Following a brief surge of optimism in the cryptocurrency market, spurred by encouraging developments in the ongoing SEC lawsuit against Ripple (XRP), the digital asset landscape finds itself grappling with deflation once again. The fleeting bull run, ignited by the positive legal news, has given way to a bearish trend, with key players Bitcoin (BTC) and Ethereum (ETH) experiencing significant price drops.

Crypto Tony (@CryptoTony__), recently shared his predictions on Twitter for the current drop in the prices of Bitcoin (BTC) and Ethereum (ETH). According to Tony, a well-known trader and technical analysis expert, the targets for this drop are $28,500 for BTC and $1,780 for ETH.

However, many analysts expect this to be a short-lived cooling off before the nascent bull run continues.

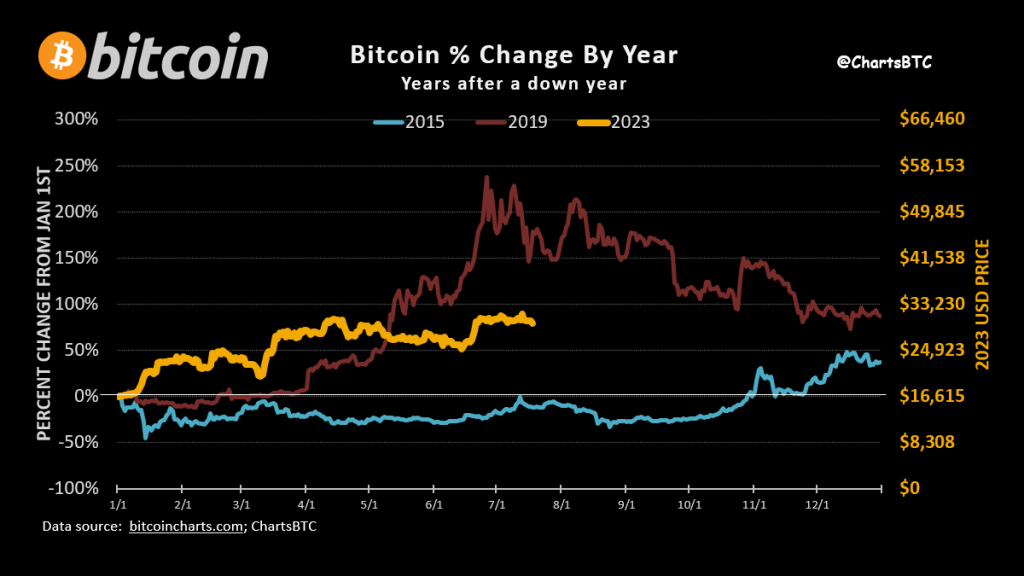

Another famous Twitter analyst, ChartsBTC (@ChartsBtc), provided some historical context to the current situation that confirms this bullish narrative. The analyst pointed out that Bitcoin has only had three down years (2014, 2018, 2022), hinting at the potential for a rebound in the following year.

Looking at the price action for BTC over the last month, it’s clear that the cryptocurrency has been on a prolonged sideways trend. Starting from June 18, 2023, when BTC was trading at $26,335.8, the price has seen a series of highs and lows, reaching a peak of $31,641.4 on July 14, 2023, before falling to its current price of $30,148.4 as of July 17, 2023. This represents a significant drop from its peak, aligning with Crypto Tony’s prediction.

Similarly, Ethereum has also experienced a ranging trend over the past month. On June 18, 2023, ETH was trading at $1,720.97. It reached a high of $2,012.22 on July 13, 2023, but has since dropped to $1,911.24 as of July 17, 2023. This drop is not as drastic as that of BTC, but it still signifies a bearish trend in the market. With these trends in mind, it seems that the predictions made by Crypto Tony and ChartsBTC could potentially come to fruition. However, as with any market predictions, only time will tell.