Leading cryptocurrency exchange Binance announced on February 6th that it will delist privacy coin Monero (XMR) along with three other tokens, AntShares (ANT), Multi-Collateral Dai (MULTI), and Venus (VAI) on February 20th,2024.

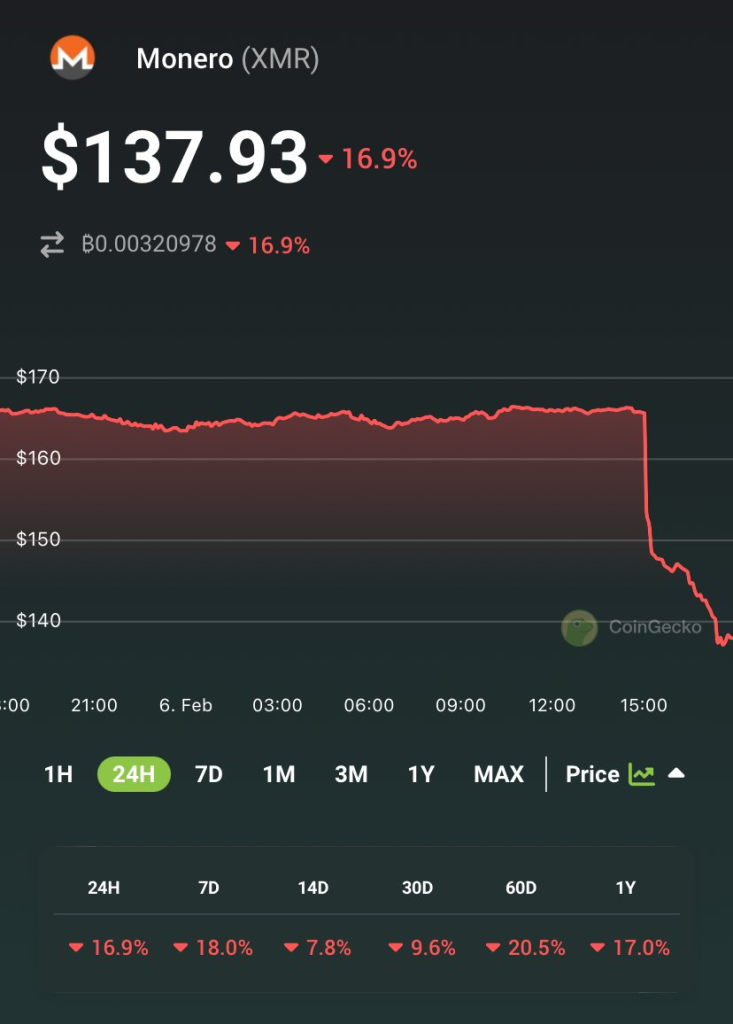

The news immediately sent XMR prices crashing. According to cryptocurrency data site CoinGecko, XMR fell 16.9% following the Binance announcement, dropping to $137.93. The privacy coin has since fallen even further, with the latest price updates showing XMR at $114.20.

Over the last 24 hours, XMR is down 30.44% on trading volume of $205 million. Besides, at the current price, XMR is 77.94% below its all-time high of $517.62, which it reached nearly 3 years ago on May 7, 2021.

What you'll learn 👉

Why Did Binance Decide to Delist Monero?

Binance likely made the move to delist XMR over regulatory concerns surrounding the privacy coin. As a privacy-focused cryptocurrency, XMR offers users anonymity by obscuring transaction details. However, this hidden nature of transactions could facilitate illegal activities.

Cryptocurrency exchanges like Binance have come under increasing regulatory pressure to crack down on tokens that enable illegal transactions. Consequently, Binance has opted to delist Monero rather than contend with potential regulatory issues.

The Future of Privacy Coins

The regulatory scrutiny facing Monero exemplifies the uncertain future confronting privacy coins. Governments and regulators favor transparent blockchains to track transactions, combat money laundering, and enforce anti-terrorism financing laws.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Hence, with exchanges unwilling to deal with possible regulatory problems, the long-term viability of privacy coins remains in doubt. Therefore, unless Monero and other anonymous cryptos adequately address regulator concerns, more delistings could occur, further eroding prices.

You may also be interested in:

- Why is Arcblock Price Up By 140%? Analyst Warns ABT Investors Of This Metric

- Why Ronin’s Price Tumbled After a Major Exchange’s Listing Mix-Up: Will the RON Listing Lead to a Rebound?

- Presale grows and grows – Ripple (XRP) & BNB (BNB) holders continue the bull run in Pushd (PUSHD) presale as 2024 shows big rewards

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.