Bitcoin has sunk over 6% in the past week, dropping from the $45k-$47k range down to around $42k at the time of writing. This price slide has puzzled some investors, given it comes on the heels of the long-awaited approvals for Bitcoin spot ETFs in the US last Wednesday.

So what explains this seeming contradiction of positive news followed by negative price action? A closer examination of the data suggests some profit-taking and repositioning by traders in the wake of the ETF launch.

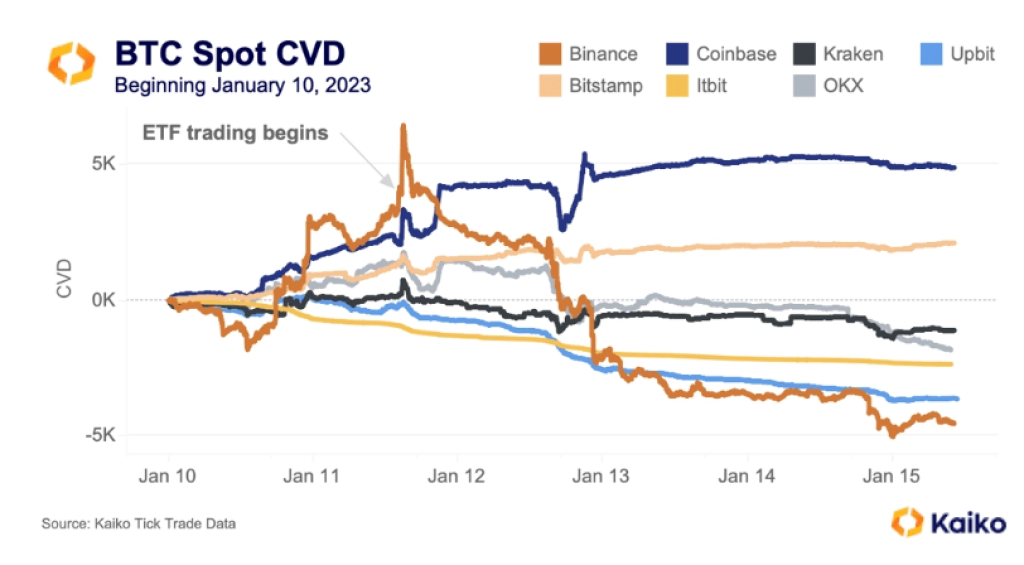

Analytics provider Kaiko dug into the exchange data around the ETF launch day last week. They found a classic “buy the rumor, sell the news” pattern unfolding across major Bitcoin trading venues.

As the ETFs began trading on Thursday morning, Binance saw a spike of around 3,000 BTC bought in the first hour. But this bullish sentiment quickly faded, with Binance’s trading activity flipping negative along with OKEx shortly thereafter.

Yet intriguingly, more institutional venues like Coinbase and Bitstamp saw consistently positive flows despite the slide in Bitcoin’s price. This divergence suggests the selling pressure originated from retail traders, rather than larger crypto funds and investors.

Adding further nuance, fellow institutional exchange Itbit showed steady selling activity in contrast to Coinbase and Bitstamp’s positive flows. Upbit, a retail-focused Korean exchange, also displayed consistent selling after the brief surge from the ETF open.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +So the data indicates an influx of short-term retail money piling in to “buy the news”, before quickly turning around and booking profits. As crypto market veteran Qiao Wang summarized, “ETF approval has been the glue holding markets together…that glue is now gone.”

With the long wait for ETFs finally over, traders turned their attention to taking profits rather than pouring more speculative money into Bitcoin. The mood has now shifted towards a renewed focus on fundamentals like growing adoption and expanding use cases to support prices at current levels.

The next key catalyst on the horizon is a potential approval for Ethereum ETFs, which could face tougher regulatory hurdles compared to Bitcoin. For now, the ETFs represent a major win but have removed a key psychological support fueling Bitcoin’s prior rally. The market must now stand on its own feet going forward if further gains are to materialize.

You may also be interested in:

- Here Are Updated Ethereum ETFs Deadlines

- Why Is Celestia’s TIA Up Today? Technicals Suggest a Retracement to These Levels Is Imminent

- Cardano (ADA) Going Down, VC Spectra Surges Ahead, Drawing Closer to the $0.025 Target with a Surge in Trading Volume

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.