The recent announcement by Hong Kong regarding its regulatory proposal for centralized virtual currency exchanges has sparked a significant surge in the price of LINA coin.

This proposal mandates that all exchanges operating in Hong Kong or catering to its investors must obtain licenses from the securities and futures authority.

The proposal covers various crucial areas, such as asset custody, client verification, cybersecurity, risk management, and anti-money laundering measures. As the cryptocurrency market eagerly awaits the outcome of these regulatory requirements, the connection between Hong Kong, China, and the positive influence on LINA’s price becomes evident.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +What you'll learn 👉

Hong Kong’s Regulatory Proposal

The regulatory proposal put forth by Hong Kong requires centralized virtual currency exchanges to acquire the necessary licenses before operating within the city. These licenses aim to ensure compliance with key aspects of the cryptocurrency ecosystem, including safe asset storage, due diligence for tokens, governance transparency, and disclosure practices.

Moreover, the proposal emphasizes the importance of preventing market misconduct and enforcing measures against money laundering and terrorist financing. The comprehensive nature of these requirements signals Hong Kong’s commitment to fostering a secure and transparent cryptocurrency ecosystem within its jurisdiction.

Impact on LINA Coin

While LINA coin is not directly linked to Hong Kong or China, its prominence as a top DeFi solution has led to increased interest from Chinese traders. LINA serves as the native token of the Lina Platform, a blockchain-based review platform. Offering cross-chain compatibility, the Lina Platform presents a complete ecosystem that includes an exchange, enabling traders to access a wide range of liquid assets based on cryptocurrencies, commodities, and thematic indexes. Chinese traders view LINA as a gateway to the decentralized finance space, making it a preferred choice amidst the evolving regulatory landscape.

LINA’s Role in DeFi and Governance

As an ERC-20 token built on the Ethereum network, LINA coin serves multiple purposes within the Linear Finance ecosystem. It acts as collateral for Liquids, a feature that utilizes the Buildr protocol. Additionally, LINA coin plays a crucial role in community governance, granting token holders access to the Linear DAO. Through the DAO, token holders can participate in voting on various initiatives and proposals, actively shaping the development of the Linear ecosystem. These governance mechanisms ensure that the protocol remains responsive to the needs and preferences of its community members.

Tokenomics and Market Performance

Currently, the total supply of LINA stands at 10 billion tokens, with an inflationary system implemented. The initial inflation rate is set at 75%, decreasing by 1.5% per week until it reaches a terminal floor. Adjustments to the inflation rate can be made through consensus achieved by the LinearDAO. This controlled inflation model aims to strike a balance between maintaining token value and incentivizing participation within the ecosystem.

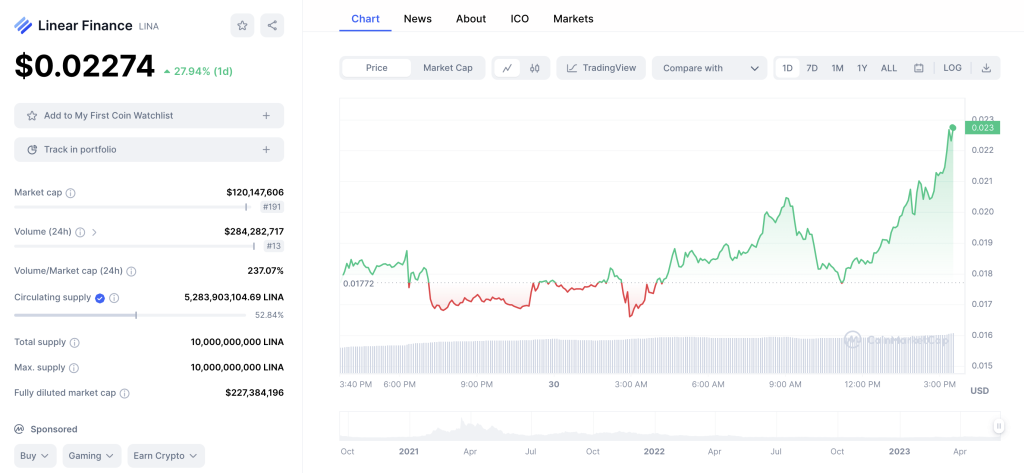

The recent surge in LINA’s price highlights the market’s positive response to its unique offerings. With a price of $0.02239779 and a 24-hour trading volume of $258,692,708, LINA has experienced a remarkable 26.36% increase in the last 24 hours and a significant 109.62% increase over the past 7 days. This surge in price demonstrates growing investor confidence in LINA’s potential, further solidifying its position as one of the top China coins to consider.

Where to Buy LINA

For those interested in acquiring LINA tokens, several options are available. TokoCrypto, Binance, and Pionex are popular choices among centralized crypto exchanges. Among these options, TokoCrypto stands out as the most active trading platform for LINA/USDT, boasting a 24-hour trading volume of $420,362. Binance and Pionex also provide a reliable avenue for purchasing and trading LINA, offering a seamless user experience and extensive liquidity.

Conclusion

The regulatory proposal introduced by Hong Kong has triggered a significant surge in the price of LINA coin. While LINA is not directly connected to Hong Kong or China, its appeal as a comprehensive DeFi solution has attracted the attention of Chinese traders seeking to participate in the decentralized finance space. As LINA continues to provide cross-chain compatibility, liquidity, and decentralized governance, its influence within the cryptocurrency market is likely to grow further. Investors and enthusiasts keen on exploring the potential of LINA can turn to reputable exchanges like TokoCrypto, Binance, and Pionex to acquire and trade this promising token. With a strong foundation and a positive market trajectory, LINA is positioned to thrive amidst the evolving cryptocurrency landscape.

Disclaimer: The information presented in this article is for informational purposes only and should not be considered financial or investment advice. Always conduct thorough research and consult with a professional before making any investment decisions.