What you'll learn 👉

Table Of Contents

The altcoin market has grown significantly throughout 2017 to a market of $ 400 billion, with a presence of almost 1,500 altcoins that investors can choose from when building their portfolio of digital assets. One of these altcoins is Steem (STEEM), which is one of the older digital currencies in the market having been launched in July 2016.

What is Steem?

Steem (STEEM) is a decentralized cryptocurrency that runs on the Steem blockchain and it can be bought and sold on the open market.

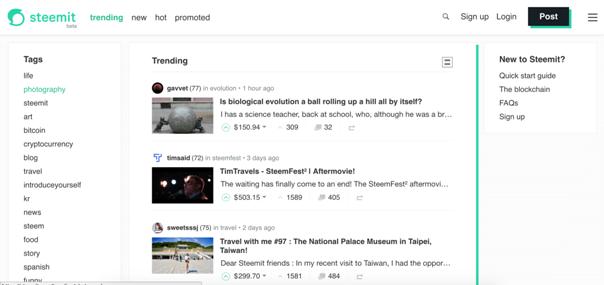

Steemit is a social network that looks and functions a lot like Reddit, but with one HUGE difference – it rewards users with cryptocurrency for their participation.

Steemit rewards writers when their content gets upvoted, as well as the people who curate the best content on the site by upvoting others work. It’s important to note that Steemit is meritocratic platform. This means that users that hold more currency can cast votes with greater influence.

Steem, one of the three currencies the Steem platform offers (Steem (STEEM), Steem Dollars (SBD), and Steem Power (SP)), is an integral part of this system.

Steem is primarily used on the Steemit platform, but there are also a handful of other social media networks that support Steem, such as Busy, Steepshot, and the Esteem app.

At the time of writing (5 March), the coin is going for $3.49, market cap stands at $875.892.061 and volume moved is $4.718.180 (it ranks in the top 30 of the largest cryptocurrencies). STEEM can be bought on several popular crypto exchanges, including Poloniex, Bittrex, and ShapeShift.

Steem History

New York-based Steemit, Inc. was founded by Ned Scott and Dan Larimer (the CEO of BitShares) on July 4th 2016. Steemit has become particularly popular among cryptocurrency enthusiasts in developing countries and it has managed to grow its user base to over 500,000 users in less than two years. Steemit.com has grown tremendously since launching. It now has close to 1 million unique users daily and about 10 million unique users monthly.

The concept was introduced in a whitepaper in March 2016, with the goal to become a censorship-free Reddit-like social media and content creation platform that financially rewards users in the form of cryptocurrency for contributing and curating content. The unique and highly incentivized nature of the platform has caught the interest of thousands of content creators.

Steemit has a dedicated reputation score system coded into the blockchain, and this system is designed to incentivize good online behavior and etiquette, which is hoped will foster a positive community on the platform. Much of the content on the platform is related to cryptocurrency. However, there have also been a number of very popular accounts dedicated to topics such as lifestyle, gaming, travel, and artwork.

Steemit runs on top of a decentralized network known as Steem, which is a blockchain with transferable tokens. As of Nov 2017, there are more than 450,000 Steem accounts, which are made to be able to interact with the Steem database using simple user-chosen alphanumeric names.

Steem uses proof of stake (PoS) consensus method to reach a consensus where block-creating accounts (called witnesses) are elected by Steem stakeholders. 75% of the tokens that Steem Platform creates go to the Steem reward pool, which is split between authors and curators. 15% of the tokens become rewards for Steem Power holders, while the remaining 10% goes to the witnesses to power the blockchain.

How Does Steem work?

The Steemit platform creates new tokens every single day and distributes them to its users who can then exchange these units on the open market for Bitcoin, other cryptos, or fiat. It’s important to note that new users should have realistic expectations. It’s rare for an individual to have a first post go viral and earn a huge reward.

Steemit has gathered important and highly relevant information because it virtually allows anyone to write about interesting topics and start earning money.

Steemit is different from other cryptocurrencies like Bitcoin because it doesn’t solely rely on mining to generate new currency units. Mining is an activity reserved for “geeks” who run mining computers. On the other hand, on Steemit the mining is done by publishing, commenting and upvoting content — something everyone knows how to do these days. The network creates new Steemit currency units and automatically distributes them to people who engage with the site. The amount you get is correlated with the number of upvotes the content you write gets and the amount you engage with the site (the more you engage, the more you get).

Steemit solves an enormous issue the content world is facing.

Companies like Reddit, Facebook, YouTube, and Twitter have provided a platform on which their users can share content with other users and they earn billions of dollars of profit through the content generated by their members. You will see little to no return for your input no matter how hard you worked on specific content, and the platforms profit from the value you’ve created.

Steem wants to change this. The Steem blockchain allows the creation of social media platforms on which creators of content are directly rewarded for their effort, and this is made possible by a social media economy in which people are rewarded for the creation of content. Another revolutionary idea of Steem is that their social media platforms are completely decentralised, which means that the users decide how the platform will be used, look like and most importantly: what content is valuable. Moreover, users who upvote and help curate the best content on the site, as well as commenters who contribute to discussions will receive some micro-rewards as well.

Steem is different from most other cryptos in that users do not need to sacrifice money or hardware to earn a significant profit, because anyone who puts in the time and effort to contribute meaningful and interesting content has the ability to potentially earn a lot of money. Well-received posts in the past have included everything from make-up tutorials to chalkboard crypto analyses.

Steem Coin Supply and Sustainability

One big difference between Steem and other digital currencies is that there are three different kinds of Steemit currency units – Steem (STEEM), Steem Power (SP), and Steem Dollars (SBD).

Steem

Steem (STEEM) is the cryptocurrency that powers the Steemit network. It can be exchanged for Bitcoin or other cryptos via several prominent exchanges such as Bittrex, Poloniex, UpBit, and HitBTC. Steem can be used on the Steemit platform to gain Steem Power (SP) through a process called “powering up” or you can convert Steem into Steem Dollars. It’s worth noting that holding Steem for long periods of time is not recommended because the Steemit platform creates more every single day. Steem Units will become diluted and lose value if you hold them for a long time. Due to this production, Steem currently erodes at a rate of 9.5% every year. However, Steem’s price has generally gone up. There are actually some people who have been able to combat Steem’s orchestrated inflation and profit significantly.

Steem Power

Steem Power (SP) is basically a token symbolizing how much influence you have inside the Steemit platform. Steem Power cannot be traded on digital currency exchanges.

Owning Steem Power Units is essentially like making a long term investment in the currency because you can’t sell it for 13 weeks. This is essentially a long-term investment in the platform, as holding Steem Power units entitles you to a proportionate ownership in the network, which means that as the network grows, so will the value of your piece of ownership and you’ll be heavily rewarded along the way.

The way things are set up now, 90% of the new Steem Currency that is generated every day is distributed to the users who already hold SP in the form of additional Steem Power Units, which creates an incentive for participants to invest their earnings back into the network. The remaining 10% goes to content creators and curators.

Half of the pay users receive for their content will be in Steem Power Units. The more Steem Power Units users have, the more their upvotes will count, helping them to have more influence on the site and they will also get paid more for upvoting other people’s work (when users upvote someone else’s content, they will get paid more as well). Hence, there is a strong incentive for Steemit users to gain as much Steem Power as possible.

Steem Dollars

Steem Dollars (SBD), valued at 1:1 with the US dollar, is another internal currency on the Steemit platform and is meant to be to be stable. When content creators make popular content, 50% of their pay will be in Steem Dollars. According to CoinMarketCap, the Steem Dollar has a market capitalization of around $50 million with a daily trading volume of approximately 25 million. It can also be traded on several major exchanges.

Steem Dollars are interesting because when you earn them for creating content, you have three choices:

- You can convert the Steem Dollars to Steem and sell it on the open market for real money, essentially cashing out (this takes about 3.5 days).

- You can hold the Steem Dollars and earn an interest rate of 10% annually.

- You can exchange Steem Dollars for Steem Power (this is considered to be long-term investment).

Steem Distribution and Supply

Every day, the Steemit network creates new Steem units. 90% of the new Steem units are rewarded to the people who hold Steem Power Units, while 10% of these new units are paid out to content creators, upvoters, and commenters.

Content creators that create content worthy of payment receive half their compensation in Steem Dollar Units that can be exchanged for actual money right away (or converted into Steem Power), and the rest in Steem Power.

The Steem Team

Steemit has a vibrant engaging team of developers, which helps in making investors have trust in it. Steem was founded by Ned Scott (the CEO and Steem) and Daniel Larimer (founder of Bitshares). The two individuals have been active players in the cryptocurrency industry for a long period and they believe that digital currency and social media marketing is the future.

Ned Scott graduated in 2012 and after three years of food industry analyses, he decided to try and disrupt the current social media model. Daniel Larimer is a successful serial entrepreneur, early Bitcoin adapter, software engineer and praised programmer. On March 14, 2017, Daniel Larimer resigned as Chief Technology Officer of Steemit and decided to work on his new project, the Ethereum competitor EOS.

The founders have been able to attract talented developers, but Steem’s unique strength lies within its community. Today Steemit has millions of users and this number is growing daily and a community with a strong sense of belonging has blossomed.

Steem Trading History

Since its launch, Steem crypto is unlike the majority of other tokens currently available on the market. Shortly after the launch of Steemit.com, STEEM saw a massive explosion in price and on July 19th, 2016, the coin was trading for $4.34, its market cap surpassed $384 million and the volumes traded then were at $3.3 million. STEEM was the third highest valued cryptos during this period, behind Bitcoin and Ethereum.

The massive hype, combined with the exposure of flaws, led to a market cap devaluation of over 95% between July 2016 and March 2017, when the price fell to a low of $0.14. Fortunately, the crypto surged again when the major altcoins started performing extremely well in November 2017. On December 21st, the price passed the $4 mark and the market cap went beyond $1 billion, while on January of this year the coin experienced an explosion even greater than the first one, and Steem achieved a market cap of almost US$2 billion. However, February and March haven’t been very favorable and the coin is going for $3.49, market cap stands at $875.892.061 and volume moved is $4.718.180.

The price of Steem will generally always go down in order to allow content creators and curators to cash out.

However, the price doesn’t have to go down. If Steemit manages to keep its leadership position as the go-to get-paid-to-post content creation platform and manages to establish itself as a reputable global social media network, the price should go up. However, it’s worth noting the natural downward pressure from the increase in supply and “cash out” use case, and that’s the reason why Steemit has three different kinds of currency units (Steem (STEEM), Steem Power (SP), and Steem Dollars (SBD)), each intended for a different purpose.

How to Buy Steem?

If you’re interested in purchasing Steem, you can do so on several popular cryptocurrency exchanges, including Poloniex, Bittrex, and ShapeShift. You can also try and earn Steem by sharing valuable content and actively engaging with content of others on the Steemit platform.

Bittrex, with roughly 73% of the total Steem/BTC volume, is the most popular way of buying and sell Steem. Poloniex, which is the 18th largest cryptocurrency exchange in the world, is probably your next best bet. These two exchanges generate the most trading movements of Steem and using one of them will allow you to purchase and sell Steem on the open marketplace, as well as store it in the respective wallet associated with that crypto exchange.

Shapeshift.io is another exchange that allows you to exchange different pairings for Steem. However, you would have to have a destination wallet to hold your purchase.

How Can Steemit Solve the Micropayment Problems?

Micropayments are small amounts of money (usually under $10) that can be transferred. Over the last few years, micropayment has become something of a buzz word and the use of micropayments is often brought up in any discussion about monetizing any type of content at scale.

Unfortunately, micropayments haven’t worked so far and there are two main reasons for this:

- Fees

- Many people don’t like micropayments because they take too much time and are too much trouble.

Steem and Steemit have solved the two underlying problems with micropayments:

- Steem has no transaction fee

- Micropayments have been reduced to one click

That’s the reason why many people refer to the Steemit platform as using micropayments to keep things running smoothly and successfully.

There is a very good section on Steemit’s relationship to Micropayments the White Paper – Page 19, where they explicitly state that they believe micropayments don’t work.

It’s interesting to note that Steemit has a unique compensation plan that encourages long-term growth. Steemit encourages community spirit and growth, by awarding digital currencies, which can be sold on the market for fiat or other tokens.

The issuance of new currency can also be viewed as a public company issuing new stock in order to raise money for capital investment.

Another way to look at this is by viewing this system as a tax on people who use the network. The depreciation caused by the issuance of new Steem causes the currency to drop a little bit, while rewarding people financially for their content contributions as well as curation efforts on the platform.

Ultimately, the price of Steem is largely dependent on the supply and demand of the token, determined by buyers and sellers on the exchanges.

Conclusion

Steemit has been around for since mid-2016 and it seems like an awesome self-sufficient ecosystem for content creators, curators, and people who secure the network. It is trying to disrupt an industry in which some of the biggest companies in the world are active and presents a value proposition that is hard to compete against.

Steemit has experienced steady and constant growth, which can be attributed to digital currencies. For example, it is a well-respected cryptocurrency worldwide that has generally seen some pretty sizeable growth in 2017 alone. Also, it is listed on some of the biggest crypto exchanges and it can be traded for other digital currencies like Bitcoin and Ethereum. In addition, its compensation plan encourages long-term growth (for instance, half of what you earn is converted to Steem Power Units, which are locked in for two years and provide users some pretty incentivizing benefits).

However, this is not a get-rich-quick scheme and new users should have realistic expectations. It’s rare for an individual to have a first post go viral and earn a huge reward, which means that you will have to work your socks off, just like other online businesses.

If you are an active blogger on social media platforms or are simply looking for some new forums to peruse, check out the Steem community and platform. You’ll encounter some valuable ideas, some interesting personalities, and you might even earn some money on the way.

This article also serves as a good introduction and is meant to introduce you to a few points to help develop your understanding of where this platform and token could be headed in the future. However, there is much more to the technical aspects of Steem and Steemit than meets the eye.

For more information check out their whitepaper, which is one of the better ones in the crypto space.