Bitcoin’s shortcomings led to the development of the cryptocurrency Dash (formerly known as XCoin and DarkCoin). However, the question is: do Dash’s results live up to its lofty ambitions?

Bitcoin and Dash are 2 different and important cryptocurrencies. However, they are also 2 different social experiments that we really need to focus on.

Bitcoin entered the scene in 2009 and was the first currency of its kind to take hold, and it now has an established market cap. Bitcoin developed a sizable network effect in a realm of little competition, but as the Bitcoin network grew and development standardized, improvements became difficult to implement. Such changes require an overwhelming consensus from all network participants. However, this creates many contentious debates, as has been witnessed recently in the Bitcoin scaling debate. As a result, a lot of Bitcoin’s shortcomings are now solidified into the protocol. This means that it can only maintain certain specific use cases.

What you'll learn 👉

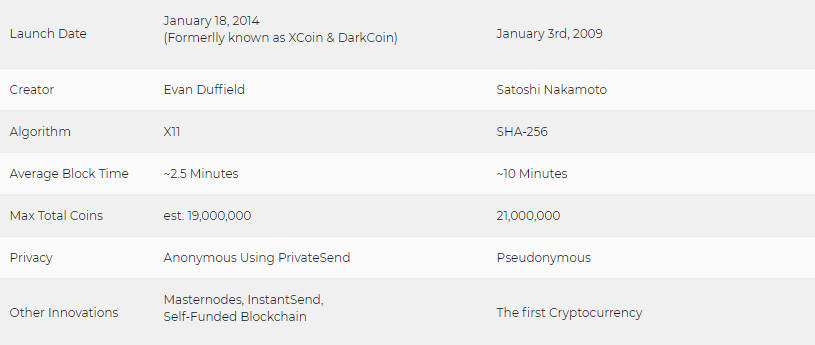

Dash vs. Bitcoin: Key Information

What Bitcoin Blockchain Weaknesses Does Dash Want to Overcome?

Bitcoin’s weaknesses include a 10-minute block creation period that constricts Bitcoin’s real world transaction usage by users and a block size limit that slows transaction processing time.

As an open source project, Bitcoin lacks a developer funding model. This leaves the development to be managed by powerful interest groups or volunteers. Also, Bitcoin has no formal governance structure that would allow for protocol changes to be easily agreed on and implemented. The only way to make a big change is to introduce a hard fork – creating a second Bitcoin, and hoping that everyone will come along with it. The blockchain data validation is managed by low end-nodes on a voluntary basis. Also, there’s no financial incentive to upgrade to the latest software and hardware. Bitcoin has apparently fallen prey to politics. This is the one thing which we thought it would save us from.

The funding for Bitcoin development has come from various sources – the Chinese exchange BTCC, Ciphrex, Chaincode Labs Inc., the company Blockstream, MIT Media Lab’s Digital Currency Initiative, and others. However, the big question is: do all these organisations have Bitcoin’s interests at heart? Of course there are powerful interests who would prefer to see Bitcoin fail. And when money gets involved, there’s a big chance for there to be a central point of failure.

Another problem is that Bitcoin transactions also lack privacy and data mining companies are becoming uncomfortably good at identifying the source of Bitcoin transactions.

Bitcoin faces increasing barriers to market adoption as a result of these and other weaknesses, and the dream of a true peer-to peer (P2P) electronic cash has been mired by endless debate and slow upgrades.

What Does Dash Do Better Than Bitcoin?

Dash developers wanted to unleash a new blockchain that will be free of these ‘baked in’ weaknesses. The developers of Dash designed their new blockchain to be the world’s first self-governed and self-funding blockchain protocol, with instant payments running on a network of incentivized Masternodes. Let us see some of the key features Dash introduced that Bitcoin doesn’t have:

- Masternodes – Dash introduced Masternodes to incentivize users with payments to secure the network and add some nice transactional features like InstantSend, which allows transactions to be almost instant. Masternode operators must invest 1,000 Dash to host a Masternode, so when they vote, we know they are invested. Masternode operators get 45% of the reward for every Dash block that’s mined, 45% of the Dash created goes to miners and 10% goes to a treasury. Every month each operator receives their reward of around 7 Dash.

- InstantSend – Dash has an optional feature called InstantSend that uses the instantX Masternode feature to send and confirm transactions in seconds. Bitcoin’s block propagation takes an average of 10 minutes. Also, 6 typical conformations for large purchases could even take an hour.

- PrivateSend – Bitcoin transactions are pseudonymous and can be traced to their users. On the other hand, Dash introduced PrivateSend transactions that basically make it impossible to trace the transaction. Dash made PrivateSend an optional feature, not a default feature.

- Self-Sustainable Decentralized Governance – Masternodes are incentivized and can govern the blockchain with 1 vote per Masternode. However, the Dash blockchain is also self-funded. A portion of each block – currently 10% – is allocated to the Network Development and Promotion Budget, which means that Dash promoters and developers receive payments for their contributions, unlike on Bitcoin where contributions are voluntary and unincentivized.

What Is the Market’s Opinion of Dash?

Dash is still catching up to reigning champion Bitcoin’s 5-year headstart despite all these cool features, and currently Dash ranks behind Bitcoin as the 7th largest cryptocurrency in terms of total market capitalization.

A coin’s market cap is one way of measuring the size of a cryptocurrency and is often used to anticipate its potential for investment return and the types of risk it may pose to investors. The volatility of a cryptocurrency’s price influences the market cap of cryptocurrencies. Daily trade volume, which is calculated in USD, is arguably a more useful measure because it reflects how much a particular cryptocurrency is actually used. Bitcoin still reigns at the top of the chart here. Today Dash trade volume ranks 11th, with $61.27 million behind Bitcoin’s $1.9 billion first place value.

However, even daily trade volume does not give the full picture though. The reason for that is that much of it consists of trading activity on exchanges rather than real world purchases, which is an important distinction. Many exchanges use Bitcoin to trade. This means that you would have to initially purchase Bitcoin to then trade for other cryptos. This may skew the figures. However, it also shows the strength of Bitcoin’s first mover advantage.

Bitcoin has become a clear market leader. However, Bitcoin has first mover advantage, which makes for a skewed and unfair comparison with all other cryptos. Yet, while looking at trade volumes and market caps, it is important to note that other cryptos which have similar features to Dash are sometimes higher up in the pecking order. Monero, another privacy focused coin, has a higher daily trade volume and is released in the same year as Dash. Litecoin, a crypto that has long held a higher market cap than Dash, also generates new blocks every 2.5-minutes. Ripple , which is firmly positioned in the top 5, also has fast transaction confirmations.

Conclusion

Although there are problems on the surface of Bitcoin, all this seems to suggest that simply introducing features that are an improvement on Bitcoin’s deficiencies is currently not enough for the market. Dash’s self-funded blockchain provides plenty of money to spend on marketing and development. However, Dash still seems to be struggling to attract second tier developers to build out the blockchain aftermarket infrastructure, like Point of Sale apps and an array of innovative wallets for users. Bitcoin and the leading cryptos such as Litecoin, Ethereum, and Monero among others, have built more connections with secondary industry players that connect users and merchants.

Comparing a cryptocurrency that is 3 years old with one that has been around for 8 years may be unfair. But at a similar stage of its development, Bitcoin was still an obscure computer science project, or ‘futuristic nerd money’. What is certain is that Dash has rarely been outside the top 10 currencies since hitting the scene, which means that it has shown resilience. Having improved governance mechanisms and developers and Masternode operators paid for their efforts directly by the blockchain, certainly has positive implications for Dash’s long term expansion and agility in adding new features. As cryptocurrencies mature, the number of holders will expand meaningfully and there will be plenty of space for many to establish their own markets, so instead of trying to pick an outright winner, it is probably more important to see which cryptocurrencies have the right fundamentals to survive and thrive. In those terms, Dash is well positioned to continue innovating and growing, and it could take advantage of the current disorganized state of Bitcoin.