UMA is a protocol for decentralized financial contracts that uses optimistic oracles to enable communication between off-chain data and on-chain smart contracts. This allows for the creation of synthetic assets and financial derivatives atop UMA’s platform.

As an optimistic oracle solution, UMA has carved out a unique value proposition in Web3 infrastructure, being vital for the continued growth of DeFi.

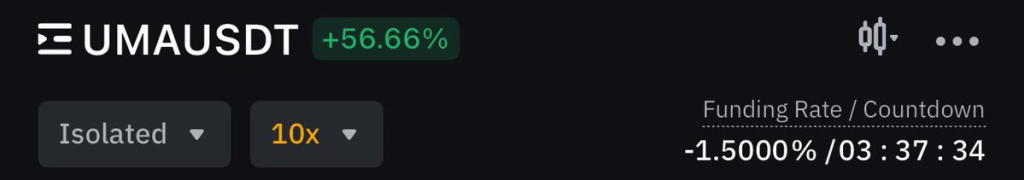

Negative Funding Rates Signal Bullish Sentiment

Recently, crypto analysts have pointed to very negative funding rates for UMA on derivatives exchanges as a strong signal of building bullish momentum. As NekoZ tweeted, “Why is no one talking about $UMA having a -1.50% funding rate… That’s insane this is going to the moon.“

How Do Funding Rates Affect Prices?

When futures contracts trade at a substantial premium to spot prices, the funding rate goes negative as market makers must pay long contract holders. This dynamic causes the futures contract price to converge back down towards the spot price.

In the case of severe backwardation like UMA has seen, traders attempt to front-run this convergence by going long the spot and short futures. As they buy up UMA tokens on spot exchanges, increased demand applies upside price pressure.

Over 70% Price Spike in 9 Hours

As KennyLe points out above, this mechanism recently played out for UMA as short-term futures hit over a 3% premium, helping drive a remarkable 70%+ price surge over just 9 hours. With funding rates still extremely negative, further short squeezes and spikes in the UMA token price appear likely in coming days.

You may also be interested in:

- Choppy Waters Ahead? Here’s the Risk of a Pre-Halving Bitcoin Selloff

- Solana (SOL) Turns Bullish Across All Timeframes but Analyst Insists This Resistance Must Break First

- BlockDAG Unveils Miners for Profitable Mining as Bitcoin’s Funding Rate Hits 66%, and Litecoin Expects a Rally

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.