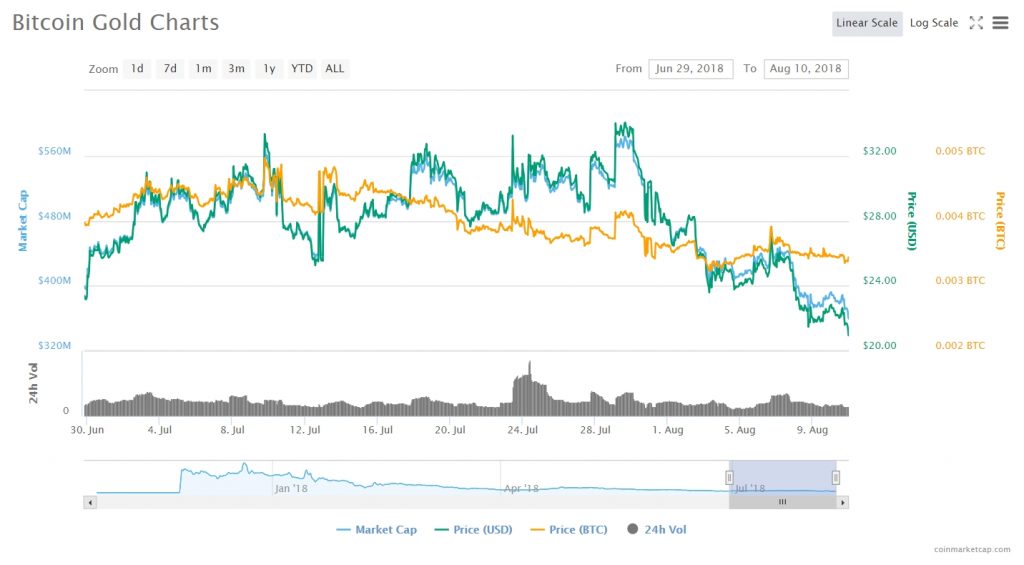

Bitcoin Gold hasn’t seen much action during the last couple of weeks. We saw it reach July highs around 9th, when its value briefly touched 496703 satoshi. Dollar highs were reached sometime later, with one BTG going for $34,04 USD on July 29th. That little spike near the end of the month seemingly implied that there could be a recovery ahead of Bitcoin Gold but this turned out not to be the case as the price soon fell back down, reaching the monthly lows of 340 thousand satoshi on the last day of July (lowest USD point was seen on the 12th, when one BTG=$25,25 USD). August has been equally as dull, and currently you can purchase a single piece of this cryptocurrency for $19.56 USD (a drop of 0.30% in the last 24 hours)/313396 satoshi (a drop of 2.80% in the same time frame).

Daily trade volume of Bitcoin Gold is at 1215 BTC at the moment of writing. The currency has a market cap of $335,183,777 USD, which puts in the 25th spot of coinmarketcap’s list of most valuable cryptocurrencies.

A member of the horde of Bitcoin clones/forks that have flooded the market in previous years is currently enjoying slightly heightened interest from the community, mostly because Coinbase Custody announced its plans to check out this coin as a possible addition to its portfolio. Coinbase Custody is a separate service from Coinbase fiat/crypto exchange; its mere purpose is to allow people with bigger bags of coins (aka whales) to safely store their wealth. As such, a potential addition to this platform shouldn’t really have a strong effect on Bitcoin Gold’s value or trade volume. Still, even mentioning the Coinbase name in the same sentence with a coin can cause said coin to spike in value, so we’ll see how things will turn out.

The coin’s creators claim that Bitcoin’s decentralization has been endangered by ASIC mining. The Bitcoin Gold currency has been created with exactly that in mind; its developers moved away from BTC’s SHA-256 and embraced the Equihash algorithm, one that is more resistant to ASIC mining. It’s now been over a month since the currency’s blockchain has upgraded/hard forked itself to use an Equihash-BTG algorithm which made sure that BTG can only be mined with a GPU.

So many forks – what is Bitcoin Gold? And what is Bitcoin Cash? Then again, there is bitcoin diamond. And bitcoin atom. And Super BTC. And some others we didn’t cover since they are not worth mentioning. And most recent one – Bitcoin private BTCP.

This didn’t peak much interest in the currency. Partnerships like the one with Paytomat, Lightning network integration, coindirect, Hotels24, ZelTrez wallet and changehero all happened within the last month and didn’t really help Bitcoin Gold that much either. Partial blame for this sits on the back of the general cryptocurrency market which has been controlled by Bitcoin movements for good three quarters of the year.

But the other part sits on the back of Bitcoin Gold, which is basically a harder to mine Bitcoin. As such, there really isn’t that much interest for it around the market. A couple of BTG communities have arisen in the poorer countries of Africa and Asia, but none of this has been enough to bring the coin to mainstream popularity. It remains to be seen if Bitcoin Gold has any real ability to break out as a legitimate cryptocurrency or if it will end up on the graveyard of Bitcoin forks.

Laughable: “And most recent one that actually seems legit – Bitcoin private BTCP.”

People bough ZCL up to $200 to get BTCP pre-fork. After BTCP forked it, ZCL collapsed to below $5.

After fork, people bought BTCP at $60 to $80… then the lead dev started another “fork an old dead coin” scam, and the BTCP crowd threw out their own lead dev!!!

Which led BTCP to a never-ending slide down and is currently below $4. This is old news.

Meanwhile, the BTG/BTC price in the chart above is fairly level – looks like BTG’s dollar decline is just the bear market decline in cryptos.

This article looks like a hit-piece on BTG by someone who’s still hoping their BTCP recovers.

ZCL could make a comeback if they changed the algorythm. Currently mining is in it’s poorest I’ve seen it since before ETH jumped to 8$ last year. Profits have fallen greatly after Dagger-Hashimoto and Equihash were made into ASICs. Not a fan of BTG, but at least they stayed honest on their ASIC resistance, ZEC laughed it off, ZEN stopped existing, fuck Horizen, they killed an amazing project, ZCL is inbetween. The reason crypto made a comeback was mining. Those 6 RX 470 rigs started it again, just like 290s made BTC what it is, people mine before it goes to the mainstream, now that Equihash is no different from SHA-256, what’s the difference between ZEC and BTC, BTC is exponentially bigger, period. If they wanna go ASIC, fine, but you’re competing with BTC, LTC, DASH. Siacoin went ASIC, it’s dead. Decred, dead. Electroneum, dead. Libry, dead. 3 of these were a side product of ETH, I mined DCR as I double mined ETH, all of them failed to realize that most of their hashing power came from people mining Ethereum. The Equihash coins are redundant, we simply don’t need most of them, and they think going ASIC is a good idea, the morons are giving ASIC miners one choice, mine the most profitable, fuck it,use nicehash, get BTC instead of 6-8 coins that could all be one by now. A hardfork was their only choice. People will mine them, but none of them make a better bet than BTC or other alts like Monero. Very few people actually buy them, it was mostly miners who were HODLing and making that bet.