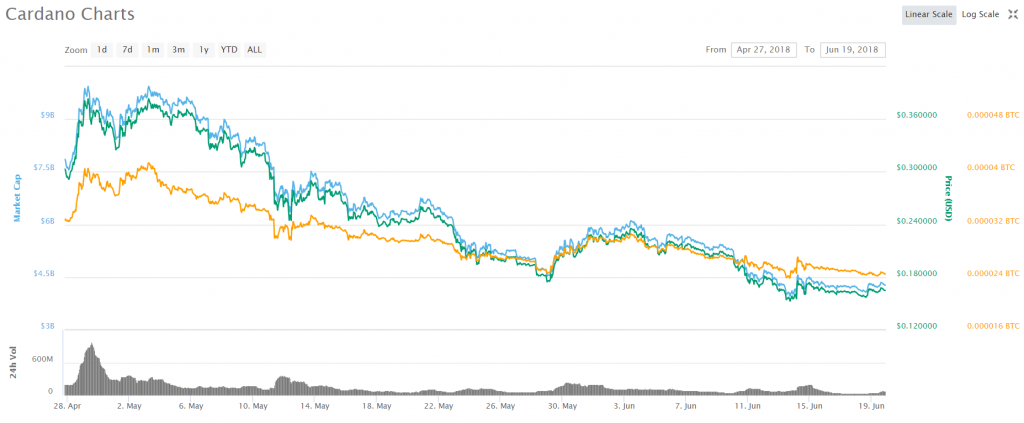

Cardano (ADA) has lately followed the latest bearish trend line set by Bitcoin, just like every other alt on the market. Its USD price has dropped off by more than half, falling from 0.39 USD to 0.16 USD in just over a months time. Both its trading volume and the market cap have trailed off as a result of the general negative market sentiment. With a market cap of 4.270.266.299 USD and a daily trading volume of just above 73 million USD, Cardano has been holding the 8th spot of the most valuable cryptocurrencies out there without much contention from the ninth placed IOTA.

The coin is still staying put inside of its descending channel, but there is potential to pick up some positive momentum on the bounce. RSI and stochastic indicators are showing upwards movement and the price could be following. For now, they are out of the overbought zone, further cementing the theory of an incoming recovery. After applying the Fibonacci tool, we get a clearer picture that indicates that the 61.8% Fib is just above the 0.2000 psychological barrier. For now this remains a bullish target and breaking it could signal a boost in volume and further rise in price.

The FA side of things looks ok as the project isn’t turning off the set development path, as they clearly show in in their weekly technical reports that can be found here. Latest report saw preparations for Daedalus 0.10.1 with Cardano 1.2.1 hotfix release. The maximum wallet limit has been increased from 10 to 20. This includes a fix in the UI logic that does not allow the user to add more than 20 wallets.

A wallet backend that had it experience large spikes in traffic was patched out, and new progress has been made on developing new wallet specifications. Additionally, the team continued to work on the data migration and plans to dedicate the coming week to pending wallet restoration work. Further work was done on networking and Cardano decentralization initiative. Ultimately, all of these steps are a part of the continued effort to fulfill the Goguen part of the projects roadmap, with IELE testnet launch seen as the culmination of this. The testnet is expected sometime in July.

What is pool mining and which mining pool is legit to join and earn crypto? Read our reviews of Genesis mining and Hashing24.

Good news are coming in from the outside support are as well. Namely, major South Korean exchange Bithumb has confirmed the addition of Cardano (alongside Status) as a part of its trading portfolio. Both coins became tradable on the platform and as a result the coins saw spikes in daily trading volumes. Similarly, another big trading platform, eToro, confirmed on June 18th that Cardano has been officially made a part of their line-up. Cardano communicated on this addition by saying the following:

“Cardano is the latest cryptocurrency to be added to eToro’s selections. eToro clients can now trade and invest in ADA and add the crypto to their portfolios. As the blockchain revolution continues, it can be assumed that companies that present added value, such as Cardano’s blockchain development platform, will have a stronger foothold in the market. While some other cryptocurrencies could fall to the ebb and flow of supply and demand, Cardano’s strong, highly-regarded blockchain platform could be a driving force in maintaining its position as one of the world’s leading cryptocurrencies.”

New exchanges and regular development updates are positive news for any project. While there isn’t much to suggest that an upturn in price could happen against the current market, expect Cardano (ADA) to move into green once the bulls come out to play. ADA seems to have found a solid support at current prive levels so entering ADA at this price could be a good long-term decision.