Cardano (ADA), the popular smart contract platform, is showing signs of a potential bullish continuation as its price action appears to be mirroring patterns observed in its previous bull cycle.

As ADA consolidates above key support levels, traders and analysts are growing increasingly optimistic about the token’s prospects, with some even suggesting a potential parabolic move toward $10 in the future.

What you'll learn 👉

Cardano Follows Previous Bullish Cycle Pattern

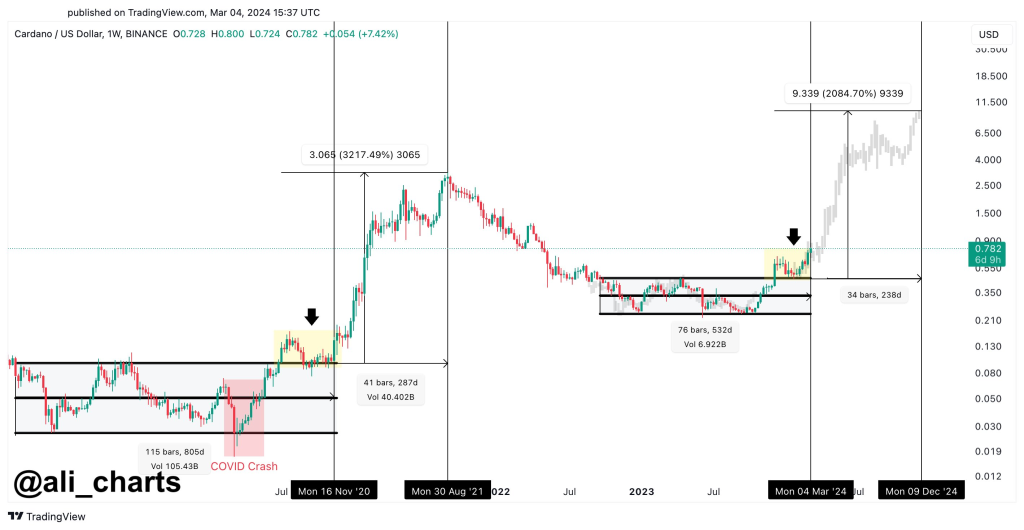

Crypto trader Ali recently noted that Cardano’s current price action seems to be following a similar pattern to its previous bullish cycle. If this trend continues, Ali suggests that ADA could experience a brief correction before embarking on a parabolic rally toward the $10 mark.

“Cardano seems to be mirroring its previous bullish cycle. If this pattern continues, we could witness a brief correction before ADA goes parabolic toward $10!” Ali tweeted.

The trader’s observation highlights the potential for Cardano to repeat its past performance, which could lead to significant gains for investors if the pattern holds true.

ADA Bounces Perfectly from $0.75 Support

Another trader, Sssebi, pointed out that Cardano has achieved a perfect bounce from the $0.75 support level, effectively turning previous resistance into support. This technical development is a bullish sign for ADA, as it suggests that the token may have established a strong foundation for future price appreciation.

Sssebi also noted that ADA is currently moving within an ascending channel, with the next target around $0.84. A breakout above this channel could propel ADA into the $1 area, while a breakdown could lead to a retracement toward $0.60.

“ADA gets a perfect bounce from $0.75, turning previous resistance into support. Currently ADA is moving within this ascending channel, next target is around $0.84. A break out of the channel could send $ADA in the $1 area while a break down could send ADA at $0.60,” Sssebi explained.

Understanding the RSI and 200-Day Moving Average

Cardano’s daily RSI (Relative Strength Index) currently stands at 79.16, indicating that the token is in overbought territory. The RSI is a momentum oscillator that measures the speed and change of price movements, with readings above 70 suggesting that an asset may be overbought and potentially due for a correction.

However, it’s important to note that during strong bull markets, assets can remain overbought for extended periods, and the RSI alone should not be relied upon as a sole indicator for making trading decisions.

Notcoin airdrop on Telegram made millions to people. Don’t miss out on the next TG airdrop by the same team – Dogs on Ton!

Show more +Another key technical level to watch is the 200-day moving average (MA), which currently stands at $0.4202 for Cardano. The 200-day MA is a widely followed long-term trend indicator, and ADA’s ability to maintain above this level suggests that the token remains in a long-term uptrend.

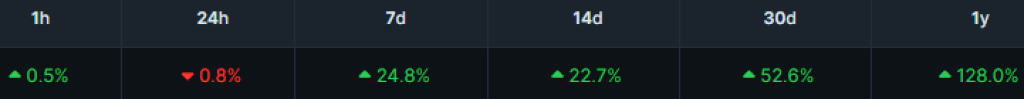

Over the past 7 days, ADA has gained 0.7%, while its 30-day and 1-year performance shows gains of 24.8% and 52.6%, respectively. These positive returns across multiple time frames underscore the bullish sentiment surrounding Cardano.

As Cardano continues to navigate its current bull cycle, traders and investors will be closely monitoring key technical levels and patterns for signs of a potential breakout or correction. While the RSI suggests that ADA may be overbought in the short term, the token’s ability to mirror its previous bullish cycle and maintain above crucial support levels bodes well for its future prospects, with some analysts even eyeing a potential parabolic move toward $10 in the coming months.

You may also be interested in:

- Meme Coins Outperform Polygon Amid Steady Climb: Not MATIC’s Time Yet?

- Massive Ethereum (ETH) Purchase Reportedly Linked to PulseChain/X

- Binance Coin (BNB) Panic Sells, Investors Shift Focus to Pushd (PUSHD) Amid Cardano (ADA) and Ripple (XRP) Discord

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

eToro offers staking for certain popular cryptocurrencies like ETH, ADA, XTZ etc.