GMX Review – How Does This DeFi Perpetual Trading Platform Work?

Are you looking for an exchange that allows you to earn a yield while trading and staking your assets? Look no further than GMX Exchange.

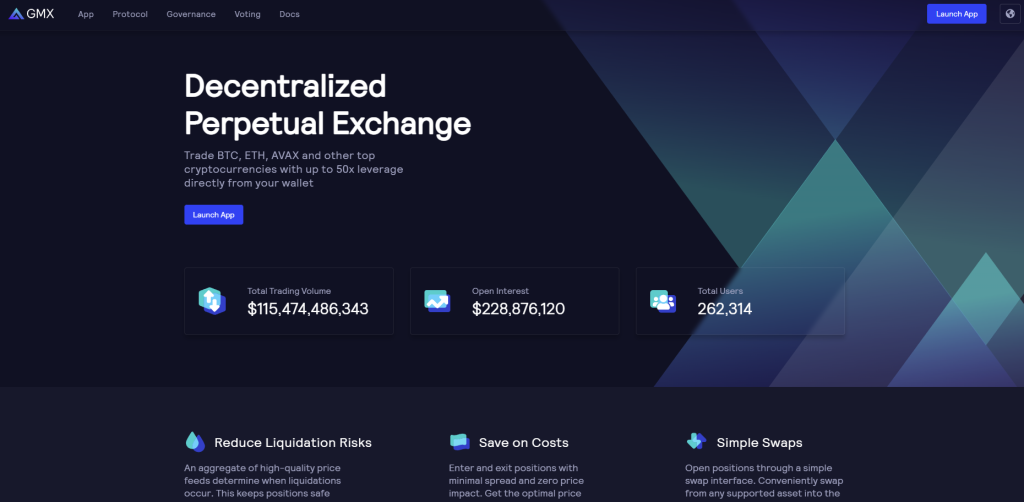

GMX is an innovative crypto exchange platform that offers users the opportunity to trade, stake, and lend their digital assets.

Through its revolutionary $GMX token and GLP pool, users can enjoy instant liquidity, low fees, and great rewards. In this review, we dive into everything there is to know about GMX Exchange and how you can use it to make the most of your digital assets. So if you’re ready to take control of your financial future with GMX, let’s get started!

What you'll learn 👉

📧 What is GMX? A Comprehensive Overview of the Platform

| 📰 | Content |

|---|---|

| 😃 | What is GMX? |

| – Decentralized perpetual and spot exchange | |

| – Margin trading without KYC or Professional Investor requirements | |

| – Leverage up to 30x (50x in alpha) | |

| – Reduced risks of liquidations | |

| – Lower costs and simple interface | |

| – Multi-chain presence on low-fee networks | |

| 😎 | What Networks is GMX Available on? |

| – Arbitrum | |

| – Avalanche | |

| – BNB Chain (soon) | |

| 🌐 | What Assets are Tradable on GMX? |

| – Arbitrum: WETH, WBTC, LINK, UNI, USDC, USDT, DAI, FRAX | |

| – Avalanche: WAVAX, WETH, BTC.b, WBTC, USDC, USDC.e | |

| 💰 | How can I Earn Yield with GMX? |

| – 100% of protocol revenue distributed to token holders | |

| – 30% to GMX, 70% to chain-specific GLP | |

| – Staking GMX or GLP tokens | |

| – Escrowed GMX (esGMX) and Multiplier Points (MP) for long-term holders | |

| 💸 | GMX Fees |

| – 0.1% per trade | |

| – $1-3M in fees per week on Arbitrum | |

| – Majority of fees from margin trading, some from swaps | |

| 🏁 | Bottom Line |

| – Decentralized trading protocol with margin trading capabilities | |

| – Wide range of assets available | |

| – Operates on low-fee networks like Arbitrum and Avalanche | |

| – 100% of protocol revenue distributed to token holders | |

| – Unique blend of functionality, low costs, and high returns |

Built on the Arbitrum and Avalanche blockchains, GMX provides users instant liquidity, low fees, and great rewards through its native token $GMX and GLP pool.

With a leverage of up to 50x, users can use GMX to maximize their profits while keeping their risks under control. Furthermore, GMX’s decentralized spot exchange allows traders to buy and sell cryptocurrencies without having to actually own them.

Finally, with its innovative price impact trades feature, users can get the most out of their investments by making sure they’re getting the best price possible for each trade they make.

📡 What Networks is GMX Available on? Supported Networks and Compatibility

GMX Exchange is available on two of the top blockchain networks, Arbitrum and Avalanche.

Both blockchains provide users with low fees, instant liquidity, and a secure environment for trading digital assets. Arbitrum is an Optimistic Rollup Layer 2 on Ethereum that enables fast transactions with low transaction costs.

Meanwhile, Avalanche is a Layer 1 blockchain with its own EVM architecture and 3-chain structure, making it one of the largest L1 networks. GMX Exchange also supports several crypto wallets, allowing users to securely store their digital assets while they trade or stake them. With support from these two powerful networks plus robust security measures, GMX Exchange provides traders with great value and a safe place to trade cryptocurrencies.

🤔 How does GMX work? A Step-by-Step Guide

GMX Exchange works by allowing users to access a decentralized derivatives market. A native token powers this market called the Governance Token (GOVT) which allows token holders to be part of the platform’s governance system, providing them with voting rights and the ability to influence decisions made on the platform.

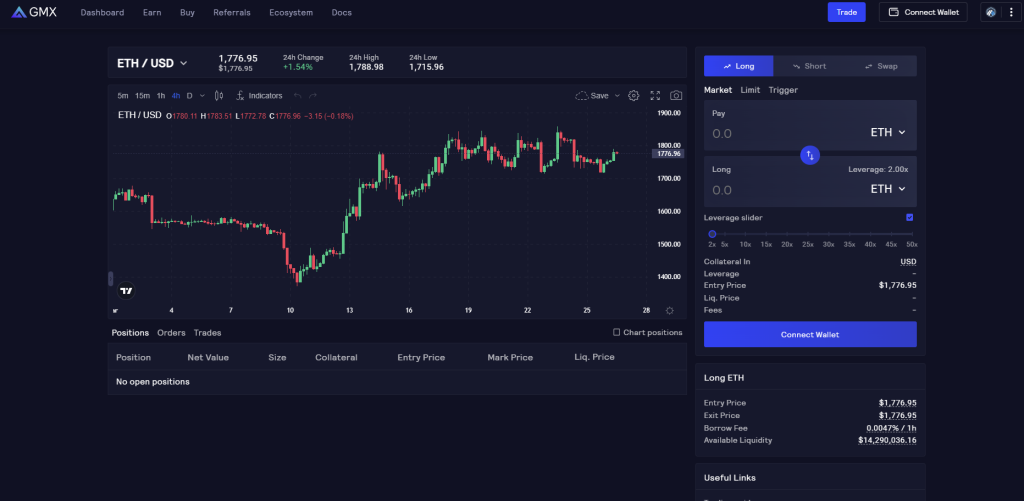

GMX also provides traders with access to a perpetual exchange and leveraged trading, allowing them to take advantage of price swings in the market. To ensure liquidity, GMX has implemented temporary wicks and a floor price fund in order to minimize any sudden price dips or surges.

To further incentivize liquidity providers, GMX offers dynamic pricing as well as swap fees for those who provide liquidity. Overall, GMX is an efficient and secure platform for traders looking to make the most out of their digital assets.

With low fees, dynamic pricing, and a unique governance token, GMX Exchange is the premier choice for traders looking to get the most out of their digital assets. But what kind of assets are tradable on GMX? Read on to find out!

💰 What Assets are Tradable on GMX? A List of Supported Cryptocurrencies

GMX Exchange provides users with access to a range of tradable assets.

These include popular cryptocurrencies like Bitcoin, Ethereum, and Ripple, as well as other digital assets such as tokens, stablecoins, and utility tokens.

Additionally, GMX also allows traders to take advantage of decentralized spot trading, leverage trading up to 50x on select assets, and long-term holders can benefit from liquidity pools.

With an array of tradable assets available on the platform and low fees compared to other exchanges, GMX is an ideal platform for traders looking to get the most out of their digital assets. Moreover, thanks to smart contracts and innovative features such as price impact trades and position size limits, GMX offers a secure trading environment with minimal price impact on trades.

💸 GMX Fees: Understanding the Costs of Trading and Investing

GMX Fees are relatively low compared to other exchanges, and are made up of two components: trading fees and platform fees.

Trading fees vary depending on the asset traded, but typically range from 0.02% to 0.05%. Platform fees include a fee for using GMX’s decentralized exchange, swap fees for swapping assets between different coins, token holders who receive a portion of the trading volume, and liquidity providers who offer temporary wicks to allow traders to enter or exit positions at a better price.

Additionally, GMX also offers Dynamic Pricing which allows users to set floor prices on their funds, as well as its native token GXT which provides holders with reduced trading fees and access to its perpetual exchange.

All in all, GMX’s low fees make it an ideal platform for traders looking to get the most out of their digital assets.

💱 $GMX the Token: Understanding Its Purpose and Benefits

$GMX is a governance token for the GMX decentralized exchange. It’s used to pay fees on the platform and rewards long-term holders with reduced trading fees and access to GMX’s perpetual exchange.

Additionally, $GMX holders can benefit from token emissions which are split between stakers and liquidity providers.

Furthermore, $GMX provides traders with the ability to make use of features such as position size, leverage trading, floor price fund, and price impact trades. It also offers liquidity pools to facilitate spot trading between different coins.

💰 Staking GMX: How to Earn Passive Income on the Platform

Staking GMX is a great way to maximize profits on the GMX decentralized exchange. By staking their tokens, users can earn rewards in the form of Escrowed GMX (esGMX) tokens, variable ETH and AVAX APR from trading fees, and multiplier points that boost APRs.

Additionally, holders benefit from features such as position size and leverage trading, floor price funds, and price impact trades. All these benefits come with a low fee structure. The rewards accrued through staking $GMX are even higher when held for longer periods of time.

📈 GLP — Built on the Failed Dreams of Degens: A Look at the Governance Token

GLP (Global Liquidity Protocol) is a project built on the failed dreams of degens. It is an automated liquidity protocol that allows users to deposit funds into a decentralized exchange and trade any digital asset with ease.

GLP leverages blockchain technology to create an efficient and trustless platform for trading digital assets. The protocol also offers its own native token, which is used to pay fees and provide rewards for liquidity providers.

This token helps incentivize traders to actively participate in the network by providing rewards for their contributions. Additionally, GLP provides dynamic pricing based on market conditions, allowing traders to take advantage of temporary wicks or long-term holders looking to gain exposure to a wide range of cryptos at once.

GLP’s revolutionary approach to liquidity and trading makes it a must-have for any investor or trader looking to maximize profits from the ever-evolving world of digital assets. With its automated protocol and dynamic pricing, GLP offers users an efficient way to trade with confidence. But that’s not all – stay tuned for more on what makes GMX unique!

🚀 What Makes GMX Unique? Platform Features and Advantages

GMX is a cryptocurrency exchange that stands out from the crowd. Unlike other exchanges, it has several features that make it stand out.

First, its decentralized spot trading platform allows users to trade crypto assets without having to rely on any centralized third party for custody or execution. This means users can trade securely and without the risk of their funds being stolen.

Secondly, GMX offers perpetual leveraged trades with no price impact and low fees. This allows traders to maximize their position size and increase their returns on each trade. Finally, GMX also has a Floor Price Fund which helps protect traders from sharp market moves by offering them insurance in case of losses due to sudden price drops.

All these features combine to make GMX one of the most innovative cryptocurrency exchanges available today.

💼 How can you use GMX? Practical Use Cases and Applications

📈 Trading with Leverage on GMX: A Guide to Margin Trading

One of the highlights of trading on GMX is the ability to leverage your trades. A leverage trade allows traders to increase their position size without having to put down a large sum of money upfront.

This means you can take larger positions with much less capital, thus allowing you to make more profits from smaller price movements. On GMX, you can trade with up to 100x leverage and choose between traditional or perpetual contracts.

Leveraged trading can be an effective way for experienced traders to make profits in highly volatile markets, but it’s important to remember that it comes with higher risk and requires careful management of your position size.

As always, do your research and use proper risk management strategies when trading on GMX!

💰 Staking GMX to Earn a Yield: A Comprehensive Guide

Staking GMX is a great way to earn a passive income with compounding and boosted rewards.

When you stake GMX, you will be rewarded with the native token of the exchange, GLP, which can then be used for trading or exchanged for other cryptos. You can also use the staked tokens to vote on governance decisions and share in the profits generated by GMX.

The yield you can earn from staking GMX depends on the amount of tokens staked and the current market conditions. For example, at present, GMX offers an ~10% yield in ETH before any boosts are applied.

Moreover, as more people join the platform and start staking their tokens, the yield increases further due to compounding rewards.

So if you’re looking to earn a passive income without taking too much risk, consider staking your GMX tokens today!

💦 Providing Liquidity with the GLP Pool: A Guide to Yield Farming

The GLP pool is a unique feature of GMX, which allows users to provide liquidity in exchange for a real yield. The pool is backed by assets on the exchange, and traders can swap any constituent token for GLP.

This makes it easier for long-term holders to earn yields without needing to trade actively. By providing liquidity, you are helping to reduce slippage and increase trading volume, which in turn increases the profitability of the platform.

As a token holder, you will be rewarded with GMX tokens when traders use your liquidity and pay fees. Additionally, you can also benefit from temporary wicks that occur during price impact trades as well as dynamic pricing from the Floor Price Fund. All in all, if you’re looking for a way to earn passive income with minimal risk, then consider providing liquidity through the GLP pool!

GMX & GLP have an important relationship that investors must understand. GMX is the utility and governance token of the pool, with currently providing 18.8% APR (11.3% ETH/AVAX, 7.5% esGMX). Meanwhile, a whopping 70% of all revenue from each chain is distributed to GLP, the liquidity token for the pool — currently providing 28.9% APR in ETH on Arbitrum and 23.7% APR in AVAX on Avalanche!

As GLP is a basket of assets, it works as an index – when BTC and ETH increase or decrease in value so does GLP’s price – which GLP holders need to be aware of. Additionally, since GLP acts as the ‘house’ whenever a trader wins or loses money they are betting that traders will lose more often than they win over time to see returns on their investment. Thus, if you’re interested in investing inGLP then you need to be sure that your income outweighs any losses!

🔒 Escrowed GMX: A Look at the Platform’s Innovative Security Feature

Escrowed GMX is an innovative way for holders to maximize returns on their investments. It is a locked form of the GMX token, with two options: stake it to earn a higher share of the fee distribution to GMX holders (equivalent to 1 GMX), or convert it linearly over a year period, forfeiting its earning potential.

To vest in Escrowed GMX, users need to lock either their GMX or GLP tokens in equal amounts as what earned them the esGMX in the first place. With this system, users can securely and efficiently increase their returns without actively trading, making Escrowed GMX an attractive option for all types of investors.

🔢 Multiplier Points: A Guide to Maximizing Earnings on GMX

Multiplier Points (MPs) are a unique form of reward for long-term GMX holders.

The system works by rewarding holders with MPs based on the amount of GMX they stake.

These points can be used to earn fees at an equivalent rate to staked GMX, and can provide an effective way to increase returns without any active trading. Upon unstaking their GMX, MPs are burned off in proportion to the size of the unstake, meaning that long-term holders will be able to maximize their profits over time.

The concept behind MPs is simple: reward those who believe in the project and hold onto their investment over a longer period.

❓ GMX FAQ: Answers to Commonly Asked Questions

👉 Bottom Line: Is GMX Worth Using for Trading and Investing in Cryptocurrencies?

GMX is an attractive option for both long-term and short-term investors alike. With its wide range of assets, low swap fees, native token and smart contracts, GMX offers traders a secure and efficient platform to trade on. Furthermore, the protocol’s liquidity pools and decentralized spot exchange offer traders access to high liquidity and low price impact trades.

On top of that, GMX also offers dynamic pricing options as well as a floor price fund which prevents temporary wicks in the market. And lastly, 100% of the fees generated through trading on GMX are distributed back to token holders, providing real yield for investors. All in all, GMX provides an innovative and exciting way for traders to get involved with decentralized finance.