What you'll learn 👉

Table Of Contents

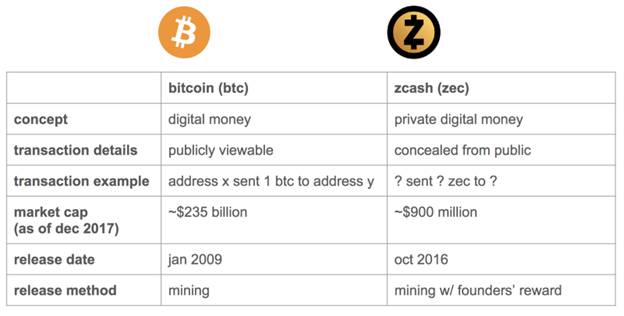

In a world where online privacy is becoming more of an issue by each passing day, coins that focus on providing it are becoming more and more valued. Zcash is one of these so called “privacy” coins as it represents an open, permission-less cryptocurrency that can fully protect the privacy of transactions using zero-knowledge cryptography. This coin runs on a decentralized Blockchain, similarly to Bitcoin, but keeps transaction amounts hidden and parties involved anonymous. While Bitcoin allows you to follow someone’s transactions if you know their wallet address, with ZCash all the information is encrypted. Zcash transactions are still published on a public blockchain but the sender, recipient, and amount of coin transferred remain private.

Bitcoin vs. Zcash

What makes a privacy coin?

Enhanced privacy and anonymity are becoming increasingly sought after in all corners of the Internet. Naturally, a part of this demand comes from people that are engaged in illegal activities. This fact became a focal point of any anti-Bitcoin or anti-cryptocurrencies narrative. Still, these criminals are dime a dozen; conserving your privacy simply means that you wish to have absolute control over who knows what about you.

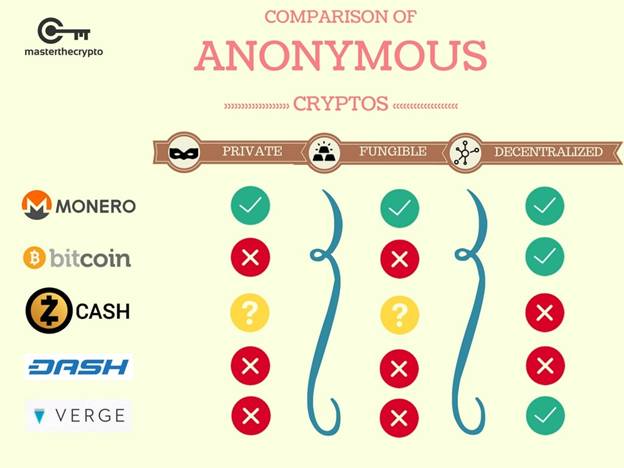

A privacy coin is usually defined by 3 key features:

- Privacy: The amount of coins you own, send and receive are not observable, traceable nor linkable by looking at the transaction history on the Blockchain.

- Fungibility: Every coin is worth the same value and is thus mutually interchangeable. No coin risks potential blacklisting or debasement due to deprecating transaction history.

- Decentralization: All nodes have equal power and control; there are no nodes that have more influence than others, i.e. masternodes. The currency is not created, maintained nor controlled by any one person or company, i.e. a central authority.

Zcash currently doesn’t offer much in any of the three listed categories. It does allow for private transactions so the privacy is there, but the encryption service is being used for only a fraction of the total transaction volume. This causes fungibility issues, as the coins that were a part of encrypted transactions could potentially end up being more valuable than those that were “tainted” via unencrypted transactions. The decentralization can be an issue as well, as the Zcash foundation could potentially end up owning up to 10% of the total supply of their tokens (explained further in the article). Zcash still has a long way to go before achieving the status of an actual privacy coin.

Zcash vs other popular privacy coins (source: https://masterthecrypto.com/wp-content/uploads/2017/09/CRYPTOCURRENCY-4-min.jpg)

Zcash technology

Zcash is based on the Zerocash protocol which aims to fix Bitcoin’s privacy issues. The Zcash team created a hard fork, a copy of the Bitcoin blockchain and kept the design relatively the same aside from a few differences. These differences include changing the block interval target from 10 minutes to 2.5 minutes, increasing the block size limit to 2MB, introducing a confidential value transfer scheme and implementing a 20% reward to the Zcash team for each block rewarded for the first four years.

Zcash uses advanced cryptographic techniques, namely zero-knowledge proofs (zk-SNARKs) to guarantee the validity of transactions without revealing additional information about them. The team behind the testing and verification of this technology is made out of high profile researchers including professors Eli Ben-Sasson and Alessandro Chiesa. The acronym zk-SNARK stands for “Zero-Knowledge Succinct Non-Interactive Argument of Knowledge,” and refers to a proof construction where one can prove possession of certain information without revealing that information, and without any interaction between the prover and verifier. This allows the network to maintain a secure ledger of balances without disclosing parties or amounts involved in transactions. Currently, the only known way to produce zero-knowledge proofs that are non-interactive (meaning that they require a single message to be sent from the prover to a verifier) and short enough to publish to a blockchain is to have an initial setup phase that generates a common reference string shared between prover and verifier. We refer to this common reference string as the public parameters of the system. The generation of these parameters is random, and said randomness needs to stay hidden from malicious parties (otherwise they would be able to create false proofs that would look valid to the verifier). For Zcash, this would mean the malicious party could create false proofs and counterfeit coins. To prevent this from ever happening, Zcash generates said public parameters through elaborate, multi-party ceremonies.

Zcash gives its users an option to conduct transparent (public) and shielded (private) transactions. It also allows users to selectively disclose information about their shielded transactions. Optional transparency can be beneficial for situations where an entity needs to be audited or submit information for tax purposes. What enables this selective transparency is the usage of a “view key”. This key can be shared with others to allow transaction details to be selectively viewed by certain individuals. Knowledge of the view key is not enough to spend the funds you are viewing. The “view key” is separate from the “spend key” which used to spend funds. Knowledge of the spend key is necessary and sufficient to spend the ZECs that are stored on a payment address. This separation into two different keys ensures that one may allow a third party to view the transaction details without allowing said party to spend the funds that are present on the account.

Zcash also provides encrypted memo fields. These memo fields can be used to send encrypted messages to a receiver on the network. Only a holder of the view key for a specific memo field is able to read this message. This can be used for a variety of purposes such as including a payment code or sending a message to the recipient.

Zcash’s technology isn’t without limitations. Most often cited weaknesses that the Zcash team is actively working on fixing in the future are:

- Computation and setup: One of the downsides to zk-SNARKs is that it requires the performing of a multi-party computation ceremony conducted by a group of network individuals. This ceremony is conducted in order to generate the public parameters of the zero knowledge technology. To maintain an accurate total of the Zcash monetary base you need to trust that at least one member in the group has successfully completed their part without being compromised. Note that this parameter does not affect Zcash privacy guarantees. Given this tradeoff, there is already research happening with a newer technology called zk-SNARKs that enables privacy but doesn’t require a trusted setup.

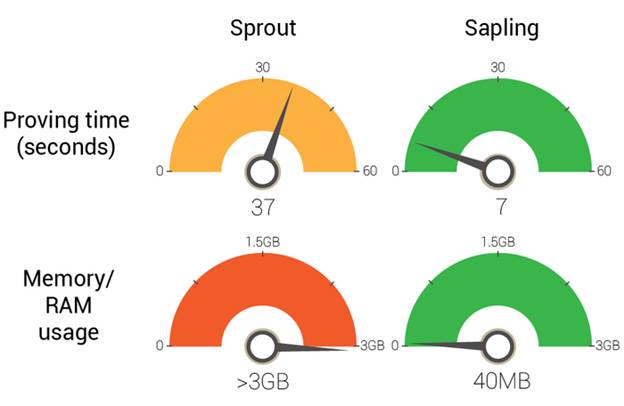

- Required resources: Generating encrypted transactions in Zcash requires a lot of computer memory and time which makes it inconvenient for commercial use. As a result currently not all transactions are shielded in Zcash (only an approximate 5.05% of funds are held in z-addresses). This means that some coins may be more valuable than others because they weren’t a part of a possibly tainted transaction. However, the team has focused on performance improvements in a future update, promising an introduction of Sapling technology which will significantly reduce the amount of time and memory required which is a key requirement for opening up mobile support for Zcash shielded addresses.

All of this means that a greater percentage of Zcash transactions will be shielded, increasing overall privacy. The development team has even alluded to a future plan for abandoning fully transparent addresses altogether.

Zcash funding, coin and governance

Zcash was launched on the 28th of October 2016 with the initial phase of the blockchain receiving a code name ‘Sprout’, which emphasizes that that this is a young, budding blockchain with great growth potential. It was started by an investor named Zooko Wilcox, a man who has more than 20 years of experience in open, decentralized systems, cryptography and digital startups. Its development is run by a US-based, for-profit company, the Zerocoin Electric Coin Company. While they claim that they are committed to the open-source nature of the blockchain (something they have backed by making their code open source), the company plans on taking 20% of all Zcash coins mined for the first four years as a “founders reward” – “distributed to the stakeholders in the Zcash Company — [the] founders, investors, employees, and advisors.”

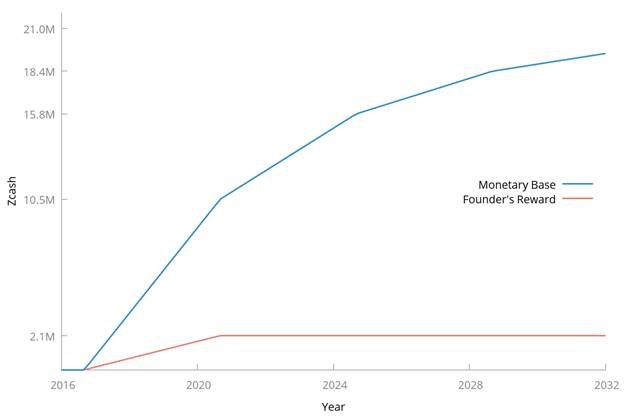

With 50 coins being generated every 10 minutes for the first four years, an approximate 10,512,000 coins will be created, with the founders owning 2,102,400 of what is in circulation. After those first four years, coin generation will be reduced to 25 coins per 10 minutes, and only then will miners receive 100% of what is mined. Once the cap of 21,000,000 coins is reached, the “founders, investors, employees, and advisors” can potentially end up owning approximately 10% of all coins in circulation. There has been a lot of talk on forums about this – and with the coin being open source, there have been some suggesting they will create their own currency based on exactly the same protocols but without the 10% tax on mining rewards.

Many community voices have been critical regarding Zcash’s pre-mine policy and founders reward system. However, while the policy is somewhat greedy (especially when remembering that the project has received some heavy initial backing from big money investors like Pantera Capital, Roger Ver and Barry Seibert) the necessity of a founders reward system is understandable, especially with a prolonged development project like Zcash. One of its major investors is the Digital Currency Group, which owns a large percentage of the media outlets involved in the crypto currency space. This of course prompted some to accuse DCG of “shilling” and ZCash of being a product of corporate greed. As a sign of being focused on decentralization, the receivers of the founders reward have promised to donate 10 percent of the total reward funds to a non-profit “Zcash foundation”, which will focus on fair and unbiased governance of the project. Still, in some sections of the community doubts remain about the levels of decentralization that this project will reach in the future.

The Zcash total coin supply is going to be 21 million, similarly to Bitcoin. The project even follows the same coin issuance rate with 21 million ZEC being issued over 131 years. Still there is a difference, as instead of having Bitcoins 10 minute blocks, Zcash will have a 2.5 minute block average with 4 times bigger block rewards that halve every 4 years (or every 840 thousand blocks).

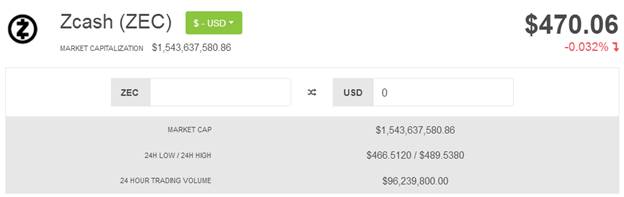

Zcash is currently taking the 23rd spot among all available cryptocurrencies marketcap-wise, while also being the 7th most expensive coin on the market. These stats show a relatively pricey coin that can potentially be a good target for those who prefer to mine their coins, rather than trade for them.

How to mine Zcash

ZCash will use Equihash as its hashing algorithm, which is an asymmetric memory-hard PoW algorithm based on the generalized birthday problem. It relies on high RAM requirements to bottleneck the generation of proofs and make ASIC development unfeasible, much like Ethereum. In order to avoid Instamine, ZCash will have a slow mining start, where block rewards will be issued slower than normal. Check out the Zcash official blog update on how to start your own Zcash mining node.

How to Buy Zcash

- Set up a Zcash wallet

Start by downloading a wallet, either a desktop or a mobile one. There are already a variety of third-party options for storing and sending ZEC, in addition to the officially supported core client, zcashd. Many of the third-party wallets have limitations in their support for Zcash; in particular regarding the address-shielding memory requirements. You can browse a list that the company put together of third-party support at launch here.

For a desktop wallet, you can download the official Zcash wallet for Mac or for Windows. Once you install it, you can use the wallet right away but you won’t be able to see transactions before you let it sync. Once it’s installed, you go to the Own addresses tab, right click the address the client has created for you, and then click Obtain Private Key.

A screen will appear, showing your private key and letting you know it’s been copied to your clipboard. Keep this backed up very carefully and very securely. Either screenshot it, type it down on a secure note or write it down on a piece of paper. If you lose this key you won’t be able to rebuild your wallet if your current computer fails. At the same time if anyone finds this key they can take control over your money.

Once that’s done, go to the Own Addresses tab, double click the available address and copy it. This is the address you’ll later need to get your Zcash out of the exchanges and into your own wallet. This address usually starts with a “t” or a “z”, the same way bitcoin addresses typically start with a “1” or a “3”. The thing with these addresses is that the ones that start with “z” include the privacy enhancements provided by zero-knowledge proofs.

Copy the address above by right click/Copy or using the Ctrl+C keyboard shortcut

You can also store you Zcash on your mobile, hardware or exchange wallets. However, its unsafe to keep your funds stored online so be sure to send it to cold storage. For further options, check out this neat, Zcash community approved list of ways to store your coins.

- Purchase BTC/ETH

As with any coin out there, your best option is to buy it with either Bitcoin or Ethereum. Buying BTC/ETH is simple and can be done via an exchange which allows fiat-for-crypto purchases like Coinbase, Kraken or Bitfinex.

- Purchase ZEC for BTC/ETH

Once you purchase your Bitcoin or Ethereum, transfer it to your wallet on one of the exchanges which offer ZEC as a trading partner for BTC/ETH. Binance is your best bet but there is a wide variety of available exchanges (some of which allow you to buy ZEC with USDT or even offer direct fiat purchasing of ZEC). Once your funds are transferred, you are free to purchase a desired amount of ZEC.

- Send your funds to cold storage

Use the abovementioned address on your windows wallet (or a receiving address on whichever cold storage account you choose) to send your funds there.

Future

Zcash is still a young project, having so far barely completed a year of official existence. During this time, their official team as well as many interested individuals worked on laying down the foundations of a global Zcash ecosystem. While the development team has been focused on security and stability of the Zcash network, the third party developers continued to add support for Zcash to existing wallets and exchanges. The team regularly puts out put State of the Network posts throughout the year which so far marked milestones like the distribution of the first 1 million ZEC (now approaching 3 million), the market cap reaching 100 million USD (now well over 1 billion USD) on the 6 month anniversary and Zcash’s first birthday. In a recent roadmap update the Zcash team came out with ambitious yet achievable plans for the future, which include the Sapling usability and security improvements, further support and adoption of Zcash by third-parties and future collaborations promoting more research around zero-knowledge proofs and utility behind the privacy they enable.

Zcash has had a great year with its price hitting over $400 in June 2017 and has since kept his position as one of the most valuable coins on the market. Many in the community have taken great pride in endorsing the Zcash platform as they understand the importance of anonymous transactions in the future of cryptocurrency payments. There has been serious talk of combining the Ethereums smart contract based blockchain with Zcash anonymous payments, suggesting that there is great potential for increased scalability in both platforms. The competition on the privacy coin market is strong, with Monero, Dash, Verge and even Bitcoin showing significant privacy improvements. All things considered, Zcash has shown a lot of potential so far. It will need to deliver on said potential and perhaps even more than that to convince the entire market that it can become the new, private version of Bitcoin.

Read more about other interesting coins we wrote about. So many forks – what is Bitcoin Gold – BTG? And what is BCH? Then again, there is bitcoin diamond. And bitcoin atom – BCA. And Super BTC. And some others we didn’t cover since they are not worth mentioning. And most recent one that actually seems legit – Bitcoin private BTCP. For all the stoners among our readers – reading about potcoin will probably be a big joy. Many would argue that Cardano coin is the next bitcoin. Einsteinium coin has an interesting story behind it – read more about it on the link. For all the green energy and eco-conscious guys Burst coin is great concept that might solve most common problems in this sector.