The cryptocurrency Solana (SOL) has seen impressive gains recently, significantly outperforming top coins Bitcoin and Ethereum. But according to crypto investor Thor Hartvigsen, the rally may be more driven by hype than fundamentals. In a recent Twitter thread, Hartvigsen provided an in-depth analysis of Solana’s performance to make the case for why investors should exercise caution despite the recent price rise.

What you'll learn 👉

A Closer Look at Solana’s Gains

Hartvigsen started his thread by highlighting Solana’s stellar monthly performance, writing:

“Thor Hartvigsen: $SOL has been crushing it lately, outperforming both BTC and ETH. But is the rally sustained by fundamentals?”

He then outlined Solana’s 30-day gains against both Bitcoin and Ethereum, showing increases of 30-46% in SOL/BTC and SOL/ETH pairs. On the surface, this seems like an indicator of strong momentum.

Underlying Metrics Don’t Support Rally

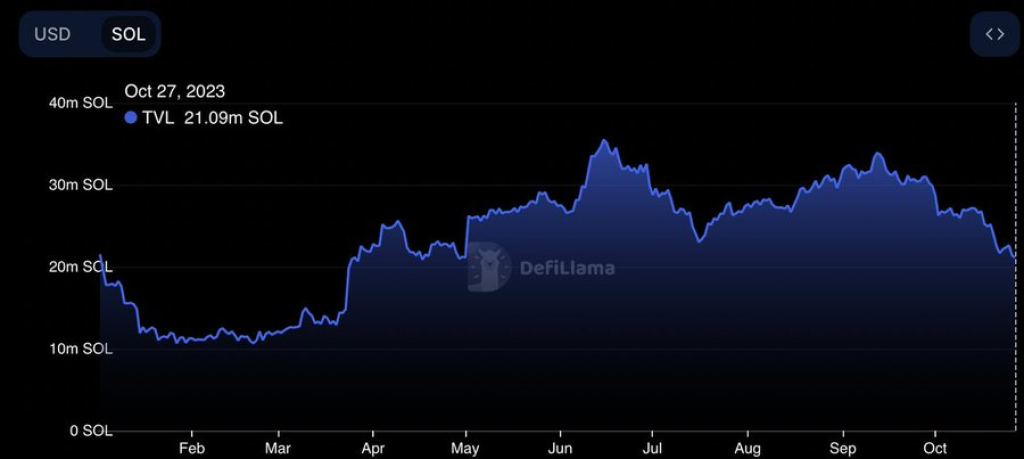

However, Hartvigsen argued that looking deeper at on-chain activity paints a different picture. He noted that despite rising volumes on Solana’s decentralized exchanges, total value locked in DeFi protocols has remained flat in SOL terms this year. He also showed that active users and fees generated are down from earlier 2022 highs, suggesting usage is lagging.

Per Hartvigsen: “Thor Hartvigsen: It seems the recent rally has been led more by speculation and prominent accounts hyping the token rather than fundamental growth.”

In his view, the data indicates Solana’s gains have been driven more by hype than platform growth. He advised caution given on-chain trends and recommended evaluating projects fundamentally.

Solana has seen impressive price performance recently. However, according to experienced investor Thor Hartvigsen, the altcoin’s rally may not be justified by current usage and activity growth. While Solana shows long-term promise, his analysis suggests investors should be wary of hype-driven short-term speculation and carefully examine fundamentals. This balanced perspective provides useful insights for those considering Solana.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.