A common theme amongst crypto deniers is harping on about Bitcoin’s lack of environment awareness. And their criticism isn’t exactly misplaced, as Bitcoin mining eats insane amounts of energy. The world’s supply of energy is being more and more dedicated to computers that are solving complicated algorithms which maintain Bitcoin’s blockchain. Bitcoin’s proof of work algorithm ensures that the network can run autonomously with no requirements for including a trusted third party. Alex Hern of the Guardian wrote:

“Burning huge amounts of electricity isn’t incidental to bitcoin: instead, it’s embedded into the innermost core of the currency, as the operation known as “mining”. In simplified terms, bitcoin mining is a competition to waste the most electricity possible by doing pointless arithmetic quintillions of times a second.”

Mining is the basis of Bitcoin’s proof of work algorithm and the main cause of Bitcoin energy expenditure. While very environment-unfriendly, it is extremely important for the Bitcoin network. A new block is added to its blockchain every 10 minutes, containing transactions that were picked up by miners and placed into said block. A miner creates these blocks and solves extremely difficult mathematical tasks to add said blocks to the chain. Once he creates a block, other miners pick it up and keep mining (verifying transactions inside of it); once the set 10 minutes pass, the block is added to the blockchain. Every time a new block is added to the blockchain, miners are awarded with a new batch of freshly minted Bitcoins as a compensation for energy and computer power they invested into mining.

Mining becomes harder with time, as the Bitcoin network has a limited supply of 21 million Bitcoin. Whenever an event called halving happens, the mining rewards are cut in half, forcing miners to spend more computer power/electricity if they want to keep mining as much as they did before. All of this keeps the network’s energy expenditure on a continuous rising path and this trend probably won’t end until 2140, when last Bitcoin is expected to be mined.

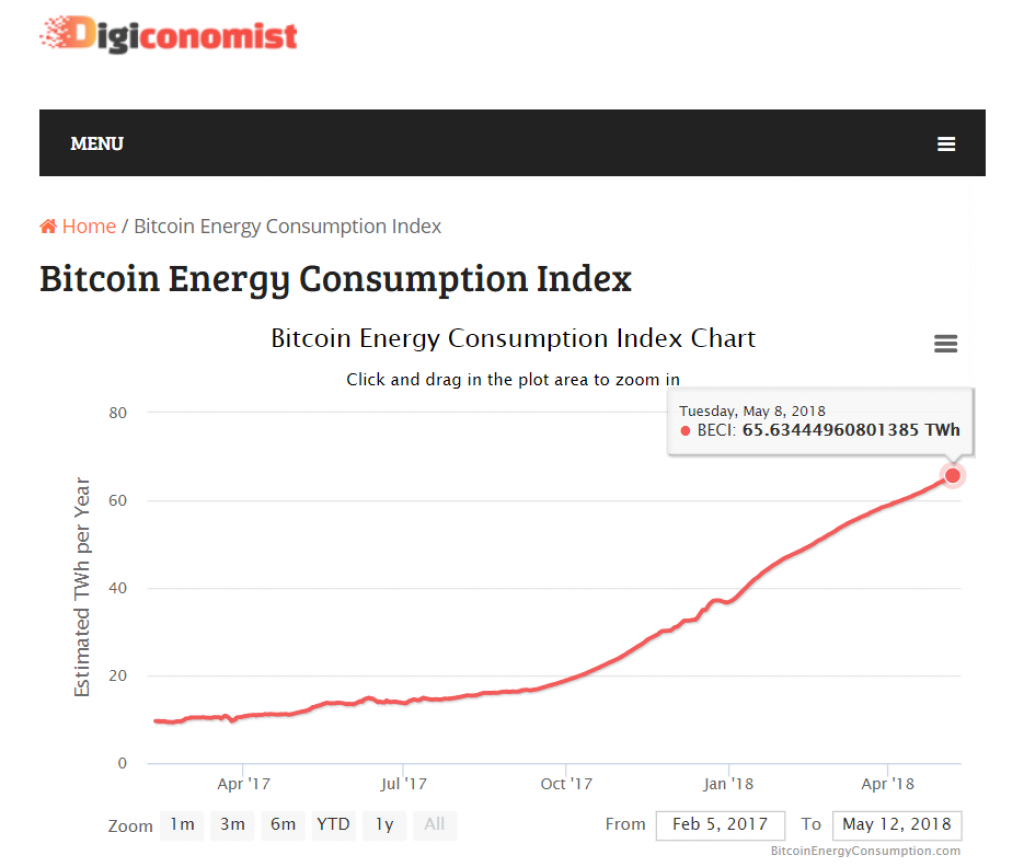

Digiconomist, a website created to track Bitcoin’s energy consumption, announced a couple of days ago that total electricity consumption of mining Bitcoin is currently at an estimated yearly level of 65.26 TWh (terawatt hours). This means that one Bitcoin transaction uses 850kWh; to put this in perspective, 100 thousand Visa transactions are completed with only 169kWh of electricity.

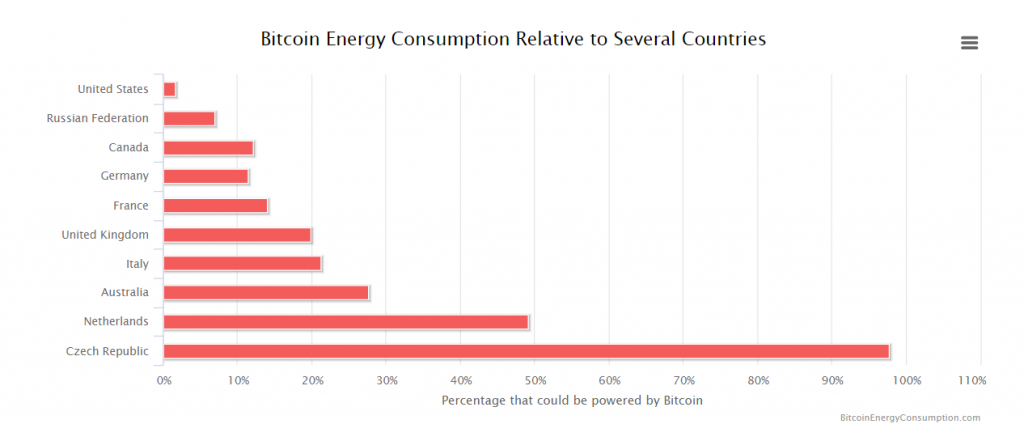

Said number (also called Bitcoin Energy Consumption Index) is a shocking increase from the 36% that were registered at the turn of the year; all the signs are there that this index is going to keep rising. As it stands, Bitcoin’s yearly energy expenditure could, for that same period, power one of 160 world’s countries, including New Zealand, Denmark or Czech Republic, or around 6 million US homes.

Morgan Stanley researchers estimate that this pace isn’t slowing down anytime soon; by the year of 2025, the cryptosphere will be spending more energy than all of the world’s electric cars combined.

As the process becomes harder and more expensive with each passing day, miners are looking for ways to circumvent and lower the costs of mining Bitcoin. As of today, 144 blocks are added to BTC blockchain and 1800 Bitcoins are generated each day. The cost of mining a single Bitcoin in USA amounts to cool 4.6 thousand dollars, which is still profitable a number. This number places USA on the 41st place on the list of cheapest countries to mine cryptocurrency in. For clarity, the cheapest country is Venezuela, where a single Bitcoin costs 731 dollars, and most expensive one is South Korea, where a single Bitcoin will cost you 26.170 dollars to mine.

Cheap and dependable energy sources are being hounded by people wanting to mine cryptocurrency. As a direct result we have seen Iceland, famous for its geothermal and hydro power, experience a real boom in crypto mining. The process accounts for about 90% of Iceland’s data center industry in terms of electricity consumed, according to a KPMG study. This doesn’t bode well with the environmentalist crew, as Iceland is a country known for its preserved nature. One internet commenter expressed concern about the fact that so much of the country’s electricity is being directed in a single enterprise and stated the following:

“So when this silly cryptocurrency bubble bursts, Iceland will suddenly lose 90% of the electrical demand that the greenies are so worried about? Seem to recall the country went pretty much bankrupt a few years ago.”

At the same time, China possesses huge natural sources of coal which makes its thermo-generated electricity very cheap. Thermal plants are a regular sighting in coal-rich rural areas of China, and as of recently so are Bitcoin mining “farms”. In fact, Bitcoin mining has become so popular in China, due to cheap electricity and electronics, that the country became the leading source of Bitcoin mining hash power; over two thirds of total processing power used to mine this cryptocurrency originates from China. However a clampdown on these mining enterprises seems to be on the way, as Chinese government outlined plans to curb the power supplied to Bitcoin miners. Still, mining seems live and well in China and in the rest of the world, as the total available hash rate keeps moving upwards.

How bad is the energy consumption really?

While these numbers alone, and even in some contexts, look extremely inflated, the bigger picture gives a clearer overview of how much energy cryptocurrency mining is actually spending. According to Digiconomist, only 0.29% of world’s total energy expenditure is currently going into Bitcoin mining. The mentioned Morgan Stanley research also adds:

“In the short term, cryptocurrency power consumption is a small percentage of global power usage so we don’t anticipate it will impact utility valuations in the near- to medium-term. But over time the energy consumption of cryptocurrencies and blockchain technologies will likely become a hot topic for the utility sector.”

So for now, the situation is under control. As for the future, the electricity grids will become more and more overloaded by Bitcoin mining. As the pools of fossil fuels are being slowly depleted, many different solutions are being suggested. Proof of stake algorithms are frequently suggested, as they use much less energy demanding processes to verify transactions and mine crypto. Companies are building combined mines that are using multisourced energy, with some even running completely on green energy. Some coins (SKY for example) are talking about “solar miners” which aren’t exactly miners; still, the idea of legitimate solar powered mines sounds interesting. All in all, the environmental consequences of Bitcoin mining cannot be put aside. Cryptocurrencies are definitely the future, but sooner rather than later they will have to start using renewable, green energy to operate their underlying networks.

Does that visa transaction cost count all of the bank buildings, offices and employees driving to those locations?