The price of Bitcoin has been in an uptrend for over 3 weeks after reaching a local bottom around $38,600. Since then, the price has rallied and reached new yearly highs, with the price presently above $51,000. Crypto analyst Ali recently shed some light on what may be causing this latest Bitcoin surge.

What you'll learn 👉

Institutional Demand Fuels Price Action

According to crypto analyst Ali, the recent bitcoin price rally appears to be driven primarily by institutional demand rather than retail investors.

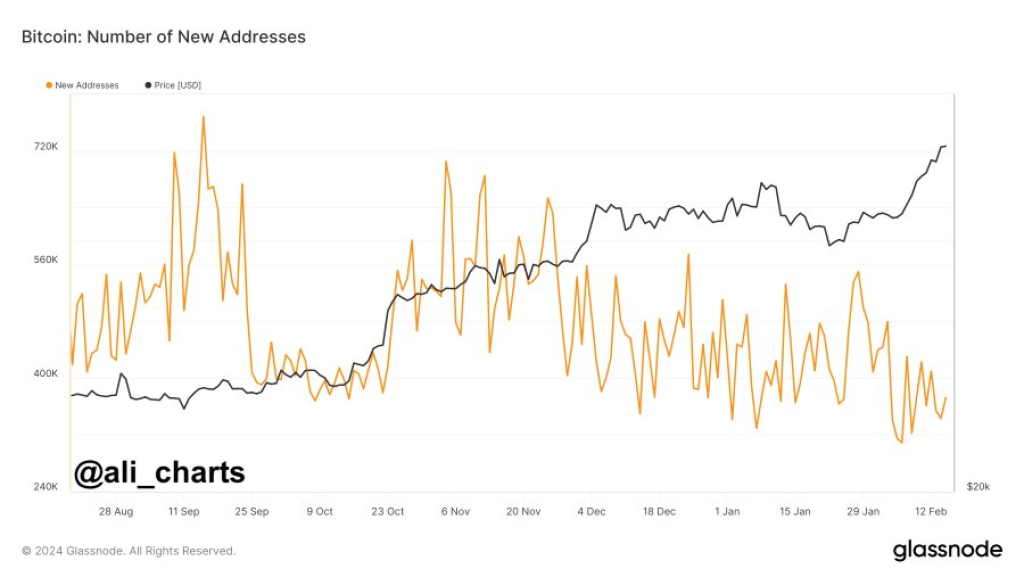

Ali points out on X that as the price of bitcoin has increased, there has been a noticeable decline in the number of new bitcoin addresses created daily. This suggests a lack of participation from individual retail investors in the current bull run.

Meanwhile, the SEC has approved several spot bitcoin ETFs set to begin trading this year. Analysts predict significant inflows into these ETFs from institutional investors, estimating up to $39 billion by the third year. The ETFs allow institutions easier access to gain exposure to bitcoin.

Mainstream Adoption Increasing

The approval of spot bitcoin ETFs also signals growing mainstream acceptance of the cryptocurrency. Major financial outlets are covering the expanding institutional interest in bitcoin as a digital store of value or “digital gold.”

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Bitcoin now represents around 48% of the total crypto market capitalization. Its market dominance points to its strength as institutional investors increasingly look to diversify into the space.

Their participation helps drive innovation and maturity in the broader cryptocurrency ecosystem. Additionally, the education and awareness resulting from institutional involvement helps pave the way for further mainstream adoption.

The confluence of factors suggests bitcoin’s appeal to institutional investors is a significant driver of the ongoing rally. While retail activity may be declining, institutional demand appears to be on the upswing and fueling the latest bull run.

You may also be interested in:

- Bitcoin Bound for $150K? These Key BTC On-Chain Metrics Point to Potential Breakout

- How One Trader Made $150,000 with Just $198 Ethereum in 18 Hours

- Avalanche and Chainlink Climb Impressively While Investors Anticipate Huge Returns on Rebel Satoshi’s DEX Launch

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.