Delving deep into the weirdest pockets of the crypto market, we will find all sorts of peculiar ideas which dance on the thin line between brilliancy and lunacy (and at the same time reality and fraudulency). A cryptocurrency called Unobtanium has definitely been one such idea.

A name originally popularized by James Cameron’s Avatar – where the word was used to describe a rare material worth fighting wars and destroying planets/civilizations for – has been co-opted by this cryptocurrency about 5 years ago. Staying true to the “source material”, the currency’s shtick is that it was designed to be the rarest cryptocurrency in the world. “Colder and rarer than CGB, Shinier and more fair than BitBar, more collective than Franko” is the main motto of the people who created this coin.

And the currency is indeed very rare. While BTC, with its 21 million coins, is considered rare when compared to the rest of the market, Unobtanium takes this to a whole another level. Its total supply is going to be a measly 250 thousand coins. Current circulating supply is 199,051 UNO and the designers of the currency envisioned the last coin hitting the circulation in 2043. The team that created it decided to use the SHA 256 Proof of Work algorithm to ensure the fair distribution of this currency. There was no pre-mine, no ICO, and there will be no inflation related to Proof of Stake algorithms.

Read here about best NEO and GAS wallets.

The technical details around it are pretty much what you’d expect out of a SHA 256-based cryptocurrency. It’s a mineable coin, with miners being in charge of keeping the network up and validating the transactions. Naturally they receive rewards for mining on the network and adding new blocks to the currency’s blockchain (called “The Rockchain”). Initially these rewards were at 1 coin per block with halvings scheduled every 100 thousand blocks gradually bringing the rewards down. Currently the block reward is at 0.1 UNO and the network hash rate sits at 3815,10 PH/s. Use of the SHA 256 algorithm allows miners to merge mine this coin with either BTC or any other coin that uses the same algorithm.

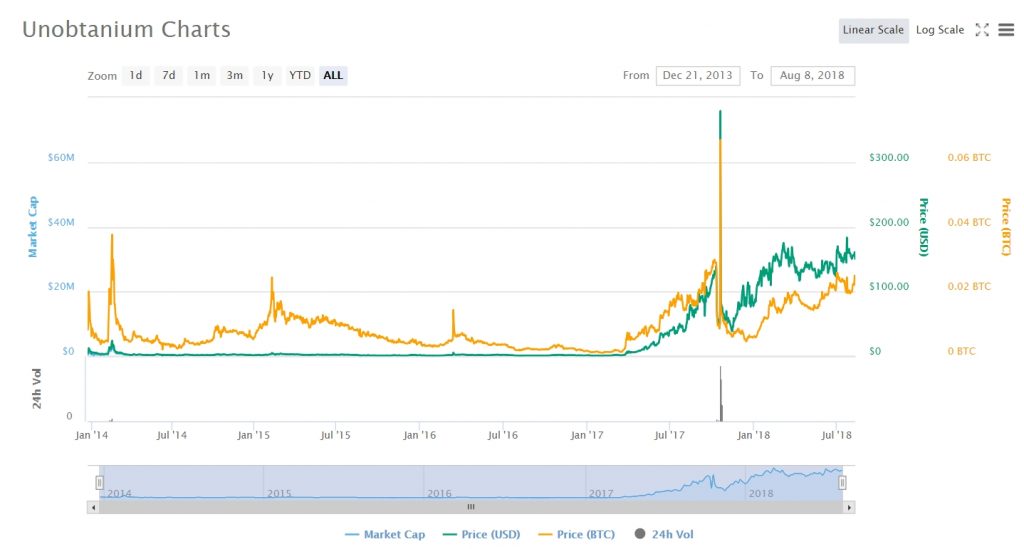

The coin’s release went without much fanfare. The price on release was rather low (around $6 USD) and the miners slowly but surely got to work to start extracting the coins. From 2015-2016 the price went down, at times barely hovering above $1 USD, but this didn’t stop the machine from caching steam. And caught steam it did.

The year of 2017 was a good one for Unobtanium, just like it was for any cryptocurrency. The coin started becoming more and more valuable as the end of the year crept up and it finally reached its ATH during October, when one UNO was worth $420 USD/0,074 BTC. This peak was short-lived as the coin came tumbling down against the rest of the (at the time booming) market and landed back at $54 USD in November.

Surprisingly enough, the coin has been faring pretty well since then. Looking at its price graph reveals a currency that actually grew against the market, defying the general bear run that was set-up by Bitcoin.

Currently, one UNO is worth $146.89 USD (4.23% drop in the last 24 hours). We can see its resilience to Bitcoin movements if we look at the coin’s BTC price. Right now, the coin is valued at 0,02390470 BTC, which is a rise of 0.98% in the last 24 hours. It is important to note that BTC managed to drop around 9% during the last day (mostly thanks to the American SEC postponing their decision on BTC ETF’s) and UNO completely ignored that, unlike the rest of the alts that got slaughtered.

FallingKnife, one of the creators of the coin, offers his insight into this phenomenon:

“UNO was designed to behave like this. Now almost five years old, Uno passed through its inflationary phase. It’s a low inflation, rare, fair launch cryptocurrency. There’s not much out there. A lot of Uno is held by strong, long term hands.”

For now, Unobtanium is certainly living up to its name. It’s rare in both its supply and its market behavior. Some attribute its success to the maturity of its chain. Evil tongues claim that its low trading volumes (barely 8 BTC at the moment of writing) allow its creators/miners/whales to manipulate the price. Not much is known in general about the currency, but they are alive and kicking pretty well right now. Check out their Bitcoin Talk, Twitter or Telegram for more information and future updates.