AlejandroTM, a popular crypto influencer with over 78k followers, published an extensive 23-tweet thread explaining his decision to leave Polkadot after 4 years of support. He outlined numerous issues making him lose confidence in DOT as an investment.

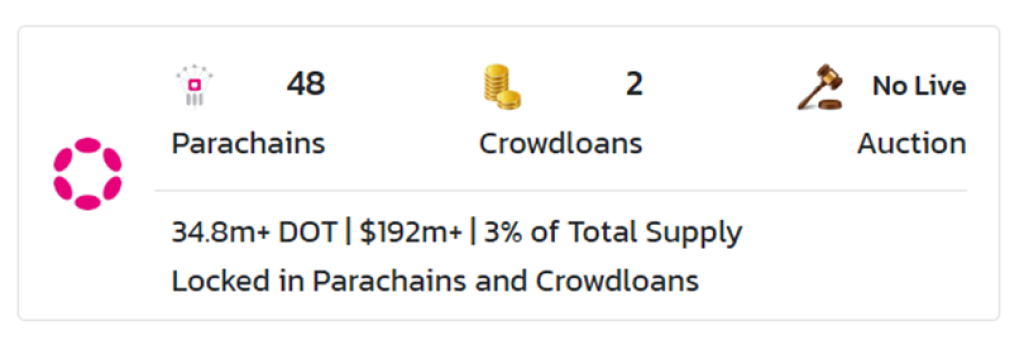

Alejandro began by acknowledging Polkadot’s parachain model seemed appealing initially. Projects could bid for slots by staking DOT, with crowdloans allowing participation for those lacking funds. But things have not panned out as expected over the past two years.

According to Alejandro, Polkadot now features overly complex technology beyond what ordinary users can comprehend and adopt. Despite ambitions to be a thriving ecosystem, it has onboarded only 48 projects in two years and locked up a mere 3% of total supply.

Major projects like Astar are even migrating away to competitors like Polygon. “Let’s talk numbers. The Total Value Locked on All Chains (TVL) is less than $150M. This is very low compared to other blockchains,” highlighted Alejandro.

He compared Polkadot’s market cap and TVL to Ethereum, Tron, Binance Chain, Polygon, Avalanche, and Solana – showing it is failing to capture value relative to competitors.

Alejandro also noted Polkadot’s lack of growth in holder count and on-chain activity. Holders have increased only 10% in 12 months to 1.15M. Transactions remain stagnant with hardly any new accounts created. “It’s simply the same people over and over,” he remarked.

Price-wise, DOT continues lagging top altcoins substantially. It is up just 21% year-to-date versus gains exceeding 50% for ADA, SOL, AVAX, ROSE, FTM, ETH, HBAR, and more. Recently, AVAX surpassed DOT in market capitalization as well.

Another concern is Polkadot’s open-sourced technology being copied by chains like Cardano without benefitting it. Alejandro warned this could render Polkadot irrelevant long-term as competitors utilize its innovations for free.

He also criticized the lack of clear leadership and marketing after development was handed to the community. This has led to negligible exposure and people talking more about competitors.

Additionally, Alejandro accused Polkadot’s treasury system of becoming a “Ponzi scheme” benefitting select whale investors. He compared it to a communist dictatorship where power resides with a few who control voting.

Alejandro believes the same “four whales” approve whatever they want with little oversight. They coordinate as an oligarchy to rule the treasury, which contains a juicy $242M in DOT.

Read also:

- Why QUBIC’s 10,000% Explosion Outperformed Even Solana’s Meteoric Rise

- Why is PIVX Coin Pumping? Here Are Reasons Behind the 160% Pump

- Can the Cronos Rollercoaster Soar to $1.00? After Raising $1.5M, Is This the Next Top 100 Crypto?

In summary, Alejandro sees Polkadot continuing to underperform and fade into irrelevance in coming years. He advised followers he will be selling his DOT holdings at an opportune time.

The scathing thread from a former Polkadot advocate indicates growing disillusionment about its future prospects. Alejandro highlighted issues around technology, adoption, governance, and tokenomics that paint a concerning picture. It remains to be seen if Polkadot can deliver on its early promise and turn things around.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.