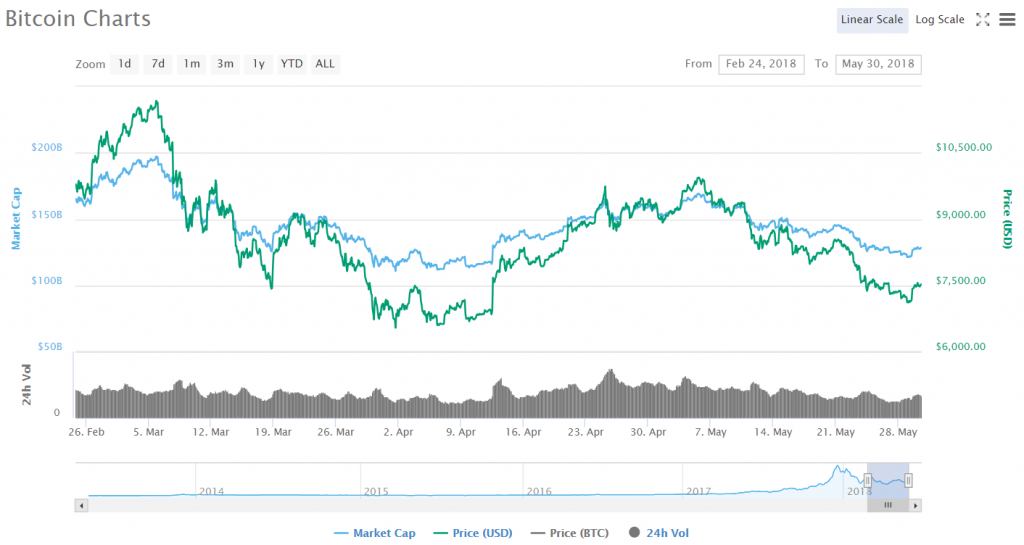

Bitcoin, and with it the entire crypto market, has had an underwhelming start to the second quarter of 2018. While many were optimistic after we broke above $10000 for the first time since early Q1, the joy was short lived. The resistance proved to be too strong and the price started spiraling down, bouncing a couple of times off of the $7000 support line. We even saw Bitcoin reach almost $6000, during the direst of price movements back in April.

Today, on May the 30th, Bitcoin has been experiencing a slight bounce. Currently trading at $7500 for almost a day now, it has created a sideways calm which resulted in the entire market turning green. It’s just one of those days when everything looks nice across the board and you feel like the altseason is on the horizon. Looking at the current Bitcoin graph, a triple bottom pattern can be noticed, seemingly forming a rising trend line.

Source: Youtube/SkrillaKing

Some analysts still feel that the market will bounce back short term, possibly even as early as of June. Most of these predictions are based on an interesting pattern that has been noticed since the turn of the year: Every 6th day of the months that passed by was either a high or a low.

Looking at the chart, we can see that the highs and lows have alternated perfectly, with the next low supposed to hit somewhere around June 6th. This means that a reversal is bound to happen, and many people are leveraging their holdings accordingly already.

Still the question remains, what happens during the rest of 2018? The opinions are naturally divided, with some expressing bullish thoughts and others having a more bearish outlook.

Tim Draper, David Lee, John McAfee have previously came out as “Bitcoin bulls”. All of them feel that the currency will have a strong third and fourth quarter of 2018. Llew Claasen, an executive director of Bitcoin foundation recently stated that he expects Bitcoin to hit $ 40,000 by the end of this very year. He further added that there will be a significant amount of volatility before Bitcoin actually hits those levels.

And while most of these analysts offer generalized feel-good thoughts on Bitcoins future, it is always good to stay grounded by looking at what more bearish commentators have to say. And Sean Williams (@TMFUltraLong) of fool.com recently delivered a very bearish expose on what 2018 has in store for Bitcoin. In his article Mr. Williams seemingly blames the fact that Bitcoin lost almost half of its market cap value in almost one month for our current struggles and goes on to tell us why it might not have the brightest of futures ahead of it.

Trying to place a finger on what caused this downfall is difficult. Williams partially blames increased focus of regulatory agencies on the cryptosphere. South Korea recently banned ICO’s and requested its banks implement mandatory verification of every customer who attempts to link its bank account to a cryptocurrency exchange. China has also banned ICO’s and performed a series of moves which suggest that they want the crypto market around, but only if it remains under government control.

Same has been done in USA, with SEC looking to implement securities regulations in crypto and DOJ looking to expose potential market manipulators and unfair traders. Market manipulation has always been an issue with crypto but it has seemingly become amplified with the introduction of futures trading. DOJ feels that the exchanges don’t have enough measures in place to protect the market from manipulations, bots and cheaters, leaving regular crypto traders in much more danger than they should be in.

More specifically, the market is dominated by spoofing (a trader, or group of traders, places an order that creates a new best bid or adds to the perceived liquidity of an asset; shortly thereafter, the trader(s) will then cancel their initial bid (the spoof) and place a trade on the opposite side of the market) and wash-sale trades (an individual, or group of traders, buy and sell an asset with themselves in the hope of pushing its price higher and giving off the perception of improved liquidity). These have indeed been noticed on the crypto markets and some regulatory measures could eliminate them.

In summary, Mr. Williams offers the following predictions for Bitcoin in 2018:

- Crypto Market Cap Will be Lower by Year’s End

The market cap has fallen greatly since its early January highs of 830 million. Williams expects this downtrend to continue, as the increased attention of institutional investors combined with the blossoming futures market for BTC will lead to further decline in Bitcoins market cap.

- Bitcoin Will Lose Half of its Value and a Flippening Will Happen

With a drop in market cap comes a drop in price as well. Williams feels that there is a possibility that Ethereum, currently no.2 on coinmarketcap’s market cap list, could take advantage and temporarily replace Bitcoin as the most dominant cryptocurrency in the world.

- Expanded regulations

In December, the Securities and Exchange Commission (SEC) Chairman Jay Clayton, warned that a lot of the trading activities take place outside the U.S. something that would make it difficult, for the SEC to protect American investors. According to Williams, this was a call for regulations. There is also an increased push from the IRS on platforms like Coinbase to provide trade details of their users so that they can be taxed accordingly for their gains and losses. He feels USA could mirror South Korea in requesting verification of crypto trading individuals.

- Bitcoin ETF will hit the market

NYSE and CBOE are itching to bring a Bitcoin exchange-traded fund (ETF) to the crypto market. Assuming the regulation predictions turn out to be correct, the next logical step would be for the SEC to allow a Bitcoin ETF to hit the market later in the year.

- A major country bans cryptocurrencies

Currently, cryptocurrencies are illegal in Bolivia, Bangladesh, Ecuador, Kyrgyzstan, Morocco, and Nepal. There are also quite a few countries where crypto is frowned upon, but not wholly illegal, such as Venezuela and China. Williams feels that Britain might be the first major country to completely ban Bitcoin and the rest of the bunch, with British banks banning Bitcoin purchases with credit cards back in February, and, just weeks later, the Treasury Committee of the U.K. Parliament announcing a probe into how cryptocurrencies are impacting U.K. consumers, investors, and businesses.

As a final disclaimer, Williams adds that these are indeed predictions that aren’t necessarily going to come true. Cryptocurrencies don’t have the traditional balance sheets, income statements, earnings reports which help determine trends and movements. TA and FA do exist in crypto but are done on a much more volatile market, so the predictions don’t always pan out. Crypto is still very much an early technology, with big businesses yet to give it a real chance. To conclude, he claims that cryptocurrencies are in for a wild ride in 2018 and suggests you should keep your money away from them for now.

Mr. Williams, while being a “filthy no-coiner” (he adds that he has no money invested in crypto at the end of his article) does raise some solid, if not bearish points in his expose. The general feeling around the market is similar, feeling like we will test out the 5000s before any serious recovery begins. Only future will tell if that feeling is right or wrong.