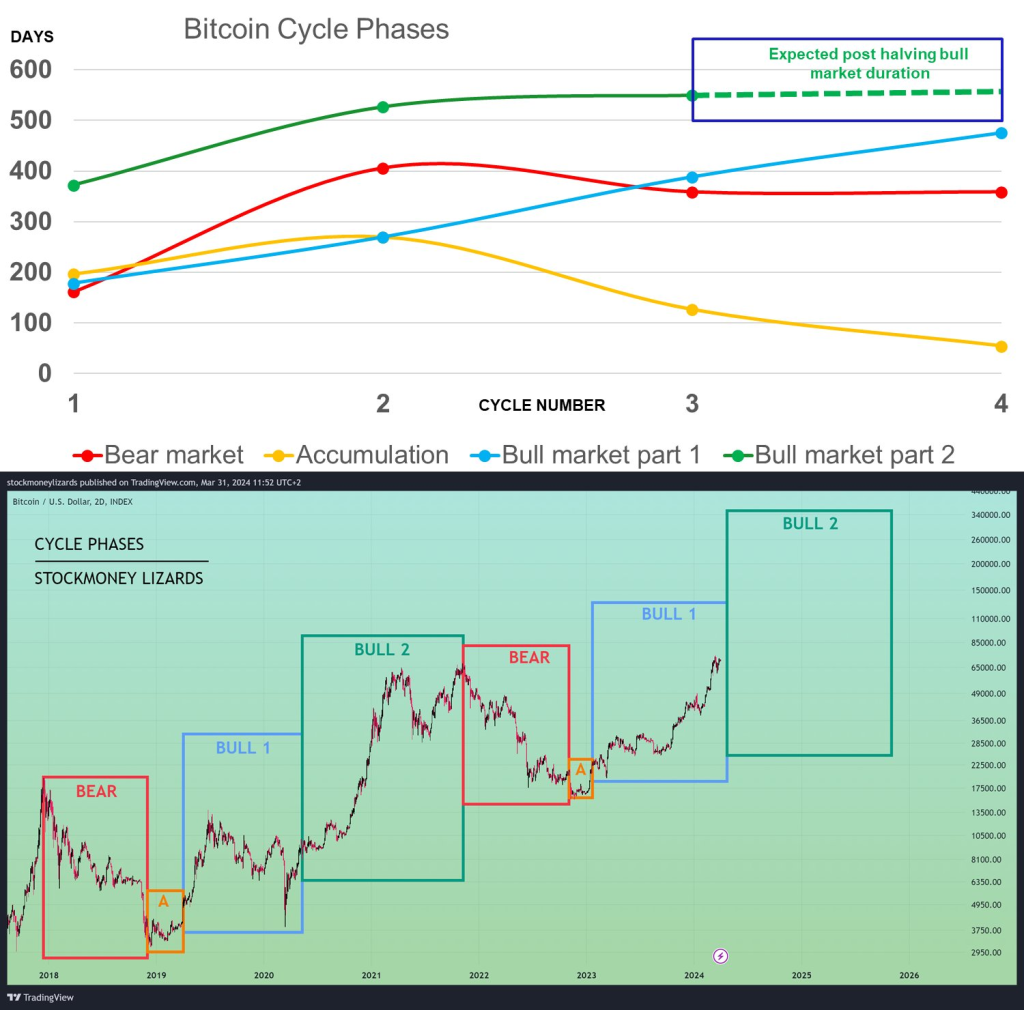

According to top analyst Stockmoney Lizards, Bitcoin (BTC) might reach its cycle top prematurely in the current market cycle. However, after analyzing the dynamics of previous cycles, the analyst suggests that a shift towards shorter bear markets, brief accumulation phases, and longer pre-halving bull markets could lead to a cycle top in early Q4 2025.

What you'll learn 👉

Institutional and Retail Inflows Fuel Optimism

Stockmoney Lizards, in his tweet post, highlights that the influx of institutional and retail money into Bitcoin could drive the market towards this projected cycle top. This inflow of capital is expected to contribute to the asset’s sustained growth and momentum.

Notcoin airdrop on Telegram made millions to people. Don’t miss out on the next TG airdrop by the same team – Dogs on Ton!

Show more +Bitcoin’s Recent Price Performance

Besides, as per price data from CoinGecko at the time of this writing, the price of Bitcoin (BTC) is currently $70,378.57, representing a 0.39% increase in the last 24 hours and an 8.23% increase over the past seven days. This upward trajectory aligns with the analyst’s bullish outlook on the world’s largest crypto.

The analyst’s prediction is based on a thorough analysis of previous Bitcoin market cycles. Moreover, Stockmoney Lizards observes a clear shift towards slightly shorter bear markets, short accumulation phases, and increasing pre-halving bull markets. Additionally, the post-halving bear markets have remained relatively stable.

Potential Implications of the Cycle Top

If Stockmoney Lizards’ analysis proves accurate, the Bitcoin market could witness a cycle top in early Q4 2025. This projected peak would align with the growing participation of institutional and retail investors in the cryptocurrency space, further fueling the asset’s price trajectory.

Therefore, while market predictions are uncertain, Stockmoney Lizards’ analysis provides a data-driven perspective on Bitcoin’s potential market cycle dynamics. As the crypto ecosystem continues to shift, analysts’ data like Stockmoney Lizards’, play a crucial role in deciphering market patterns and informing investment decisions.

You may also be interested in:

- Price Pattern That Triggered the Last 200x Move for Dogecoin (DOGE) Re-emerges; Here’s the Potential Target

- Chainlink Continues Uptrend with Bullish Forecasts and Mixed Signals Amid RWAs Expansion: How High Can LINK Go?

- From Playful to Profitable Dogecoin (DOGE) and Shiba Inu (SHIB) Investors Pounce on Koala Coin (KLC) Opportunities

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

eToro offers staking for certain popular cryptocurrencies like ETH, ADA, XTZ etc.