate by the community even though there are split opinions on Bitmain and their business practices.

- AntPool

Another one of the popular mining pools, AntPool has been founded in 2014. The pool was founded by Xu Lingchao and Tian Xin and operates from China. The pool currently lets you mine a fairly solid number of cryptocurrencies, including BTC, BCH, LTC, ETH, ETC, ZEC, DASH, SC, XMC & BTM. There have been very few complaints about the legitimacy of this pool throughout the past.

The pool is said to be supported by 2000 servers running all across the world to ensure it remains up all the time. The pool markets itself as “the most advanced mining pool on the planet” and currently supports 4 payment methods: PPS (2.5% fee), PPS+, PPLNS (0% fee) and SOLO (with daily settling of payments if they exceed 0.001 BTC).

AntPool offers three types of mining contracts. It also offers a wide variety of tools including a native phone app, APMiner Tool, Worker IP configuration Tools and AP connectivity. Finally, the pool has a variety of security options, including two-factor authentication, email alerts, wallet locks, as well as a sleek interface suitable for beginners.

Overall AntPool is also seen as a trusted mining pool that will let you profit by mining Bitcoin. Some people cite their fees as being on the higher side but they justify this with the quality of mining service they offer. Overall, another solid pool to be a part of, whether you are an up and coming miner or a mining veteran.

- Slush Pool

Oldest Bitcoin mining pool out there, it ushered in the mining pool revolution (for better or for worse) with its 2010 launch. Founded and run by Satoshi Labs, a Czech company which is also responsible for creating TREZOR hardware wallets. Satoshi Labs are also credited as the original developers of the mining stratum protocol currently being used by other mining pools. The pool found its first block in January 2012 and has since mined out over 15 thousand blocks.

This pool charges a 2% fee for transactions which is shared among the miners. It performs payouts regularly with a long history of stability and accuracy, and allows users to set their own payout thresholds (needs to be above 0.0002 BTC). The pool utilizes a score-based method which makes older shares have less value than newer shares at the start of the round, thus decreasing the risk of cheating by shifting between pools within a round. Besides Bitcoin, the pool enables its users to mine ZEC as well.

Slush is another community approved pool which has all the standard security features you’d expect, including 2FA (Two Factor Authentication), wallet address locking and read-only login tokens if someone else is monitoring your mining. It also allows users to utilize their hash power to vote on issues concerning protocol proposals.

- ViaBTC

ViaBTC is a Bitcoin, Litecoin and Bitcoin Cash mining pool which always hovers at the top of the hash rate percentages. ViaBTC.com opened its Bitcoin mining pool in 2016. The pool initially mostly utilized the Antminer S9 hardware, at the time one of the most powerful ASIC mining devices. Since its establishment, ViaBTC managed to mine out more than 22 thousand BTC. Since its establishment, ViaBTC has managed to maintain an uptime of greater than 99.9%, signaling consistency and dedication.

The pool takes a percentage of the mining income to acquire funds for managing the accounts and covering all normal maintenance, including costs for the mining farm, deployment, repairs, staff salaries, risk prevention, and any other necessary expenses. 4% fee is charged for the PPS payment system and a 2% fee for the PPLNS. Profits are distributed daily at 0 AM Beijing Time (minimum payout offered by ViaBTC site is 0.0001 BTC). Their user UI is also lauded for its simplicity and usefulness.

- F2P Pool

F2Pool is a Chinese mining pool which was created in 2013. Also among the network hash-rate heavyweights, it lets its users mine Litecoin (LTC), Ethereum (ETH), and Zcash (ZEC) besides Bitcoin. It also offers merged mining with Namecoin, Syscoin and Dogecoin. Called the “Discus Fish” mining pool, which is a nickname stemming from their Coinbase signature. As the website was in Chinese and had no official English name people decided to call it 七彩神仙鱼 (Discus Fish), which was the nickname of one of the operators. Since then they’ve introduced the English interface option.

The website utilizes PPS payment method with 4% fees on transactions. The pool uses the Stratum mining protocol and offers port 25/80 mining, with daily automatic payouts enabled. It has minimum withdrawal limits which sit at 0.001 BTC, 0.01 LTC, 0.01 ZEC or 0.1 ETH. Their website is HTTPS protocol ready and can be criticized for not having 2FA enabled. The UI is simple and well presented, thus being suitable for beginners.

- BTC.top

BTC.top is a private mining pool, meaning that potential new miners require an invite from someone already in the pool in order to start mining themselves. As such, the information about the pool is very scarce online except that it was founded in 2016 and is regularly among the top hash rate providers on the network.

- Poolin

One very young mining pool, created in 2018 in China. Launched by Blockin, a global online platform focused on developing blockchain related technologies and enterprises. Poolin.com is a multi-cryptocurrency mining pool, supporting mining of Bitcoin (BTC), Bitcoin Cash (BCH), Litecoin (LTC), Dash (DASH), Ethereum (ETH), Monero (XMR), ZCash (ZEC), Monero Classic (XMC), and Decred (DCR).

Poolin offers a website with extensive FAQ’s and instructions on how to configure your mining setup and on pretty much anything mining related that would interest you. Each of the minable coins comes with its own fee and payment method which are detailed here. Poolin might not be among the oldest and most talked about pools out there, but their hash rates speak for themselves.

Nice write up, will share with friends