Enterprise blockchain developer ArcBlock (ABT) staged a vertical parabolic surge in recent trading, pushing its token value over 140% higher. However, one analyst warns the explosive move likely constitutes an unsustainable “fake pump” at risk of sharp rejection.

Per market data, ABT spiked from around $0.54 to as high as $1.39, representing a giant triple-digit intraday percentage spike. Driving the immense volatility is a liquidity frenzy, with over $51 million changing hands in 24 hours. The token is up by 140% at press time, with its market cap standing at $136 million.

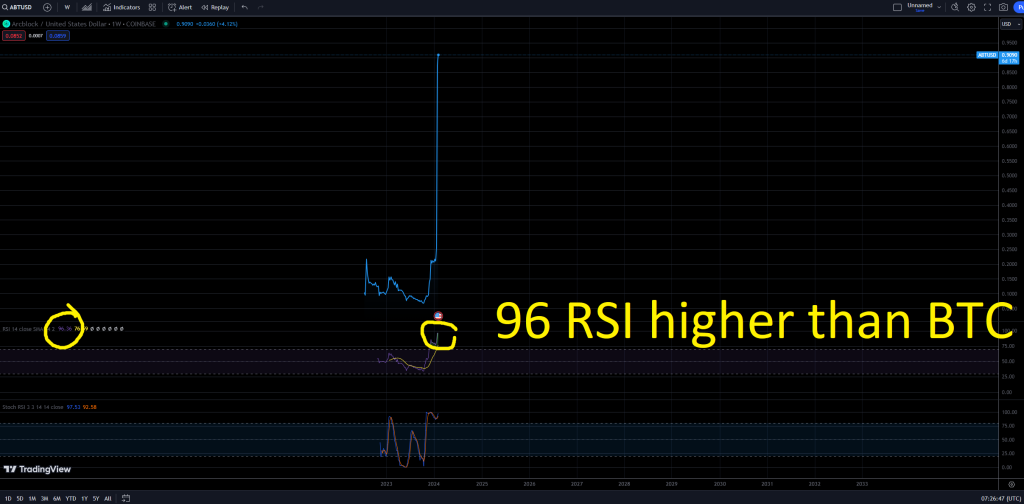

Still, analyst XYOPepe cautioned, noting that ABT’s weekly RSI surged to 96 on the Coinbase exchange—the highest ever reading for any listed crypto asset—even exceeding Bitcoin’s peak levels.

While momentum oscillators like RSI above 70 reflect overbought extremes (unsustainable yields), readings in the 90s territory usually signal capitulatory pops rather than durable trend change. These present optimal short-selling opportunities known as “fake pumps” or bull traps.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Warning Signs Apparent Despite Surge

Despite the parabolic spike, ArcBlock fundamental developments remain sparse; the team only rolled out minor website updates rather than tangible adoption progress. This contrasts severely with the trading frenzy, underscoring the likely speculative mania driving unsafe excess.

With technical signals utterly extended, ABT seems destined for intense volatility in both directions. The same way it spiked over 140% vertically could easily translate into rapid plunges on the way down.

So while short-term gains entice during these bull traps, prudent risk management remains vital until seeing clear confirmation of durable adoption tailwinds. For now, data and momentum point to necessary mean reversion ahead for ABT following its unsustainable arc higher.

You may also be interested in:

- Why Is Flare’s FLR Price Up? Partnership With This Tech Giant Attracts More Investors

- Shiba Inu Bulls Eye Crucial Breakout as Continuous SHIB Burn Could Spike Price to This Level

- Solana (SOL) New Rival Is Only $0.009 Today; Will It Reach $1 in 2024?

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.