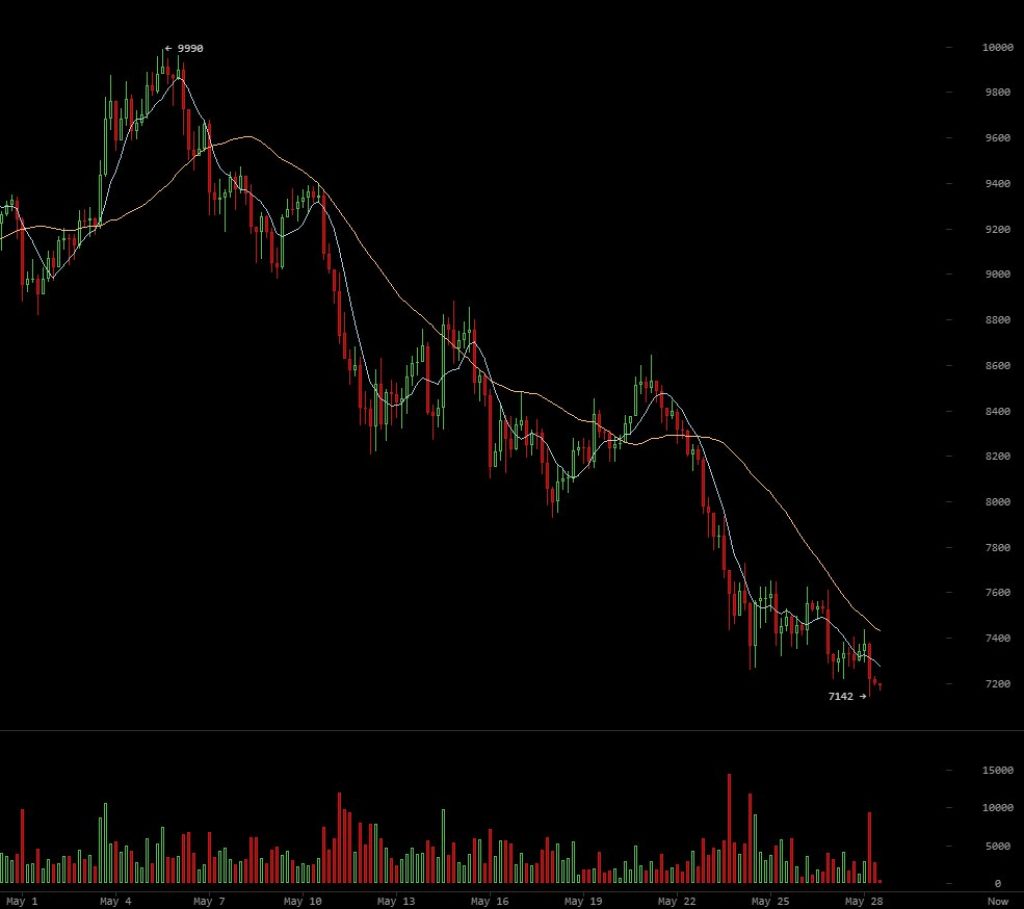

The crypto market has seen better days. Ever since we almost broke the 10k resistance, a bearish trend took over and brought the price down to just above 7000 dollars.

While this might scare some people off Bitcoin and the rest of the market, venture capitalist Spencer Bogart has some encouraging words for crypto enthusiasts.

In a recent interview with CNBC’s Fast Money, Bogart expressed confidence in Bitcoin, citing its increasing adoption as the main reason to stay optimistic. The use cases for Bitcoin are indeed growing almost daily with more and more institutions embracing it as a payment option.

As Mr. Bogart reserved plenty of praise for Bitcoin, he obviously feels that the downtrend we are currently experiencing is going to go away soon enough.

He also pointed out that the rest of the market doesn’t look that good, as most altcoins are still very far away from general adoption. According to Bogart, most of the market is currently “over-promising and under-delivering. Meanwhile you have a few that are kind of excelling at their use cases. Bitcoin being one of them.”

Bogart pointed out how he feels that coins like Cardano, TRON, IOTA and NEO shouldn’t be a part of your portfolio right now.

Still, even after blasting some of the most popular coins out there, Mr. Bogart did have some neutral words for a few other alts on the market. Ethereum, Ripple, Bitcoin Cash and EOS were his choice as the alts that are currently ok to hold. He followed up his comments on Ethereum by claiming that most of its future will depend on the success of the ICOs and projects that have been built on top of it.

His words do ring true here, as there are plenty of bad projects and straight up scams using the Ethereum platform for their ventures. We mustn’t forget the looming SEC threat which could clamp down on many of these projects, possibly taking the entire Ethereum network into a downspin.

Boghart ended his interview on a slightly cheerier note, saying that Bitcoin should “at least” end above $10,000 by the end of the year. “But when I look out over the next year, two years, I mean the story is very much materializing,” he said of Bitcoin, seemingly confirming the notion that we are bound to leave this transition period in the near future.