Christopher Matta, a man famous for leaving the Vice President position at Goldman Sachs Investment Management Division in order to create Crescent Crypto Asset Management and start a passive crypto index fund, recently gave his hot take on how to invest in the current crypto market. During his debut interview with CNBC’s Smart Money, Matta proclaimed that investors will be better off putting their money into a diverse portfolio of altcoins rather than placing their money exclusively into Bitcoin.

When asked to elaborate on his statement, Matta said how diversifying your holdings is a better way of managing your risk and adjusting your returns than putting it all into a single asset like Bitcoin. He also added that the coins you chose to invest in should be elaborately analyzed and selected. Investing in a coin that suddenly “exploded” in value isn’t the best idea; Matta claims that the coin should retain its “post explosion” position to prove that it is a worthy investment.

Learn more about Cex.io in our Cex.io review.

Crescent Crypto Asset Management was founded months before the winter’s Bitcoin all-time high and subsequent drop-off. Nosier among us might wonder if Matta thought his actions through as well as he advises his potential investors to do. It does seem like Crescent Crypto Asset Management was founded somewhat impulsively, in the middle of the Bitcoin’s pre-drop run.

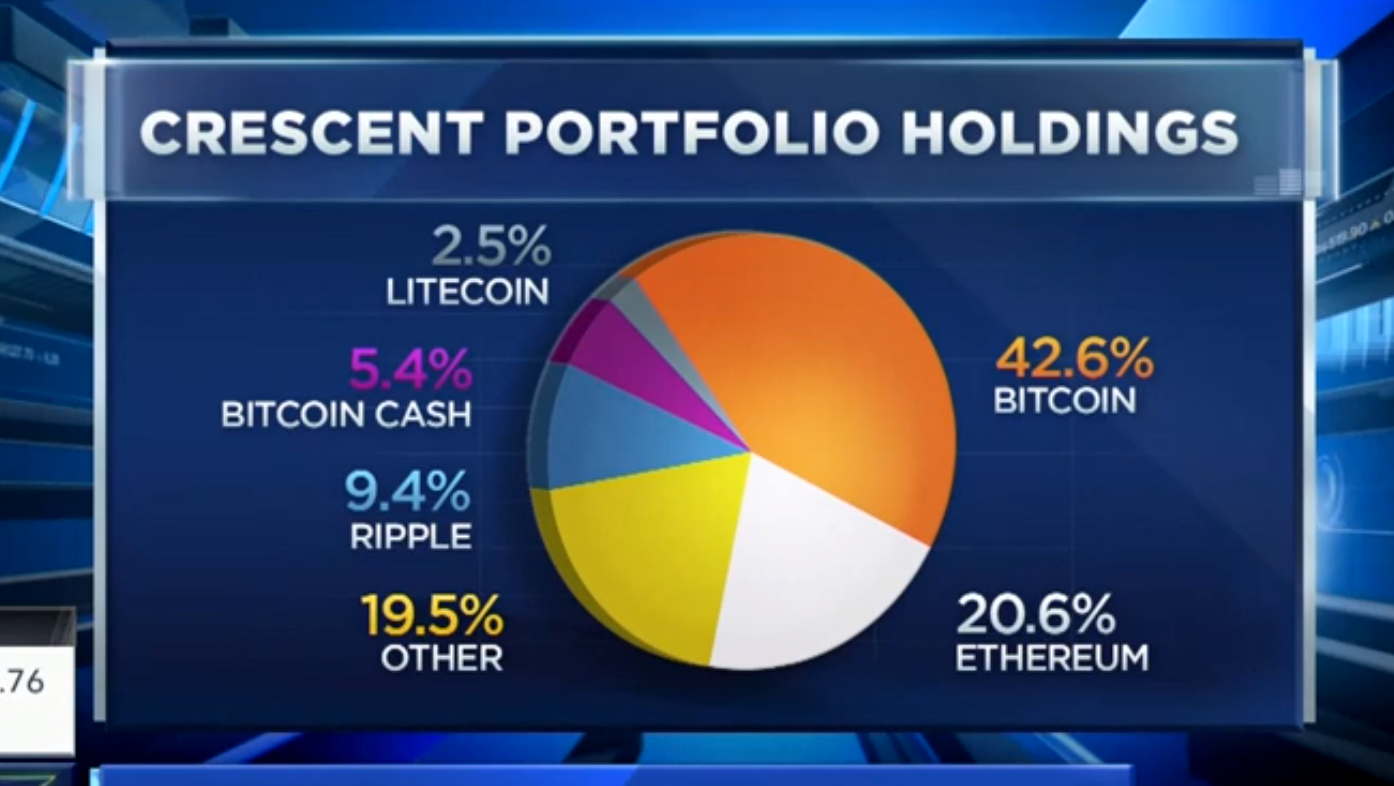

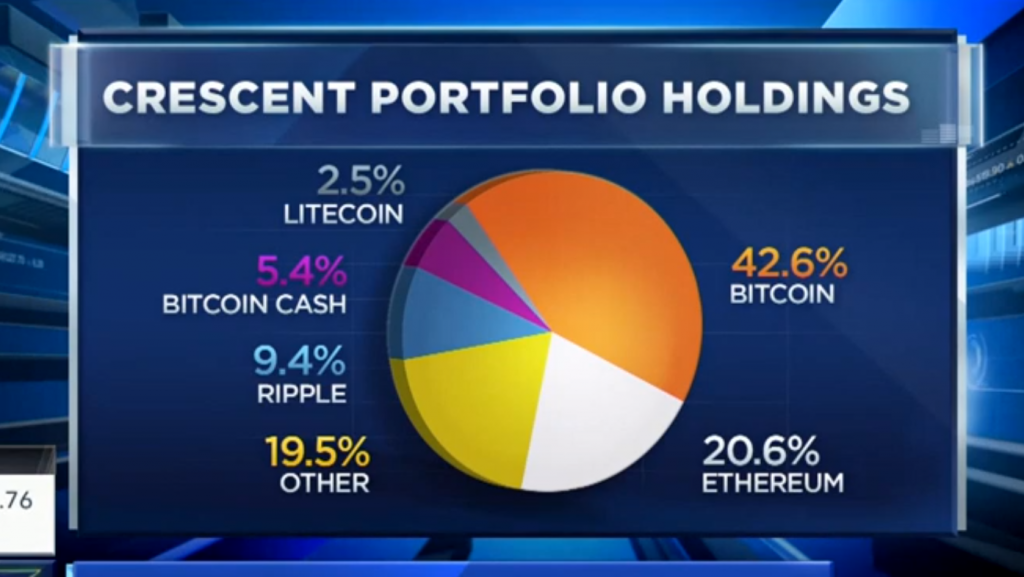

Still, he noticed that there was demand for a passive, diversified, complexity free way of becoming a crypto investor and decided to start his current enterprise. CCAM biggest portfolio holdings are Bitcoin, Ethereum, XRP and Bitcoin Cash. Besides their ability to retain post-rise value, the funds that are added to this portfolio are chosen on the basis of their 90-day market cap weigh. Their liquidity and their ability to be held in cold storage also play an important part in becoming a part of the Crescent portfolio.

Matta adds that investing in crypto is a long term ordeal and that potential newbies should look at a period of 2-5 years in the future before seeing real gains on what they put in right now.

As a passive crypto index fund manager, Matta knows a thing or two about diversification. He suggests that his belief in his fund is so great that he would invest even his grandmothers money into it. He feels that everyone should invest at least a part of their portfolio into crypto, as the risk-reward ratio of the market is more than enough to tickle the imagination of even the most conservative of investors.

However, Matta has drawn criticism for his claim that diversification is the best way to manage risk in crypto. Many twitter users have ganged up on him, with most echoing the thoughts of Brian Kunzig:

“Scary that a guy from Goldman thinks a person can diversify in crypto to minimize risk lol. Buy shitcoins and risk goes up. Buy bitcoin and you’re at minimum risk. Not too hard.”

And this is a good point. Bitcoin is still the undisputed king of the market. When looking at the altcoin charts we can see that all of them follow Bitcoin’s movement as if they are tied together with a rubber band. While diversification isn’t the worst thing to do, holding Bitcoin long-term is a tactic that you can’t go wrong with.