Ripple’s XRP token is currently sitting in place 2 of the cryptocurrency rankings weighted by market cap. Even though, many would strip its right to be called cryptocurrency (even Ripple CEO refuses to define it as such), XRP is considered by many to be bitcoin’s most serious competitor.

The interest in XRP token in the open cryptocurrency market is very low, even though the nominal trading exchange volume numbers don’t show it at the first glance, because of the flawed logic used by coinmarketcap and other data trackers in their exchange volume measuring. According to the data from Messari, XRP had $355 million worth of trading action on exchanges, putting it on 5th place by volume in the last 24 hours. However, the much of this liquidity is false which can be proven if we look at coinmarketbook.cc.

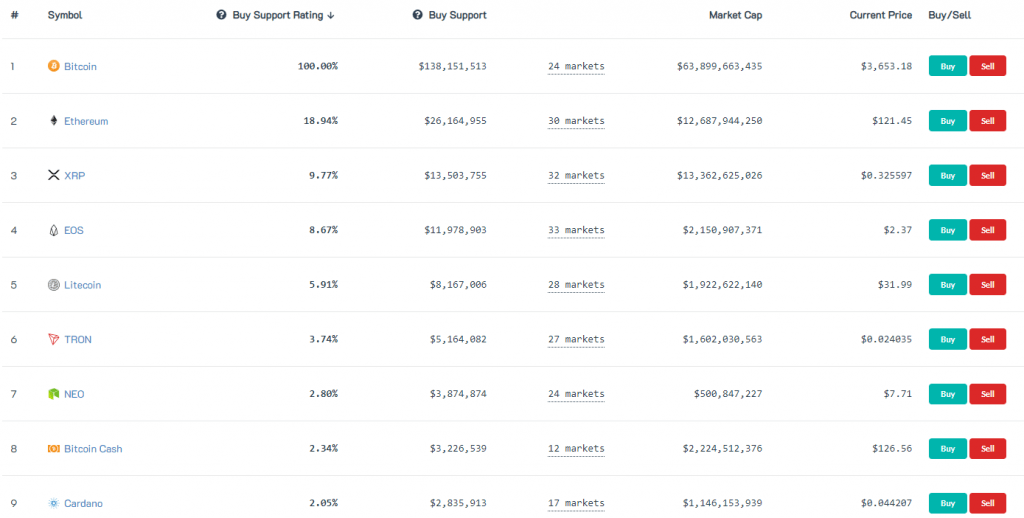

Coinmarketbook.cc introduces new metrics that gauge real liquidity of major coins in the market. The so called “Buy Support” is a sum of buy orders at 10% distance from highest bid price and is calculated by summing buy orders close to bid price (max 10% distance), then converting amount into USD.

This way, Coinmarketbook cleverly avoids manipulation of the markets by big whales and market makers (paid by someone?) that put up big orders to support the price of the coin which masks the real lack of interest in the coin further down the buying line.

The “buy support” indicator shows that there is $138 million waiting to buy bitcoin, $26 million buying orders for Ethereum and only $13 million for XRP. EOS has 6x smaller market cap than XRP but is right behind it in “buy support” with $11 million worth of USD locked in buy orders.

XRP fans are hanging their hopes on the Ripple company and their deep pockets and ostensible competence in building a new value transfer technology.

However, there is an important distinction between Ripple and XRP: what is good for Ripple is not necessarily good for XRP. Ripple is laying ground and infrastructure to challenge incumbent Swift network, an aging solution for money transfer among banks across the globe. And Ripple’s technology is sound, lending it genuine punching chance against the reigning solution. However, XRP is only marginally involved in the Ripple story.

Some XRP holders mistakenly believe that the XRP token is fundamental element to the operation of the company’s cross-border payments solution. Sadly that is not the case as most banks appear to be favouring a Ripple product known as xCurrent that does not use XRP at all.

The XRP purpose or lack thereof

In their piece on Ripple and XRP, Widmer Dum struggles to see any value accruing avenue for XRP, declaring it essentially a DOA asset:

“Banks don’t want to just hold their XRP, or that would be no better than the old system, where capital was lying idle. The cost savings depend on the ability of banks to find liquidity. That means, if a bank in India receives XRP and they want to be able to trade it for Rupees they should be able to do that on an exchange. Banks also want the price of XRP to be relatively stable, or the risks during transfers would be too high. For XRP to be stable there has to be some price the market settles on for one XRP. This is determined by the demand and supply of the asset.

As we have seen above, banks don’t really want to hold XRP. It is not an investment, but a settlement mechanism. Because of this it doesn’t matter to them if one XRP is worth 5 cents or 5 dollars. Banks want to buy it, send it and then the receiver wants to convert it into a government currency. But who is on the other side of the order book? According to Ripple there will be Market Makers on the other side who are incentivized by profits from trading XRP and currency pairs. The details of how this would work are vague at best.

So, how does the price of one XRP get determined? Right now it is determined by speculators on crypto exchanges. In the long term speculation cannot be the driver of value of XRP. XRP could derive value from people’s beliefs, in the same way as Bitcoin, however, this is unlikely as Ripple’s customers, the banks, are unlikely to be motivated by beliefs and ideals.”