With the Bitcoin ETF approval looming, traders are wondering if the price of Bitcoin can head to $50,000 this week.

The US SEC has a brief seven-day window remaining to approve twelve Bitcoin ETF applications.

The approval potential has caused buyers to rush to Bitcoin, helping it surge by 6% and set a new 2023 high near $38,000.

Despite this, traders believe Bitcoin ETF ($BTCETF) might provide a better 50x return potential as its growth is directly linked to the Bitcoin ETF approval – with $200,000 raised in 48 hours.

What you'll learn 👉

Bitcoin Bulls Return As SEC Has Window to Approve Bitcoin Spot ETF

According to Bloomberg analysts, the bulls have rushed back to the Bitcoin market as the SEC has a brief seven-day window to approve twelve Bitcoin ETF filings.

James Seyffart and Eric Balchunas highlighted a window between November 8th and 17th for the US SEC to have the opportunity to approve twelve pending Bitcoin ETFs.

The window was opened as the US SEC previously provided a deadline extension, with Wednesday, November 8th, chosen as the last day for rebuttal comments.

The twelve ETF filings include those from BlackRock, Bitwise, VanEck, WisdomTree, and the Grayscale Trust conversion.

Despite this, the analysts still firmly believe there is a 90% chance for a Bitcoin ETF approval by January 10th, 2024, if the approval doesn’t come sooner.

Is Bitcoin Heading to $50,000 This Week?

With the window for approval open, buyers are rushing to Bitcoin – pushing the market to fresh 2023 highs near the $38,000 level.

The cryptocurrency has been on a rampage since breaking above an ascending price channel toward the end of October.

The breakout was caused by a false news report from Cointelegraph stating that the BlackRock ETF had been approved.

Although later proven to be false, the news kickstarted a parabolic bullish run that led to the current 2023 highs;

So, can Bitcoin hit $50,000 this week?

Well, there’s lots of resistance on the way up for the market before being able to test $50,000.

The first resistance level lies at $37,190 – provided by the March 2022 lows.

This is followed by resistance at $38,000, $39,500 (early-June highs), and $40,000.

Beyond $40,000, resistance lies at $40,600, $42,000, $42,885, $44,750, and $48,285 (2022 highs).

If all these levels are cleared, Bitcoin will have a chance to hit $50,000.

What Alternatives Provide Better Options?

With the optimism back in the market, traders are looking for alternative projects that provide better options for higher returns.

In particular, Bitcoin ETF ($BTCETF) is starting to turn heads after raising $200,000 in just 48 hours.

Traders are rushing to become early adopters of the project as its growth is directly tied to the Bitcoin ETF approval – with 50x returns on the table.

Bitcoin ETF Raises $200,000 in 48 Hours as Investors Believe it Provides Better Exposure.

Bitcoin ETF ($BTCETF) has speedily raised $200,000 in 48 hours, demonstrating the building momentum behind this token.

The project is directly linked to the Bitcoin ETF approval, and investors believe it provides better exposure to the event than buying Bitcoin.

Although Bitcoin will skyrocket if the Bitcoin ETF is approved, investors believe that $BTCETF has the potential for 50x returns – something that BTC itself could never produce at these elevated market cap levels.

Bitcoin ETF allows investors to ready their wallets before the first Bitcoin ETF is approved.

The project intends to celebrate and capitalize on the arrival of the Bitcoin ETF in the US market ahead of the event – allowing direct exposure before the surge.

Bitcoin ETF introduces a clever burning mechanism that burns tokens based on real-world milestones related to the ETF approval.

As a result, more $BTCETF tokens are burnt the closer to the approval, and investors believe there will be a price surge at each milestone.

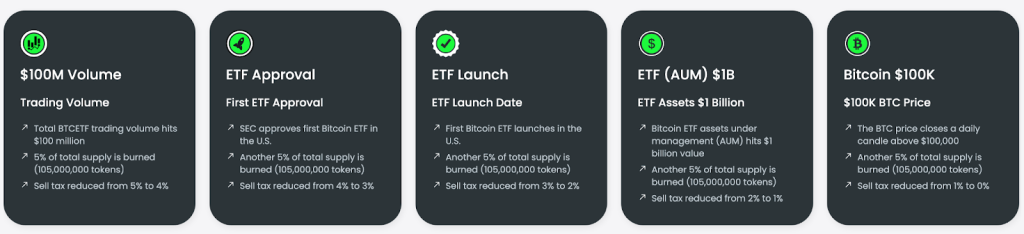

The five milestones include the following:

- 24-hour trading volume in $BTCETF reaches $100 million

- SEC approves the first Bitcoin ETF in the US

- First Bitcoin ETF launches in the US

- Assets under management in Bitcoin ETFs reach $1 billion

- Bitcoin price closes a daily candlestick above $100,000

The smart contract will burn 5% of the supply when each milestone is reached.

There’s also a sales tax to incentivize long-term holding – starting at 5% – which is reduced by 1% each time a milestone is reached.

Once all milestones are achieved, the sales tax will disappear entirely.

Overall, Bitcoin ETF is tied to the fate of the Bitcoin ETF itself, providing direct exposure to the event, and investors are backing its potential.

Investors can buy the token for $0.005 at the current stage, with the next price hike scheduled in just one day.

Disclaimer: CaptainAltcoin does not endorse investing in any project mentioned in this article. Exercise caution and do thorough research before investing your money. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the reader. CaptainAltcoin is not liable for any damages or losses from using or relying on this content.