From hashing algorithms to blockchains, crypto world is full of terminology that can easily confuse the relative newcomers and newbies. One such term is “Bitcoin halving”, which to an untrained ear could sound like someone is speaking about possession of the famous cryptocurrency. However, this term isn’t related to Bitcoin ownership but is rather an important element of the process of Bitcoin mining.

What you'll learn 👉

What is Bitcoin mining?

Satoshi Nakamoto, the original creator of Bitcoin, envisioned a unique currency that wouldn’t have to depend on a centralized entity in order to be created or distributed. He realized that an online blockchain, which would contain data about every transaction ever made, would be an integral part of this currency. The idea was to reward people with new units of this currency, now known as Bitcoin, for doing computational work of verifying new transactions (adding new transactions onto the Bitcoin blockchain). This process was named Bitcoin mining, as it technically represents the action of minting and creating new coins on the blockchain.

Every day millions of watts of electricity are spent to mine new Bitcoins. Currently the process is still profitable, as the rewards are higher than the electricity expenditure. Such system is important, as no one would want to mine Bitcoin without incentives and at a loss. At the same time, the rewards can’t be too high and can’t happen too fast, as that would create an oversupply of the coin and result in the Bitcoin price going down.

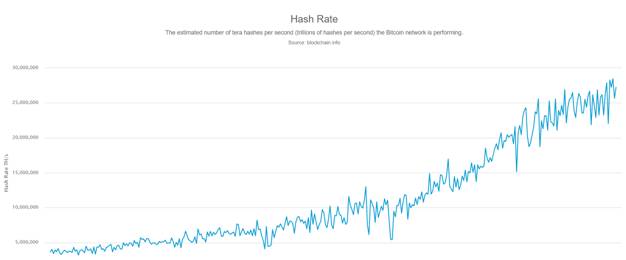

Such decentralized system ensures that currency is created on nodes of the Bitcoin peer-to-peer network, with Bitcoin hashing algorithms determining how Bitcoin rewards are generated and at what rate. Satoshi Nakamoto noticed a potential problem with this: he predicted that, with time, computing power inevitably doubles in strength.

Graph of the rate of hashing (number of computer operations that nodes on Bitcoin network are capable of performing)

Nakamoto was quoted writing on this topic: “By convention, the first transaction in a block is a special transaction that starts a new coin owned by the creator of the block. This adds an incentive for nodes to support the network, and provides a way to initially distribute coins into circulation, since there is no central authority to issue them. The steady addition of a constant of amount of new coins is analogous to gold miners expending resources to add gold to circulation. In our case, it is CPU time and electricity that is expended.”

This meant that his system of generating Bitcoin will become overrun with advanced hardware, capable of mining much faster than the 10 minutes per block he envisioned as ideal. This would cause the above mentioned oversupply and inflation. Next to a gradual increase in the difficulty of the mining process, Satoshi decided to implement a “halving event” in order to deal with the upcoming issues that the currency might face. The event first happened in 2012, and again in 2016, and it is expected that it will happen again sometime in 2020 and 2024.

What is Bitcoin halving?

Nakamoto’s system is created as self-sustaining and it emulates gold-mining. With that in mind, we need to be aware that mining would become more difficult with time, as the resources dry out and the rewards collected will slowly reduce.

Nakamoto decided to control the Bitcoin supply in a similar vein, by limiting the rewards one can reap upon successfully adding a block to the blockchain. When Bitcoin started, the block rewards were a whopping 50 Bitcoin every 10 minutes. With the current BTC exchange rates, that is more than 300 thousand dollars. Thanks to a statement ingrained in the Bitcoin code which says that after every 210,000 blocks this reward is scheduled to drop by half. If we multiply these 210,000 blocks with the 10-minute period per block, we will get a time-table of around 4 years. In 2012 the reward halved to 25 BTC, in 2016 it went down to 12.5, in 2020 it will be 6.25 and so on. You can track when the next “halvening” will happen on many countdown websites like this one.

The effects of the halving system are what make Bitcoin maintain itself as a functional cryptocurrency:

- The reward system remains operational for a longer time. If the rate of releasing coins was still stuck at 50 Bitcoin for every 10 minutes, the total supply cap of 21 million Bitcoin would have been reached very quickly. Most predictions indicate that said milestone would be reached in 8 years if it weren’t for the halving system. Reducing the rewards every so often ensures that the mining will continue to take place for much longer than that.

- Bitcoin value rise is slow and steady. Looking at currencies that have went through periods hyperinflation, one thing is clear: the rampant and uncontrolled printing of new banknotes was the main accelerator of it. It’s the simple law of supply and demand: each time a country pumps in new banknotes into the supply while the demand stays the same, the value of each single banknote will decrease. This is why it was extremely important to somehow control the increase of the Bitcoin supply. The amount of new Bitcoin added on the crypto market decreases with time, thanks to the halving effect. Limiting the supply like this increases coin’s scarcity and ensures that its future price will rise.

- The cost of mining each individual Bitcoin is gradually increased. With the ever-increasing difficulty of the mining process and a dropping reward rate, the actual cost of mining out a single Bitcoin increases over time. As a result, miners will be looking to sell their tokens at higher prices which will cause an increase in the market price as well.

Similarly, Vertcoin and Ethereum Classic have their own halving events (Ethereum Classic’s event dropped its reward from 5 to 4). Other cryptocurrencies have their own specially coded ways of reducing the mining rewards as well, as the principle of limiting the increase of the supply ensures the coins long-term stability.

What happens when the mining stops?

Observing the total planned and the current supply of Bitcoin will reveal that more than ¾ of the coin have been mined so far. Naturally, the question arises: what happens when every single token is mined out? Several things need to be considered here.

- With the way the mining difficulty is increasing right now and with the halving mechanism functioning the way it does, it is expected that the final Bitcoin will be mined out sometime around the year of 2140. As the cryptocurrency was launched back in 2009 it will, in total, have about 130 years of mining time. No one can say in what kind of condition will the Bitcoin blockchain be by then, meaning that the rewards might not even be necessary.

- Bitcoin miners don’t earn just from getting blockchain rewards but are also rewarded by being paid in transaction fees. The number of transactions that daily take place on the Bitcoin blockchain is in hundreds of thousands; this is expected to continuously rise in the future. So it is plausible to expect that by 2140 mining purely for transaction fees could be profitable enough for miners to continue mining indefinitely, without block creation rewards. Nakamoto wrote the following in his whitepaper on this: “Once a predetermined number of coins have entered circulation, the incentive can transition entirely to transaction fees and be completely inflation free.”

- While Bitcoin in its initial state is already an obsolete currency, there are a number of projects that are in the workings looking to coexist alongside Bitcoin and improve its functionality. Two of the most quoted ones are the Lightning Network and Rootstock. Lightning Network will create special transaction channels which should increase the networks throughput. RSK is a smart contract platform that is intended to run on top of the Bitcoin network. It will allow for smart contract and decentralized application execution while making use of the Bitcoin blockchain itself. It is intended to be a competitor to Ethereum. Rootstock adds additional advantages for miners as it should allow them to process the RSK transactions, at the same time as mining Bitcoin transactions and with almost no additional hashing power required. This means that miners will be given an opportunity to earn extra cryptocurrency by handling these transactions.

Final thoughts

Bitcoin halving is both an excellent mechanism which was designed to solve many potential issues that were sure to strike this currency as its age and adoption grows. In a similar fashion to gold mining, Bitcoin mining becomes more expensive and more complicated with time, as specially designed code simulates the decrease of the Bitcoin reserves. Satoshi noticed this wisely and also realized that this has led to a slow but steady rise in the price of gold over the last 100 years. It is expected that this mechanism will help stabilize the Bitcoin prices in the long term and help it fulfill its faith of becoming the “Internets gold” to the fullest.

Some minor disagreements:

“The cost of mining each individual Bitcoin is gradually increased.”

The cost of mining a bitcoin should always be approximately the cost of a bitcoin. Consider that If the price of a bitcoin drops to $1, miners are not going to spend more than $1 to mine it.

“What happens when the *mining* stops?”

The *mining* never stops. It continues even after the *subsidy* goes to 0.