In the ever-changing landscape of cryptocurrencies, investors and enthusiasts are constantly on the lookout for projects that hold the promise of significant gains.

Two such projects, $HEX and $PLS, have been the subject of discussion recently, with many wondering why they haven’t experienced significant price increases. In this article, we will explore possible reasons behind the lackluster performance of these tokens and examine the potential for a future pump once the overall market becomes bullish, led by Bitcoin.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +What you'll learn 👉

Market Readiness and Priorities

One possible explanation for the absence of a price surge in $HEX and $PLS could be attributed to the projects’ state of readiness.

It is crucial for any cryptocurrency project to ensure it is fully prepared to cater to its user base and deliver on its promises. In the case of #PulseChain, the first priority appears to be the release of eToken and pToken farms, which will provide users with opportunities for yield farming. By focusing on this crucial aspect, the project aims to capture the attention of cryptocurrency enthusiasts and build momentum for subsequent developments.

Lack of Mainstream Attention

Despite the potential of #PulseChain and its associated tokens, $HEX and $PLS, there seems to be a notable absence of coverage from mainstream influencers.

This could be attributed to various factors, including the prevalence of paid endorsements in the crypto industry. Genuine organic growth and recognition often take time to manifest, especially in an environment where influencers may be driven by financial incentives. However, it is important to note that the absence of mainstream attention does not necessarily reflect the true value or potential of these tokens.

Emerging Volume and Investor Behavior

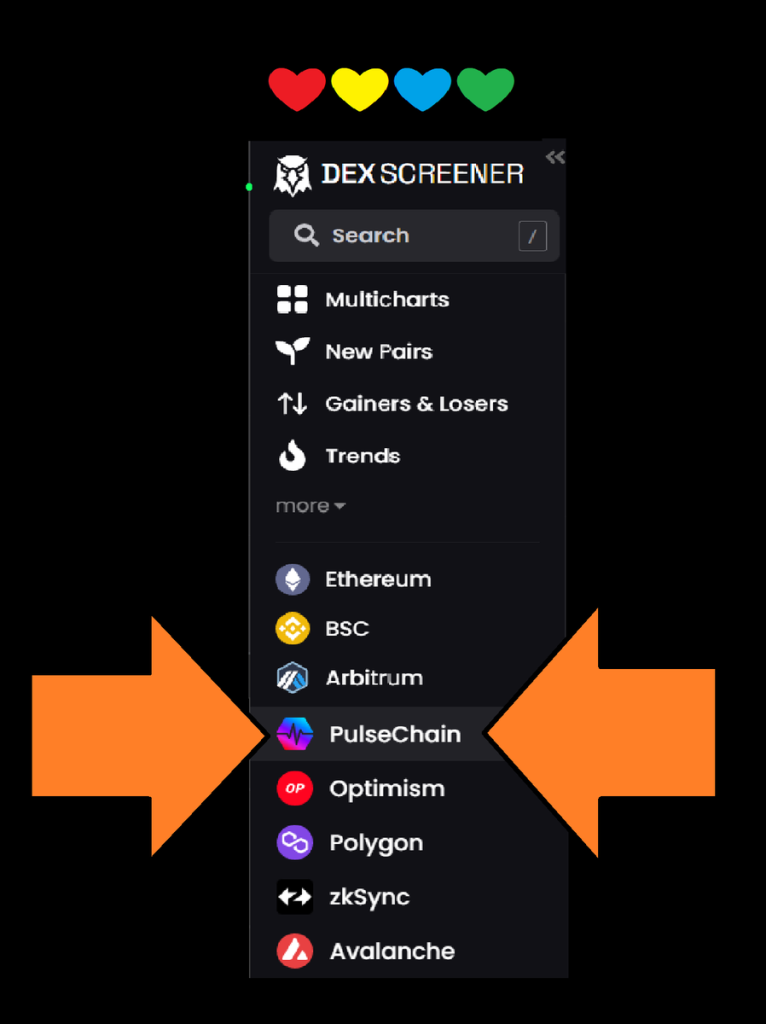

A significant development worth considering is the recent overtaking of Polygon in volume by PulseChain. This indicates a growing interest and participation from investors, despite the lack of mainstream coverage. Additionally, the presence of significant sell-offs by investors who have already profited substantially from their initial investments suggests a dynamic market. These individuals, who have been exiting their positions at 2x-4x their initial investment, contribute to establishing a cap on $PLS. Consequently, the ecosystem is gradually working through these exits, potentially paving the way for a new wave of investors.

GIGANTIC News and Potential Catalysts

Recent news regarding the listing of $PLS on OKX, the fourth-largest cryptocurrency exchange in the world, has generated significant buzz within the community. This development holds great significance for multiple reasons. Firstly, OKX’s reputation as a Tier 1 exchange brings attention not only to $PLS but also to Richard Heart’s PulseChain ecosystem as a whole. Furthermore, the availability of a fiat bridge through OKX alleviates the challenge faced by community members who previously required $PLS for transactions. This listing effectively addresses the pent-up demand that hindered seamless transactions within the ecosystem.

The listing on OKX serves as a signal to the broader crypto community that the gates are beginning to open for Richard Heart’s ecosystem. This milestone could potentially trigger a domino effect, compelling other exchanges to follow suit and list $PLS. The volume generated on PulseChain cannot be ignored by these exchanges, as their revenue models heavily rely on trading activity. As a result, business decisions and the pursuit of increased volume could lead to wider recognition and adoption of $PLS.

Conclusion

While $HEX and $PLS may not have experienced significant price surges thus far, several factors indicate the potential for future growth and a pump once the broader cryptocurrency market turns bullish. The focus on market readiness, the absence of mainstream attention, emerging volume, and recent pivotal developments such as the listing on OKX all contribute to a narrative of cautious optimism. It is crucial to approach these projects with a critical eye, considering the risks and uncertainties inherent in the crypto space. However, the convergence of positive factors, coupled with a market-wide bullish trend led by Bitcoin, may create favorable conditions for a potential price surge in the future.