If you’re looking to make profitable decisions in the crypto world, it’s important to stay up-to-date with current and future trends and narratives. One narrative that’s gaining popularity is RWA, and it’s definitely worth paying attention to.

Many influencers in the industry have mentioned it, and some RWA coins have even experienced a hype-based pump. But what exactly is RWA, and how does it work? In this article, we’ll explore the basics of the RWA narrative and highlight some projects that are thriving under it.

What you'll learn 👉

Real World Asset Tokenization a Promising Niche in Crypto Market

Real-world asset (RWA) tokenization is expected to be a major area of growth in the crypto industry in the coming years. According to CoinMetrics, a leading analytics firm, this process involves converting physical and traditional financial assets into digital tokens on a blockchain.

These tokens can then be traded like securities, offering a secure and efficient investment environment for those who cannot or do not hold the physical assets. This trend is expected to gain momentum in 2023, making it a potentially lucrative area for investors to explore.

Top Reasons Attention Should Be Paid to Real-World Assets (RWA) DeFi Tokens

Real World Assets (RWAs) are gaining popularity in the Decentralized Finance (DeFi) ecosystem.

These DeFi tokens offer tailored solutions that can be linked to the real world, such as loans and real estate.

According to DeFi analyst @DeFiIgnas, RWAs are poised to be the next frontier in the growth of the industry.

In fact, statistics show that four of the top 10 lending protocols based on cumulative interest fees paid by users are dominated by RWAs.

With DeFi yields inching closer to traditional finance yields, RWAs provide opportunities for higher yield and portfolio diversification.

However, concerns around default risks due to undercollateralized loans exist. Nonetheless, with the industry exploring new trends and opportunities, RWAs offer a different method to earn yield by tapping into real world assets. As such, investors should pay attention to RWAs as they continue to gain traction in the DeFi space.

Securities Tokens Offerings

Securities Tokens Offerings, or STOs, are a type of token issued on a blockchain system that can be either permissioned or permissionless. These tokens represent a portion of a larger asset, such as a stake in a business or an investment. STOs can be used similarly to traditional securities like bonds or stocks, and even large corporations and governments can create their own security tokens.

By utilizing security tokens, companies can offer perks like voting rights, dividends, and shares to investors without the need to purchase the entire asset. RWA coins are also considered Securities Tokens, making them a potential investment opportunity.

What is RWA?

RWA refers to physical assets that can be tokenized and represented using blockchain technology. It’s not limited to physical assets alone as it also covers verifiable revenue streams or cash flows. There are four categories of physical assets that can be tokenized for RWA, which includes yield-bearing instruments, real estate, alternative assets, and financial products.

In addition, RWA protocols enable the use of these assets as collateral for securing loans in cryptocurrencies, mainly stablecoins. The debt is transformed into a non-fungible token split into several tokens that represent the lenders’ shares, which can be exchanged for stablecoins that ultimately transfer to the borrower’s account.

Furthermore, RWA encompasses the emerging trend of issuing capital market products using blockchain technology, which involves tokenizing digital securities that can be offered to retail investors.

Within RWA, There are 4 Categories:

1. Yield-Bearing Instruments

- Dividend paying assets like stocks

- Assets from which royalties are earned such as songs, art works, movies

- There is profit and loss in every asset.

2. Real estate

- Hard Assets,

- Funds,

- Non-Traded REITs

3. Alternative Asset

- Private Assets like equity, debt

- Collectibles items like art, cars, sports

4. Financial Products

- Stablecoins,

- ETFs,

- Indices

When it comes to investing in RWA coins, there are several categories to consider. These include Yield-Bearing Instruments, Alternative Assets, Real Estate, and Commodities.

These physical assets can be tokenized and represented using blockchain technology, allowing them to be used as collateral for securing loans in cryptocurrencies, particularly stablecoins.

Additionally, RWA encompasses any verifiable revenue streams or cash flows, as well as the issuance of capital market products using blockchain technology.

RWA tokens, which are based on real-world assets such as real estate, art, and luxury goods, have become increasingly popular. STOs, or Security Tokens, are also part of the RWA token category and are based on traditional assets such as companies, real estate, and stocks. Overall, there are various types of RWA coins to consider when investing in this market.

Read also:

- 9 Most Volatile Cryptocurrencies: Which Crypto Has the Most Volatility?

- 14 New Cryptocurrencies to Invest In: Which Crypto Will Boom?

- Most Profitable Cryptocurrency to Invest In: A Comprehensive Guide

Top 8 RWA Coin: Asset to Token & Earn High APY

Polytrade (TRADE)

Polytrade (TRADE) is a blockchain-based decentralized protocol designed to revolutionize receivables financing by creating a seamless connection between buyers, sellers, insurers, and investors. This protocol leverages blockchain technology to enhance transparency, security, and efficiency in financial transactions, thus transforming the traditional methods of financing receivables.

One of the standout features of Polytrade is its marketplace for Real-World Assets (RWAs). As the first platform dedicated exclusively to tokenized RWAs, Polytrade offers a diverse range of assets including T-bills, credits, stocks, real estate, commodities, and collectibles. This marketplace allows users to invest in these tokenized assets, providing new opportunities for diversification and potential returns. The platform’s multi-chain compatibility further enhances its appeal, enabling users to access RWA opportunities across different blockchain networks from a single, user-friendly interface.

Polytrade also incorporates advanced technologies such as ERC-6960 to enable the tokenization and fractional ownership of real-world assets. This technology allows users to discover, trade, fractionalize, bridge between chains, and leverage RWAs, making these assets more accessible to a broader range of investors.

Clearpool (CPOOL)

CPOOL is the native cryptocurrency powering the Clearpool protocol, a decentralized platform that facilitates uncollateralized lending for institutional borrowers like crypto hedge funds, market makers, and trading desks. Clearpool’s innovative approach allows these institutions to access liquidity without putting up collateral or risking liquidation.

CPOOL serves multiple functions within this ecosystem. As a governance token, CPOOL holders can propose, vote on, and implement changes to the protocol rules and operations through decentralized governance. CPOOL is also a utility token used for whitelisting new borrowers, incentivizing network participants through rewards, and enabling staking.

Staking CPOOL tokens is required for borrowers to access loans. Liquidity providers who stake their CPOOL earn additional tokens as rewards, effectively boosting the interest rates they earn on supplied liquidity. This staking mechanism helps attract liquidity to the platform.

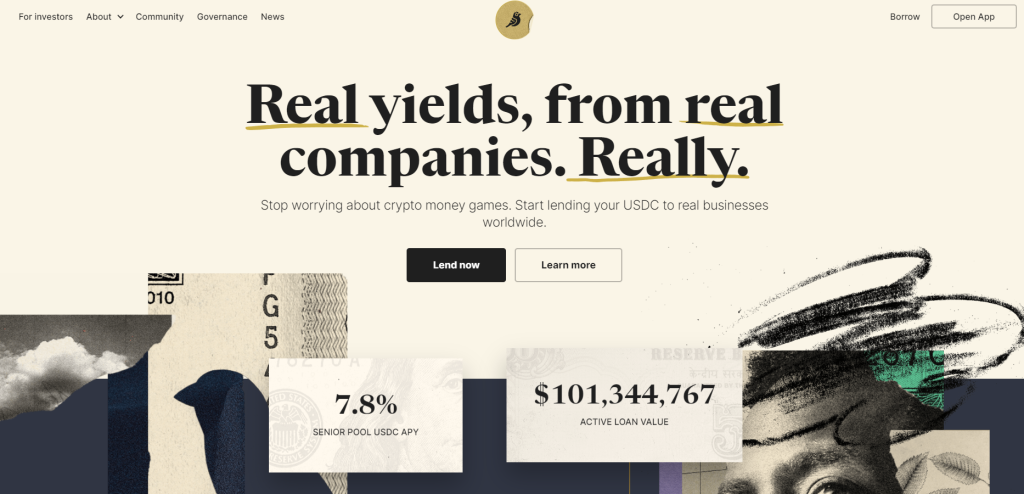

Goldfinch (GFI)

Goldfinch Finance is a popular platform for investing in RWA coins, offering loans to various businesses. Its high APY has made it a favorite among investors, with fixed APY rates of 13%, 17%, and 14% available on USDC.

Additionally, they are currently running a fund raising pool for SME Loans in Southeast Asia, offering a fixed APY of 13.05% on USDC. The platform has a good track record, with many successful deals, and in cases where the pool is not filled 100%, investors receive their money back. While Goldfinch operates similarly to a bank, there is always a risk of defaulters.

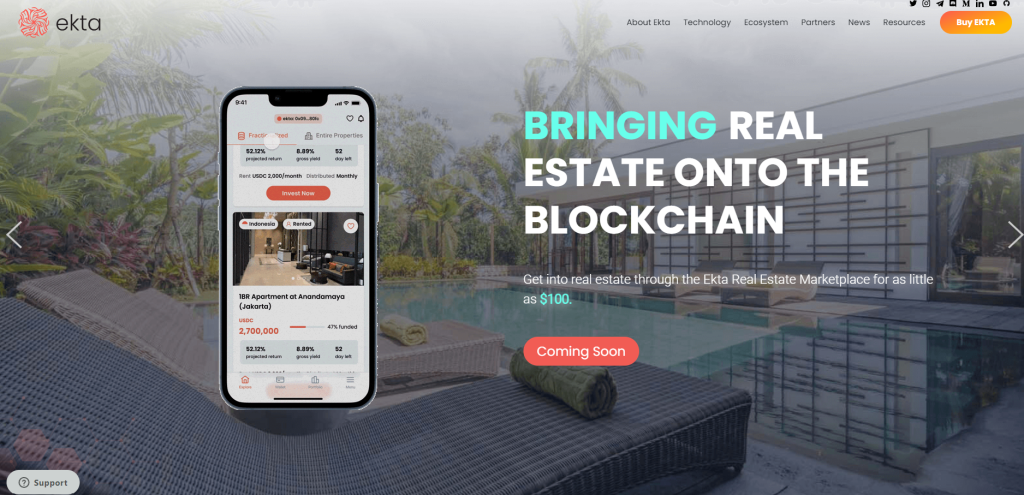

EKTA

Ekta is a Layer 1 blockchain project that connects the physical world with Web3. The company aims to create profit with purpose by bridging the physical world with the digital world, by integrating traditional businesses with blockchain technologies and unlocking new economic opportunities for everyday people. Ekta has a comprehensive blockchain ecosystem that simplifies blockchain participation and unlocks real-world financial opportunities.

By tokenizing real-world assets such as real estate, Ekta can make it available to more people across the globe.

Ekta has several products in development, including the Ekta Portal, which simplifies Web3 adoption, the Ekta Island, where NFT holders can invest in fully managed beachfront real estate, and the MetaTrees, a blockchain game world that incentivizes environmental protection through tokenization and gamification.

Additionally, Ekta is developing the HYBEX exchange, which combines the best features from DEXs and CEXs, facilitating credit card purchases, and implementing KYB and KYC. Ekta’s token, EKTA, can be traded on decentralized and centralized crypto exchanges, including Sushiswap, MEXC Global, and PancakeSwap.

Rio crypto

Rio Crypto is the native token of the Realio Network, which is a digital issuance, financing, and peer-to-peer exchange platform that uses a customized distributed network for issuing-on and linking decentralized communities.

According to the whitepaper, Realio Network offers an ideal balance of chain interoperability, legal requirements, trustless architecture, and peer-to-peer operations. The tokens created on any supported blockchain can use Realio’s built-in DEX capabilities using the Realio Network’s interoperability features. The process thus enables P2P (wallet to wallet) bulletin board type trading.

The platform aims to provide a customizable, scalable architecture and allows for built-in liquidity while spreading previously highly centralized processes like issuance and regulatory compliance over a private and secure network of independent players. RIO is the utility token for Realio Network and platform. RIO is utilized to pay fees for project creation and token issuance and also fee payments and discounts on the forum.

Leox

LEOX is a QRC-20-based token that serves as the native token of the Galileo protocol on the Quant network. It has four primary functions within the platform, including being used as a means of exchange, paying transaction fees, paying royalties, and minting.

As a utility token, LEOX plays a crucial role in the Galileo ecosystem and can be used as a digital currency for dealing with physical assets. It also enables essential functions such as serving as a medium of exchange for platform services, milestone rewards, transaction fees, and governance rights. If you’re looking for a reliable RWA coin to invest in, LEOX is definitely worth considering.

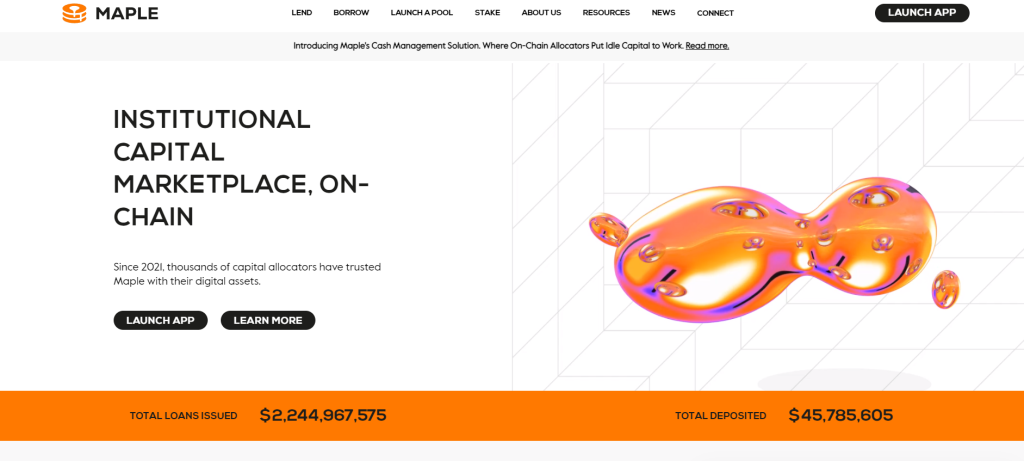

Maple Finance

Maple Finance is an innovative platform that operates as an institutional on-chain capital market. Its goal is to help credit professionals manage their lending businesses more efficiently by providing pooled capital to institutional borrowers who require funding. The team behind the project consists of former bankers and credit investment professionals who are determined to revolutionize the world of capital markets.

What sets Maple apart is its unique approach to compliance and due diligence by combining them with cutting-edge blockchain mechanics. This ensures that lending money is transparent and frictionless, thanks to smart contracts. The platform is available 24/7 and offers uncollateralized lending, allowing businesses to break free from the constraints of traditional lending practices. With Maple, users can get flexible terms on-chain in a flash, making it more efficient than traditional lending practices.

Maple’s platform is versatile, offering various options like lending out capital, borrowing funds, and even staking the MPL token. The platform has partnered with other companies to create a credit market that’s larger than anything they could achieve on their own.

The collaboration includes some big names like TRM Labs, Trail of Bits, MetaMask, Anchorage Digital, ImmuneFi, Fireblocks, meow, Coinbase, Circle, Gnosis Safe, Gemini, and Code4arena. As of now, they boast impressive analytics with 1,964,413,871 dollars worth of total loans issued and around 30,288,511 dollars deposited in total. Maple Finance is a promising project that aims to offer new opportunities for financial institutions, pool delegates, and companies that require funding.

THEO

The Theopetra Real Estate Network is powered by a cryptocurrency called Theopetra ($THEO). This token is used to gain priority within the network and become a resident. It also serves as a native token to power the network.

The project aims to reduce costs for residents by transferring ownership back to those who pay on time. The top 4000 Premium Members receive Ethereum ($ETH) rebates from residents for stabilizing liquidity within the network. Theopetra plans to bootstrap liquidity through popular mechanisms and purchase physical multi-family housing.

The project has the ability to generate revenue from both TradFi and DeFi methods, such as capturing fees on market-making and arbitraging the difference in TradFi real estate lending rates vs DeFi borrowing rates on loans. Theopetra is building a case study to analyze the efficiency of its housing compared to traditional affordable housing. Overall, Theopetra is a promising investment opportunity for those interested in real estate and cryptocurrency.

LABS

LABS Group is a real estate investment platform that utilizes blockchain technology to digitize traditional assets and make them accessible to the average investor. Their native token, LABS, is both a governance and utility token that allows users to access real estate on a priority basis and receive incentives such as discounts. LABS Group also serves as a digital securities issuance platform for any fund, company, or asset.

While not available for trading on the Coinbase Exchange, LABS can be custodied on Coinbase Wallet and traded through it. LABS Group aims to democratize real estate trading opportunities and give decision-making power back to investors.

How lending protocols leverage RWA to generate actual yield

Lending protocols like Goldfinch are addressing limitations in DeFi capital by making it accessible to businesses with real-world economic activity. These firms enter into a legally binding agreement to obtain loans issued with real-world assets (RWA) as collateral. The DeFi protocol generates yield from interest paid on issued loans, along with yield enhancements from the treasury, which collects platform fees, and additional token incentives.

Goldfinch’s yield is insulated from crypto volatility as borrowers deploy funds in real-world ventures, ensuring stable interest-sourced USDC yields despite volatility in the crypto markets. With sustainable capital demand, lenders get the best rates for deposited assets. By leveraging RWA, lending protocols are able to generate actual yield while providing a cost-effective way to pool and distribute capital between lenders and borrowers.