VeriBlock serves as the world’s first blockchain which allows every blockchain in the world to inherit the full Proof-of-Work security of Bitcoin in a completely decentralized, trustless, transparent, and permissionless (or “DTTP”) manner.

It acts as a fully DTTP security adapter/aggregation layer between other blockchains and Bitcoin.

The Veriblock blockchain launched its mainnet on March 25.

The basic idea behind VeriBlock is the concept of proof-of-proof (PoP). This is the supplemental consensus mechanism used by blockchains that integrate with VeriBlock.

Instead of relying solely on its own hashrate for security purposes, VeriBlock allows a blockchain to piggyback on the massive amount of computing power that is already pointed at the Bitcoin network.

VeriBlock uses OP_RETURN — a type of bitcoin transaction that is used for embedding data on the blockchain. It can be used for anything from proving the existence of some data at a specific point in time (proof of existence) to issuing new assets, all on top of the Bitcoin blockchain

According to Forbes, perhaps the most notable contributor to the VeriBlock project is former Bitcoin Core developer Jeff Garzik.

What you'll learn 👉

Proof of Proof Consensus Algorithm

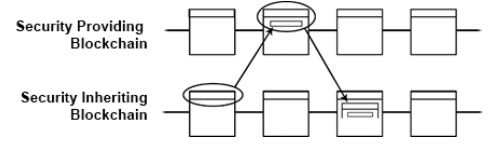

The Proof-of-Proof consensus protocol is a novel solution that enables blockchains to inherit proof-of-work security from other blockchains, creating an ecosystem wherein security originates on established blockchains like Bitcoin and extends to other blockchains.

Such an ecosystem creates indirect scalability of Bitcoin by utilizing it as a security mechanism for purpose built chains.

How is Veriblock mined?

The VeriBlock blockchain is mined in two different ways: PoW and PoP mining. PoW miners are responsible for creating the blocks, providing the blockchain with intermediate consensus, and providing blockchains inheriting security through VeriBlock with a PoW-powered first line of defense.

PoP miners are responsible for publishing a representation of the current state of the VeriBlock blockchain (and by proxy, all blockchains secured by VeriBlock) to Bitcoin in a fully DTTP manner.

vBlake is the Proof-of-Work hashing algorithm used by the VeriBlock blockchain. It is a tweaked version of BLAKE2b optimized for use as a PoW algorithm.

The PoP protocol introduces a new type of miner who performs periodic publications of one blockchain’s current state to another blockchain. These publications are referenced in the event of a potential blockchain reorganization.

PoP miners serve as the communication/transactional bridges between a SI blockchain and a SP blockchain. As often as they wish, PoP miners will take the most recent blockchain state data from the SI blockchain and publish it to the SP blockchain.

Veriblock Token – VBK

The VeriBlock blockchain provides an aggregation layer of proof, and its coin provides a means for paying the decentralized VeriBlock PoW and PoP miners in a way controlled completely by the VeriBlock blockchain protocol.

As such, the VeriBlock coin serves as a price discovery mechanism that allows the efficient allocation of the scare resource of proof, allowing all blockchains to inherit Bitcoin’s PoW security.

Benefits of Veriblock

VeriBlock Blockchain enables rapid, widespread and secure adoption of PoP security for other blockchains. This enables:

- Double — spend attack prevention

- Protection against sustained 51% attacks.

- Early attack detection.

Team

CEO Justin Fisher: He has experience over 25 years working in the Internet, web hosting, financial information services and telecommunications industries. He is also the founder of the Brevo company about providing Internet information transmission services.

Chairman Flip Filipowski: Graduated from Harvard University’s World №1. He has experience more than 40 years in founding and managing a number of companies, including the Fuel 50 (one of the largest startups in technology). He is currently the founder and chairman of the board of directors of Fluree (Blockchain Database and decentralized applications).

Technology expert Jeff Garzik: Graduated with a Bachelor of Science degree in Computer Science from Georgia Institute of Technology in the United States. He has experience over 14 years in web programming, software at well known companies such as CNN, Red Hat. Two years as a Bitcoin analyst at Bitpay.

CTO Maxwell Sanchez: He has experience more than 5 years in software programming at Curecoin company.

Does VeriBlock Create Problems for Bitcoin?

According to BitcoinMagazine.com, there have been estimates of the percentage of the Bitcoin blockspace used by VeriBlock that range from 20 percent of the network to as high as 45 percent. This may raise some concerns about how VeriBlock will affect the network.

“This was widely reported right before the VeriBlock testnet was phased out,” Sanchez said. “However, the effects of proof of proof on the Bitcoin network are actually very small … As demand for bitcoin transactions increases and users are willing to bid higher fees, the amount of space VeriBlock consumes in Bitcoin will shrink — the two economic forces result in an equilibrium.”

Sanchez also noted that VeriBlock’s solution offers security regardless of Bitcoin’s transaction frequency at a given time.

“The natural ebb-and-flow of VeriBlock transaction volume on Bitcoin does not affect the security characteristics of VeriBlock or VeriBlock-secured altchains, nor does it adversely affect Bitcoin,” he said.

After the Veriblock mainnet launch, the project is now capturing 18.6 percent of BTC transactions at the time of writing and BTC hit a weekly high of 393,000 txn on March 27. Moreover, because of all of these transactions, BTC’s average fee jumped from $0.34 to $0.49 per txn and the mempool (transaction queue) has spiked considerably.

Jameson Lopp, CTO of Casa, has been observing VeriBlock’s activity on Bitcoin’s testnet for over a year.

During an episode of the HSHR8 podcast on March 20, 2019, Lopp said that he doesn’t see the VeriBlock venture as an attack on the Bitcoin network, as some might, but he wondered about the economics of spending millions in fees to provide security.

“If you’re paying the fees to put it in the blockchain and you convince some miners to put it in, then there might be some economic rationality for this,” he said. Lopp also noted that he can see “the value of having a data anchor” for Bitcoin.

“We believe that VeriBlock elegantly expands Bitcoin’s usefulness and does so in a way that doesn’t result in a burden on the network,” VeriBlock CEO Justin Fisher told Bitcoin Magazine. “It drives demand for Bitcoin and also, in its own way, helps make Bitcoin more secure while maximizing the utility derived from Bitcoin’s energy consumption.”

Not everyone is a fan

Rick.D back at NewsBTC sees VeriBlock as an undesirable parasite that drags down bitcoin’s blockchain already brittle scalability. It will already be having an undesirable impact on the price of transactions on the network. If a large surge in utility occurs on the network again, there may be another “race to the top” situation within transaction fee markets.

Last time this occurred, $40 being spent in Bitcoin fees was not uncommon. Such a fee is difficult to swallow when it is caused directly by economic activity benefiting Bitcoin. When it is caused by a group of altcoins supporting essentially zero economic activity and supposedly in direct competition with Bitcoin, most users would find it grossly unacceptable.

Poaching BTC’s hash rate in the way that VeriBlock is doing and filling blocks with data that benefits dying blockchains only serves to delay the inevitable, whilst limiting Bitcoin’s chances of success.

The massive proliferation of cash-grab altcoins and the continued profitability of scams in the space has made digital currency difficult to take seriously for anyone outside of the industry. Many of these altcoins, particularly those needing support from VeriBlock, need to die off entirely before this can change.

Other projects using Bitcoin blockchain as an anchor

Veriblock is not the only project using the BTC chain for leverage as there have been other networks using the chain in a variety of ways. Omni Layer, the network that issues the stablecoin tether (USDT), uses OP_return transactions. Counterparty used a process called proof-of-burn (PoB) and other projects like Namecoin use merge mining. Another project using merge mining is the RSK network and the protocol is currently capturing 45 percent of BTC’s network hashrate.

Resources

Telegram: https://t.me/VeriBlock (+5500 members)

Twitter: https://twitter.com/veriblock (+1000 followers)

Reddit: https://www.reddit.com/r/VeriBlock/ ( + 70 subcribers)

Github: https://github.com/VeriBlock/nodecore-release (+10 followers)