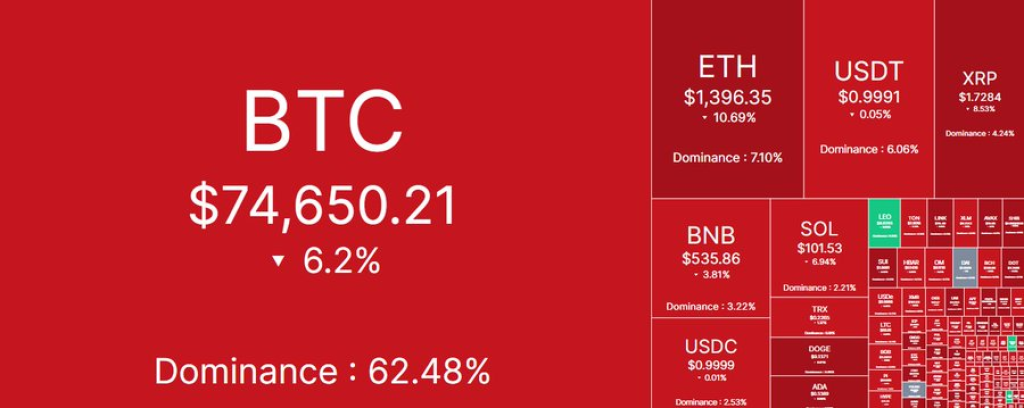

Bitcoin and the wider crypto market have continued to take a big hit this week. BTC price dropped below important levels as global economic tensions grew. Let’s look at what’s causing this drop and where Bitcoin might go from here.

Bitcoin price has continued to react to growing U.S.-China tensions. This drop happened alongside China selling $50 billion in U.S. Treasury holdings and the U.S. announcing 104% tariffs on Chinese imports.

Other cryptocurrencies are suffering too. ETH, ADA, and XRP are down by 5%, 0.65%, and 1%, respectively, right now.

What you'll learn 👉

Bitcoin ETFs Show Investors Getting Cautious

Market mood has turned careful across all investments, both traditional and crypto. We can see this in BlackRock’s iShares Bitcoin Trust (IBIT) reducing its holdings by 3,296 BTC – its third-largest one-day reduction. U.S. Bitcoin ETFs together saw outflows of $326 million during this period.

As noted by The Kobeissi Letter (@KobeissiLetter): “BREAKING: Bitcoin falls below $75,000 as crypto markets erase -$500 billion since the April 2nd high.” This shows investors are moving away from risky assets.

These moves show professional investors are cutting back on crypto while watching how trade tensions develop. This careful approach will likely continue until there’s either progress in diplomacy or retail traders show a clear direction.

Bitcoin Price Finds Support Despite Pressure

Bitcoin price dropped to around $74,000 yesterday because of negative market sentiment. While it’s recovering slowly now, the overall mood remains bearish. Yesterday’s drop was a 5.76% decline from its opening price to today’s lowest price so far. This shows how sensitive the market is to global economic news.

Today’s price is bouncing back, now above $77,000. This suggests buyers are stepping in, especially around the important support zone between $70,000 and $73,000.

Read Also: AI Predicts ONDO Price for Q2 2025 – Here’s What It Says

Charts show this support area is historically strong, making it hard for sellers to push prices lower. If Bitcoin stays above $73,000, this could be a short-term bottom, even while the broader market remains nervous.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.