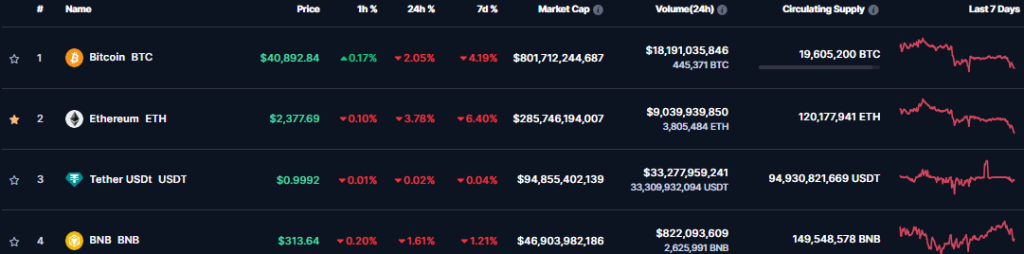

The total cryptocurrency market cap resumed its decline over the past in the last 24 hours, falling below key support around $1.6 trillion. This area previously marked the top of a multi-month trading range, suggesting the bears have regained control of the macrotrend after January’s failed rally attempt. The global crypto market cap is down by 2.86% in the last 24 hours.

Leading cryptocurrency Bitcoin also broke down from its short-term uptrend channel, reflecting similar weakness. BTC remains stuck below resistance around $41,000 as it struggles to sustain any meaningful upside momentum.

The muted price action comes after Terraform Labs, the company behind the imploded Terra ecosystem, filed for Chapter 11 bankruptcy protection. Terraform revealed liabilities between $100 million and $500 million, crystallizing the monumental fallout from last May’s stablecoin de-pegging crisis that roiled crypto markets.

Per the analysis, Bitcoin breaking below $40,000 could open the door to a steeper 12% decline toward the next significant support zone around $35,000. This area matches prior 2022 lows and could be critical for averting a deeper bearish breakdown.

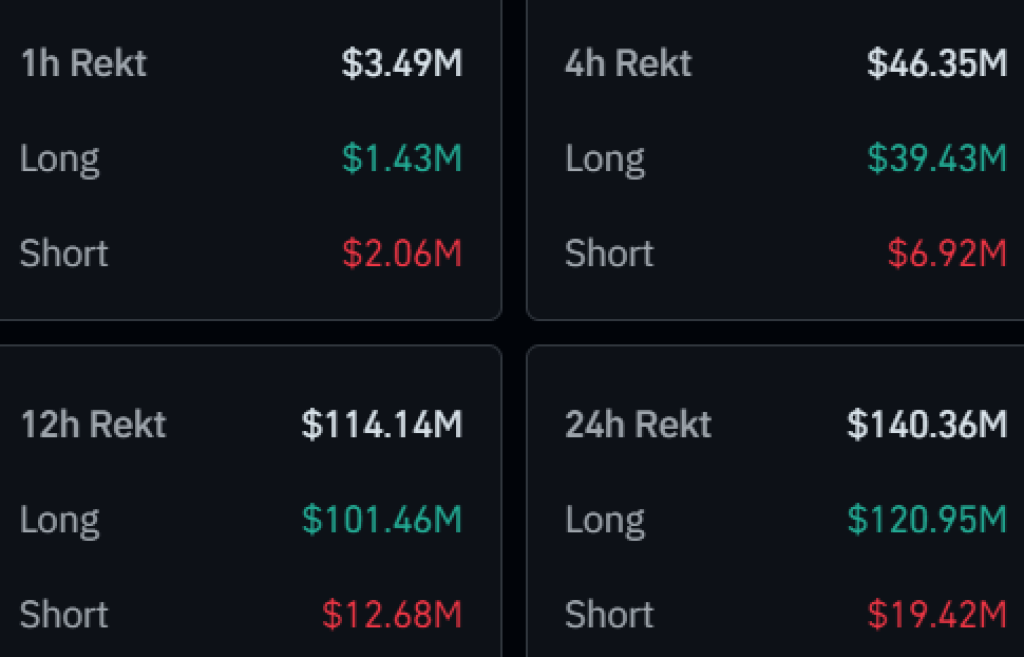

Over $139 million in liquidation

Almost all top cryptocurrencies, including ETH, SOL, and XRP, have suffered single-digit losses in the last 24 hours. ETH has plunged below $2,400, and SOL has dropped below $90.

Heightened volatility recently also contributed to nearly $140 million worth of liquidated crypto positions over the past day, disproportionately impacting longs. Ongoing market turbulence and deterioration below TOTALCAP support opens the door to intensified sell-side capitulation.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +So in summary, cryptocurrencies face sustained near-term headwinds from a faltering risk backdrop. However, with solid support nearby, the coming weeks could represent another critical inflection point following recent failed recovery efforts. Bitcoin remains the key gauge of sentiment across digital assets more broadly.

You may also be interested in:

- These Are the Two Possibilities for BTC Price With the Current Bitcoin Cycle

- Why Ripple’s Recovery Will Be Faster Than Anticipated, XRP Expected to Rise to This Price Level

- Why investors from Polygon (MATIC) and Tron (TRX) are buying into the new Pushd (PUSHD) presale

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.