A report by CryptoQuant, a leading crypto analytics firm, predicts that Bitcoin price could reach $150,000 in the next 6 months. The forecast comes from analyst onchain_edge, who spent over 100 hours analyzing on-chain data.

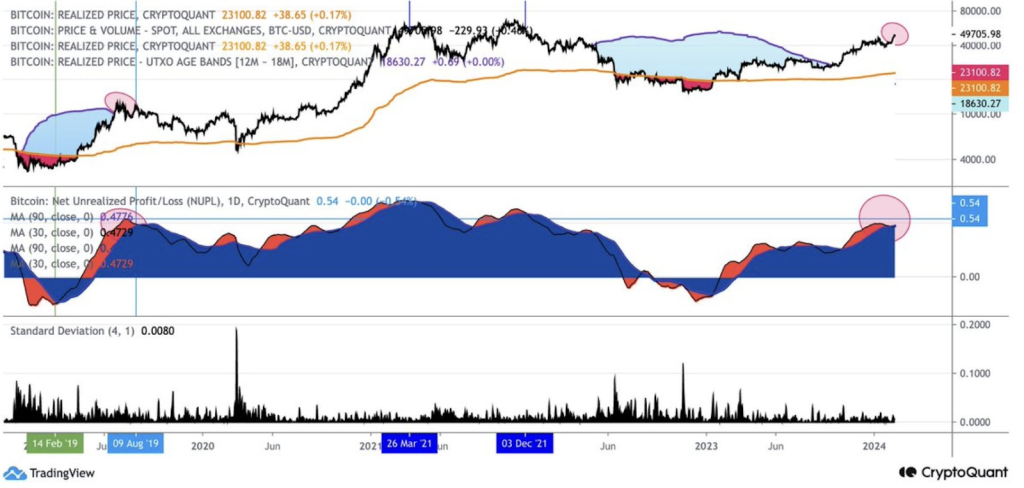

The report outlines two potential scenarios for Bitcoin over the coming months. Currently, BTC’s net unrealized profits and losses metric stands at 0.49. This gauge measures what percentage of BTC holders are in loss. In 2019, the metric peaked at 0.54 before prices crashed. So some holders are already approaching break-even.

Additionally, the Puell Multiple, which tracks miner profits, has risen to 1.83. It reached 2.05 at the peak of the last rally in early 2021. So miners are seeing strong, but not outlier profits yet.

Moreover, BTC futures open interest continues marching higher. However, it has not seen the same blow-off top that occurred in early 2021. Consequently, Onchain_edge believes such a vertical move could still materialize.

Two Potential Price Scenarios

In scenario A, BTC repeats the price action seen in 2019. The percentage of the BTC supply in loss would bottom out around 16% over the next 6 months. This would likely coincide with prices dropping to test underlying support around $23,000.

Scenario B is more bullish. Here, the supply in loss could decline to just 3% in the coming months. If this plays out, BTC could embark on a massive bull run towards $150,000.

Onchain_edge views scenario B as more likely, given the lack of open interest blow-off and new money entering the market. Hence, he recommends holding BTC rather than trying to sell the top. Crypto markets often surprise, and leverage trading is risky.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +CryptoQuant’s analysis sees Bitcoin prices potentially doubling in 2023. However, timing the top remains challenging. Therefore, patient holding seems to be the wisest strategy.

You may also be interested in:

- Polkadot (DOT) Teeters ‘On the Cusp of a Breakout’: Can It Surpass Resistance at this Key Level?

- Ethereum Finally Strengthening, Analyst Reveals When ETH Will Start to Surge Amid Favorable Price Action

- Bespoke Crypto Streaming Platform Deestream (DST) Takes Further Tether (USDT) & Polkadot (DOT) Investment As 30x Capable

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.