Are you on the lookout for the next big thing in the DeFi space? Look no further than LayerZero.

This revolutionary technology is quickly gaining popularity as a solution to bridge different blockchain networks, making cross-chain interactions and transactions seamless without the need for intermediaries.

As a result, a new wave of cross-chain projects is emerging, with LayerZero at the forefront.

But with so many LayerZero projects to choose from, how do you know which ones to invest in?

In this article, we’ll explore the top 10 LayerZero projects that are leading the way in cross-chain lending, yield aggregation, DEXes, derivatives, and more.

By the end of this article, you’ll have a better understanding of why LayerZero is such an important technology to pay attention to, and which projects are well-positioned to capture the next narrative in the DeFi space.

So let’s dive in and explore the best projects on LayerZero.

| 🚀 Project | 📝 Summary |

|---|---|

| 🌌 Stargate Finance | The first protocol and bridge with LayerZero technology, allowing users to swap native assets without requiring wrapped assets. |

| 🏔️ Altitude (ALTY) | Bridging blue-chip alt coins like $MATIC and running campaigns that might earn you airdrops. |

| 💡 Radiant Capital $RDNT | The first cross-chain lending money market using LayerZero tech, allowing users to borrow and lend with any asset and on any chain. |

| 🍹 TapiocaDAO TAP | An omnichain money market that goes beyond letting users borrow and lend across any chain and also building a stablecoin called USDO. |

| 🦸 Superform | Aiming to be the top cross-chain yield aggregator without the hassle of swapping and bridging assets. |

| 🤝 Unison | A next-gen yield aggregator with automated hedging and senior/junior vault options. |

| 💰 Cashmere | An MEV-protected cross-chain DEX with potential for low slippage and revenue sharing from large transfers. |

| 🔄 Interswap | A superior cross-chain DEX that allows for native asset swaps in a single transaction. |

| 🎛️ Synthr | An omnichain synthetic asset protocol for trading futures, perpetuals, and options across different chains. |

| 🎉 Valio | Shaking up the SocialFi scene with their innovative approach to single-trade and single-asset vaults. |

What you'll learn 👉

Overview

You’re about to dive into an overview of the top developments in the LayerZero ecosystem, providing insight into how different apps can interact without intermediaries and the potential for seamless cross-chain lending, yield aggregation, DEXes, derivatives, and SocialFi.

LayerZero technology has been hailed as a game-changer in the DeFi space, as it eliminates the need for bridges and wrapping assets, which are often security risks. With LayerZero, apps on different chains can communicate with each other seamlessly, saving users time and fees.

LayerZero has achieved significant milestones recently, including raising $120 million at a valuation of $3 billion in April and processing 10 million total transactions in the same month. This technology has paved the way for exciting projects that aim to revolutionize the DeFi space.

In the following sections, we will delve into the top 10 LayerZero projects that are set to shape the future of DeFi.

LayerZero Explanation

If you’re interested in the latest advancements in DeFi security and efficiency, you’ll want to learn about LayerZero. It eliminates the need for intermediary mechanisms when connecting apps on different chains. This means that users can seamlessly interact with different chains without having to worry about wrapping assets or dealing with security risks associated with bridges.

Here are some key things to know about LayerZero:

- It allows for cross-chain communication without intermediaries.

- It can save users time and fees by eliminating the need for wrapping assets.

- It has achieved significant milestones, including raising $120M at a $3B valuation and processing 10M total transactions in April.

- It can greatly enhance the security and efficiency of DeFi applications.

- It has enabled the development of exciting LayerZero eco projects, which we will explore in more detail below.

Overall, LayerZero is a game-changer in the world of DeFi, and it’s worth keeping an eye on as it continues to evolve and change the way we interact with different chains and applications.

Best LayerZero projects to invest in

Let’s discuss the best LayerZero projects to invest in.

Stargate Finance is the first protocol and bridge with LRZ technology. It allows users to swap in native assets without requiring wrapped assets.

Altitude (ALTY) is bridging blue-chip alt coins like $MATIC. It is running campaigns that might earn you airdrops.

Radiant Capital is the first cross-chain lending money market using LRZ tech. It allows users to borrow and lend with any asset and on any chain.

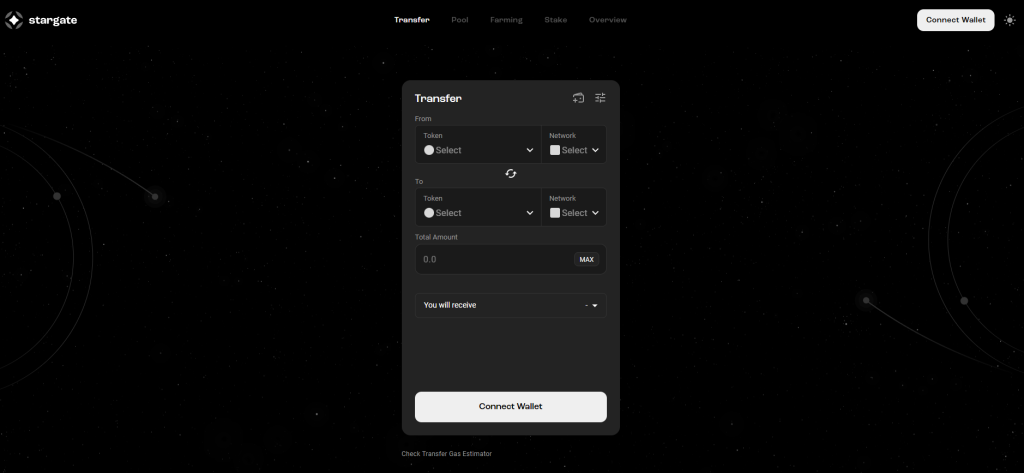

Stargate Finance

You’ll be interested to know that Stargate Finance is currently the top protocol and bridge utilizing LayerZero technology, allowing for seamless swapping of native assets without the need for wrapped assets or multiple liquidity pools.

As a user, this means you can have deeper liquidity and process higher volumes, as Stargate Finance utilizes a single liquidity pool. In April alone, Stargate Finance processed approximately $2 billion in volume.

By utilizing LayerZero technology, Stargate Finance is able to provide a more secure and efficient way for users to swap assets across different chains. With the rise of hacks and security breaches in the DeFi space, it’s important to invest in projects that prioritize security.

Stargate Finance’s use of LayerZero technology not only enhances security, but also saves users time and fees by eliminating the need for swapping and bridging assets. As it continues to gain popularity and success, Stargate Finance is definitely a project to keep an eye on for those interested in mastering LayerZero technology.

Altitude (ALTY)

Now let me introduce you to Altitude (ALTY), a promising LayerZero project focused on bridging blue-chip alt coins like $MATIC and offering potential airdrops to its supporters.

ALTY aims to make cross-chain transactions seamless and cost-effective for users. With LayerZero’s technology, ALTY users can swap assets natively without having to wrap them, saving them both time and fees.

Currently, ALTY is running campaigns that could potentially earn its supporters some airdrops. With its focus on bridging blue-chip alt coins, ALTY has the potential to grow even further if it supports more assets than its competitor, Stargate Finance.

Keep an eye on this project as it continues to develop and potentially offer new opportunities for its users.

Radiant Capital $RDNT

Radiant Capital ($RDNT) is the first cross-chain lending money market using LayerZero technology, allowing users to borrow and lend with any asset on any chain seamlessly and without fees, making it a promising project worth keeping an eye on.

Here are some reasons why you should pay attention to RDNT:

- RDNT’s vision is to enable users to borrow and lend with any asset on any chain. This means that you can use your favorite assets on any chain to borrow or lend seamlessly, without worrying about swapping and bridging fees.

- RDNT’s tokenomics have been revamped to make it sustainable and deployed on the Binance Smart Chain (BSC), gaining over 200M TVL. This is a good sign that the project is gaining traction and is worth considering for investment.

- RDNT’s cross-chain lending money market is live on Arbitrum, which is a good indication that the project is moving forward and reaching milestones.

- With LayerZero technology, RDNT is able to provide users with a seamless and secure cross-chain lending experience. This means that users don’t have to worry about security risks and can focus on borrowing and lending with ease.

TapiocaDAO TAP

If you’re looking for an omnichain money market that goes beyond letting users borrow and lend across any chain and also building a stablecoin called USDO, then TapiocaDAO’s $TAP is a promising project to consider. Leveraging the Sushiswap contract suite, TapiocaDAO aims to be the go-to platform for cross-chain lending and borrowing. But what sets TapiocaDAO apart is its USDO stablecoin, which can be seamlessly transferred to any chain without the need for bridges or fees.

To mint USDO, TapiocaDAO will create Collateralized Debt Positions (CDPs) collateralized with large network tokens and their Liquidity Sensitive Detectors (LSDs), ensuring that USDO is over-collateralized. The public testnet is already live, and the mainnet is scheduled for Q2 2023. Here’s a quick overview of TapiocaDAO’s key features:

| Features | Details |

|---|---|

| Cross-chain lending and borrowing | Lend and borrow across any chain without swapping or bridging assets |

| USDO stablecoin | ONFT that can be seamlessly transferred to any chain without bridges or fees |

| Public testnet | Live |

| Mainnet release | Scheduled for Q2 2023 |

With TapiocaDAO, you can enjoy the benefits of cross-chain lending and borrowing without the hassle of swapping and bridging assets. The USDO stablecoin is a game-changer, allowing you to seamlessly transfer value across chains without worrying about fees or security risks. Keep an eye on TapiocaDAO as it continues to innovate in the LayerZero space.

Superform

Are you ready to earn super yields across all EVM chains? Check out Superform, the LayerZero project aiming to be the top cross-chain yield aggregator without the hassle of swapping and bridging assets.

With Superform, users can deposit their assets in one single source chain and earn yield tokens minted on other chains without the need for bridging and swapping. Here are three reasons why Superform could become the go-to yield aggregator:

- Superform allows users to earn yield with deposits kept only on one single source chain, making it easier to manage assets and track profits.

- With LayerZero technology, Superform can take advantage of yield opportunities across all ecosystems, giving users access to high yield without the hassle of bridging and swapping assets.

- Superform is developing a super yield aggregator that could potentially outperform other yield aggregators, making it a top contender in the LayerZero space.

If you’re looking for a way to maximize your yield across multiple chains, Superform could be the solution you’re looking for.

Keep an eye on this LayerZero project as it develops and potentially revolutionizes the cross-chain yield aggregator space.

Unison

Get ready to optimize your yield with just one click using Unison, the next-gen yield aggregator with automated hedging and senior/junior vault options. Did you know that Unison’s vaults have already attracted over $500 million in deposits?

That’s because Unison is designed to make yield optimization easy and accessible for everyone. With just one click, you can deposit your assets into Unison’s yield-optimized vaults and let the platform take care of the rest. You don’t have to worry about managing risk or navigating complex strategies – Unison does all of that for you.

One of the unique features of Unison’s vaults is automated hedging, which helps to manage risk and protect your assets from market volatility. Depending on your risk preferences, you can choose between senior or junior vaults.

Senior vaults have a lower risk profile and prioritize the safety of your assets, while junior vaults have a higher risk profile and offer the potential for higher returns. With Unison, you can choose the option that best aligns with your investment goals and risk tolerance.

So if you’re looking to optimize your yield and simplify your DeFi experience, Unison is definitely a project to watch.

Cashmere

You won’t want to miss out on Cashmere, the MEV-protected cross-chain DEX with potential for low slippage and revenue sharing from large transfers – it’s the perfect combination of security and profitability.

Cashmere is building the first cross-chain DEX that is also MEV-protected, ensuring that users won’t fall victim to front-running or other malicious activities. Plus, it boasts a marginal slippage algorithm that allows for very low slippage, making it attractive to traders looking for the best prices.

But what really sets Cashmere apart is its potential for revenue sharing from large transfers. If built well for large transfers, Cashmere’s token could have a revenue-sharing model that would entice users to use the platform for their high-volume trades.

This could skyrocket the value of the token and make it a top contender in the cross-chain DEX space. Don’t miss out on the potential profits that Cashmere could bring.

Interswap

Looking for a superior cross-chain DEX that allows for native asset swaps in a single transaction? Check out Interswap.

This project is building a DEX that envisions itself as the best cross-chain DEX out there. It allows for native asset cross-chain swaps in a single transaction, which can save users time and fees.

Interswap also plans to lend its liquidity to cross-chain lending protocols and aggregators, making it a versatile project that can cater to a wide range of users.

Interswap’s goal is to provide an easy-to-use DEX that can handle cross-chain swaps seamlessly. Its marginal slippage algorithm ensures that users can enjoy v low slippage, which can make trading a smoother experience.

With its focus on native asset swaps, Interswap can also be a great option for users who prefer to keep their assets in their original form. If you’re looking for a DEX that can offer you a superior cross-chain trading experience, Interswap is definitely worth checking out.

Synthr

If you’re interested in trading futures, perpetuals, and options across different chains, Synthr may be the omnichain synthetic asset protocol for you.

With LayerZero integration, Synthr allows users to deposit collateral on one chain and use synthetic assets on another chain, making cross-chain trading a seamless experience. The platform enables users to mint and trade on-chain derivatives with independent liquidity and zero slippage. This means that users can easily access the derivatives market for various assets without the need for intermediaries, making the process faster and cheaper.

Synthr’s cross-chain trading feature allows users to access multiple assets on different chains, enabling them to take advantage of the best opportunities across different ecosystems.

The protocol operates on a testnet and is planning for a mainnet release in Q3 2023. With its independent liquidity and zero slippage, Synthr aims to disrupt the derivatives market and make trading more accessible for users across different chains.

If you’re looking for a platform to trade derivatives across different chains, Synthr is definitely a project worth keeping an eye on.

Valio

Oh boy, you won’t believe how much Valio is going to shake up the SocialFi scene with their innovative approach to single-trade and single-asset vaults.

Valio is building a multi-asset yield-optimised vault, where users can deposit multiple assets and earn yield on all of them. This is a game-changer as it allows users to diversify their assets and earn yield on them without having to constantly monitor and switch between different vaults.

Valio’s vaults also have a unique feature where they can automatically adjust their risk profile based on market conditions, allowing users to maximise their returns while minimising their risk exposure.

In addition, Valio is building a social layer on top of their platform which will enable users to collaborate and share investment strategies with each other. This is a step towards creating a community-driven investment platform where users can learn from each other and collectively achieve better investment outcomes.

Overall, Valio is poised to disrupt the SocialFi space with their unique approach to yield-optimised vaults and community-driven investment platform. If you’re looking to stay ahead of the curve in the LayerZero ecosystem, Valio is definitely a project to keep an eye on.

Read also:

- Best Projects on Polygon – Best DeFi Coins On Polygon

- Best Projects on Arbitrum – Top DeFi Coins on Arbitrum To Invest In

- Best Projects on Algorand – DeFi Coins Built on ALGO

Why pay attention to LayerZero

You may be missing out on a game-changing technology if you’re not paying attention to LayerZero and the potential it has to revolutionize cross-chain interactions and improve security in DeFi.

With LayerZero, apps on different chains can interact with each other without the need for intermediary mechanisms that require wrapping assets. This eliminates a real security risk in DeFi as bridges have been responsible for $2.5 billion in hacks since September 2020.

LayerZero has achieved great milestones recently, including raising $120 million at a $3 billion valuation in April and jumping from 3 million to 10 million total transactions in the same month.

By allowing users to seamlessly lend and borrow across different chains in one transaction without swapping and bridging, LayerZero saves users fees and time.

LayerZero technology has already been adopted by several cross-chain projects, such as Stargate Finance, Altitude, Radiant Capital, TapiocaDAO, Superform, Unison, Cashmere, Interswap, Synthr, and Valio. These projects are set to revolutionize the DeFi space, and by paying attention to LayerZero, you can stay ahead of the curve and be prepared for the next narrative.

Frequently Asked Questions

Conclusion

In conclusion, LayerZero has emerged as a game-changer in the DeFi space, enabling seamless cross-chain interactions and transactions without the need for intermediaries. Its popularity is on the rise, and a new wave of cross-chain projects are leveraging its technology to offer users innovative solutions in lending, yield aggregation, DEXes, derivatives, and more.

If you’re looking to invest in the best LayerZero projects, you have a range of options to choose from. Whether you’re interested in the lending platform or yield aggregator, the DEX or derivatives trading platform, there’s a project that caters to your needs.

With LayerZero paving the way for a new era of interoperability, these projects are well-positioned to capture the next narrative in the DeFi space.

In short, by paying attention to LayerZero and keeping tabs on the top LayerZero projects, you’re setting yourself up for success in the DeFi industry. So, stay updated with the latest developments in this space, and you’ll be in a prime position to reap the benefits of the DeFi revolution.