We have witnessed large oscillations in the prices of Bitcoin and other cryptocurrencies in the past few months. For experienced traders who use technical analysis and carefully monitor changes in the market, such a volatile market is a real opportunity to make a profit.

If you want to learn how to profit in this market, you are in the right place.

In this article, we’ll explain what shorting is, how shorting works, how to short Bitcoin or Ethereum on Binance Margin Trading, learn about the risks of shorting, and much more.

And so, let’s dive deeper into this topic and see how you too can make a profit on shorting.

What you'll learn 👉

What is Shorting?

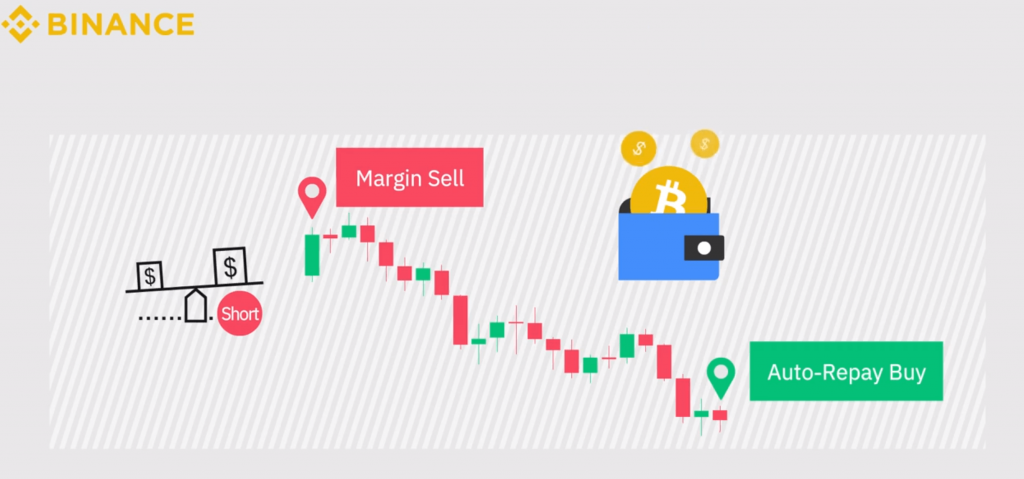

If you sell a certain asset at a higher price and later repurchase it at a lower price, then this trade is called short selling or shorting.

A trader who is “bearish” on that asset enters a short position expects the asset’s price will decrease in the near future. So instead of just waiting for the price of his asset to increase in the future and thus make a profit, he uses such price shifts to make “instant” profits and increase his initial capital. Short selling of digital assets is a common strategy for short-term and long-term traders.

Besides the crypto sphere, shorting is very popular in basically any financial market, like the Forex, stock market, commodities, etc.

A long position is the opposite of a short-selling (shorting), and that is the situation when a trader buys an asset to sell it later at a higher price.

How does shorting work?

And if that doesn’t have to be the case, shorting is usually done with borrowed funds.

You, as a trader, borrow a certain amount of Bitcoin or some other cryptocurrency on an exchange that you can trust, like Binance. Then sell the funds and wait for the price to decrease to repurchase them and make a profit.

Your goal is to price of the cryptocurrency you are shorting decrease so that you can make a profit on the difference between the high sale price and the low repurchase price.

Let’s look at this in a practical example:

1. The current price of Bitcoin is $50,000. Because you believe that the price of Bitcoin is going to drop, you borrow 2 BTC from Binance and sell it at market value. You now have $100,000.

2. Bitcoin price drops to $40,000.

3. You repurchase 2 Bitcoin for $80,000.

4. Return the borrowed capital to the lender, in this case, the Binance exchange, plus interest incurred.

5. The difference between the cost of buying and selling makes your profit (in this example, it will be $100,000 – $80,000 = $20,000, minus the interest payments and fees).

How to Short Bitcoin or Ethereum on Binance Margin Trading – steps

Let’s say you would like to short Bitcoin or Ethereum on the Binance Margin Trading platform and assume you already have a Margin Trading account on Binance.

Before you can borrow Bitcoin or Ethereum, you first need to transfer some crypto assets to your Margin Wallet so it can be used as collateral. For collateral, in the following example, we will use USDT, a stablecoin pegged to the US dollar.

Now, let’s go through the steps:

Step 1: Log in to your Binance trading account, select “Wallet,” and click on “Margin Wallet.”

Step 2: Search for “USDT” and then click on “Transfer.”

Step 3: Enter the amount of USDT to transfer from Spot Wallet to Margin Wallet (e.g., 100 USDT). Click “Confirm transfer.” Now you are ready to short some BTC or ETH.

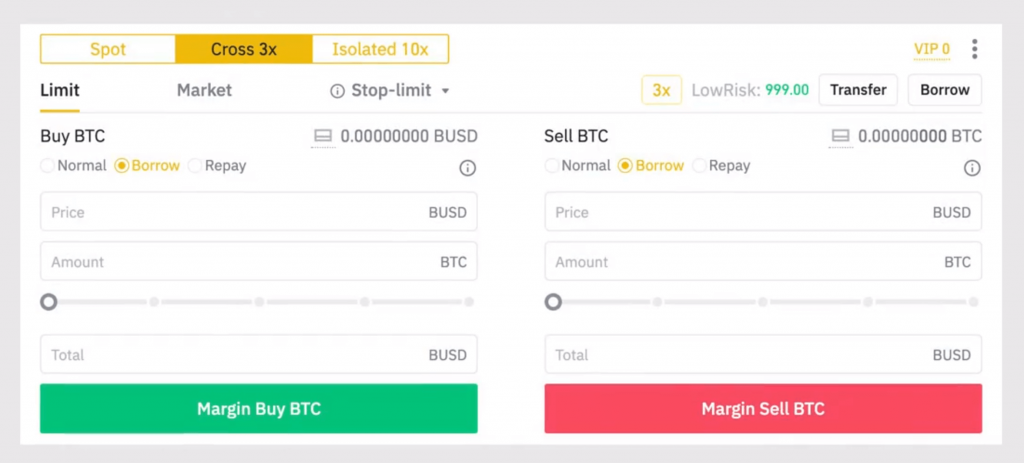

Step 4: From your Margin Wallet, search for BTC or ETH (depending on whether you want to short, BTC or ETH), select “Trade,” and click on BTC/USDT or ETH/USDT.

Step 5: Go to the “Sell BTC” or “Sell ETH” section, which is located just below the price chart.

Step 6: Select the “Borrow.” It will show you the maximum amount of BTC or ETH you can borrow.

Step 7: To place your short sale order, you will first need to define the amount and the price of BTC or ETH you wish to short in the order placement form. Click the “Margin Sell BTC” (or “Margin Sell ETH” if you are shorting Ethereum).

How to short Bitcoin on Binance Options – steps

Let’s get to the point right away:

Step 1: Download the Binance mobile app. The app is available for both Android and iOS. Log in to your account.

Step 2: Activate Futures account. Now you are ready to start trade options.

Step 3: Go to the Trades tab. Click “Options.” If you don’t have funds on your Futures Wallet, then first transfer funds from your Exchange Wallet to Futures Wallet.

Step 4: You are offered five options to choose from, and these are 10 min, 30 min, 1 h, 8 h, and 24 h (1 day) expiry. Select which one you would like to buy.

Step 5: In the Quantity field, you will need to specify the contract size. Click “Buy Call.”

Step 6: A confirmation window will pop up. Check if everything looks good and click “Confirm.”

Step 7: Under the Positions tab, you will be able to monitor your open positions.

Step 8: To close the position (if you need to), click “Settle,” located on the right side of the Positions tab. Once you click on “Confirm,” the option will be exercised.

How to close positions on Binance?

To close your positions, you just need to click “Close Position” and enter a limit price or use the market price option.

Another way to close your position on Binance is by entering an opposite order (if you have a short position, to close your position, you’ll need to enter a buy/long order).

Binance Futures fees and funding

When you open a short position, you will be charged a trading fee when your order is executed. If you pay fees in BNB, you’ll get a 10% fee discount for futures markets.

More important than trading fees is funding (payment exchanged between traders who have short or long positions) that traders receive or pay every 8 hours. If the funding rate is negative, shorts are charged a funding fee and longs receive funding and vice versa.

FAQs

Can I Earn Good Profits from Shorting Bitcoin?

Of course. Otherwise, this trading option wouldn’t exist at all. As we explained in the example above, if you evaluate the price movement well, you can make good profits very easily and quickly.

But before you start shorting Bitcoin, or any other crypto, you need to understand that markets are very volatile. It means that a price can increase to the skies within seconds with no underlying reason. So always think twice before you short.

What are the Risks with Shorting Bitcoin?

When shorting Bitcoin, you encounter two major risks.

The first risk is price risk. Price volatility in the underlying asset can make it difficult to predict the underlying asset’s price movement accurately.

The second risk is the lack of a standard regulative framework for Bitcoin worldwide. Some of the largest futures trading venues of the cryptocurrency are not regulated. If something goes wrong with your trade, you will have fewer recourse options.

What is a Bitcoin Short Squeeze?

The short squeeze is a situation in which the price of Bitcoin starts to increase drastically. In this situation, traders are usually trying to close their positions because their short orders incur losses.

Since these peaks are rarely stable, you’ll be forced to incur a loss. Because of that, always leave the stop-loss function, indicating the price level you will incur an acceptable loss.

How to short bitcoin with leverage on Binance futures

Binance and many other crypto exchanges and futures trading platforms allow their users to place bets on a decrease at Bitcoin’s price by using leverage. But never forget, leverage can magnify your gains, but it will magnify your losses if something goes wrong.

Can you short Dogecoin on Binance

You can. In addition to Bitcoin, Ethereum and Dogecoin, you can short a lot of other cryptocurrencies on Binance.

How to short on Binance without leverage

You can do this just by selling your Bitcoin (without borrowing any from Binance). That means lower profit in case of a price drop, but also a more minor loss if the price goes up because you only lost your Bitcoin.

Read also:

– How to short Ethereum? Short ETH on Binance & Co.

– Best Bitcoin Exchange for Beginners [2021]

– Best Crypto Charting Software & Tools For Bitcoin & Altcoin Traders

– Binance Grid Trading Review – Fees, Strategies, Profitability

– Binance Options vs Futures: What are the differences and similarities?