Market research analyst Layergg dives into the crypto industry, evaluating the landscape post-Bitcoin ETF with a discerning perspective on potential shifts and emerging storylines. Let’s unpack the key points:

1. “Sell the News?” Reevaluating BTC-Beta

The market realizes much of the BTC-Beta remains in its early stages. As a result, liquidity is expected to gravitate towards Bitcoin, emphasizing Bitcoin infrastructure development.

2. TradFi’s Web3 Entry – Venture Capital Portfolio Narrative

Traditional Finance (TradFi) ventures into Web3, igniting a narrative around venture capital portfolios. Examples include “VanEck” crypto portfolios, mirroring the model popularized by Grayscale.

3. ETH ETF Narrative – Impact on L2, LSD, and Restaking Projects

The potential arrival of an Ethereum (ETH) ETF could profoundly benefit Layer 2 (L2), Layer 2.5 (LSD), and restaking projects, with anticipated volatility increases in the ETH/BTC market.

Notcoin airdrop on Telegram made millions to people. Don’t miss out on the next TG airdrop by the same team – Dogs on Ton!

Show more +4. EIP-4844 Upgrade – L2 Fees Slashed, Positioning L2 Against L1s

Anticipation surrounds the EIP-4844 upgrade, set to reduce Layer 2 fees tenfold. This introduces player-versus-player dynamics between L2 and L1 networks, favoring related projects like $SOL, $SEI, $INJ, and $TIA.

5. RollApps – The Ascent of Rollups and Integrated Apps/Services

Post-EIP-4844, RollApps, combining Rollups with apps and services, gain prominence. This trend plays a pivotal role in the airdrop narrative and connects closely to the Decentralized Autonomous Layer.

6. Major Project Launches – Low-Cap Plays in Ecosystem and Memecoins

The crypto space awaits significant launches from influential projects, fostering low-cap opportunities. Notables include zkSync, StarkNet, LayerZero, Scroll, Eigenlayer, Blast, among others.

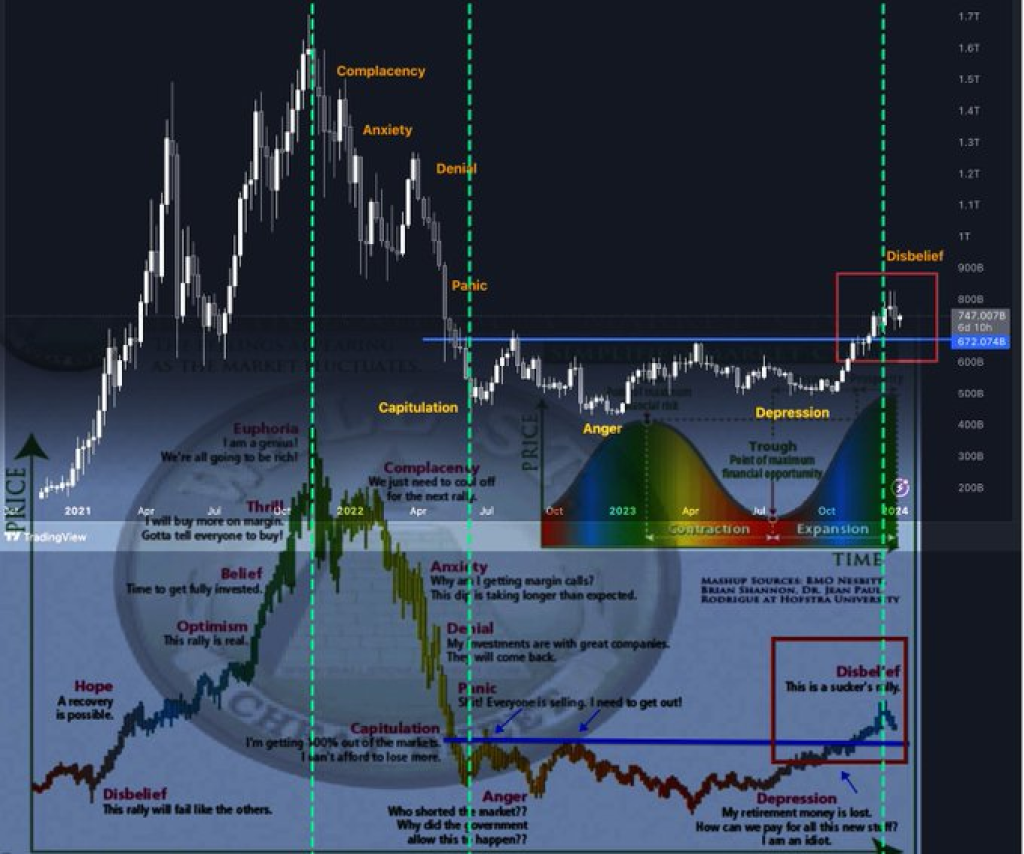

7. U.S. Influence Surges – Correlation Between Bitcoin and S&P Magnifies

Following the ETF, amplified U.S. investment may intensify the correlation between Bitcoin and the S&P. This shift could stem from interest rate cuts and the upcoming presidential election.

If the BTC ETF faces delays, Layergg suggests viewing it as a strategic chance to buy dips or Dollar-Cost Average (DCA). Notably, due to the ETF impact, the Bitcoin Halving will likely garner far more public attention than previous cycles.

You may also be interested in:

- Router Protocol Bullish Following MATIC’s Early Success: Why ROUTE Will Secure Coinbase Listing This Year

- Bitcoin Hits $46,000 For First Time In Over Two Years On ETF Approval Hopes

- Holders From Pepe (PEPE), Dogecoin (DOGE), and Uniswap (UNI) Rush To Jump Into Early Stages Of Pushd (PUSHD) Presale

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

eToro offers staking for certain popular cryptocurrencies like ETH, ADA, XTZ etc.